A major milestone for the stock market was reached this week.

Is there something magical about 40K? Not necessarily, but the economic progress and growth are notable. The stock market largely reflects the improvements in the economy over the long term, and hitting major milestones is a good reminder that we are living in a very innovative time.

We have been doing this for a long time. When we started in this business, the Dow was around 8K. That’s a 5X increase in a quarter of a century. This should be a lesson to all those who think investing is gambling. Investing remains the most accessible and best way to increase one’s wealth. As the old adage goes: “It’s not about timing the market, but time in the market.” ‘

But alas, our goal is to help investors better time the market so they can accelerate wealth creation, and we think we do it as well as anyone. When you avoid costly drawdowns, you can capitalize on better market environments. We were largely out of the market near the early April highs and got aggressively long three weeks ago. In April, the major indexes lost ~6-8%, and since the beginning of May, the indexes have been up ~4-6%. We have identified every major swing in the stock market since the October ‘22 lows. Are we 100% perfect? Of course not, but when our analysis calls for the market to turn and it proves premature, we quickly reverse course. We don’t double down to fit some stubborn bias. When the facts change, we change with them. Our goal is to protect capital to maximize returns when the environment improves. Not every market regime is optimal for investing/trading; identifying those shifts can preserve mental and physical capital.

Currently, 14 of the 20 world’s largest stock markets are at All-Time Highs. Economic growth is contagious, and when large economies worldwide grow simultaneously, that sets the stage for a thriving bull market.

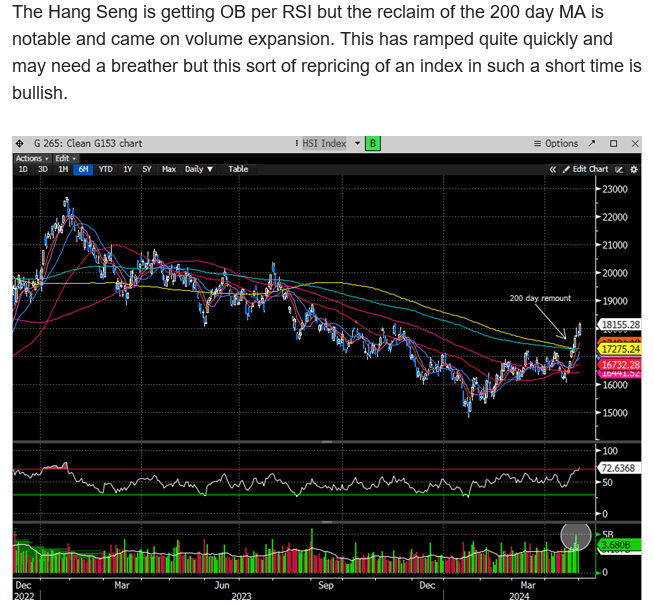

And now, the second-largest economy in the world is starting to reaccelerate. This is reflected in the Shenzen 300 Index, which is now up +18% from the lows in February and breaking a major pivot. This does look like a head-and-shoulder reversal pattern. The measured move target for this bullish break is around 4100.

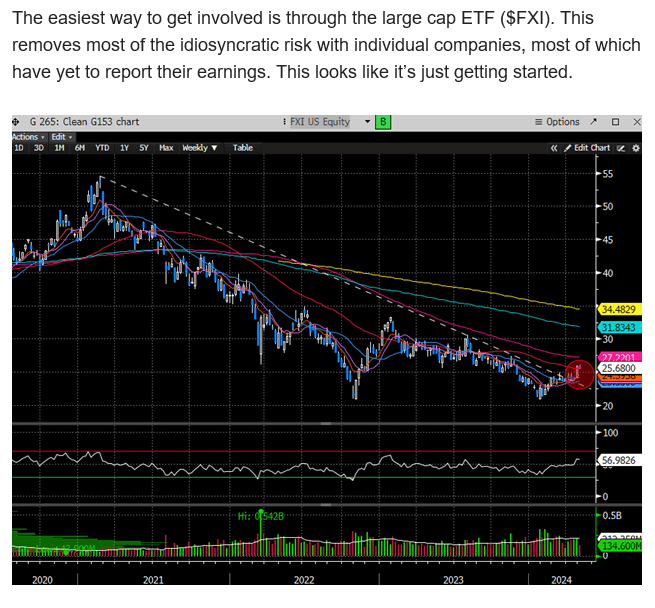

China's re-acceleration will benefit the rest of the world. In our 5/1 report, we discussed China as an investment theme and highlighted the FXI (large-cap China ETF) as an idea that would benefit from this trend. Since that report, the FXI has been up +14%.

Here are those excerpts:

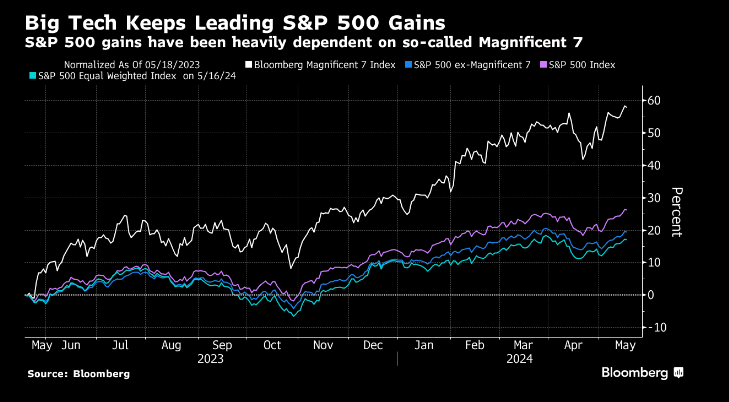

This week, we will be presented with the all-important NVDA earnings report (5/22). NVDA’s report certainly has the potential to disrupt the equilibrium for the stock market, as 25% of the SPX gains this year are due to NVDA. The rest of the Mag7 combine for roughly 53% of the gains. Certainly, the market is top-heavy, which poses a risk should NVDA disappoint.

NVDA has a very good track record of surprising investors to the upside when it reports, which has rewarded investors who are brave enough to hold through those events. Going back to 2018, NVDA has missed its quarterly earnings print twice; in 25 reports, 10 were met with negative one-day price changes.

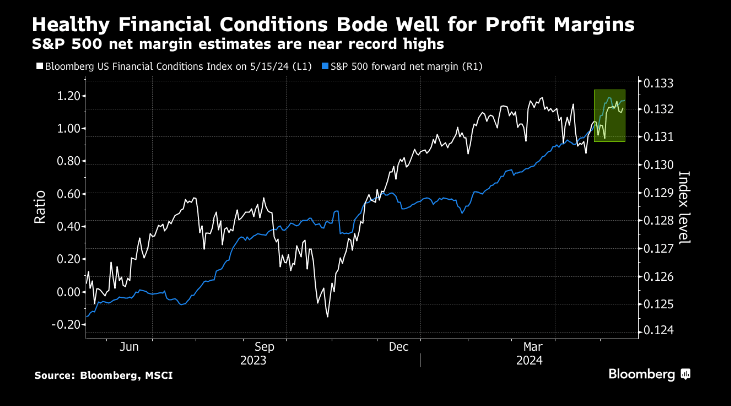

The good news on the overall earnings front is that the outperformance continues to expand, with 90% of SPX reported per-share earnings posting +7.3% compared to last year and on track for the second-best profit growth in two years, according to Bloomberg.

While the Big Tech companies are driving a good percentage of that growth, participation from the rest of the field is expanding. This is likely a large reason we are starting to see market breadth expand again.

Margin improvement in the SPX is indicative of a healthy economic backdrop, and currently, margin estimates are near record highs. If the economic environment remains robust, this bodes well for future earnings growth.

Stock market investors are always searching for a narrative that fits the market regime, and we think the current one is quite evident. Earnings growth is accelerating, and the Fed wants to reduce interest rates. We can debate all we want if this is the right strategy with stubborn inflation readings, but the reality is that’s the market we are in. The stock market is at all-time highs for a reason - Don’t fight it.

But as you know, markets do not move in a straight line and our analysis is designed to identify those inflections.

Let’s dig in…