As we approach a pivotal week for the stock markets, with the FOMC meeting, Mag7 earnings, and the Payroll Report on the horizon, it's crucial to remember that the market is filled with noise and misdirection. Many participants are convinced that the stock market "must" go in a specific direction based on their models. While these models can be useful in identifying emerging trends, they also produce errors in predicting market trajectory.

We are purely tactical analysts, viewing the stock market as a predictive tool for the economy's direction and company earnings. We rely on the collective wisdom of thousands of well-informed, well-resourced investors. By analyzing the footprints they leave in the market, we glean insights into their intentions, expressed through price movements. Price is paramount to us because it represents the truth and is the only variable that makes money in the markets, not opinions.

If you've been following our reports, you know we are unbiased in our approach. While we incorporate our opinions, they never guide our conclusions. We strictly weigh the evidence in price movements and seek supporting evidence from various indicators. Is our approach perfect? Of course not, but we have consistently identified major market moves in both directions.

Why are we sharing this? Because it's imperative for those using or considering our analysis to stay in sync with our approach. Markets do not move in a straight line, and while we may have concerns about the market's direction, we can't predict outcomes with certainty. We always need price information to confirm our views. And because markets fluctuate, there are always opportunities to trade against the dominant trend.

For instance, in our mid-week report on 7/24, we specifically discussed the potential for a counter-trend bounce as the major indexes approached key support levels. Coupled with some stretched indicators, this increased the probability of a short-term bottom.

Here is the excerpt:

“From a tactical standpoint, we should consider buying the dip in anticipation of a potential mean-reverting August…it could present a tactical buying opportunity to generate alpha when others are retreating.”

Thursday, the major indexes saw increased selling to test the support levels we’ve outlined in previous reports and closed well off the lows, and in some instances, printed reversal candles.

Here is the excerpt from last weekend’s 7/21 report:

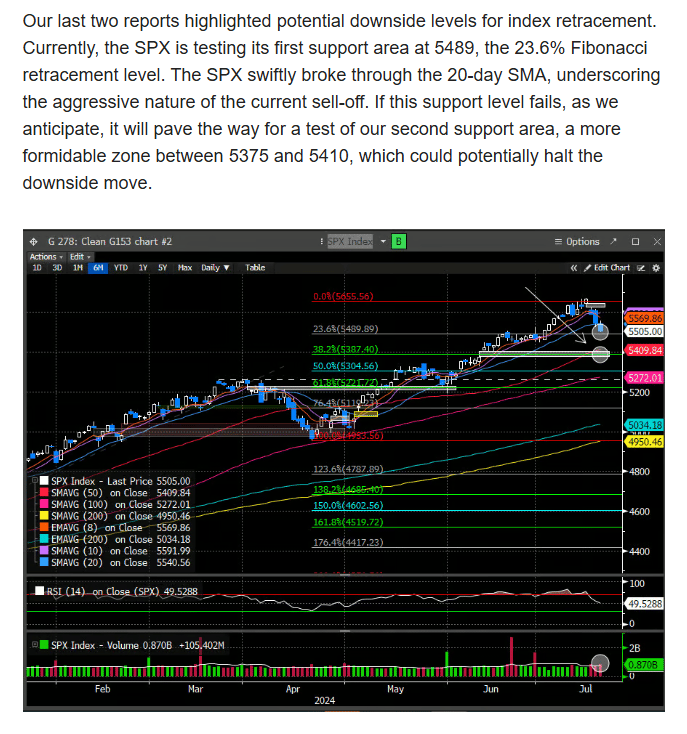

“The SPX swiftly broke through the 20-day SMA, underscoring the aggressive nature of the current sell-off. If this support level fails, as we anticipate, it will pave the way for a test of our second support area, a more formidable zone between 5375 and 5410, which could potentially halt the downside move.”

The SPX found buyers at 5390 (Thursday’s low), which was the lower end of our target range.

Should we interpret this small bounce to be the end of the drawdown? It’s possible, but again, we need more information, and given the current construction of the indexes, they do still appear vulnerable to lower prices. That could change quickly this week as we have some fairly market-moving events that could alter the index construction dramatically. We will discuss this in more detail below.

As mentioned, the FOMC will meet this week and offer their interest rate decision on Wednesday. We don’t think anything more will come out of this that has not already been discounted in the stock market, specifically the changing of their language concerning a cut in September. Should that disappoint, then we would expect a large unwind in the SMID Cap trade and more dislocation in the indexes, with money flowing back into the safety of mega-caps. That said, we see this as a low probability.

The current Fed Fund Futures are forecasting a +100% chance of a cut in September and in December, with another +70% for an additional cut by the end of the year.

As mentioned above, more than half of the Mag 7 Index reports this week (MSFT, META, AAPL, AMZN). After a 14% drubbing in this index since the CPI report on 7/10 and following two poorly received reports from GOOG and TSLA last week, maybe some reversion is in order?

The AI love fest ended abruptly last week with GOOG increasing its capex spend on AI, with little return to show. The fickle investment community thought the company should produce stellar ROI from AI dollars spent over the last year. That seems overly punitive, as cap-ex cycles are typically multi-year investments. Regardless, this is the nature of the stock market, where the narratives can shift quicker than Rocky Mountain weather.

If you are interested in the technical take for the four mega-caps reporting this week, we will discuss further below.

Lastly, if the week wasn’t action-packed enough, we will get ISM manufacturing data and the payroll report on Friday. The payroll report is critical as the Fed has voiced potential downside risks to the economy if employment trends worsen dramatically. This implies the payroll report can shift the futures market dramatically, and significant changes in expectations are usually met with market dislocation. Bloomberg believes the report will prove contractionary and could signal the Sahm rule is close to being triggered. On average, the US economy had already been in recession for five months when the rule was triggered.

Never a dull moment in the stock market.