Stock market bifurcation continues to be a dominant theme. The largest market cap stocks continue to press the major indices forward to new heights while the rest of the pack gets left in the dust. We have been writing about this growing bifurcation for over a month, and now social media and the networks are belaboring the point to death. Typically, this sort of thematic pervasive browbeating leads to a crescendo. Whether that crescendo leads to a major catch-up for the laggards or a catch-down for the large caps remains to be seen.

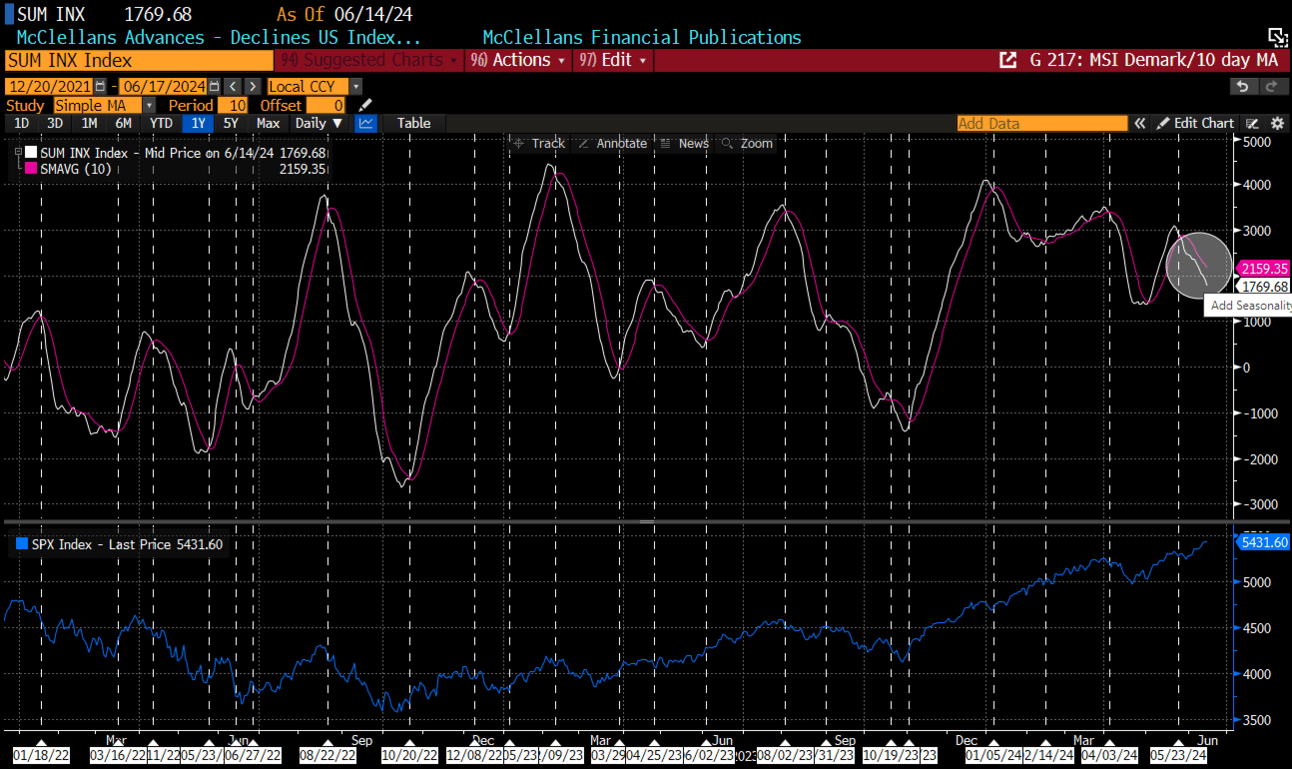

The concentration in the markets is becoming blatantly obvious as the indexes march to all-time highs (ATH’s) while most underlying stocks in the SPX continue to weaken. Only ~44% of stocks in the SPX are over their 50-day MA. Reference this time period back to March when the SPX percentage of members was declining in lockstep with a sinking stock market. Today, the bifurcation is becoming increasingly obvious.

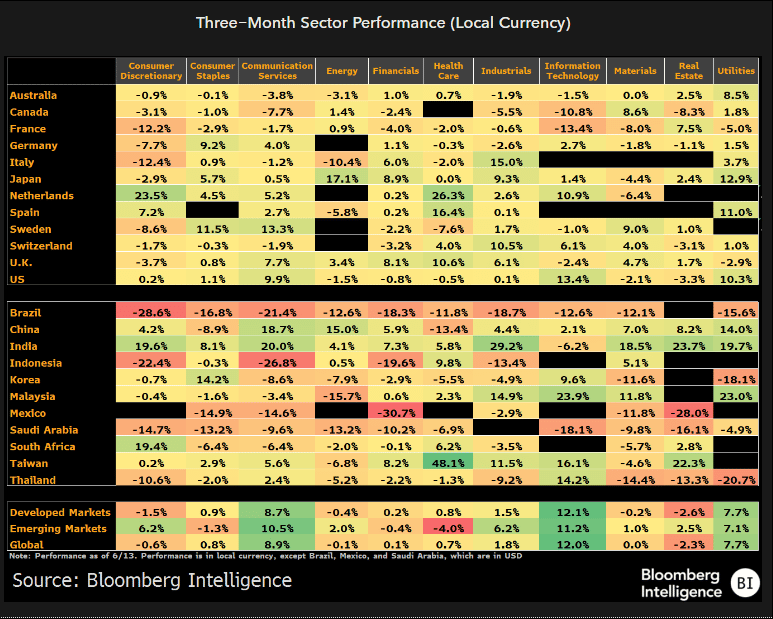

According to Bloomberg, the largest 5% of US stocks have accounted for nearly all of this year’s gains in the Bloomberg US Index. The largest companies are earning their place at the top as their earnings continue to grow, while the smallest 95% are actually declining. Interestingly enough, this is not just a US phenomenon.

It’s no surprise that technology performance is leading in most developed markets; Thank you AI.

That begs the question. Is this sort of concentration healthy? From a Chartered Market Technician (CMT) perspective, no. However, there is enough data to support the idea that concentration risk is not necessarily a harbinger of lower index prices, at least in the US. Here is a chart from Global Financial Data looking at 150 years of market concentration. The bottom line is that concentration is nothing new.

Then there is the prevailing argument that we are revisiting the overly ebullient enthusiasm from the internet bubble years. This is categorically incorrect. This chart from BofA shows that fundamentals and stock prices are moving in lockstep, which is in contrast to the bubble years, where they decoupled.

And while expanding valuations were certainly a huge driver of stock market returns over the past year, recent gains appear to be driven by earnings. Here is a chart from Jurrien Timmer at Fidelity, showing that we are now in the part of the cycle where earnings catch up to valuations.

This past week was macro-event heavy, with a loaded CPI report followed by an FOMC decision. The Indexes were pleased by the softening CPI, but the ecstasy was cut short by a surprisingly hawkish FOMC and a reduction in the rate cut forecast in the Fed’s dot plot. PPI was released on Thursday and also offered some reprieve. May’s CPI and PPI readings suggest the Fed’s preferred inflation gauge, the core PCE deflator, will likely moderate to .15% in May and on track to edge down on a 12-month basis to 2.6%, the lowest reading since March 2021, according to Bloomberg.

Friday, the consumer confidence numbers revealed further deterioration, falling to a seventh-month low, as stubbornly high inflation took a toll on personal finances.

Couple deteriorating consumer sentiment with a weakening job picture (US jobless claims rose the highest in 9 months), and the hard landing narrative permeated most stocks into the end of the week.

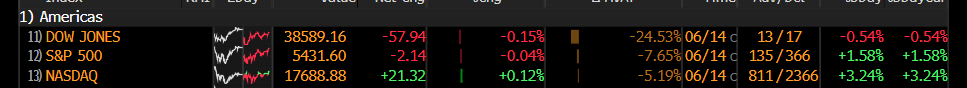

Aside from the Dow, the SPX and Nasdaq posted very respectable weeks.

Which were largely driven by the large-cap tech stocks and the Semiconductor sector. Market breadth continued to worsen per the McClellan Summation Index (MSI).

We are approaching a notoriously difficult week for the market: triple witching (quarterly/Monthly), end-of-quarter rebalancing, mid-year re-assessment, and index rebalancing with a stock and bond market closed for the Juneteenth holiday sandwiched between. This should elevate volatility considerably, at the very least.

This chart from Goldman Sachs explains it all. The worst two-second half-month returns are for June and September.

Time to put on the hard hat?