Last week we wrote about the current malaise in the stock market and possible break of the index ranges were to be expected at some point. 2 weeks ago, we wrote that if you put a gun to our head and had to pick a direction for the stock market, it would be for a breakup of the range. This prognostication was not something we were going to bet the farm on but certainly kept us in our positional longs.

Last week we sold out the remaining portion of our $GOOGL for +30%.

Thursday and Friday we were selling more of our remaining position in $AMZN for +15%.

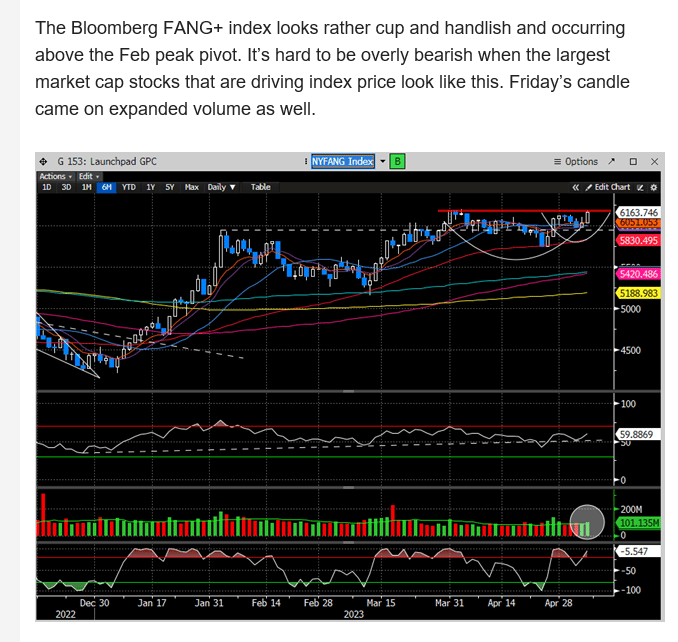

And much to the dismay of a few vitriolic twitter trolls, we disclosed bullish commentary on the largest cap tech stocks in our report on May 7th, indicating this ensuing probabilistic scenario. See excerpts below:

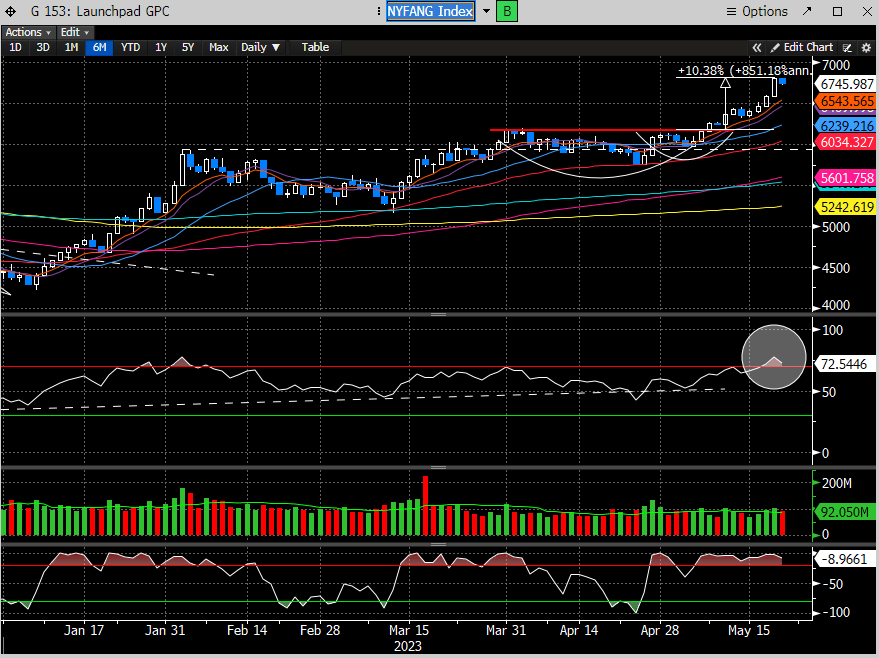

These were a few of the many reasons we were comfortable holding these large cap positions despite the plethora of negative fundamental developments that have been discussed and disclosed in previous reports. Fundamentally, it’s hard to trust the stock market, but if you can read the tea leaves for what’s being presented weekly, you can still profit handsomely. All of the charts showcased above were bullishly leaning and a breakout seemed likely. Fast forward to today, and the cup and handle break delivered a +10% gain for the FANG+ Index.

As you can imagine, this group is now OB per RSI, and starting to print sell signals (more on that below).

The short positioning and bearish sentiment are something we have discussed ad nauseum over the last 6 months. This is still quite pervasive, as UBS adds: that positioning in US stocks in funds of all types is 2 STD’s below average levels, with balanced and long/short fund allocations notably pessimistic. The bottom line is, it’s hard for the market to sell off when nobody actually owns stocks.

As we mentioned last week, any break of the recent index range will force reluctant buyers into the market. This seemed to occur last week as the index themselves did quite well. The Nasdaq continues to be the bread winner, posting a +3% gain on the week.

But our readers know we are not momentum traders. We buy low and sell high, not buy high and sell higher. Trend trading has its place but in a lopsided market environment, this can be very frustrating.

The high concentration in large cap stocks with respect to gains in the stock market, is not lost on us. We have written about it many times as seemingly unhealthy, but instead of trying to call for some cataclysmic wipeout week in and week out, we take a much more practical and constructive approach to finding laggard stock ideas that will benefit should the indexes hold the integrity of their current ranges. And most importantly, we are not caught on the wrong side of the market.

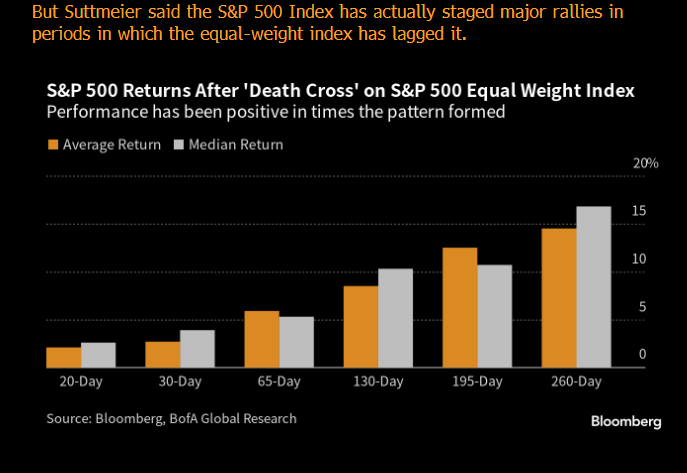

We found this statistic to be quite interesting with regard to narrow breadth. BMO cited that previous peaks in concentration have resulted in an average gain of +4.1% for the index over the following 6 months. More importantly, is the gains are not led by the large cap leaders, but by the smaller stocks in the index, with the SPX Equal Weight averaging a gain of +13.9%.

Recently, there was a death cross in the SPX equal weight index. Death crosses are when the 50 day MA crosses below the 200 day MA. This sounds ominous but more often times than not, we have found death crosses to be terrific buying opportunities.

From Bank of America indicating such:

Guess what just printed a DeMark seq 13 buy? The SPW Index (Eq weight SPX).

This is the first since printing in Sept ‘22 before gaining +21% into the Feb peak. Maybe we were on to something in our report last week?

Being on the right side of the market is a choice. We suggest you choose wisely.