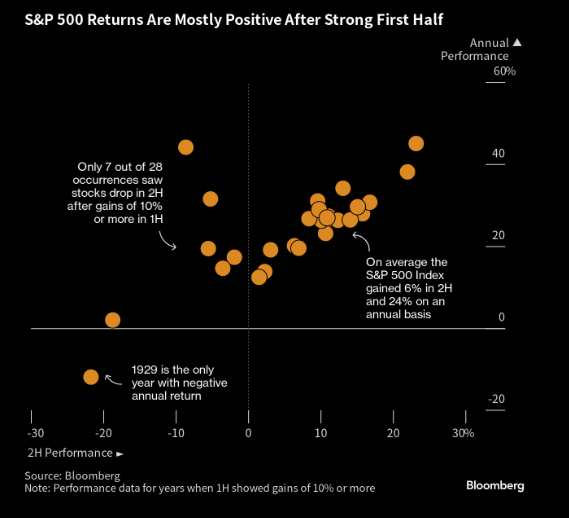

The stock market just finished a blistering 6 months, leaving all the skeptics and perma-bears to reconsider their position. Professional investors are measured by their performance when compared to their benchmarks. Typically, those benchmarks are the major indexes. If they fall behind in the first 6 months, because of a stubborn bias then they have to work hard to try and catch up, and a reason why the second half of the year, after a strong 1H, typically results in more continuation.

“Only 7 out of 28 occurrences saw stocks drop in 2H after gains of 10% or more in 1H.”

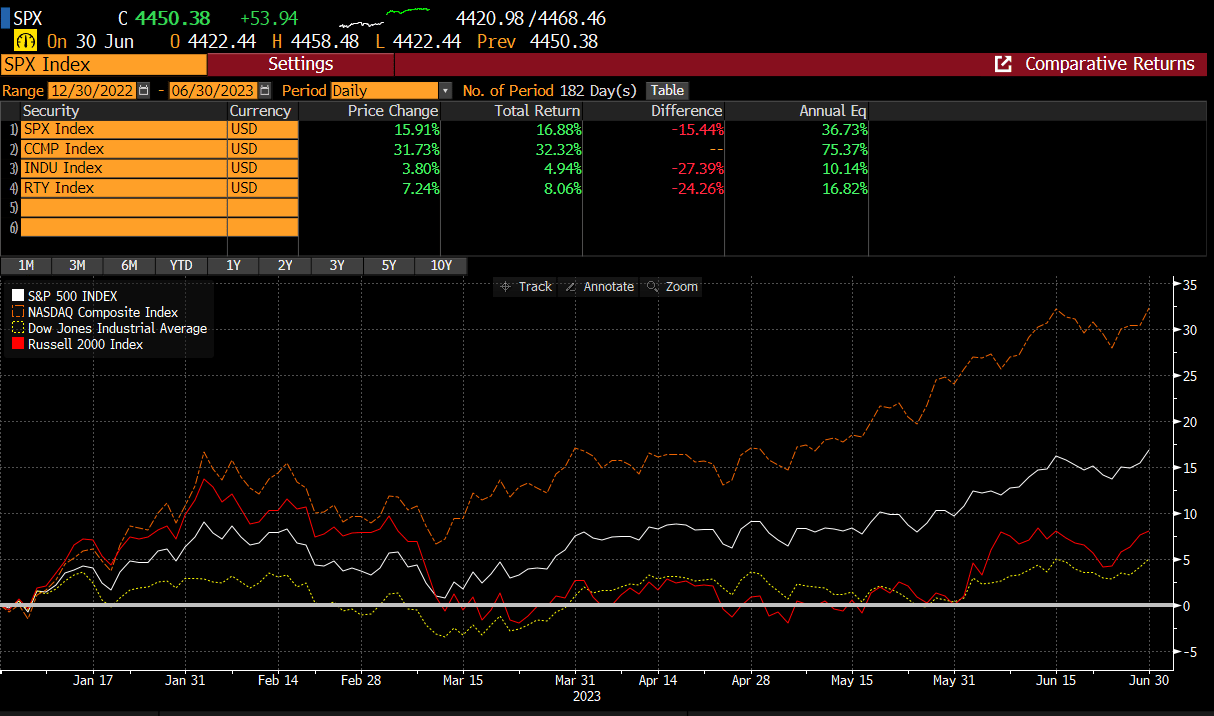

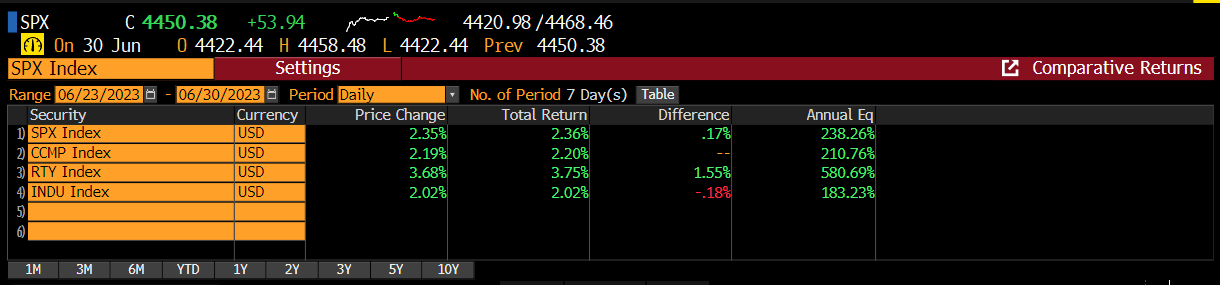

For the 1H of ‘23, SPX and Nasdaq have screamed higher where the Dow and the Russell are severely lagging. We would expect these to catch up somewhat or the major indexes to catch down. Bottom line, the performance chasm seems too great to remain this way.

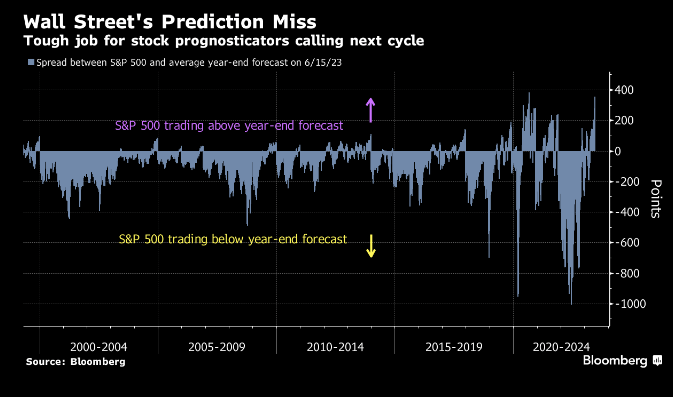

Wall Street strategists are now bifurcated on the outlook for the rest of the year, where the majority of them were calling for a terrible first half when the year began.

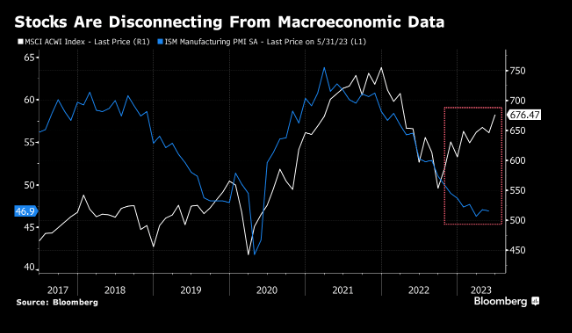

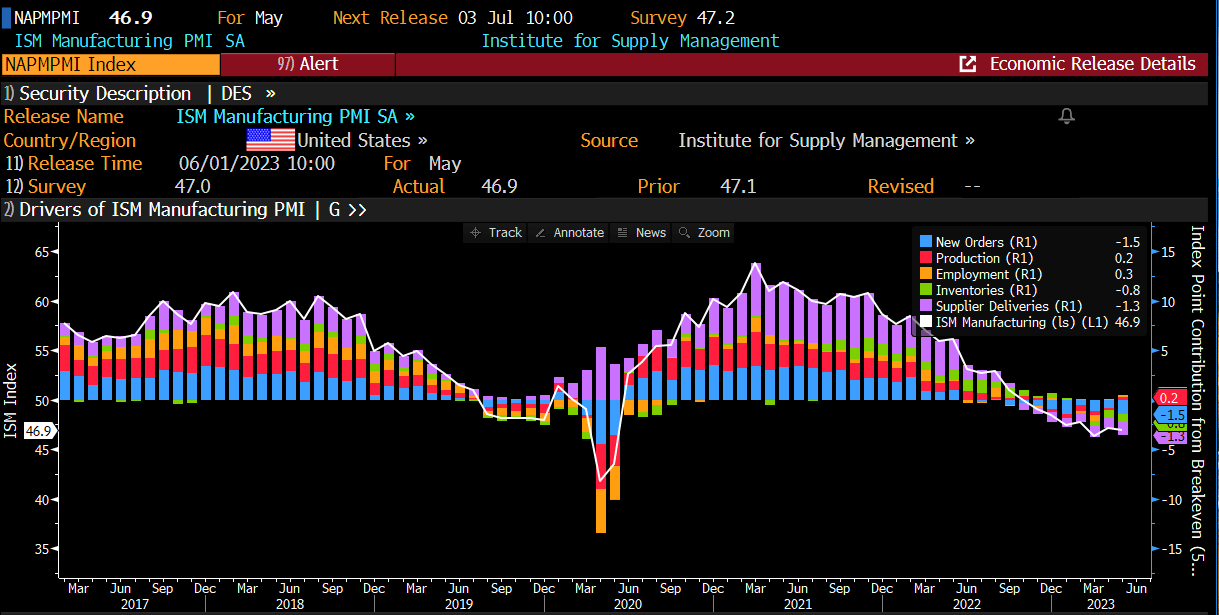

There is still a decent dose of skepticism regarding the rally, as the conventional wisdom believes that the macro data will slow as the Fed’s policies take hold. There is certainly merit to this argument and something we must be mindful of as we push into the back half of the year. For now, the stock market has been repricing all year for a recession that never came. We have discussed this phenomenon in previous reports. The bearish chorus was singing that a recession would take hold sometime this year which has yet to show up. Pockets of macro data are actually starting to reaccelerate, and something we discussed a bit in our last mid-week report. But there are certainly some pockets of weakness, specifically the manufacturing sector data.

We will actually get ISM this week which has been in contraction all year. Wouldn’t that be something if this broke back above 50, which indicates expansion?

Industrial stocks are surely discounting a recovery and now testing the 2021 highs. I can’t imagine this group would be trading where it is if the global economy was about to slip into the abyss. Last week’s candle suggests this is gearing to break up.

XLI is made up of some of the largest industrial companies in the world. Here are the top 21 largest weightings. If you have a bearish bias, this should really make you question your thinking.

July is one of the strongest months of the year for the stock market. A big reason for that is the upcoming earnings season, which begins in 2 weeks. There is some belief that 2Q earnings will be the last best Q for the year. This is evident in the recent earnings cuts globally by wall street analysts.

Usually, earnings estimates get cut throughout the Q to more manageable levels so companies can beat the estimate. Welcome to the game of earnings. This has been true since earnings estimates peaked for the SPX in early May.

2024 estimates are now about $23 higher than 2023 estimates. This implies about 10% year on year growth, which puts the SPX trading around 18x. This is not a demanding multiple and a big reason the stock market has had such a great year thus far as it reprices a recession transitioning to growth. Bears will have you believe that this number is far-fetched, and maybe it is. Maybe this Q we will start to see the slowdown in company’s forecasts adding credence to next year’s number being too high. But what if company’s start taking up their forecasts for the 2H? Then the ‘24 estimates become more reasonable. Stocks are certainly sending that message.

Much like our comment in our mid-week report regarding the PCE:

The stock market celebrated the lower PCE but our take is that the market already anticipated reduced inflation and why it’s had such a great couple of months and a fantastic week.

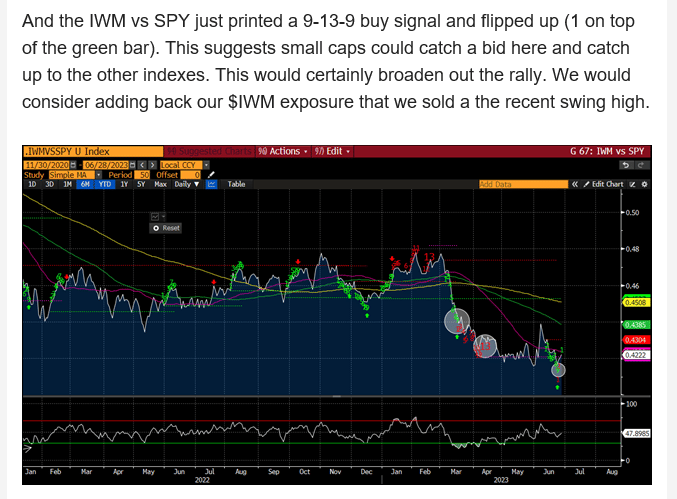

The best part of last week was that the Russell led the charge. We wrote about this in our mid-week report and suggested adding back our long position.

Here is that excerpt:

“We would consider adding back our $IWM exposure that we sold at the recent swing high.”

$IWM’s finished up another $5 from Thursdays open. Last week’s candle certainly looks important.

If you want to read the bulk of our analysis and are interested in staying on the right side of the market, we encourage becoming a premium member. We will offer another single stock idea suggestion at the end of the report.