Last week in the stock market surprised many including us. Our thinking was that the large cap tech stocks would take a breather and see rotation into laggards. Before the NVDA report, that’s exactly what transpired, but post that report, the rotation reversed and piled into the large caps again as well as semis.

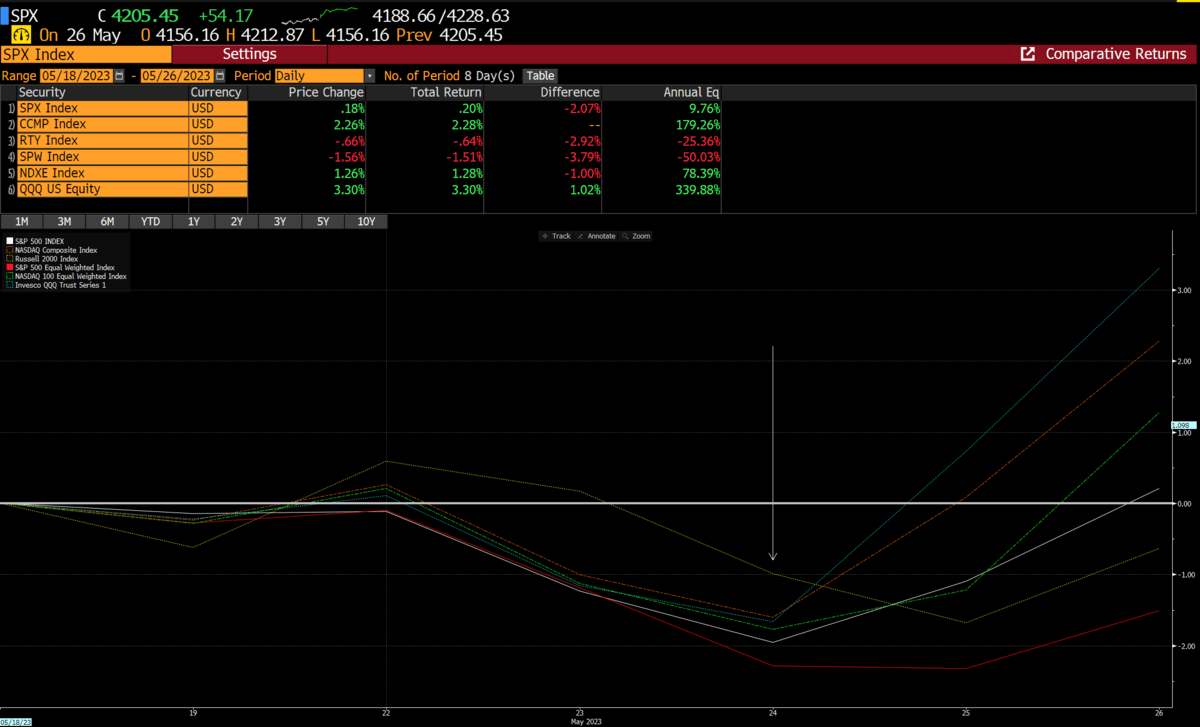

This graph illustrates that the Rusell was outperforming on the week before NVDA reported. Post that report, the $QQQ (top 100 weighted stocks), grossly outperformed.

We have not been bearish on the stock market despite many in the media, FinTwit and big firm strategists expressing such. We have been advocating a single stock focus with a hedged position. That single stock focus has served us well. Being overly focused on bearish scenarios removes your attention from what everyone strives to do in the stock market, make money. When you are overly focused on one specific outcome, you tend to miss out on some incredible trading opportunities.

Even post the NVDA report, we identified 4 more trading opportunities that would benefit from the NVDA blow out guidance. Our approach is to marry technicals with fundamentals. We come from a fundamental background, and thus we can react differently to what’s changing fundamentally. We like to think we provide considerably more value than the plethora of trading services that only focus on technicals. That is too one dimensional, as the market is much more complicated than lines on a chart. Not only are most of these services unaware of the interplay of specific company fundamentals and how it impacts the landscape, but they typically have very little understanding of how macro-economics work. Hence, why we created this newsletter. To give our readers some perspective that they typically would have to pay considerable sums of money to gain access to at the larger research shops. Not only do we love sharing our opinions, but we make it affordable so anyone can subscribe and learn.

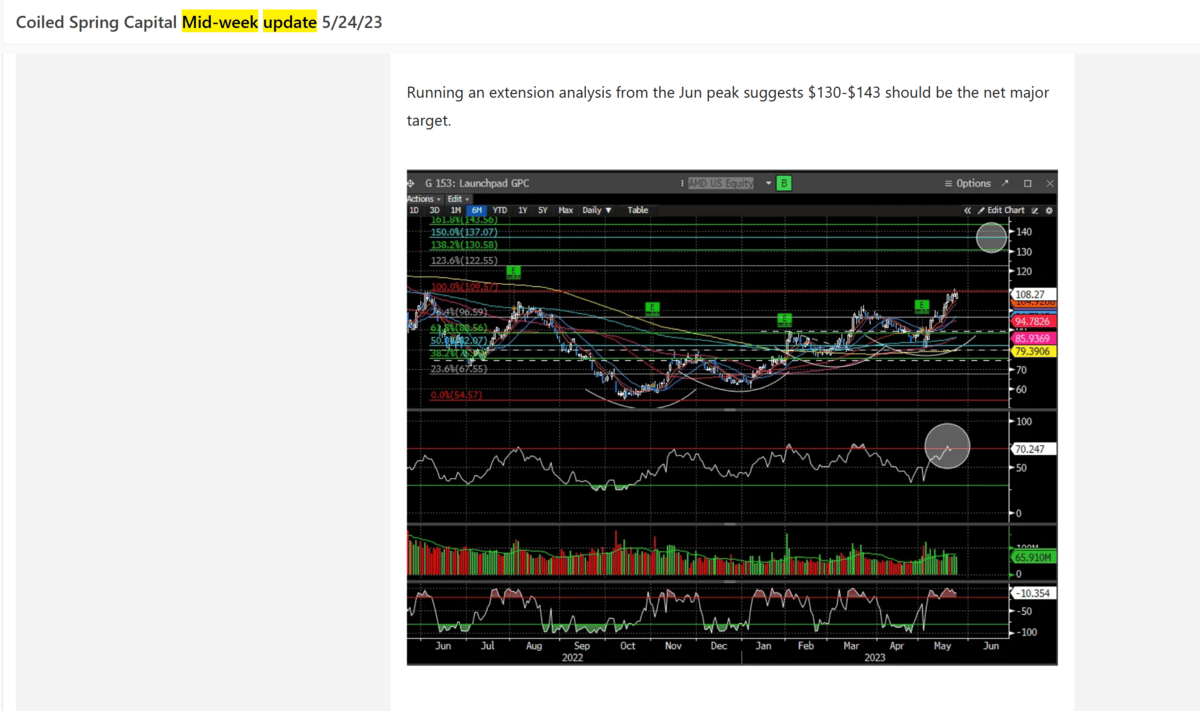

In our mid-week report we discussed that NVDA’s good fortune in AI will benefit the entire semi space but also specifically, a few individual stocks.

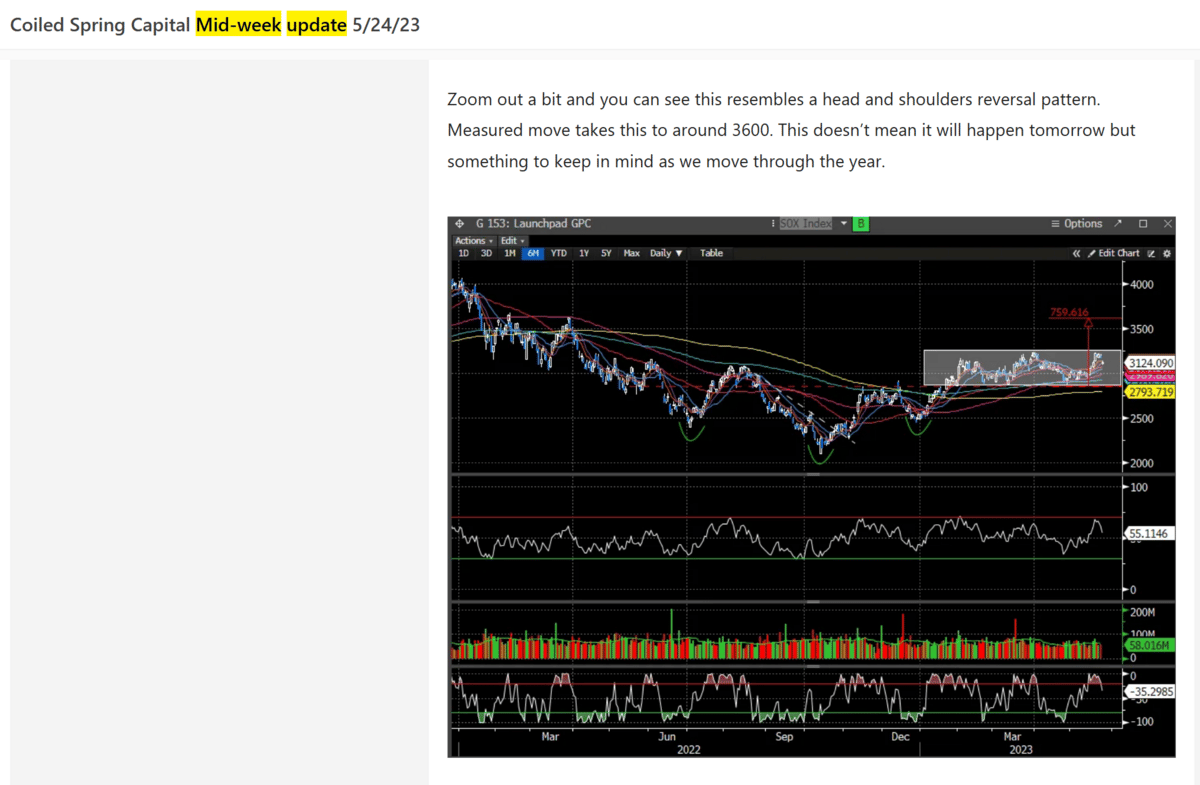

We discussed the importance of the semis on the broader tape.

Here are a few excerpts from that report on the Semis, $AMD, $TSM and $MU:

If you bought Thursdays open and sold Fridays close, these instruments would have yielded mid to high single digit returns ($SMH +7%, $AMD +8%, $TSM +6%, $MU +6%). While all the so-called experts on Fintwit were wrangling about how expensive $NVDA is and trying to short it, they missed the easy money on the peripherals. We strive to be different and try to add value, not just stick our finger in the air to make foolish trading recommendations.

If you have an interest in becoming a more astute trader or investor, we offer a differentiated take on the stock market. In essence, we like to think we make our readers smarter. Please consider subscribing below.