The events of this weekend are profoundly troubling. Setting aside political biases, these incidents are a stark blemish on global democracy. Senseless violence has no place in modern society, and we should all mourn the innocent lives lost and those impacted by yesterday's attack.

Having lived and worked in NYC during 9/11, we experienced the horror of those events firsthand. We lost dear friends and witnessed the profound devastation inflicted on families and communities. The power of hate is immense, and its effects are enduring. We must rid ourselves of the poison that hatred spreads. Our hearts go out to all the families and individuals impacted by senseless violence, including, but not limited to, yesterday’s incidents.

We understand that most of our readers are not interested in our views outside the stock market, and we totally understand. Thank you for listening.

In our mid-week report, titled CPI Sizzle or Fizzle, we specifically cited that the CPI report could be an event that gets sold and kicks off the wheels of rotation. Our call has been to be positioned very long in equities into this past week but use any strength to pare those positions.

Here is the excerpt from the report:

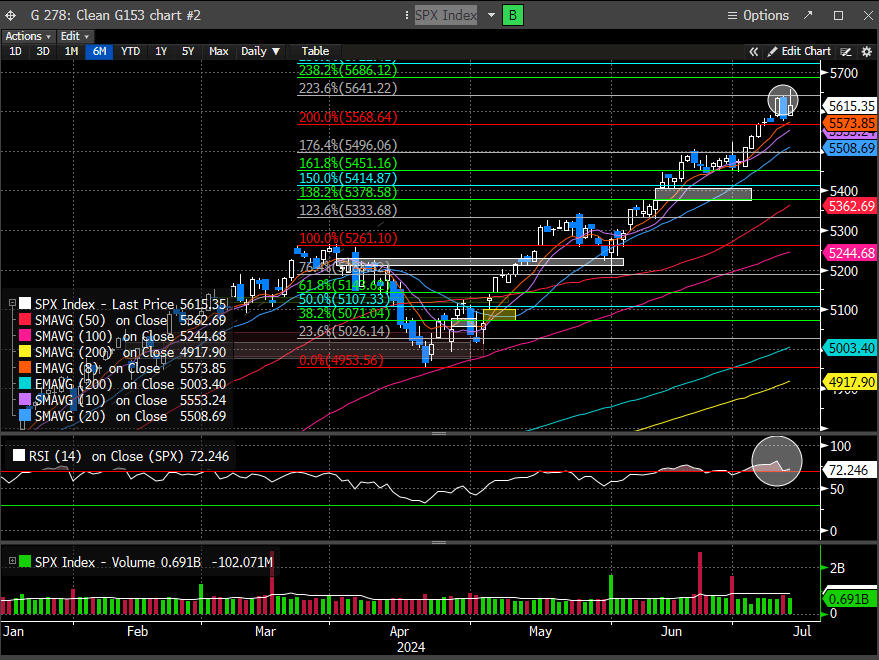

In our weekend report, we even highlighted the levels for the SPX that might mark the short-term top. We illustrated 5641-5642 as Fibonacci and DeMark Trendfactor level confluence.

Thursday’s high before the reversal was 5642, and Friday’s high, before failing was 5655.

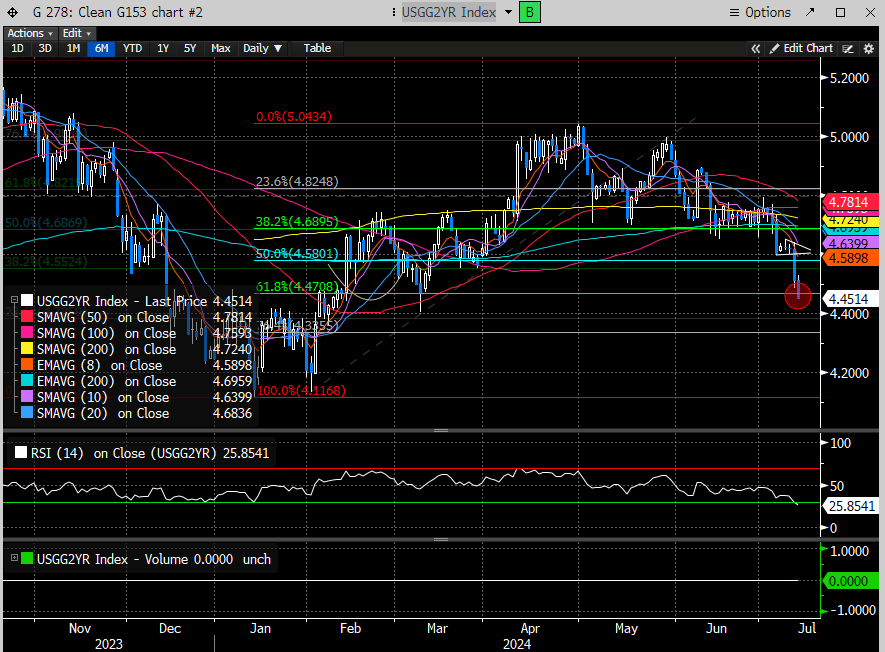

In our 6/19 report, we wrote that the 2-year treasury (a proxy for ST interest rates) might test 4.47. Here is that excerpt:

Post the CPI report, the 2-year did in fact, reach our target, closing at 4.45 on Friday.

We are not economists, but this sort of analysis seems useful to any serious investor. While most were calling for 5% rates by the end of the summer, we were calling for lower. Whether the unfortunate events this weekend ignite the Trump trade again (higher rates) or not, as it did a couple of weeks ago, we think the seeds are sown for lower rates, and we stick to our view that rates have topped.

The biggest question in the stock market exiting the week is whether the rotational thematic is here to stay. In our 6/30 report, we highlighted the potential early signs of rotation but admitted it was hard to pinpoint precisely where that rotation was occurring. Here is that excerpt:

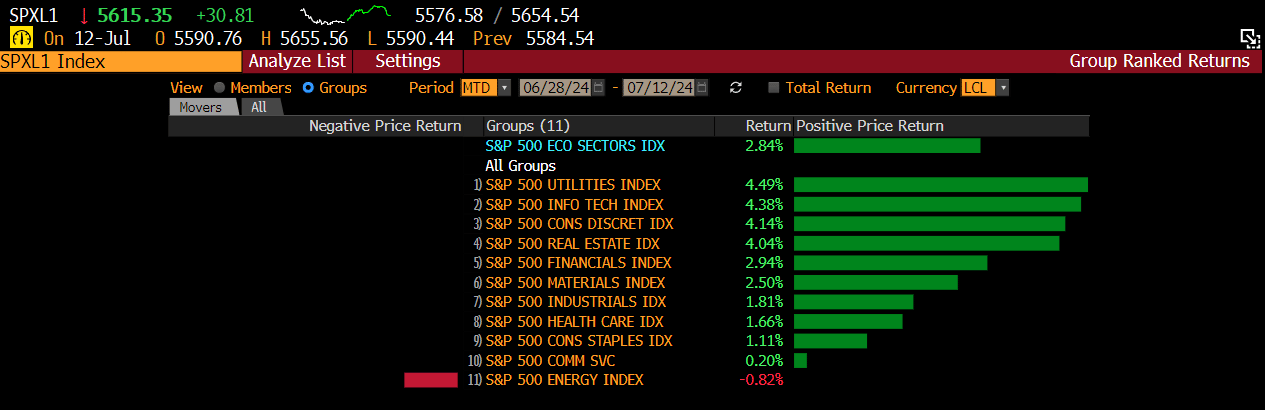

Since the beginning of the new quarter, Utilities have been the biggest gainers in the SPX GICS level index. This makes sense as lower rates make their safe and juicy yields more attractive to investors. Technology continues to perform well, as does consumer discretionary, with real estate coming in a respectable 4th place (yield sensitive). Energy continues to be the laggard.

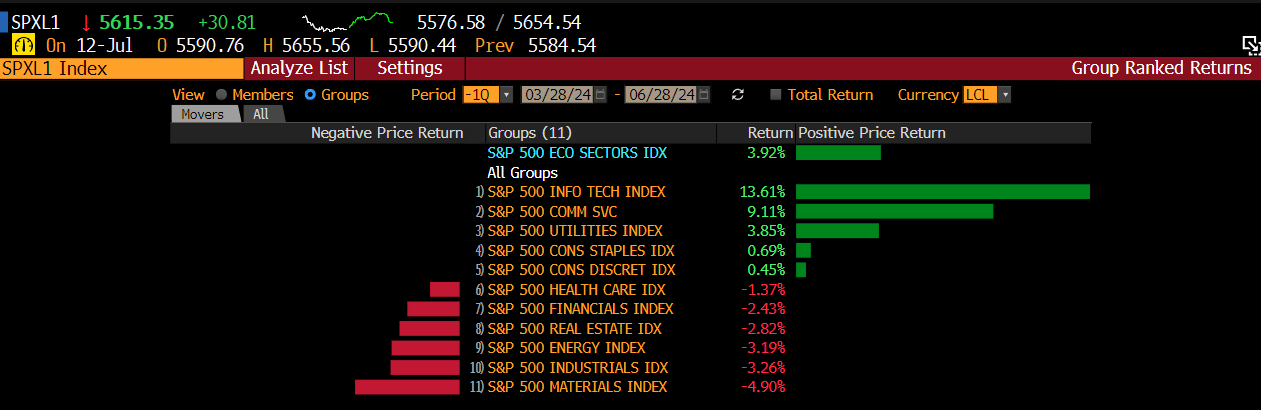

Contrast this nascent performance to the prior quarters, and the discrepancies are obvious. Interestingly, technology and utilities are still leading, but remember, this is only two weeks’ worth of data.

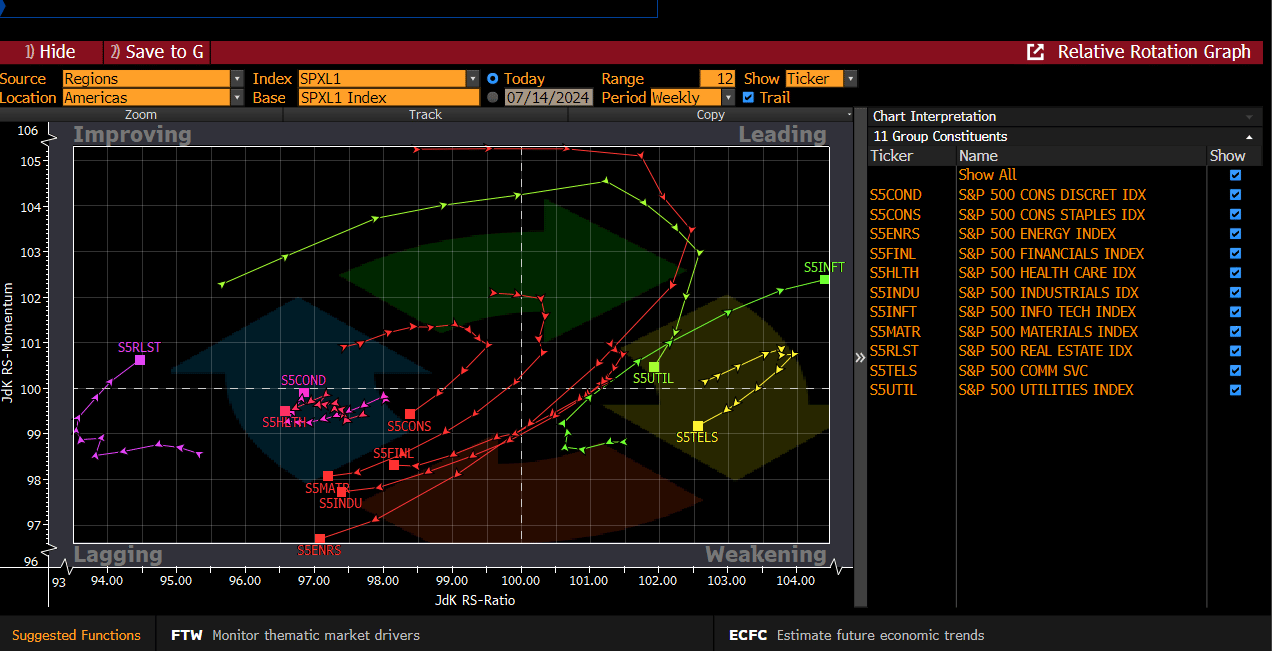

The Relative Rotation Graph (RRG) is still favoring Technology and Utilities, with Real Estate moving from the Lagging quadrant to the Improving quadrant. Consumer Discretionary is close to doing the same. This is obviously backward-looking, so take this graph with a grain of salt, but it somewhat corroborates our view that lagging growth names (ex-Mag 7) will see the benefits of lower rates and rotation away from the large-cap tech leaders. This doesn’t mean that the large-cap tech stocks have to revert meaningfully, but they could certainly trade sideways while SMID caps catch up.

Did we know for certain that the CPI would deliver a softer release? No. Did we expect it? Yes.

We have been highlighting ARKK (a proxy for unprofitable growth) for weeks, and while their biggest holding is TSLA, the technical picture has been grossly improving. Here is last week’s excerpt:

Fast forward one week and ARKK has made a new 3-month high.

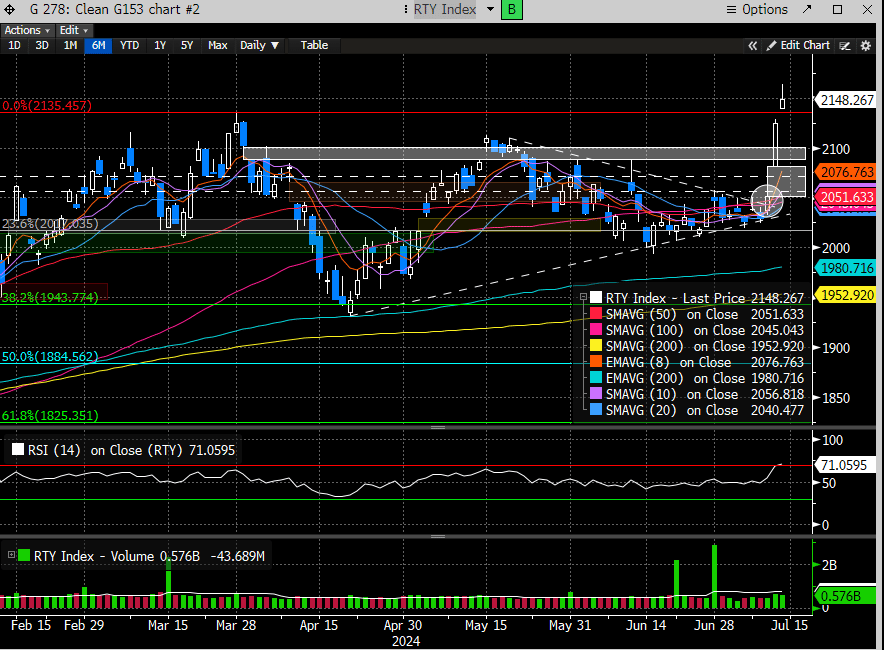

We also discussed the Russell Small Cap Index (RTY) breaking out in our mid-week, in what appeared to be the RTY’s attempt to forecast a softer CPI.

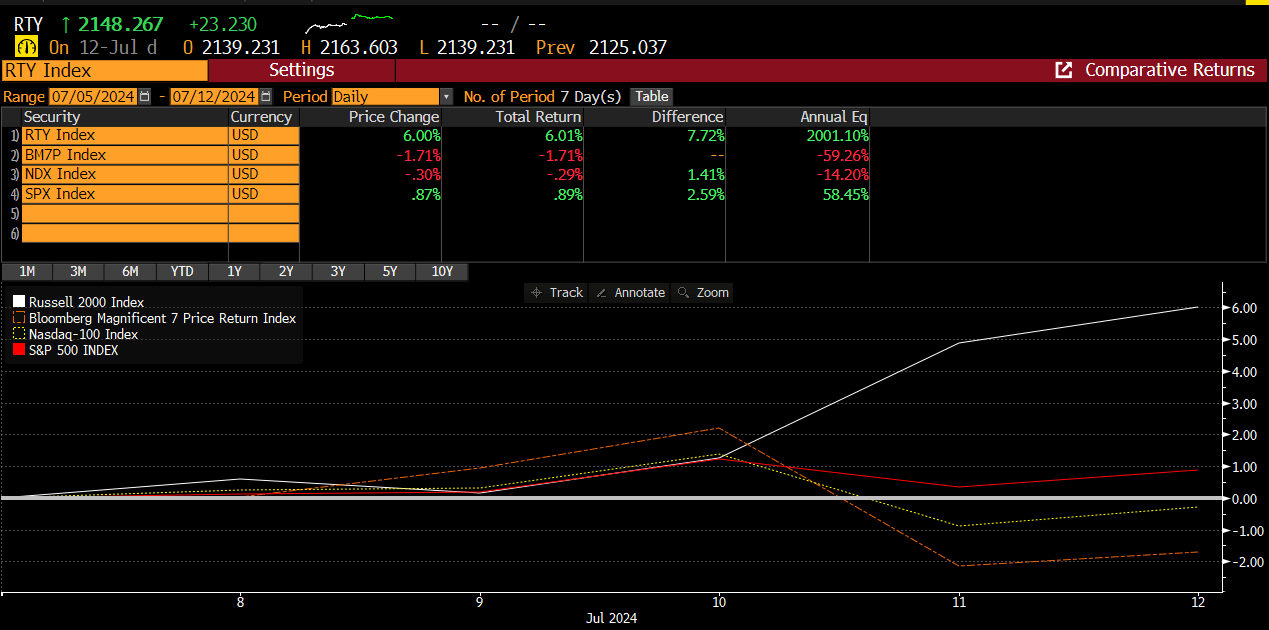

Our resistance levels were grossly outdone on Thursday’s rip. More significantly, the RTY is up +6% for the week.

And grossly outperformed the Mag 7 (BMP7) by almost 800 bps.

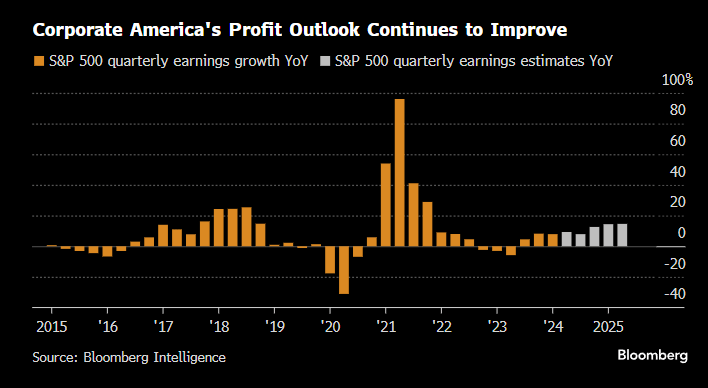

Earnings season starts this week in earnest, and the real test of this rotational thematic begins. Profit growth estimates for the SPX continue to improve, and earnings drive stock performance.

But the bar is set high, and with Mag 7 earnings growth set to decelerate, the rest of the 493 SPX companies need to pick up the slack. This quarter could mark the beginning of that earnings shift. The Mag 7 is still set to grow earnings by 29%, which is hugely respectable, but the trend is decelerating (average earnings growth was 35% in ‘23). The rate of change in earnings matters to stock price performance, and given how far the large caps have come, last week’s Mag 7 drubbing is likely forecasting this ensuing deceleration.

The back half of July will likely inject additional volatility into the markets. Following this weekend’s events, we expect the algos will also play havoc with some of the intermarket relationships that have been in place. Playing defense against black swan events is near impossible and part of the risk we all accept when trying to earn returns in the stock market.

Our goal for our readers is to keep them on the right side of the market while introducing emerging thematics (stocks, ETF’s commodities) to consider. We do this for less than $25/month. If you are a novice or expert investor/trader, our research is a perfect complement to keep you on the path to prosperity. Consider subscribing and joining us to trade, invest, and live better.