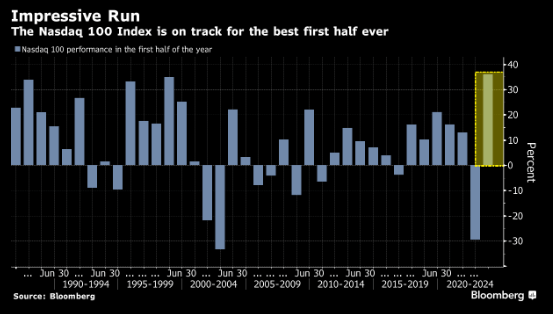

So much for all the bearish banter at the end of last year and into January, calling for a terrible first half start to the year for the stock market. The exact opposite of what consensus was calling for actually occurred. Despite the major indexes being up a very respectable double digits (SPX +13% and the Nasdaq +29%), the Nasdaq 100 is poised for its best six months to a year EVER. Let’s repeat that, “best ever.” You honestly can’t make up a more lopsided and incorrect view from Wall Street strategists, professional investors, the media, or retail self-proclaimed market geniuses as we entered the year.

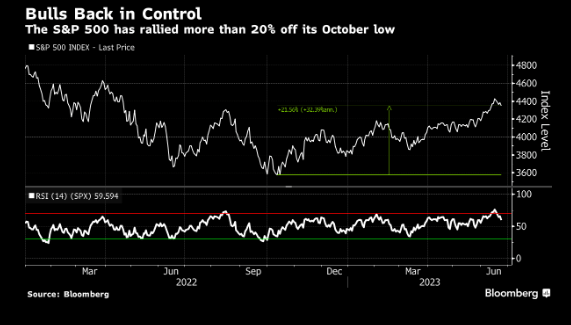

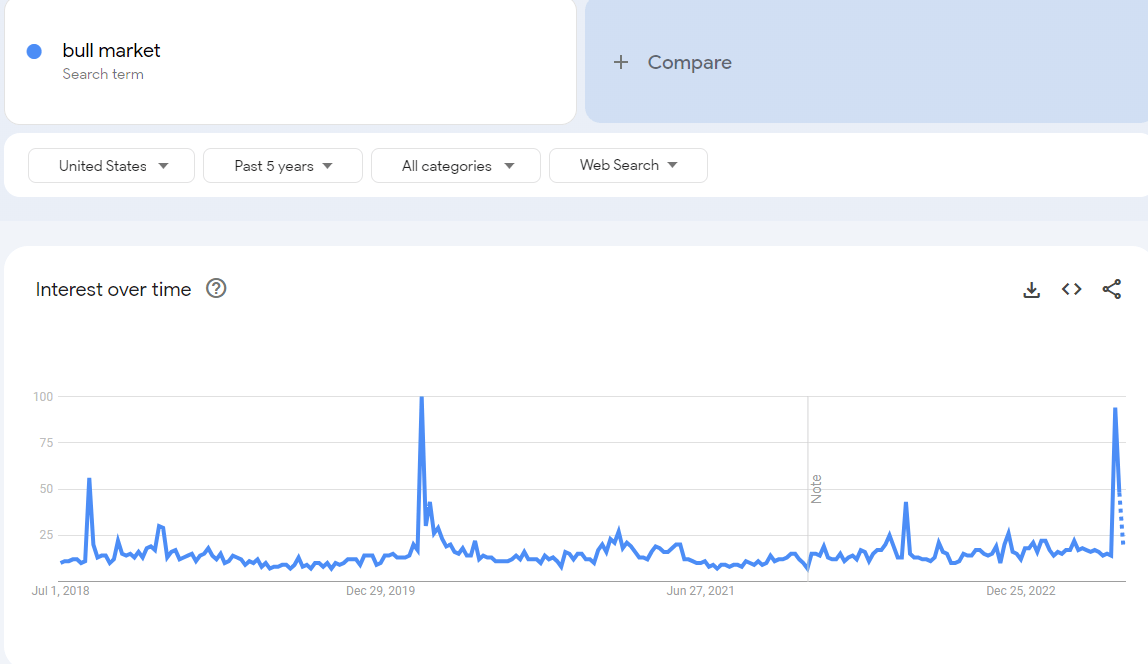

The SPX has now rallied over +20% since the Oct CPI inflation print low. This is the media’s so-called definition of a bull market. This number seems too arbitrary to consider it anything other than a sensationalistic metric, but nonetheless, google searches for “bull market” have exploded.

Fortunately for our readers and our team, we were not caught offsides, in fact we were bulled up for the Dec-Jan rally and have been tactically bullish for the bulk of the year. We are agnostic investors/traders and take a weight of the evidence approach to determine stock market direction. We understand that markets don’t move in a straight line, and there are appropriate times to be bullish and appropriate times to be bearish.

Here are the google search trends for a “bull market” compared to the last 5 years. We always find it interesting that nobody wanted to touch the stock market 6 months ago when it was on sale, but now that it’s gotten more expensive, everyone is interested. We have written considerably about the negative market sentiment trends over the last year, and that when everyone is jumping out of the boat, it’s usually the best time to buy. Conversely, if search trends for a bull market are exploding higher, is now the best time to be investing?

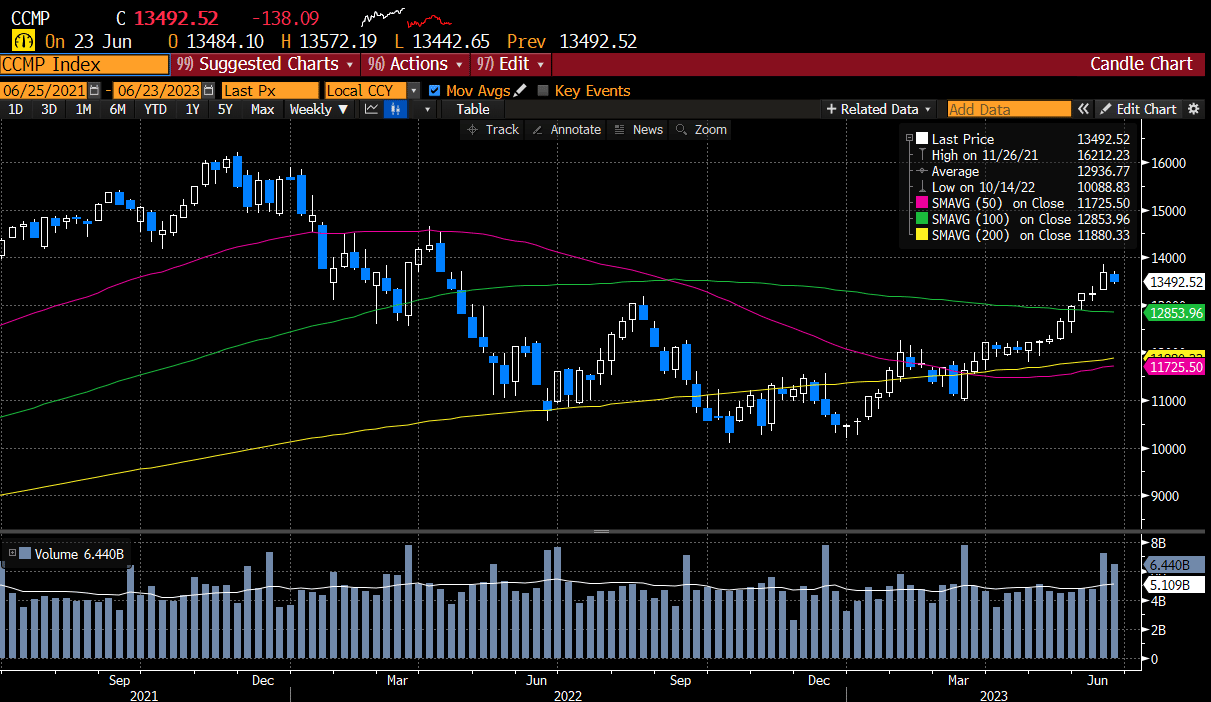

Coming into last week we were already appropriately defensive, calling for a retracement to commence. This was detailed in our Jun 21st mid-week report and last week the indexes had their first down week in quite some time.

The SPX saw its first down week in 5.

The Nasdaq with its first down week in 8.

Here is the 5 day change for the major indexes.

Both indexes recorded inside weeks. Inside weeks mean equilibrium. The bigger question is, is this the pause that refreshes or is it the start of larger down leg? We will discuss more in our paid portion below.

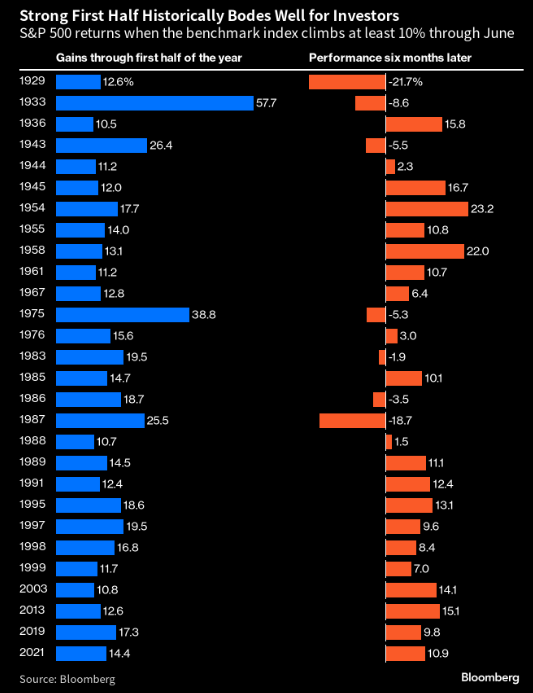

One thing is for sure, statistically the bears have their backs against the wall. When the stock market closes out the first 6 months with a greater than +10% gain, the median return is also around +10% for the second half, according to Ryan Detrick at Carson Group.

We conduct rigorous analysis to determine a probabilistic scenario so you can make better decisions on when and how to invest. Please consider subscribing below to read our premium content.