What a rollercoaster week in the stock market. We had cautioned to expect fireworks as we approached triple witching on Friday and some very large rebalances, most notably for the $XLK (technology ETF). These balances are very well-telegraphed, and professional investors use the added liquidity to make changes to their portfolios. This can cause havoc in certain areas of the market as positions get unwound.

To add to the chaos, the $XLK also attracted more than $8B of new money during the week through Wednesday. This massive in-flow made up one-third of total flows into US equities. The rebalance had $10B of AAPL for sale to make room for NVDA. As if NVDA needed any more reason to attract capital?

This phenomenon is known in the ETF world as the “heartbeat” trade. Essentially, it shields capital gains for large institutions. The result is large volume on both sides for a few days which is why the volume looks so explosive in specific stocks.

This added liquidity brought out lots of sellers, especially in semiconductors. NVDA, being the most over-owned and crowded, seemingly experienced a blow-off top.

Our analysis for one of our institutional customers discussed the setup for this potential over the last weekend. (Please contact us for institutional bespoke work).

Our analysis of NVDA suggested the top was near with its first DeMark combo 13 sell printing since March, aligned with a 13 weekly sell signal, coupled with being massively overbought and in a relentless uptrend; we posited it would top at the 300% fib extension at 141 vs. Thursday’s top at 140.76.

The DeMark combo 13 sell occurred on Thursday, marking the exact top.

This brought down most of the semiconductor space and any stock that has been on the right side of the momentum AI trade. The million-dollar question is: will the semi-sell-off take down the rest of the market? The conventional wisdom would argue that it would.

But that’s not what happened. The major indexes finished up, with the Nasdaq finishing flat. The Nasdaq gave all of its early week gains back, but the Dow and the Russell closed higher. Could this suggest that rotation is finally occurring?

We have seen this movie before; a few days of rotation give way to a slowing economic release, and money rotates back into the growth space. It’s impossible to know if the rotational winds will keep blowing.

When we examine the GICS sector performance for the week, it would certainly suggest that rotation is occurring.

It’s entirely possible that as we enter the third quarter and second half of the year, professional managers will take some of their growth chips off the table and swap those positions for some of the laggard areas of the market (see conclusion section for examples).

If we look closely at the S&P Small Cap 600 (SML Index), you’ll notice that strength was apparent very early last week with a bullish outside day. The SML index has been stuck in a range since peaking in December. Just getting this back to the top of the range would yield an almost 7% return.

50% of the index is in the financial, industrial, and consumer discretionary sectors. Two of those sectors were the top-performing sectors for the SPX this week.

This week, we also saw that the equal-weight SPX (SPW Index) and the equal eight Nasdaq 100 (NDXE Index) outperformed their big brothers.

Now, one week does not necessarily mean that the rotational thematic will continue at that level of outperformance, but we must consider that if the stock market continues its ascent, broader participation is desired and healthy. In fact, it’s entirely possible that the stock market indices do very little while laggard sectors and stocks catch up.

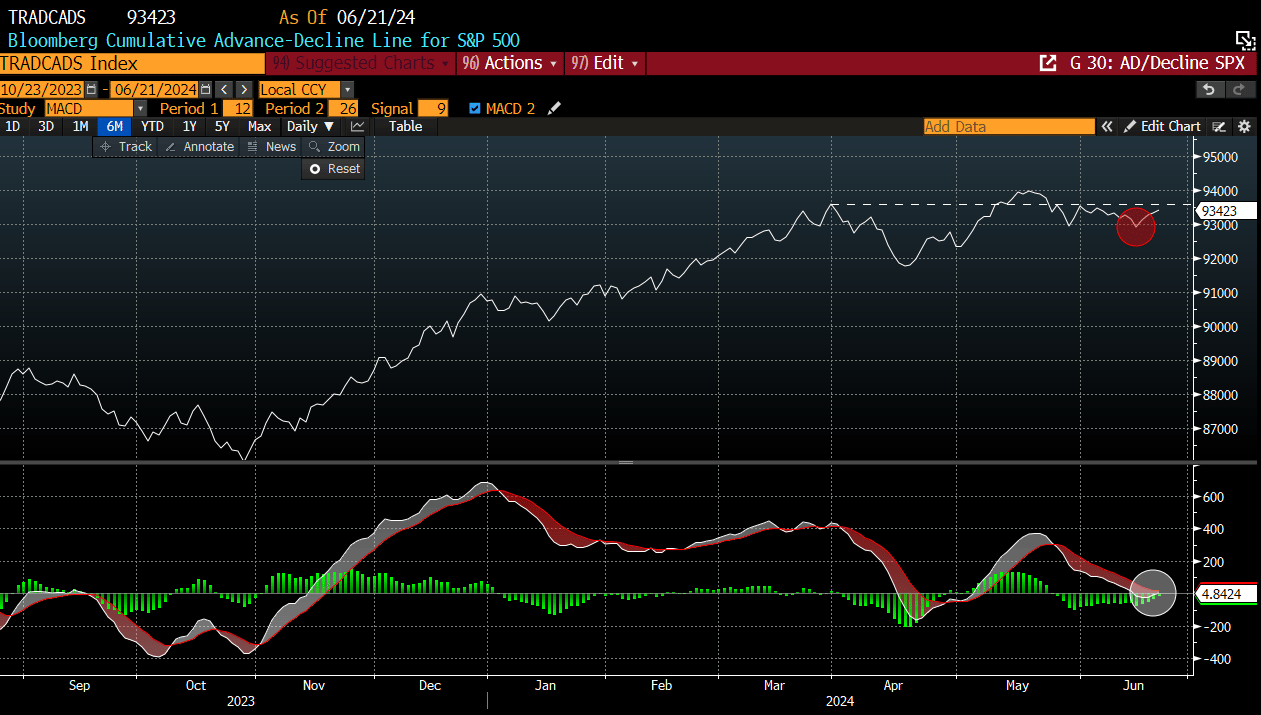

The SPX Ad/Decline inflected higher this week, implying that more issues were advancing vs. declining. Its MACD is also starting to cross bullishly, which implies we should see continuation and broader participation. The Advance/Decline has been declining since mid-May.

Next week is the final week of the second quarter, which means we should still expect violent rotations to continue as portfolio books are squared and repositioned. We will also get GDP and consumption releases towards the end of the week, which could always sprinkle some added volatility into the picture. Lastly, we are still in the window of weakness with regard to seasonality. Here is a chart from BofA depicting the performance of the first 10 days of each month vs. the last 10 days of each month. June has less than a 50% chance of closing positive in the back half of the month. Notably, the first 10 days of July are extremely strong. Get your shopping lists ready.