The US stock markets closed out the quarter with a very respectable performance, trouncing all the fears of the perennial bearish community calling for some major reversion due to stubbornly high inflation and employment, slowing economic growth and excessively high valuation.

The Nasdaq was the clear leader, rising almost 9% on the backs of the stalwart Magnificent 7, most specifically NVDA. The Dow was the unfortunate casualty along with the lagging small cap stocks.

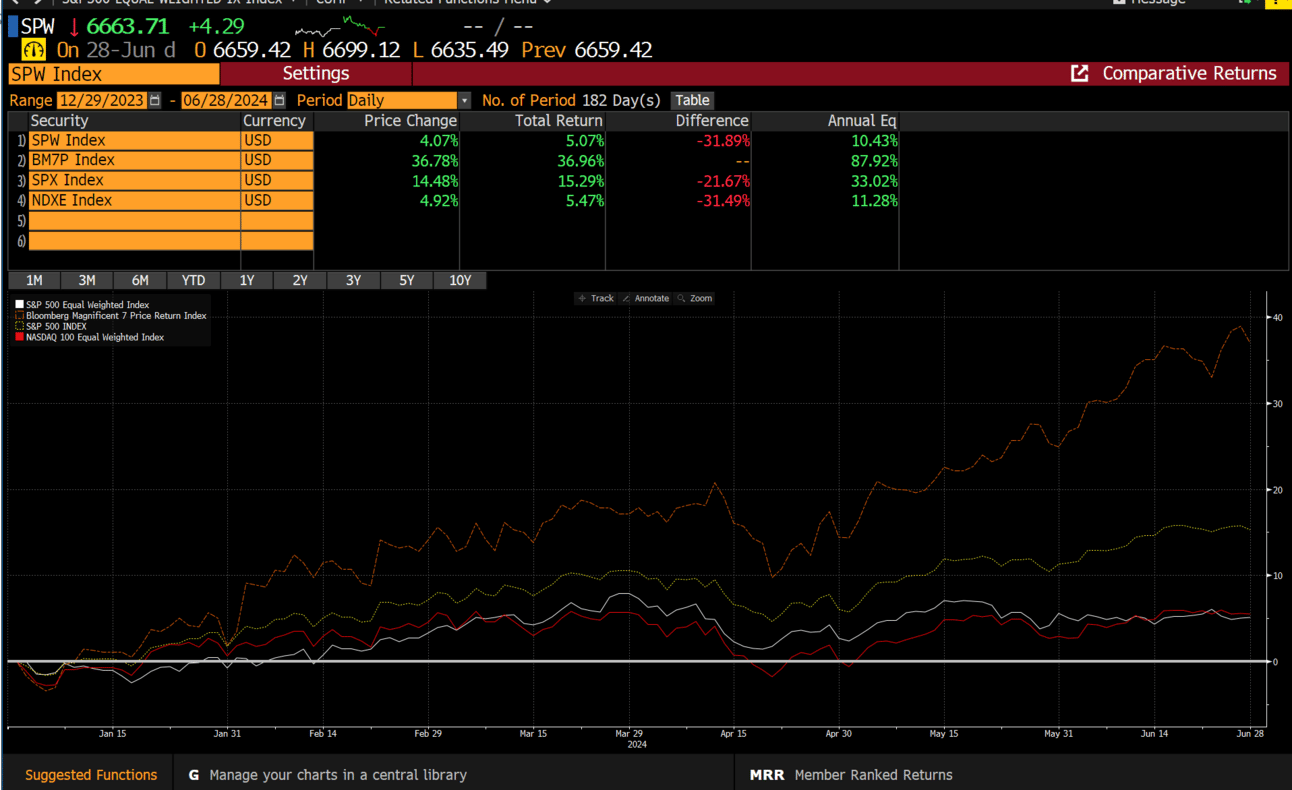

The bifurcation in performance is something we have discussed in detail in previous reports, and the dispersion for individual stocks is even more pronounced. This is playing havoc with active managers as most cannot keep pace with their benchmarks unless they are heavily overweight the Mag 7 names. This anointed group of stocks has returned over 36% since the start of 2024, beating the SPX by over 20 percentage points. When comparing the Mag 7 performance to the equal weight version of the SPX (SPW), the discrepancy is even worse, with an incredibly wide gap of 32 percentage points.

BofA notes that the average large cap fund has over 1/3 of its portfolio in just five stocks, up from 26% in December ‘22, while a quarter of all large cap funds having more than 40% of their portfolio in five stocks, up from 5%.

This makes it near impossible for active managers to differentiate themselves in a competitive field of options for investors.

Will the second half of ‘24 finally tip the scales for the astute stock picker?

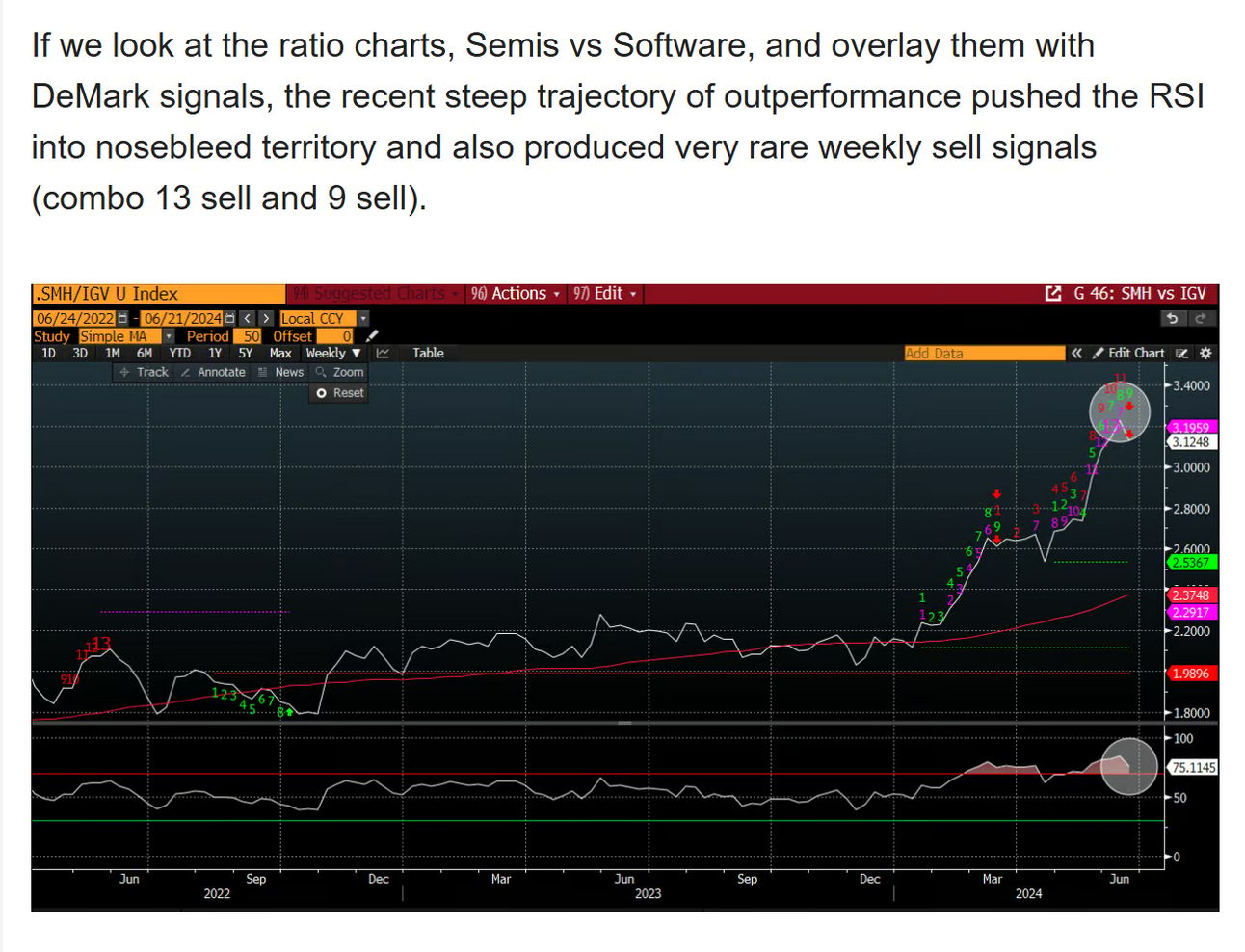

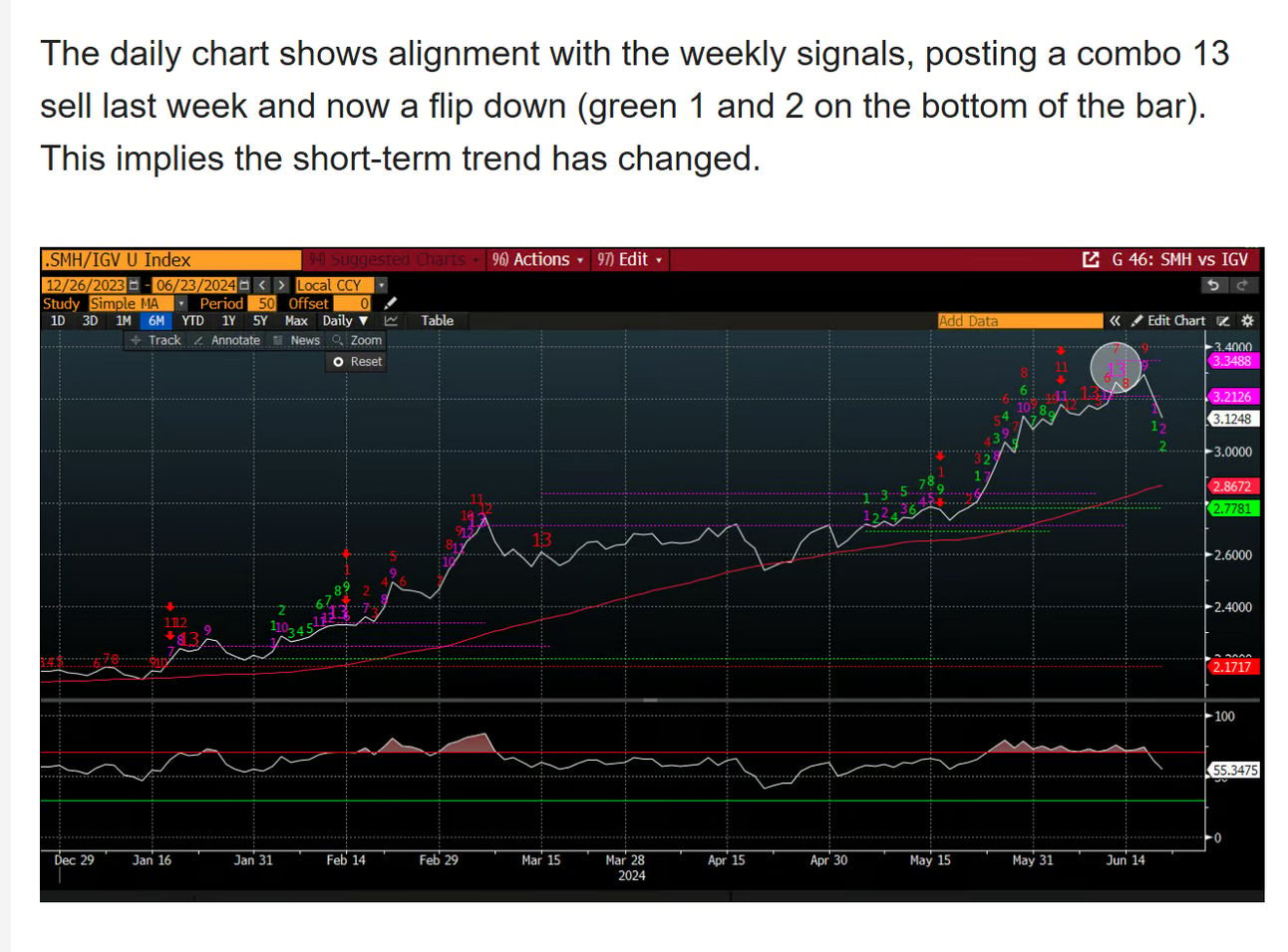

Unfortunately, we can only offer our opinion based on the observations we glean from our tactical approach to analyzing markets. In our last weekend report, we wrote about the interplay between software and semiconductors, as it pertains to growth manager allocations. It’s no surprise that the semiconductors were being overweighted last quarter at the expense of software. Last, we week we discussed, per our analysis that this relationship was set up to reverse.

Here are those excerpts:

This analysis proved prescient as software (IGV) outperformed semis by a wide margin (+400 BPS). Software also outperformed the major indexes as well as the Mag 7.

Will this level of outperformance continue? Thats hard to say and most likely will be determined by the 2Q earnings season. Our fundamental opinion on this has little value, so we will spare you from our theories. What we will tell you is that the monthly picture for Software is extremely bullish, and what this simple chart tells us, is that Software, may very well take the baton from the semiconductors in the third quarter.

This is a monthly chart of the IGV. This is a long-term (monthly) cup and handle chart (C&H). C&H patterns are continuation patterns and suggests a continuation of the current trend. We are now approaching the pivot point for this pattern which goes back to the ‘21 highs. All patterns must be confirmed with a break, but this looks important and worth tracking. The measured move target of this pattern is around $130 or 85% from here. This target could take years to play out but something to keep in the back of your mind should we see this break up soon. Long term patterns have much more meaning than short term daily charts. The June monthly candle is also very bullish, which implies software should remain bid over the next couple of months.

When considering the Semiconductor (SMH) monthly chart, the cup and handle formation break was confirmed in December ‘23. The measured move target of this break was 240, which was achieved in four months. This is not to say that software will see a similar ramp, but only to illustrate the power of this pattern. The monthly candle for SMH does look a little toppy with a long tail. This may just imply digestion vs. an outright reversal but compared to the software candle, software looks poised to take the baton, in our opinion.

According to RenMac, the calendar shift for Semis turns quite negative in July. This offers more support to the notion that Semis may have seen their highs for the summer.

With regard to the stock market, the SPX is up 14% year to date, and historically that bodes well for the rest of the year. Since the 1950’s, when the index climbs more than 10% through June, it rises by a median of roughly 10% in the 2nd half, as per Bloomberg data.

And according to Carson Research, stocks have never peaked in Jun. Last time we checked, never is a long time.

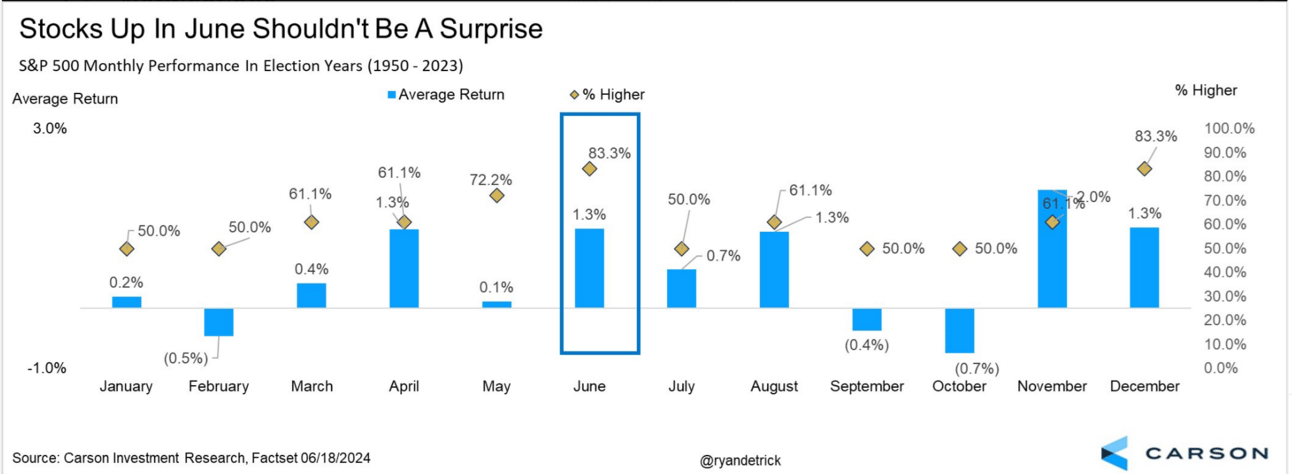

The seasonality component this year has been quite strong when thinking about stock market direction. June is typically a tough month for stocks historically, but in election years, that relationship flips quite bullish with positive June performance 83% of the time since 1950, according to Carson Research.

And now we are approaching one the strongest periods of the year: the first two weeks of July, especially for the Nasdaq and technology.

this i

Interestingly, the first half of US presidential election years is historically weaker than the second half, yet this past January-June performance is the second best since 1928, according to Ned Davis Research. Maybe this implies that mean reversion is due to occur sometime this summer.

Should the next two weeks be used to tactically reduce long exposure and prepare for a more turbulent summer?

Outside of software, are there other sectors that looked poised to catch some rotation?

Let’s expand…