“Hammer Time”

For those not old enough to remember the 80-90’s rapper sensation MC Hammer, we have included one of his photos above from one of his iconic performances. Our reference to his “Hammer time” lyric from one of his most famous hits, “U Can’t Touch This,” comes to mind when scanning the stock market post-Friday’s aggressive ramp into the close. Hammers are currently littered everywhere in the market.

What is a hammer besides something used to nail objects?

What are the implications of hammer reversals? Typically, they signify the end of a trend. In the stock market, we had been selling off for days, and in the case of some individual stocks, the selling had been occurring for weeks.

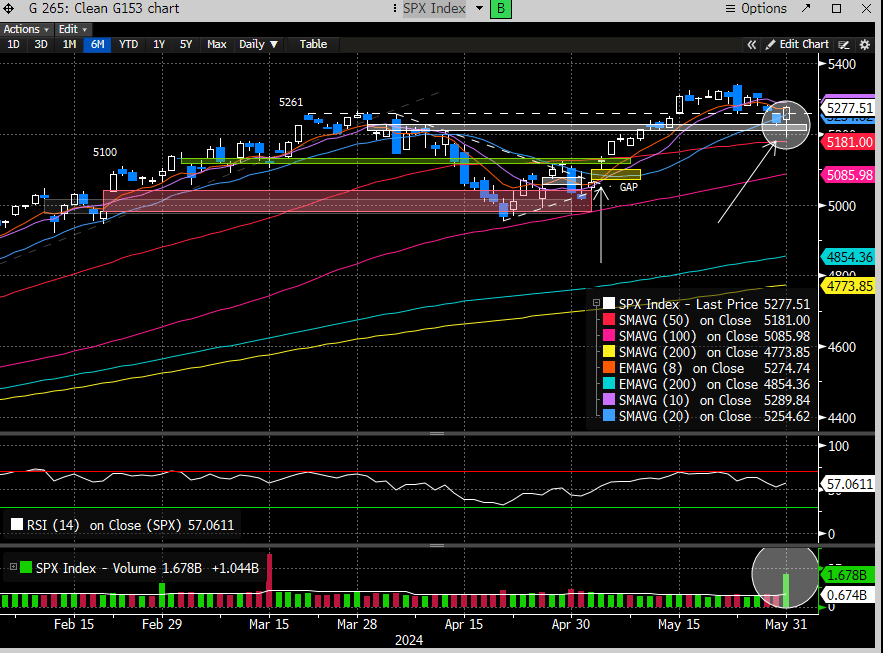

Friday’s hammer reversal for the SPX occurred right near the important 50-day MA and with significant volume.

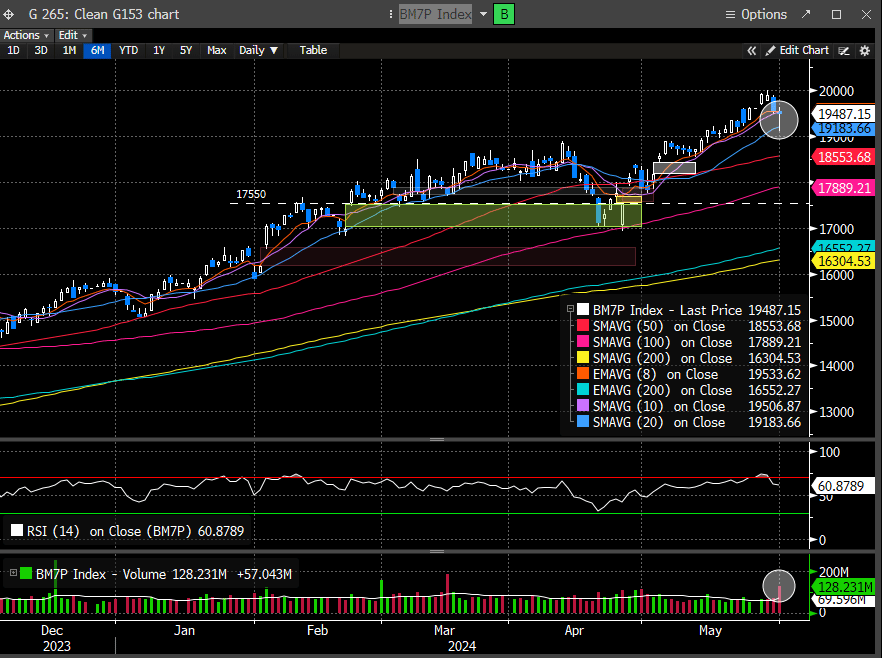

The Nasdaq also saw a hammer reversal, which occurred right at the March pivot to reclaim the 20-day MA.

The Mag 7 Index has its own hammer reversal right at the 20-day MA.

The Semis, the leader in growth stocks, posted their own hammer reversal candle, also defending the 20-day MA. This came on extraordinary volume.

Even software, which has had one of the toughest weeks in recent memory, posted its a hammer reversal.

Interestingly, our ETF sector page is predominantly green from Friday’s trade, with notable laggards (Semis, Large Cap tech, Momentum, Internet, Non-profitable tech).

One day does not make a trend, but this occurred on the last day of the month, which is a notorious rebalancing period. This screams market rotation to us, and while a large MSCI rebalance took place, which can explain some of the large volume prints, the rotational action is pervasive.

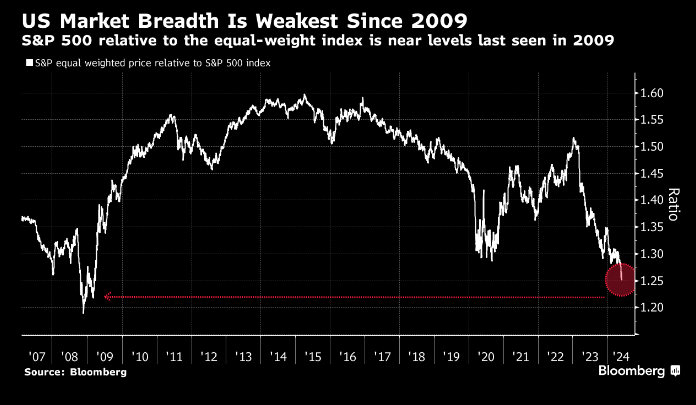

In our last weekend report, we were notably cautious after the NVDA report. The major indexes saw an outside day after the robust PMI report, which showed unusually strong business activity, pushing the rate cut rhetoric back again. This was on the back of our previous cautionary reports highlighting the market bifurcation and the clear delineation between heavy sector weights propping up the indexes while the rest of the market had been expressing softness for weeks.

This was no better illustrated than with the transports (IYT) that had been underperforming the market since March. Dow Theory holds that Transports must confirm the strength in the Dow Jones, or the index strength could be prone to failure.

While the Dow Jones made a new all-time high (ATH) on 5/20, it was abruptly rejected for -5% over the last week and a half (until Friday). This large index move should not be dismissed; it has to make you wonder what is being discounted. Is the economy slowing rapidly, and rates are being viewed as too restrictive? We think that’s likely.

Last weekend’s report highlighted that deteriorating market breadth had broken a key moving average (MA), a big signal that we should start playing defense.

Here is an excerpt:

We also discussed in that report the new short-term DeMark sell signals that could press the indexes lower:

We highlighted the new DeMark 9 sell signal for the Nasdaq that could potentially disrupt the bullish trajectory. These signals are typically good for 1-4 price bars and ultimately produced price reversion on day 3.

So, while our cautious approach to the market proved correct into Friday’s lows, the abrupt reversal on Friday is nothing to ignore. Couple that reversion with the pervasive rotation, and it’s difficult not to interpret that as anything but bullish. Rotation is the life’s blood of a bull market. Again, that doesn’t mean that all stocks will benefit. This rotation away from growth may continue as the laggards play catch up.

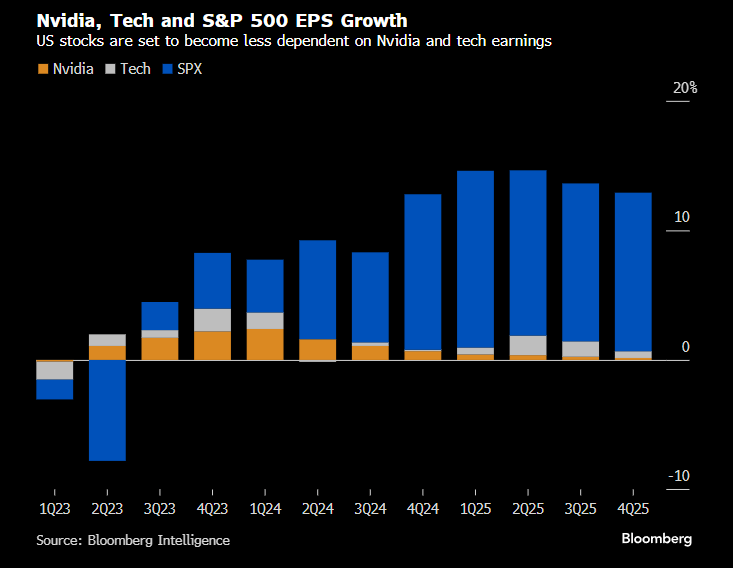

It’s no surprise that the concentration in the stock market remains extreme. In the first five months of the year, the SPX has derived 60% of its total returns from just five stocks. It’s even more crowded at the top, with NVDA accounting for more than 30% of total YTD returns.

According to Bloomberg, SPX EPS growth is set to become less dependent on NVDA and technology’s earnings growth. If correct, this plays directly into our rotational thesis, and maybe the early evidence of that rotation took place on Friday.

Given how depressed the rest of the field is regarding performance, rotation away from the leaders is overdue.

According to Goldman Sachs, a strong first half of the year leads to more gains, which must come from somewhere if the Mag 7 stocks struggle to add to their annual gains. This implies that the laggards need to pick up the slack.

For that to happen, we think rates need to retrench, and last week’s reversal in the short-term treasury market is certainly a good start. Will it continue, however, is the bigger question.

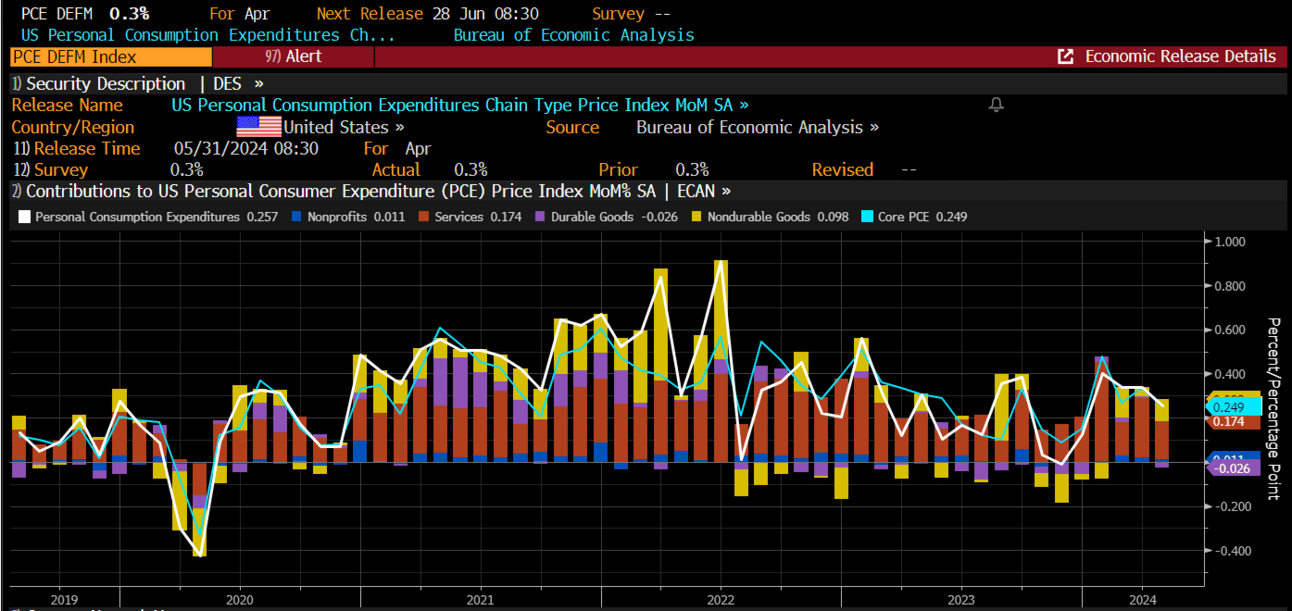

On Friday, the PCE was reported and exhibited softness. This pushed short-term rates down even further and likely was a big reason the market rebounded into the close on Friday.

This week, we will receive more ISM Manufacturing and Services data and the important May Employment report. If you recall, the last payroll report ignited a massive market rally that took us to ATHs.

Never a dull week in the markets.