It’s been a difficult week for the US stock markets, which finally saw the torrid rally come to a screeching halt. We have been writing for weeks to de-leverage long exposure into the middle of July when seasonality would turn. We specifically discussed rotating out of large-cap leaders into the laggard SMID caps. The outperformance of that reallocation is substantial.

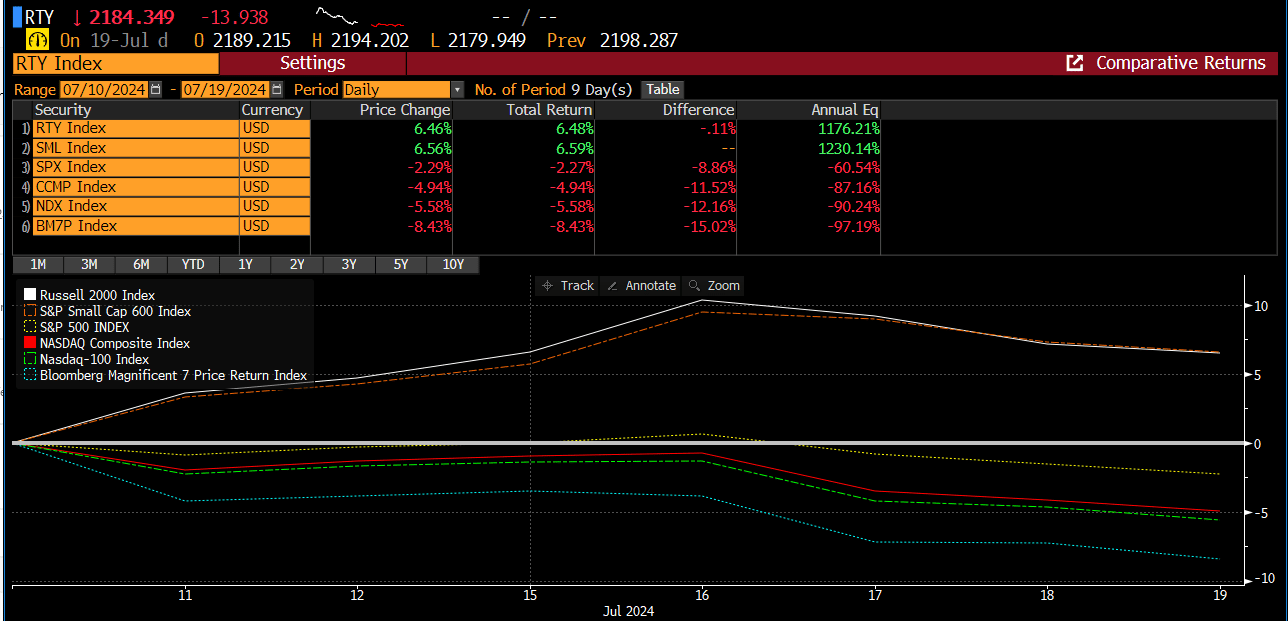

Since the beginning of July, the outperformance of the SMID cap trade vs. the Nasdaq 100 or the Magnificent 7 Index has been 500-700 bps.

Since our 7/10 report postulating that the CPI would be the likely rotational catalyst, the outperformance is even more pronounced, with 1200-1500 BPS of outperformance.

So, what's our next magic trick? In our mid-week report on 7/17, we specifically predicted that further stock market weakness would follow and that the correction had only just begun. Since then, we've easily breached some of our initial support levels and are now approaching more significant areas where the market should attract buyers. These levels were detailed in previous reports, and we will expand on them in the remainder of this report.

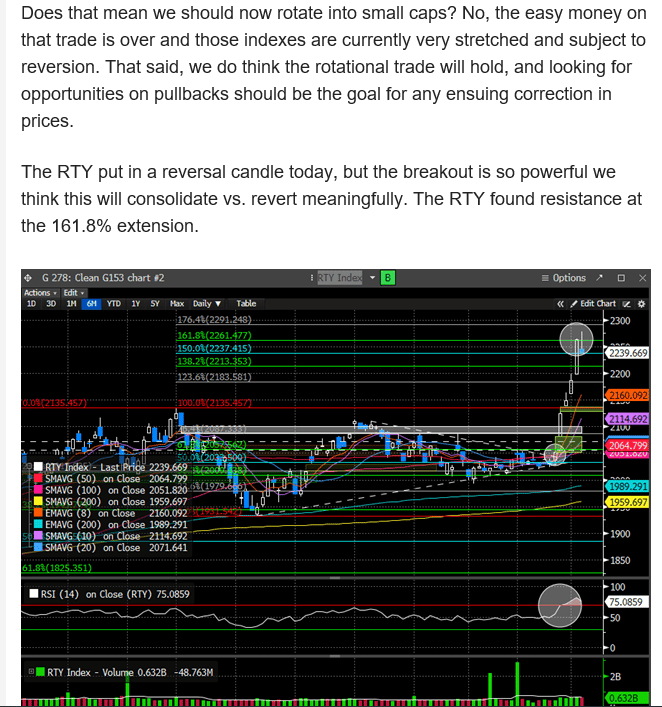

In the 7/17 report, we also cautioned against chasing the SMID cap trade due to signs of exhaustion, predicting a likely retracement.

Here is the excerpt from that report:

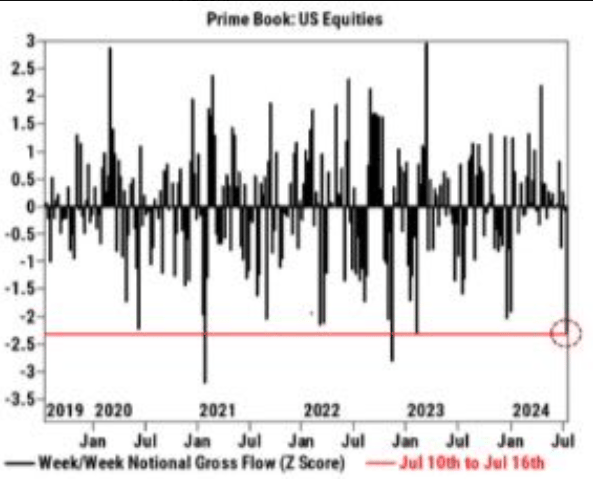

Last week was a big deleveraging event that ultimately took down all sectors, even the ones that showed promise of emerging leadership. De-leveraging typically impacts all market areas, so it’s best to let these events run their course.

According to Goldman Sachs, the de-grossing activity over the last five sessions was the largest in 20 months and ranked in the 99th percentile over the past five years.

This means there are few safe havens when the machines start selling. The upside of this de-leveraging is that it resets market exuberance and our indicators, setting the stage for the next leg of the bull market. Determining when the sell-off will end is always challenging, as it can last for weeks. Exhaustion happens when sellers have reduced their positions enough to no longer overpower the natural buyers. The good news for our readers is that we excel at identifying trend changes.

One of our main questions is whether the rotational theme will persist. We believe it will, suggesting that large-cap stocks may trade sideways within a broad range. The next two weeks, with many companies reporting earnings and providing forward outlooks, will likely define this range. In a previous report, we highlighted the slowing rate of earnings growth for the Magnificent 7 compared to the accelerating growth of SMID cap laggards. We believe the sharp reversal of the Magnificent 7 Index after the CPI report and the reallocation into SMID caps signaled a significant inflection point.

Of course, this outlook could change with stellar reports from larger companies and mediocre reports from SMID caps. However, our thesis is that investors will look past any earnings hiccups toward a more favorable FOMC and a stable, growing economy. To reiterate, this is just our opinion, which is secondary to market prices. If price movements justify altering this view, we will adapt accordingly.

Another reason to possibly expect the rotational theme to be maintained, is that fund flows into the equal weight SPX is the highest in two years. Fund flows drive price.

Remember, interest rate cuts historically have been followed by strong stock market returns, but only for cycles that aren’t triggered by a recession. A lower rate complex benefits cyclical and rate-sensitive sectors: financials, real estate, staples, utilities, and energy.

Unsurprisingly, some of those sectors were the best-performing in the SPX GICS table last week.

Small Caps also saw their second-largest inflow ever at $9.9B in the week through Wednesday, according to EPFR and BofA.

We are seeing a massive de-leveraging event that is experiencing some large rotations playing havoc with inter-market relationships amid a weak seasonal window for the stock market. Couple this with a US presidential election that just got thrown a significant curveball with the Trump Assassination attempt and Biden dropping out of the race, and we have a cocktail for increased volatility.

The VIX is indicative of that elevated fear and uncertainty, which spiked 61%, peak-trough, last week. The good news is that volatility events, historically, do not last very long.

To read the balance of our analysis, including where we think support may come in for the major indexes, consider subscribing below.