It must be tough to be a perm-bear. We’ve read snippets from people on Fintwit saying they will remain short the indexes because they don’t care about 100 points in the SPX. This is because they are “so confident” that the market will be back at 3600 by the end of the year? So confident? Maybe some of the dirtiest vernacular when it pertains to the stock market. If you are “so confident” that the market will do anything, then you should be very concerned. The stock market does what it does best most of the time and inflects the most amount of pain on the most amount of people. Those calls for 3600 started when the SPX was at 4K. Now that we are almost 300 points from that level, do you think they are sweating yet?

Our bet is they are and starting to cover. We read a lot of newsletters from various participants, as it gives us a flavor for what consensus is. We are not consensus investors or traders, we are trend followers, and use DeMark analytics and proprietary indicators to help us identify those trends as early as possible. There is one newsletter that literally has called for the market to sell off every single week since January, and he’s back at it again this weekend. We are not here to ridicule this person, as he produces some interesting and thoughtful commentary on the market, but c’mon man. This is clearly a fundamentally biased individual, who believes so strongly that he will be right despite missing +26% in the Nasdaq and 11.5% in the SPX for his clients. Forgive us, we just don’t understand perma-anything.

We remain stock market direction agnostic, and despite having a bearish fundamental view, we have been predominantly bullish or constructive on the stock market direction since Oct. We simply call it like we see it, and if our signals tell us to be bullish on the market or individual stocks, we check our fundamental bias at the door, and get long where we see opportunity. We have had a stellar year thus far and we are looking forward to a strong 2H.

The hot jobs report on Friday was supposed to be bearish, after posting a significant advance, and defying the dual mandate from the FOMC. The economy added 339K jobs vs 185K forecasted. Inflation has been stubbornly sticky, forecasts for higher rates for longer is starting to gain traction, yet the stock market rallied aggressively on Friday. It’s possible that we are entering a period where good news is good news. Meaning, the Fed is closer to the end of the rate cycle campaign, yet the economy is still doing ok. Maybe this means that the imminent recession that everyone is talking about is cancelled or maybe it’s just delayed? Delayed would imply a reversion in stock prices, which basically is what we’ve been experiencing in the market. Earnings were supposed to be awful, but they weren’t. This fits nicely into that narrative that the economy is still in decent shape. Does that mean we are out of the woods? We doubt it, but it could mean that corrections in the stock market going forward are just that, corrections, and not something more meaningful. The stock market discounted a recession last year, which may or may not come this year. If that’s true, then shouldn’t the market re-rate higher? We’d say yes, and why we think the market has done so well in the face of all the negative rhetoric. The bearish community may still get there long awaited recession, but if it doesnt come until next year, then the stock market rally is real. This is why we follow our signals and don’t blindly follow a fundamental narrative. The stock market is smarter than us, and price is truth. If price is going up, who are we to fight it?

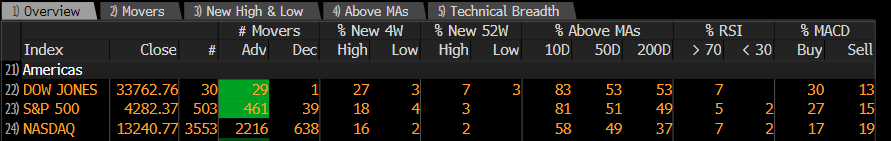

Stubborn bears will continually pounce on the lack of breadth as a reason to be bearish.

We don’t disagree that poor breadth can be a leading indicator, but more times than not, breadth can catch up with price, as stated by Renaissance Macro:

“Lots of questions on Breadth. We completely understand the argument that only 7 names are driving the market. But we don’t feel as if that’s a legitimate reason to be bearish. Historically when price is in an uptrend and breadth is a downtrend, 68% of the time, breadth comes back and improves to meet the price trend.”

We’ll have to see how this plays out. Friday was the first time in a while that saw breadth meaningfully expand.

This can also be expressed by looking at the McClellan Summation Index.

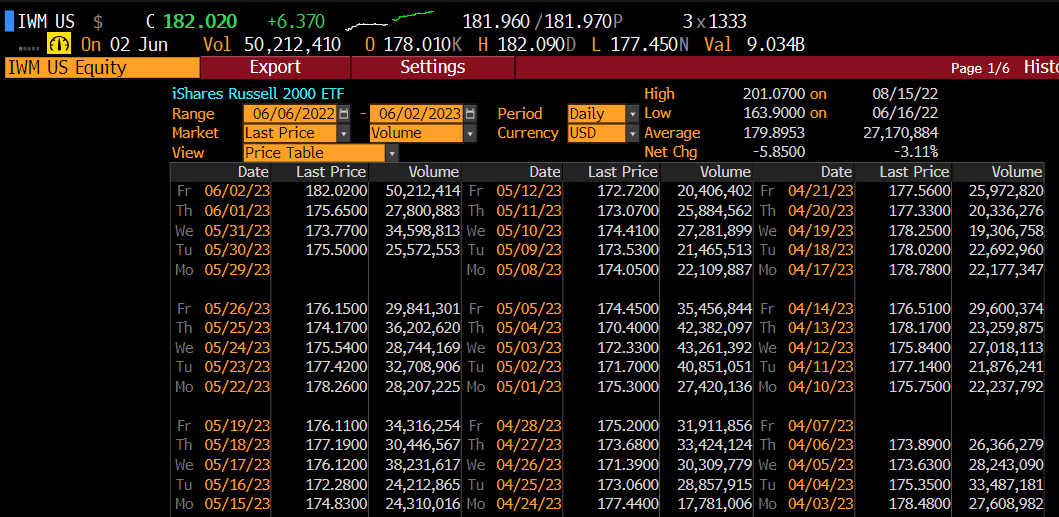

And also the Russell Small Cap 2K index ($IWM is the ETF), which is the smallest 2K stocks in the Russell 3K. This index has lagged the majors considerably. Friday saw a meaningful move on 2x average volume.

The 200 day MA for IWM’s was finally eclipsed for the first time since March. Basically, this was trapped below the 200 day for the last 3 months and finally broke out on volume. We think this is meaningful. Holding above is obviously important.

But as Tom McLellan pointed out, these sorts of moves in small caps do not necessarily lead to better outcomes. More analysis on this below.

We also thought this analysis from Bloomberg was interesting. It cites that the current dichotomy of strength in the market is quite rare, where more stocks are OS per RSI than OB, despite the index being at a 6-month high. The only time this has occurred with their data set was in 1999, which preceded the internet bubble.

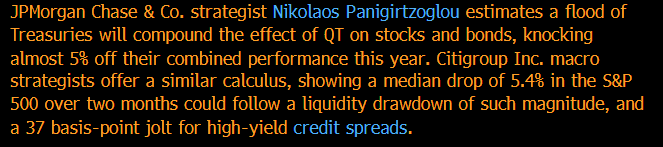

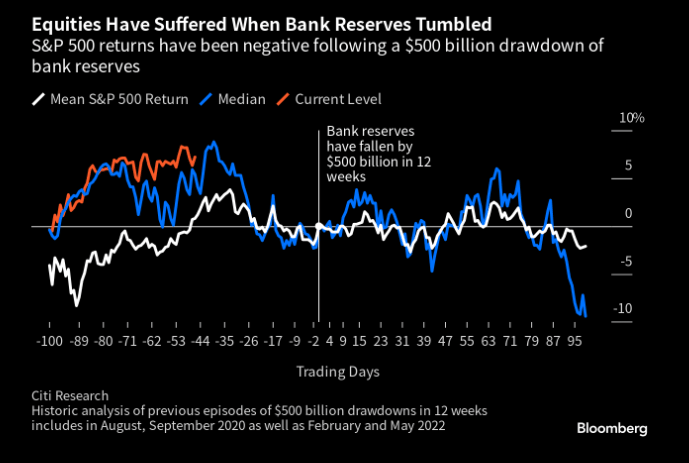

And now the new bear narrative to contend with is that the passing of the debt ceiling deal will be met with a tsunami of bond issuance to refill their coffers, starting tomorrow. The thinking is that this sort of issuance will drain liquidity from risk assets. This effectively can be seen as another dose of QT.

History has shown that equities suffer following a drawdown of bank reserves.

Although, there are some who believe that all the excess supply will be sopped up by money-market mutual funds. Regardless, it’s another brick to stack on the current wall of worry.

This sets up for an interesting June. How should you be positioned?