This past week in the stock market was certainly a wild week. There was enough to frustrate the bulls and the bears. The bulls got what they wanted in a robust NVDA report that had the power to spur the animal spirits and push the market into the stratosphere, but the “sell the news” crowd had a different opinion and sold the first opening tick in the market, which pressed lower into the close. This sort of activity can be a big warning sign if you are a bull. Good news getting sold is never a good data point if you are bullish. Was this the pivot point the bears have been looking for or was it just another fake out move to suck in more bearish involvement? One thing is for sure, the market never makes it easy.

The SPX saw a large outside day on Thursday which should send shivers down the spine of any bull. An outside day is one where an instrument trades above the previous day’s high and below the previous day’s low. This is similar to a bearish engulfing but a true bearish engulfing, as defined by the Bulkowski, is one that follows a positive close. This did not happen on Weds. Regardless, the action is bearish.

An interesting data point on the outside reversal, was the volume was below average. If you are a bear, then you have to ask yourself, why didn’t the bears show up at a sell juncture for the market? If you evaluate or trade the market for a living, this is a pertinent question. Predicting the future is a difficult business, and there are clues to investor behavior everywhere, but if you aren’t paying attention to volume, then you are doing it wrong, period.

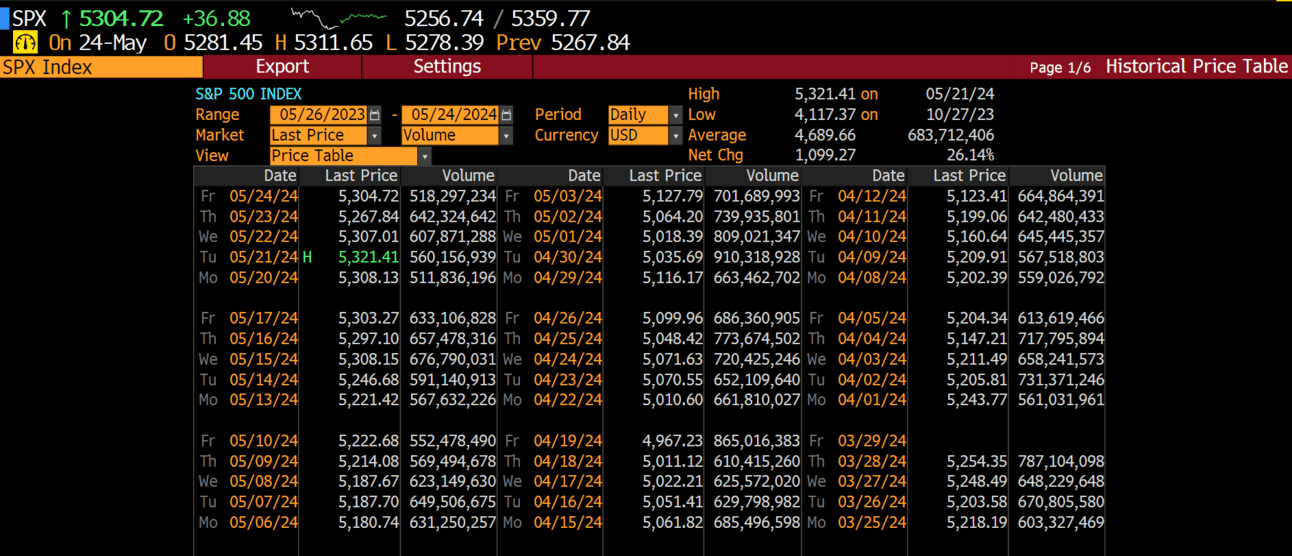

Here is the volume for the SPX. Does this look like the sellers took control on Thursday? Not at all. This looks more like buyer fatigue than anything else.

Furthermore, the SPX stopped selling right at the ATH pivot, and bears did not have the strength to push this lower on Friday. Analyzing investor behavior can be an art, but it doesn’t take some genius technician to tell you that holding above a key level is bullish. Bullish trends require violation of said trends, and an ATH pivot would be considered a key level. Until this is breached, it’s hard to argue the bears have taken back the ball.

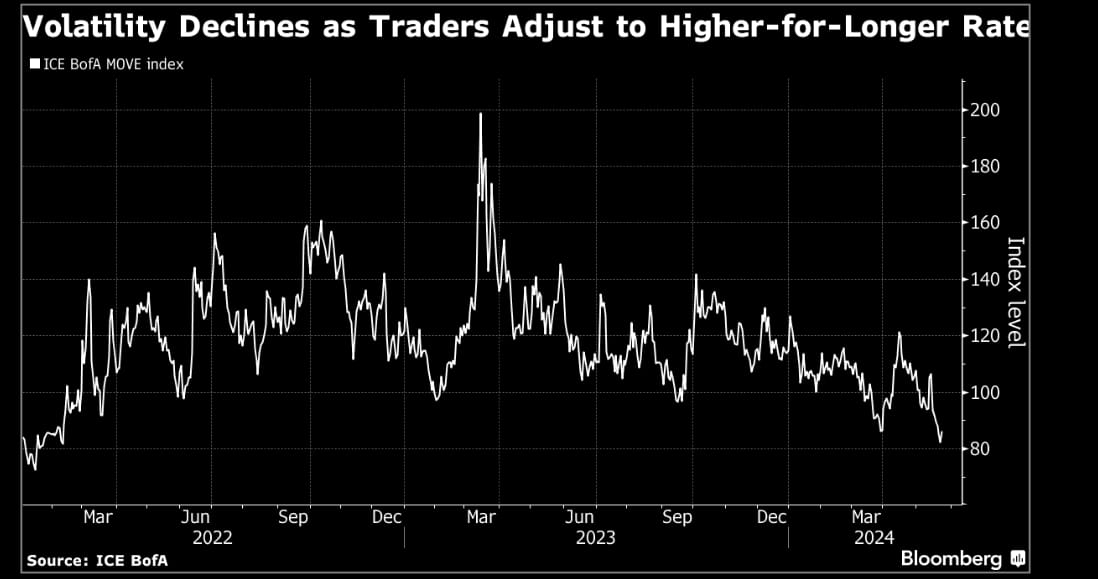

We have officially embarked on the first days of summer with Memorial Day in the US. This typically means we should expect lighter trading as we push into the summer, and lack of liquidity can mean more volatility. To combat the vacuum of liquidity, the Fed is now set to reduce Quantitative Tightening (QT) for the first time in decades. Reducing QT should, by definition, improve the liquidity. This begins on Wednesday with seasoned and harder to trade debt. In June, the Fed is set to begin the tapering of its balance sheet unwind, known as QT.

This is likely a reason we have seen the MOVE Index (measures treasury volatility) decline so significantly as of late. This implies we have likely seen the highs for rates this year.

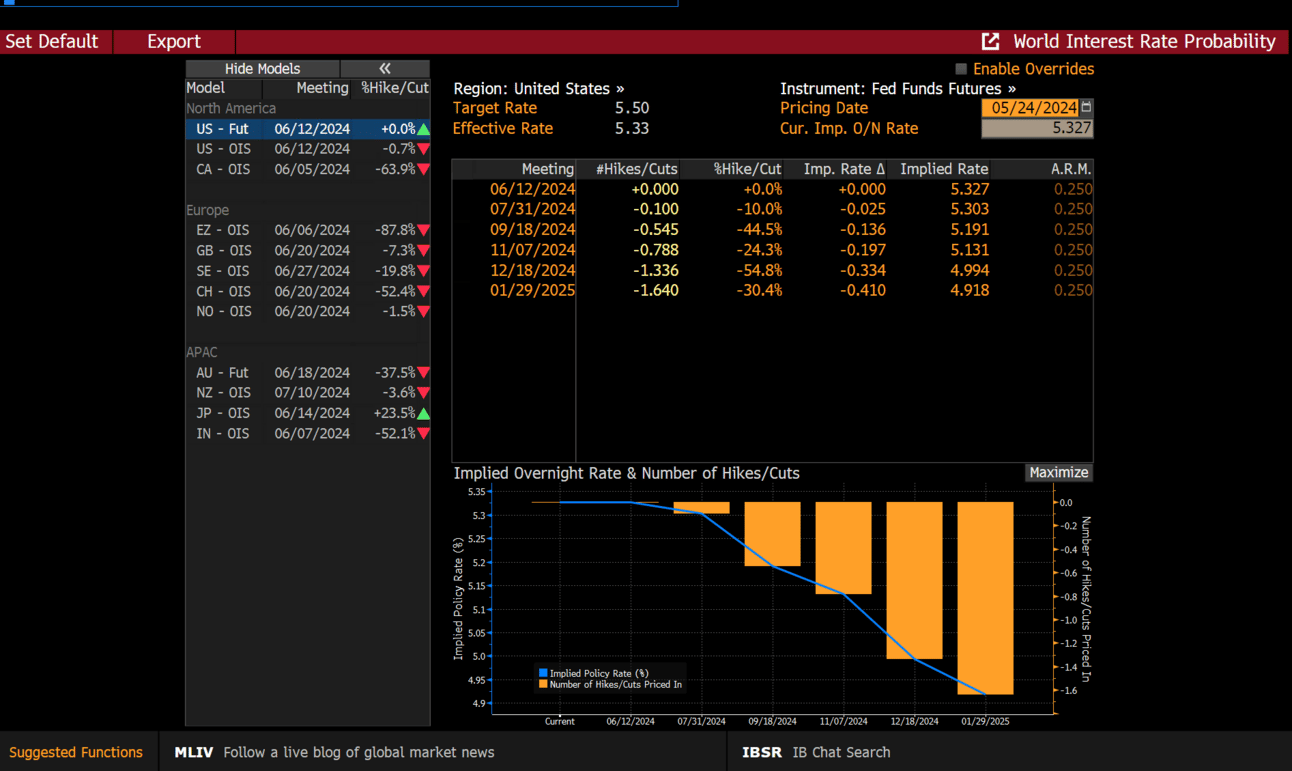

The recent PMI data in the US was the reason for the abrupt reversal on Thursday, which penned an economy that is too strong for rate cuts.

The Fed Fund Futures reversed their forecast for 50bps of cuts by the end of ‘24, and now are forecasting only 32 bps.

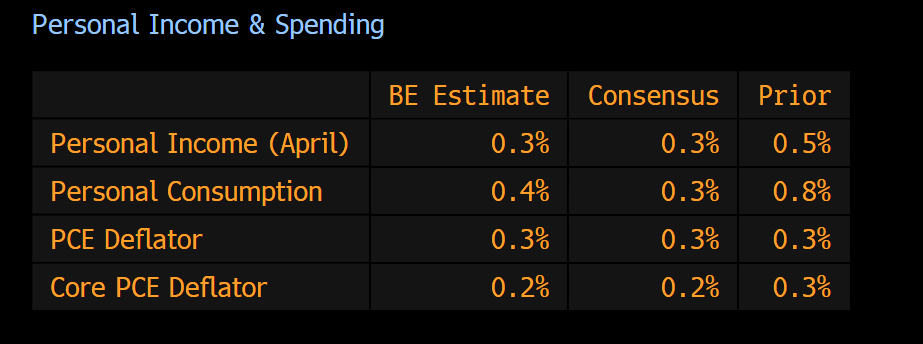

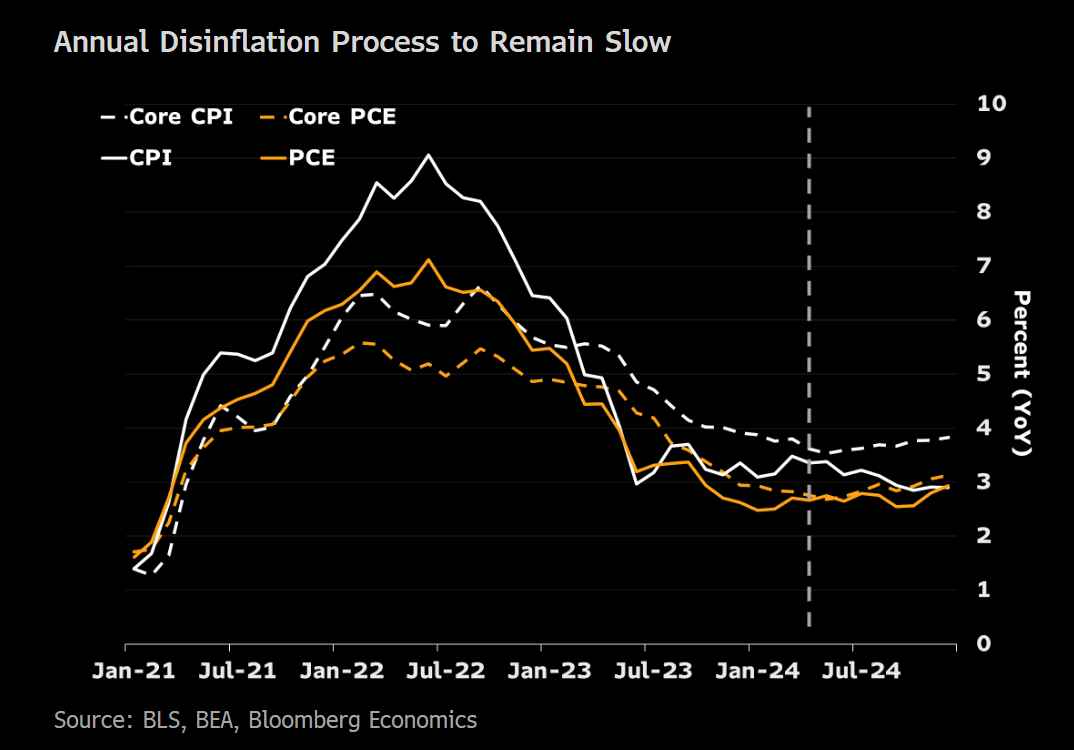

The key reading this week will be the PCE (Fed’s preferred inflation metric) that will be reported on Friday.

While there should be some slowing in the readings, the pace has been undesirable for a Fed that is looking for reasons to cut interest rates.

Now that earnings have largely been reported, the future macro releases will take center stage, with the inflation readings the most important for impacting stock market direction. Last week the bulls were thrown a curve ball post the NVDA/PMI report, but was it enough to derail the current bullish trajectory?