Another wild week in the market to stymie the bearish camp. Despite a more hawkish Fed, the stock market managed to post a very agreeable week and now the 5th week in a row of gains for the SPX and 8 in a row for the Nasdaq. The SPX is now higher than it was on March 16th, 2022, the day after the Federal Reserve embarked on the most aggressive rate hike campaign in 40 years.

The SPX posed a +2.58% gain and the Nasdaq continues to push forward with a +3.25% gain. So much for the Fed spoiling the bull’s party.

It’s not as if the FOMC didn’t surprise the market, they did. Fed Fund Futures were pricing in one additional hike in July, but guidance for two was not priced in. We have always made the case that surprising the markets with unknowns are usually met with volatility. Yet the market shrugged it off.

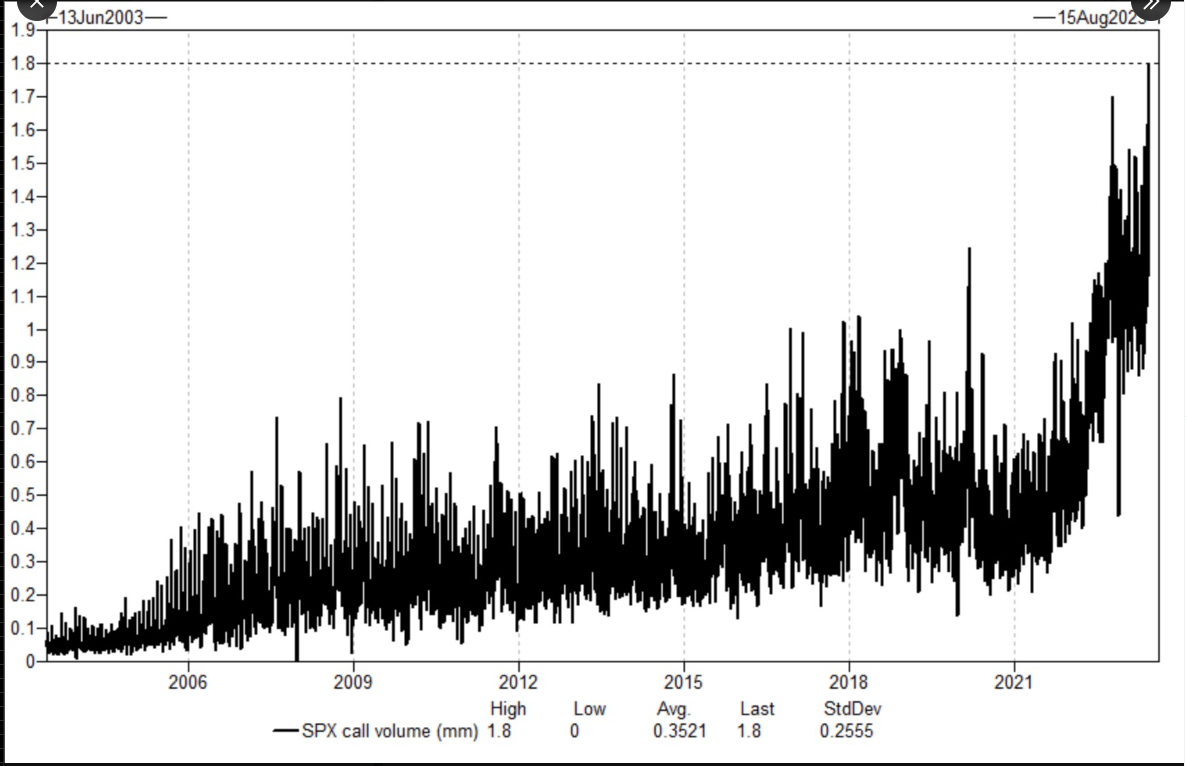

Our favorite argument for the why the market keeps rising is options and retail call buying. We’ve seen this chart kicked around this past week as it shows Thursday was the highest call buying ever.

While derivative structure definitely plays a role in market direction, do these people really believe that derivatives are to blame for the last 3K Nasdaq and 600 points SPX points since the March low? When markets rose for the last decade, the consensus blame was the Fed’s excessive pumping of liquidity into the economy. Now that the Fed is no longer “spiking the punchbowl,” that blame has shifted to the derivatives market and 0DTE options. 🤔

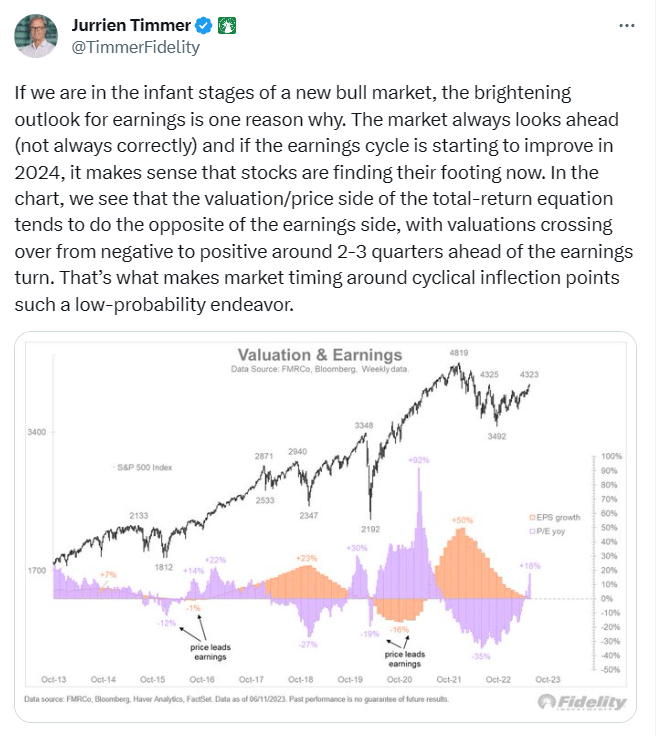

The market is a discounting mechanism. Could it be possible that the stock market overly discounted a recession in ‘22 that never came, and now it is re-rating to an economy that’s slowing but not breaking? We’d argue it is. This is why it is important to tune out all the noise and opinions that are out there clouding your judgement. We speak to our clients every day, and most of them are bearish. We read a number of newsletters, periodicals, listen to interviews, etc, and most of them are bearish. When everyone is bearish, who is left to push the stock market lower? We have been discussing this dynamic for a year now.

We read an interesting blurb on Twitter yesterday that resonated with us. “The 2022 stock market birthed an entire generation of perma-bears.” There is some truth to this. Most new market participants were enticed by the 2021 post Covid bubble stock market. They have never seen a real bear market until last year. And the reasons for the bear market were for pervasive: a cataclysmic recession that was forecasted by everyone, including us, the popping of the Fed induced liquidity bubble, sky high interest rates, a slashing of earnings estimates forcing lower valuations, bankruptcies, credit issues, exploding unemployment, etc. These were and are all very good reasons to run away from the stock market. But these were last year’s reasons, and recycled reasons in the stock market rarely work. While some of these major factors did come to fruition, i.e., sky high interest rates and fallout from reduced Fed liquidity, they did not implode the economy the way the stock market was discounting in ‘22. If this is true, then a re-rating needs to occur - Welcome to 2023.

This is a great post encapsulating this notion that the market is discounting a return to normality.

Does this mean the economy has escaped the tightening liquidity vice from the FOMC? No, it has not. The FOMC clearly wants to keep slowing things down, and eventually they will. The extent and timing of that slowdown is now what’s being debated in the stock market.

The stock market almost always over-corrects a directional bias. So now the question is, has the market gone too far too fast and needs to correct? We will discuss this and more below in the premium portion of our analysis.