We hope everyone had a wonderful July 4th break and is ready to get back to the chaos they call the stock market.

We hope you don’t mind, but we want to take some time to review some of our more recent successful calls. You may think that’s a bit self-serving, but we know how hard it is to be consistently correct in the stock market. JPM just let go of their top-ranked strategist last week for missing the rally the last two years. On the other hand, we have been consistently bullish since the October ‘22 lows.

We do not make long-term predictions on where the stock market is heading, so our approach, when compared to the typical Wall Street Strategist, is vastly different. Our analysis predominantly focuses on making more significant inflection calls and keeping our clients on the right side of the market. As a CMT, we believe that market instruments trend. In fact, we are not sure how anyone can subscribe to the “Random Walk Theory,” but we digress. We have been analyzing markets for 25 years and can unequivocally tell you that markets trend. If this is true, it would serve well to consider our analysis seriously. We follow price first, which means our opinions are secondary. This suggests that prices must confirm what we are theorizing. The stock market is complicated, and there are a lot of moving parts, which means there is quite a bit of noise to parse through. Since our analysis is written twice a week, we can sometimes get caught up in the noise of the daily machinations. We like our weekly report structure because one week has much more information to analyze than one day. Our monthly reports have even more information.

Our attempt to make micro-inflection calls can oftentimes be incorrect, but we are always quick to reverse our view if the theory is not confirmed by price.

We want to highlight a few of our more significant calls over the last 2 months:

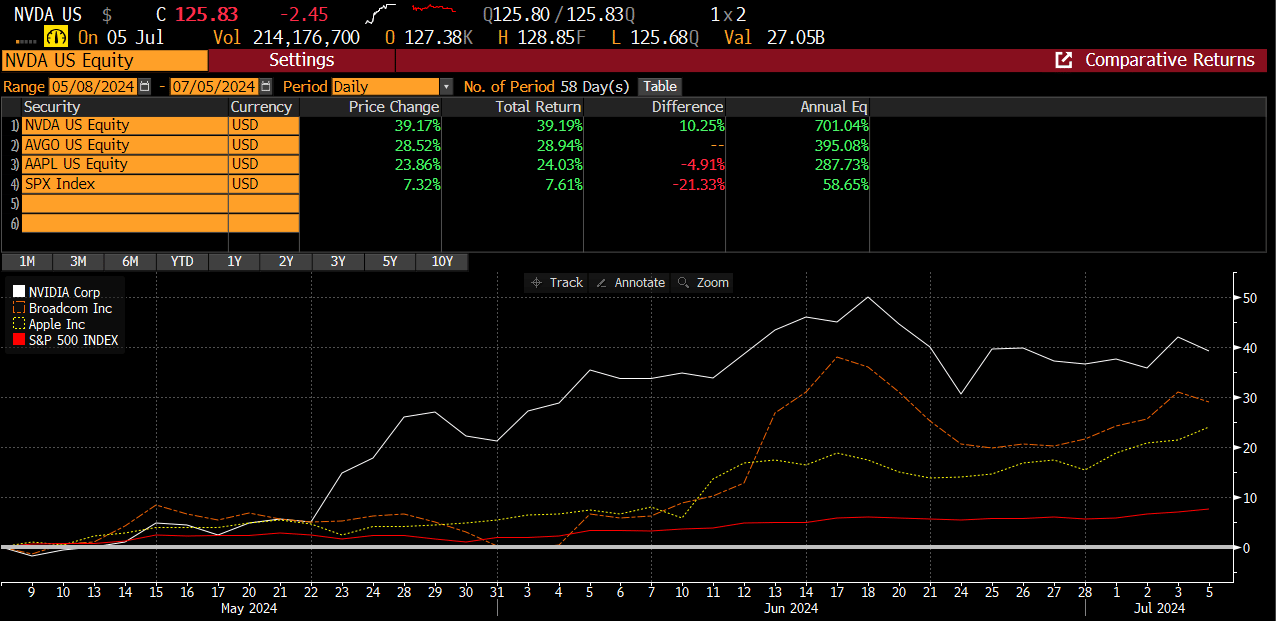

In our 5/8 report, we highlighted three single stocks for consideration: NVDA, AAPL, and AVGO.

The outperformance is substantial:

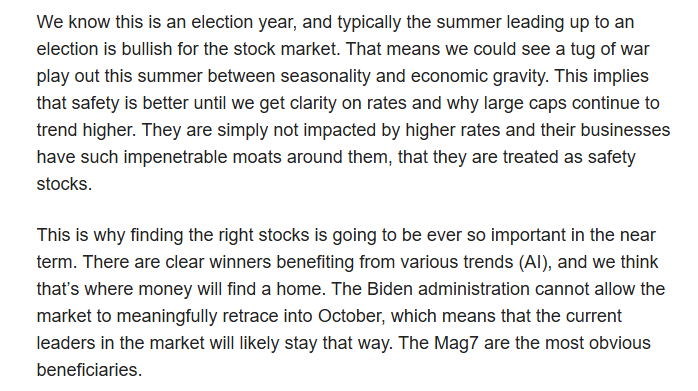

In our 5/26 report, we discussed the growing bifurcation in the stock market and explicitly mentioned favoring the Mega-cap Mag 7 stocks while avoiding the Russell Small Cap.

Here is an excerpt from our conclusion page from that report:

Since that report, the outperformance of the Mag 7 stocks has been significant (+1700 bps) compared to the Rusell (-200 bps).

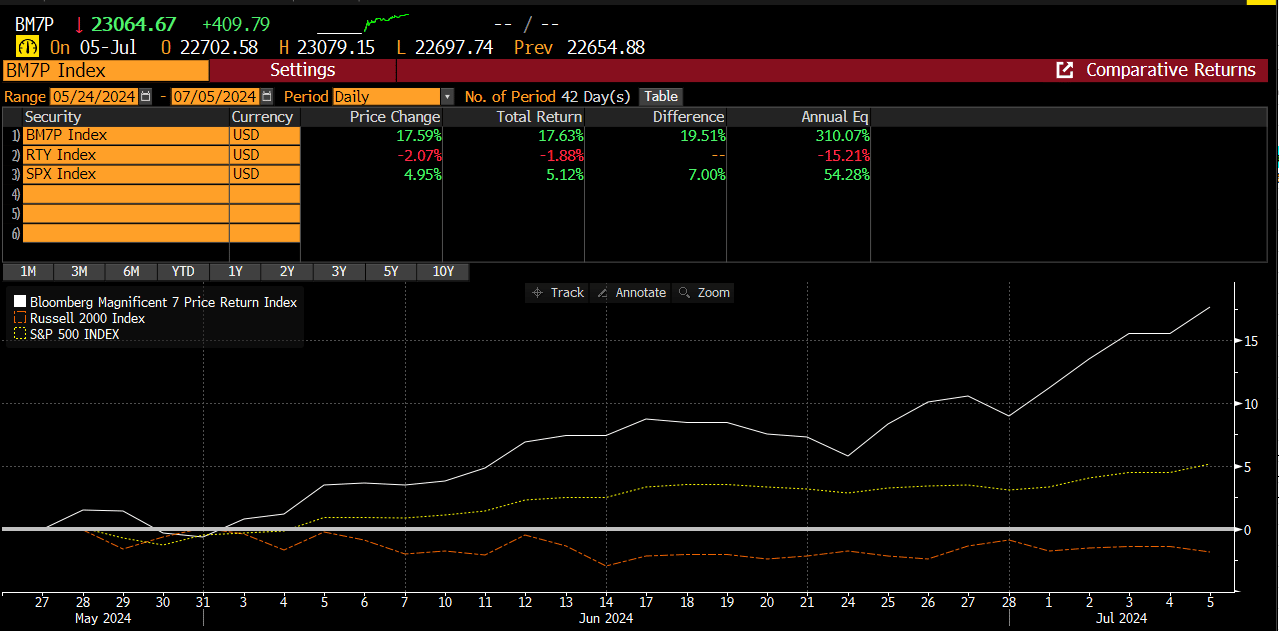

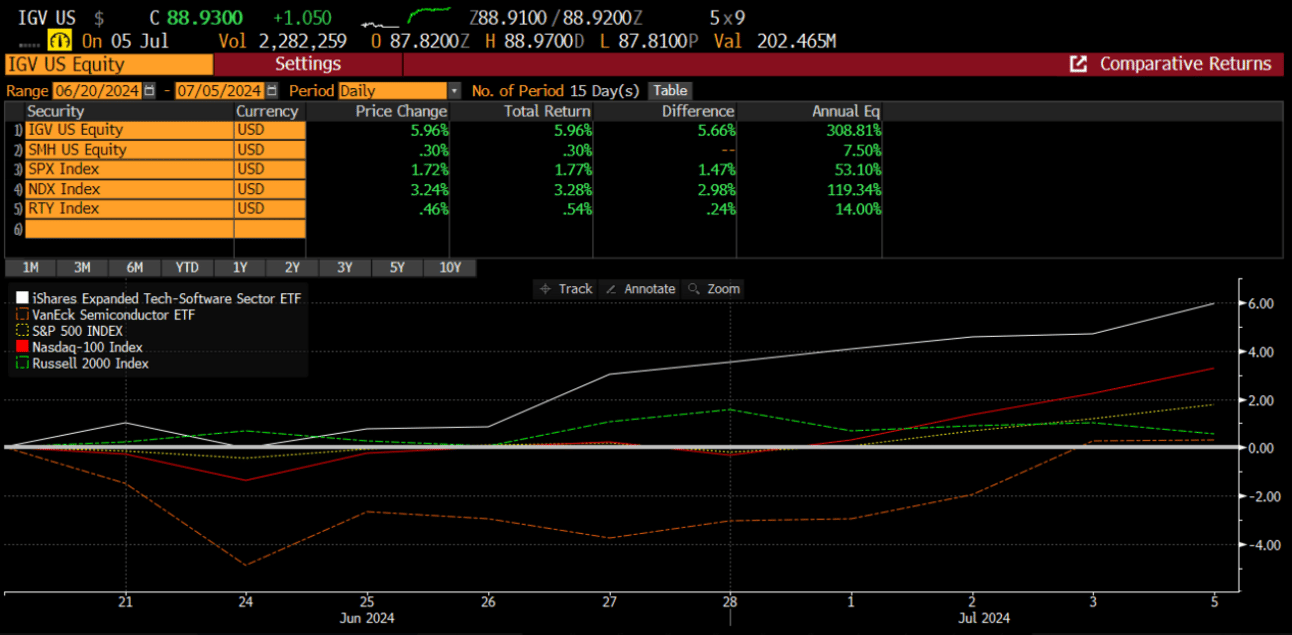

In our 6/23 report, we discussed the potential for a Semis to Software sector rotation. We highlighted those excerpts last week, so we will not belabor on this point, but this week, we saw the software index reach a new 52-week high and is currently testing its 2021 ATH.

The outperformance since that report two weeks ago is over +550 BPS.

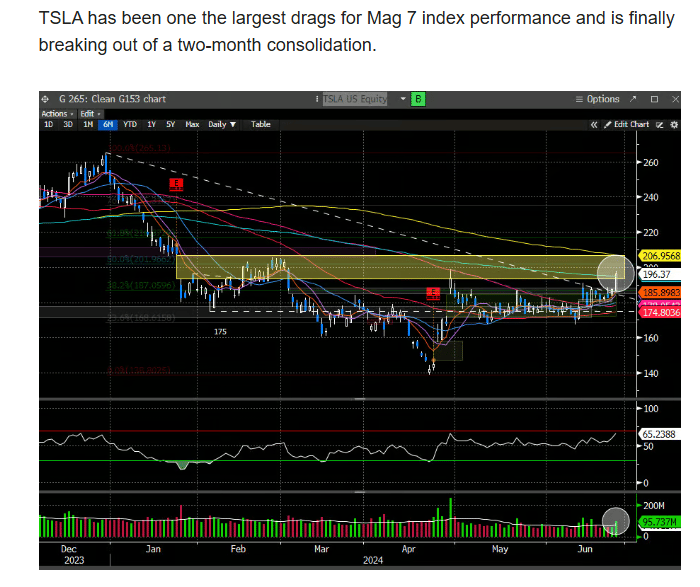

In our 6/26 report, we highlighted the Mag 7 stocks (+$NFLX), suggesting that they all looked poised to break higher and that adopting a bearish view of the stock market when the largest constituents are positioned for more upside seemed foolish. We even highlighted $TSLA as breaking out before its massive run (+27%).

We made a few sector rotation predictions in our last weekend report, but with only four days of data, we think it’s premature to discuss their performance. Please review that report for details. The bottom line is that we keep our clients on the right side of what’s working and think we do it as well as anyone; we hope you agree.

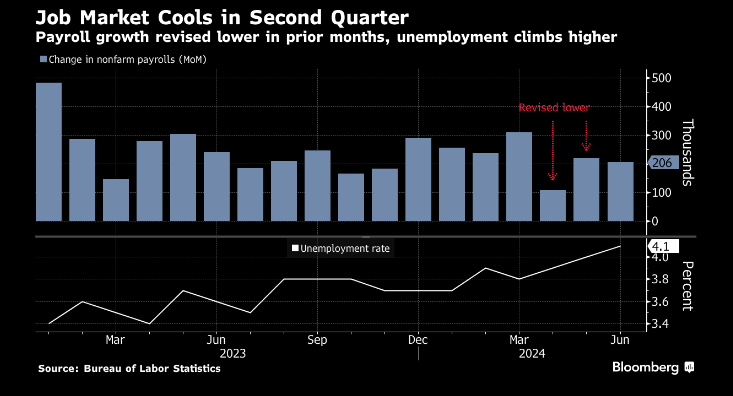

On Friday, we got a vital payroll report that saw the employment number rise to levels not seen since 2021. Payrolls rose by 206K, but the prior two month’s revision was substantial (-111K). This caused the unemployment rate to rise to 4.1%. In June, about 3/4’s of the job gains was in healthcare and government.

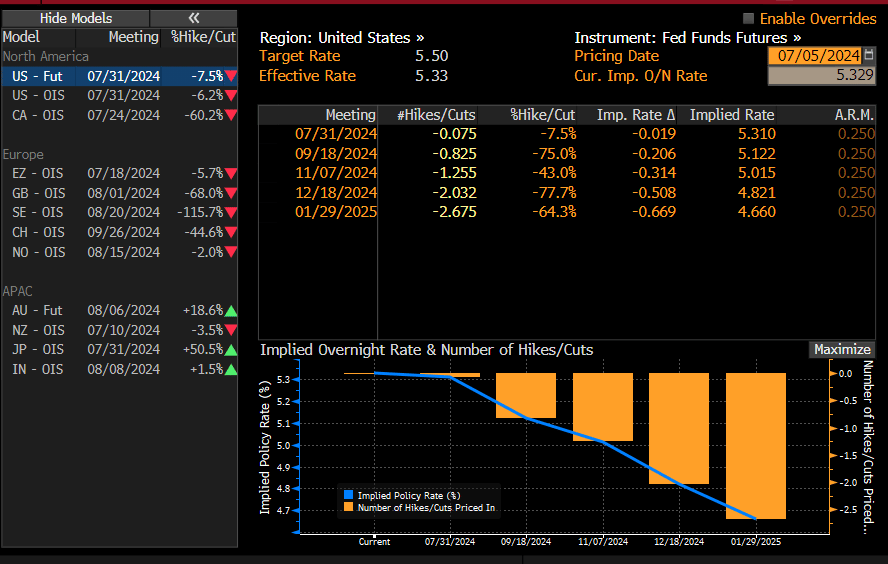

A sustained slowdown in hiring, coupled with moderating inflation, is pushing the Fed Fund Futures to cement two possible rate cuts this year, with the first possibly happening in September (75% probability).

The reduction in the yield complex has thus far not found its way into the laggard areas of the market; instead, it seems to be bolstering the Mag 7 and growth segments, again; and why we continue to maintain substantial exposure in that segment.

The positive seasonality window is still strong through mid-month, and we will be diligently monitoring for any evidence of broader strengthening or weakening in the primary instruments we track. CPI/PPI is slated to report this week and may introduce additional volatility.

Index Analysis

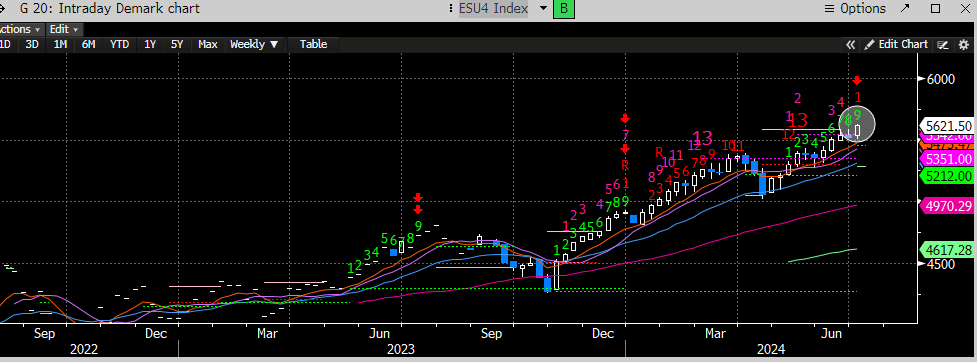

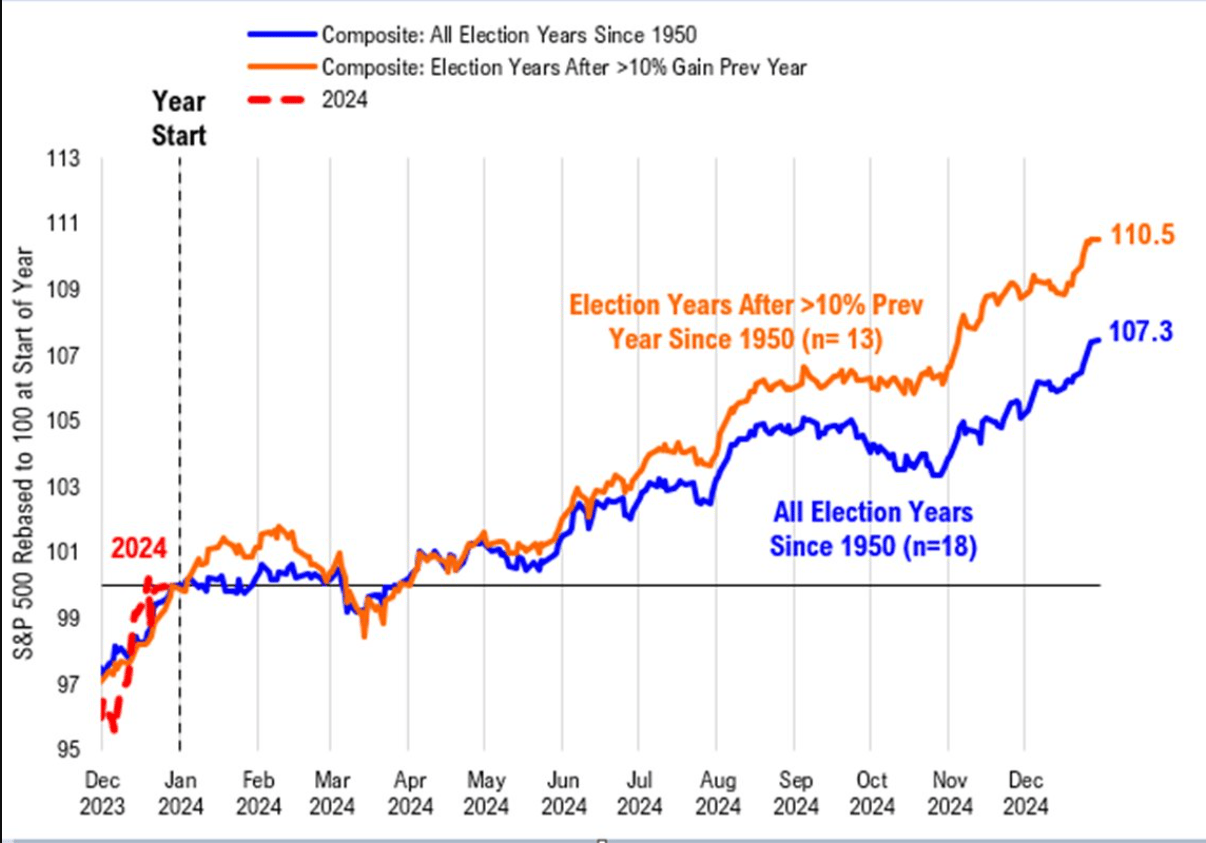

The major indexes have continued to stay on pace with the pre-election seasonality calendar, which has been a significant reason for us to stay on the bullish side of the ledger despite some cross currents with our indicators. We have not seen much follow-through in price to suggest meaningful trend deterioration. Instruments never move in a straight line and undoubtedly will revert; how those reversions are handled offers clues to trajectory.

On the last day of June, we saw some extensive rotations that skewed the construction of the instruments we track, creating trepidation that July could initially struggle. But one day does not make a trend, and there was very little follow-through. Recall one of our rules: if an instrument cannot close below the momentum moving averages, then being bearish is likely premature.

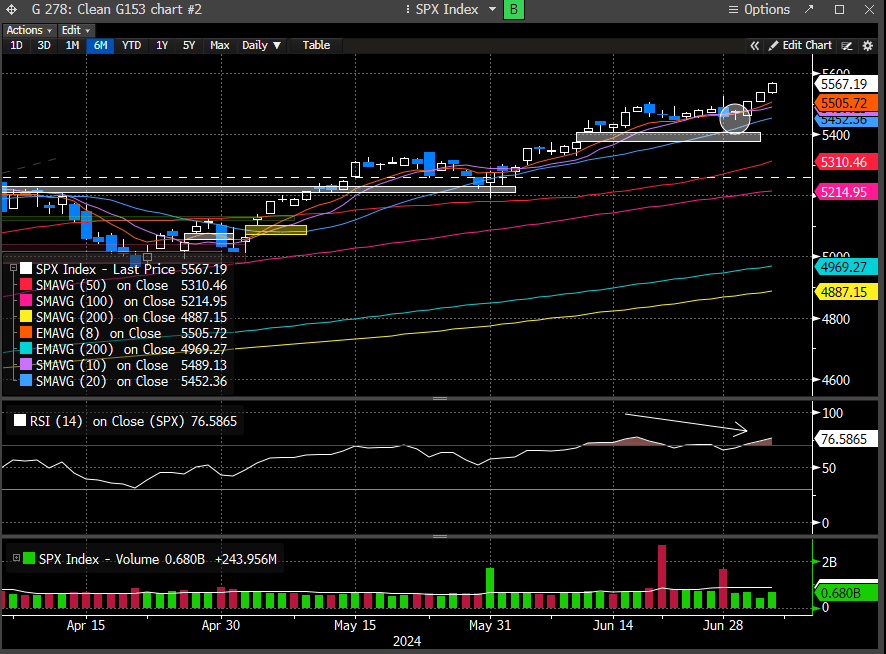

Last Friday, the SPX closed right at the 8-day EMA. We traded below the Friday low on Monday but recovered to reclaim the 8-day EMA by the close. Similarly, on Tuesday, we opened below the 8-day EMA and closed on the highs, back above the 8-day EMA. We always prefer closes vs. openings, as openings tend to be emotional and the close offers more inference to buyer behavior. How powerful are the sellers if the SPX cannot muster the strength to close below the short-term momentum EMA?

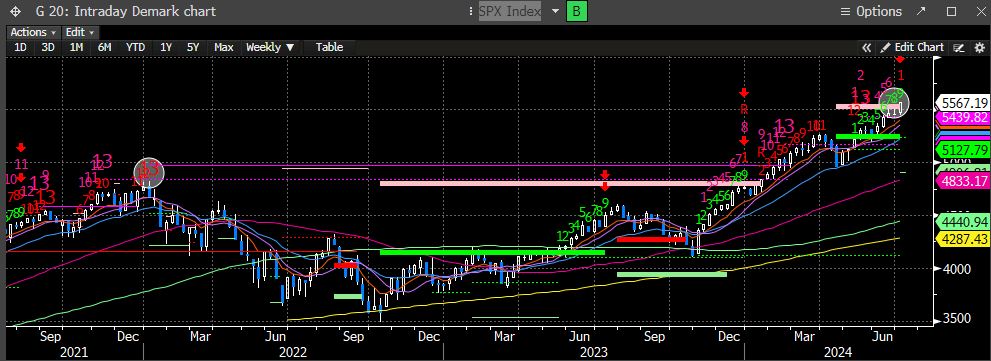

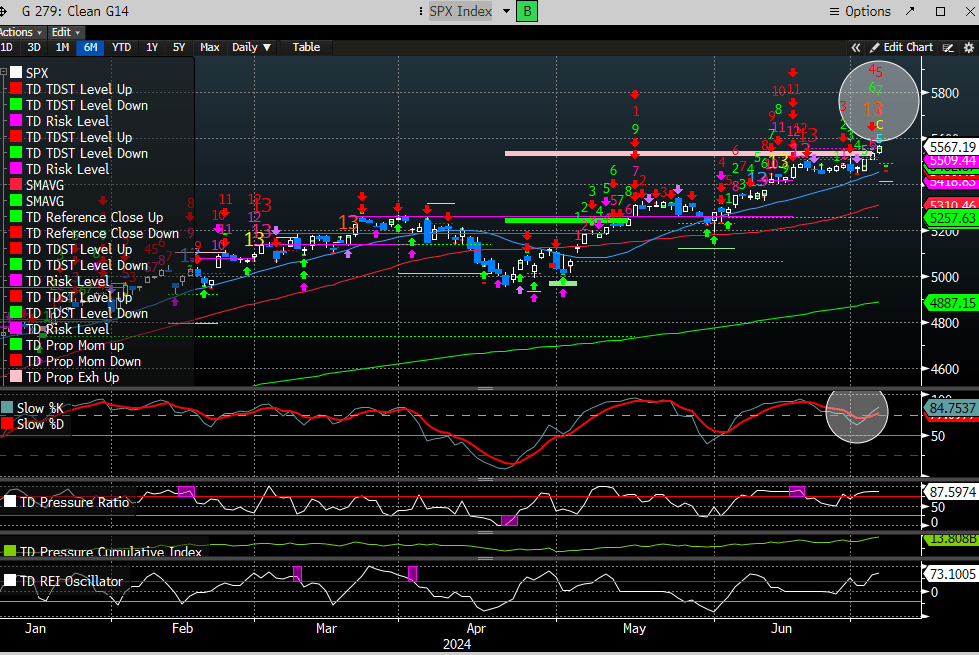

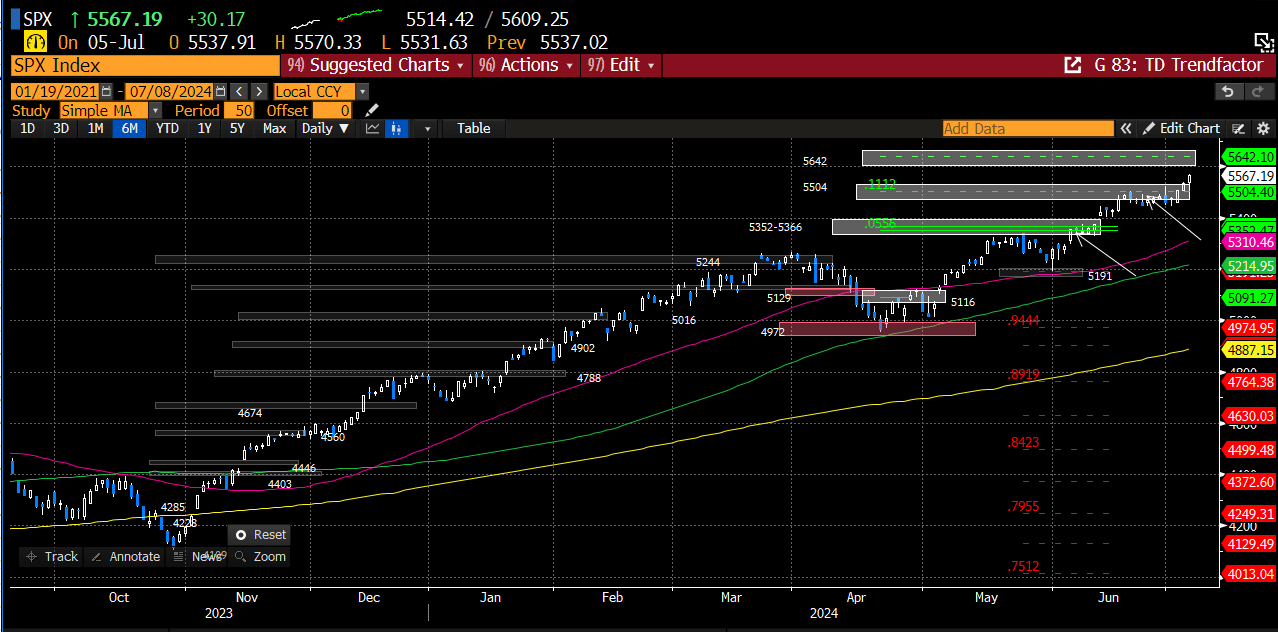

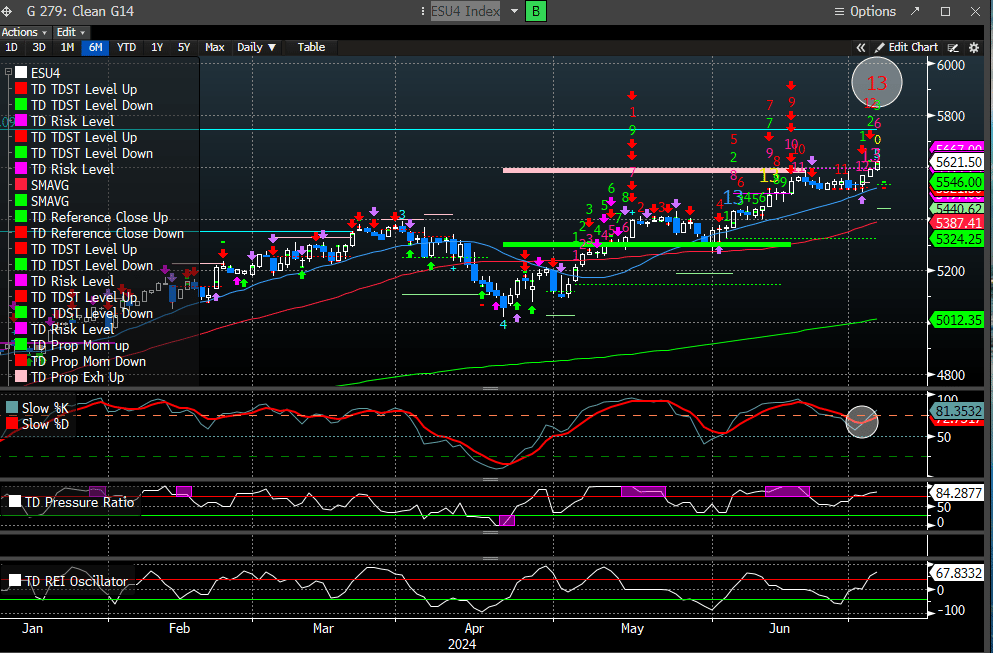

The SPX has now eclipsed the DeMark propulsion up target of 5534, and above our target range for a reversal. The weekly count printed the 9-weekly sell.

The recent DeMark 13 signals are three days from expiring, but a new 9 sell can print on Tuesday. While DeMark signals do a very good job of warning of potential trend change, we need to see more price degradation in the index before acting on them. For now, we see these as prominent warnings and to be prepared for a potential reversal. Maybe that comes in the back half of July when the seasonality window closes, and why we wrote last week to keep one foot out the door.

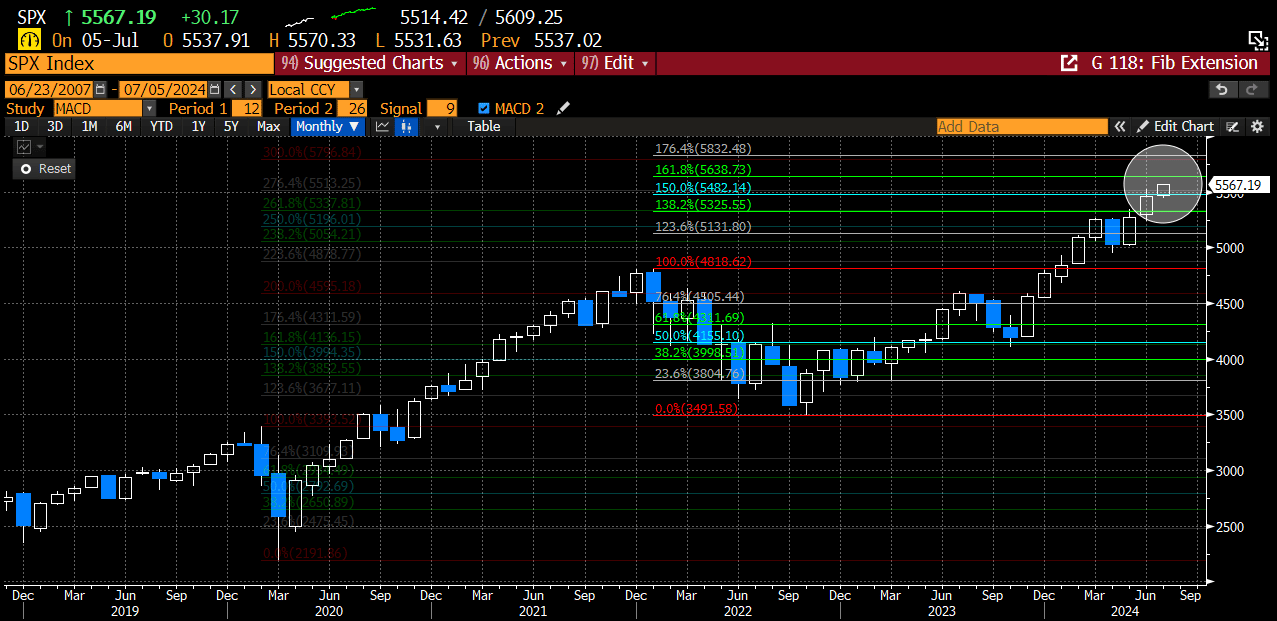

The SPX is now at the 200% extension of the March to April swing, with 5641 (223.6%) as the next level up to consider. RSI is back to being OB and starting to diverge negatively.

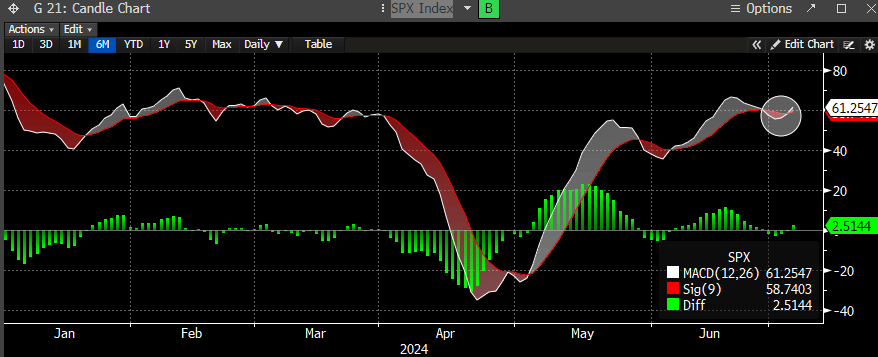

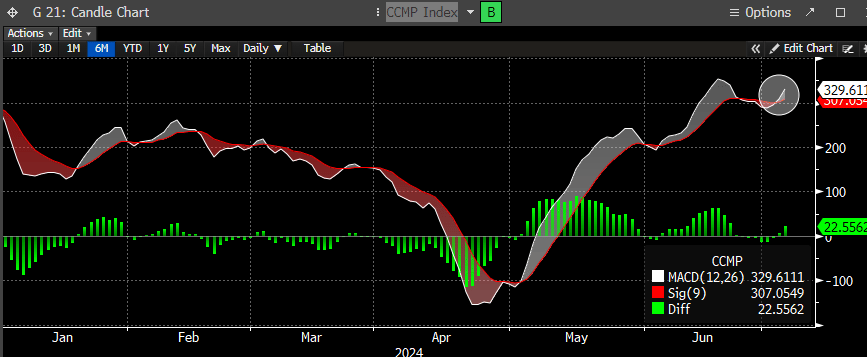

The MACD did cross back bullishly implying fresh short-term momentum.

Is it possible that the index is heading to 5638, which is the 161.8% extension from the ‘22 peak to trough? Certainly.

In December 2023, we presented this idea on “Twitter X” for the SPX, and now we are <140 points away.

DeMark Trendfactor has done an incredible job at defining the levels of resistance. The 2x level was 5504, and the SPX struggled in the back half of June with taking out this levelis until last week. The 2.5x level is 5642, which offers some confluence with the Fib target highlighted above.

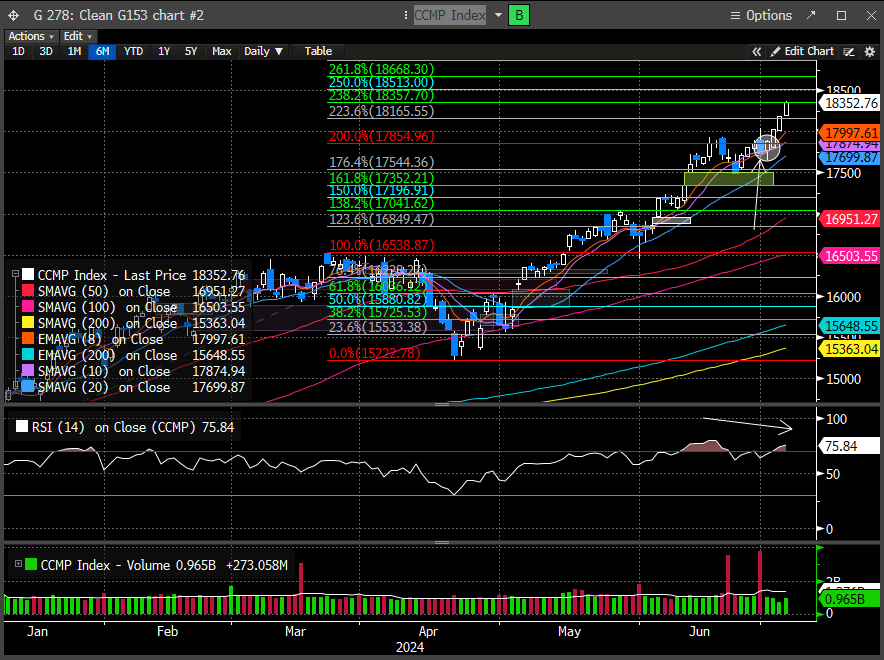

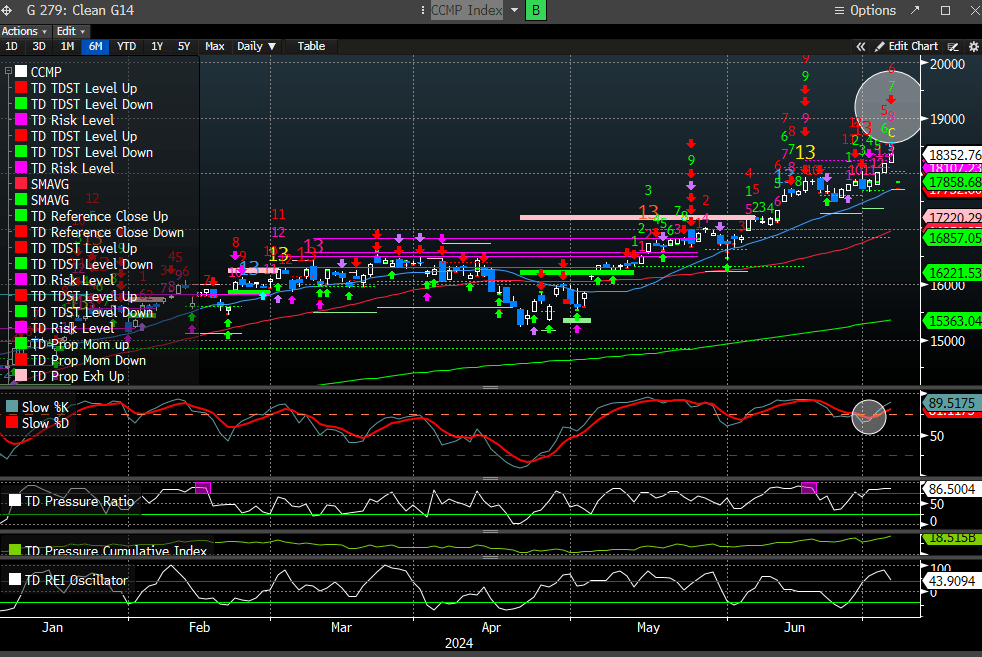

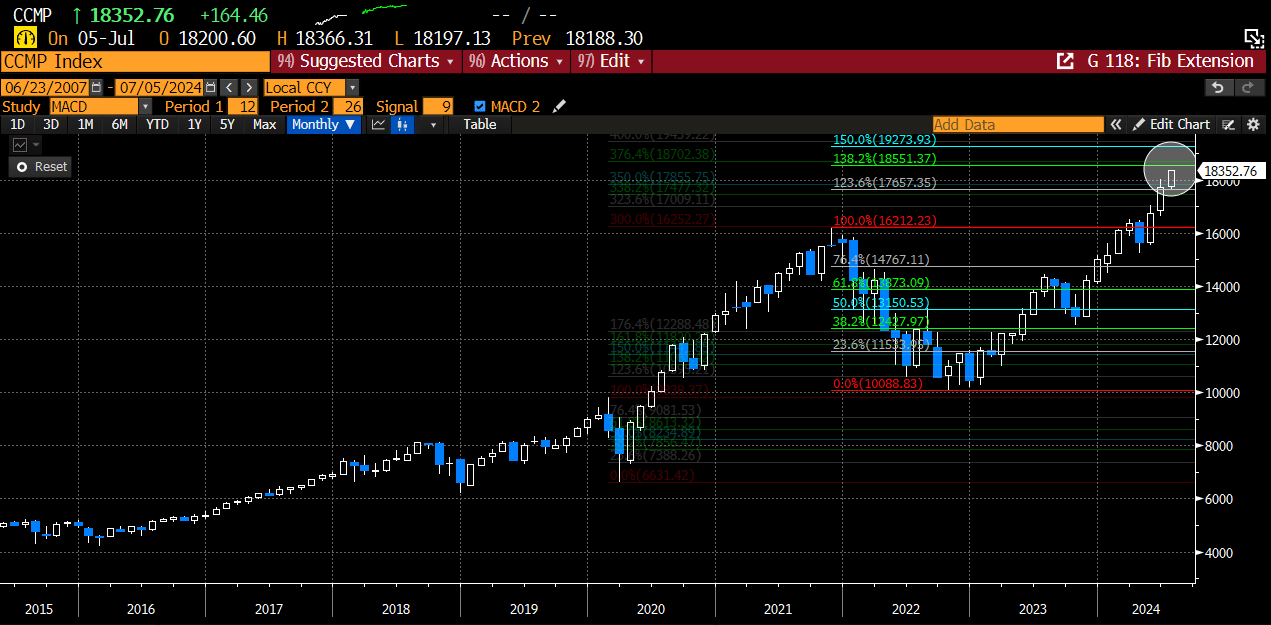

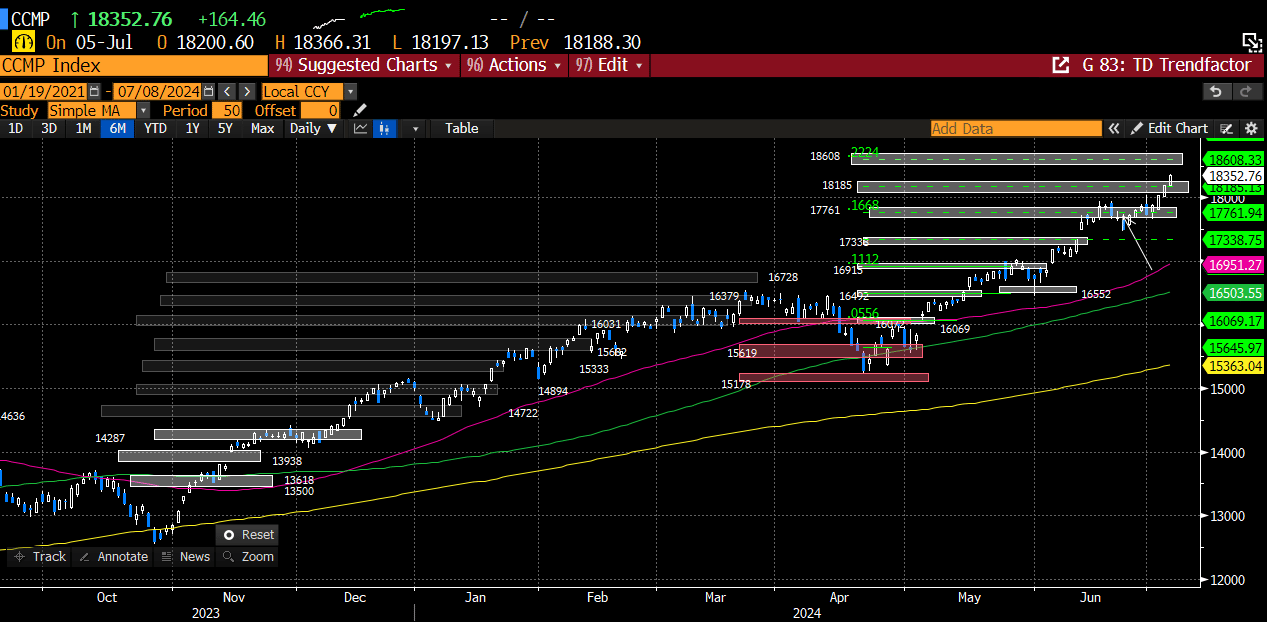

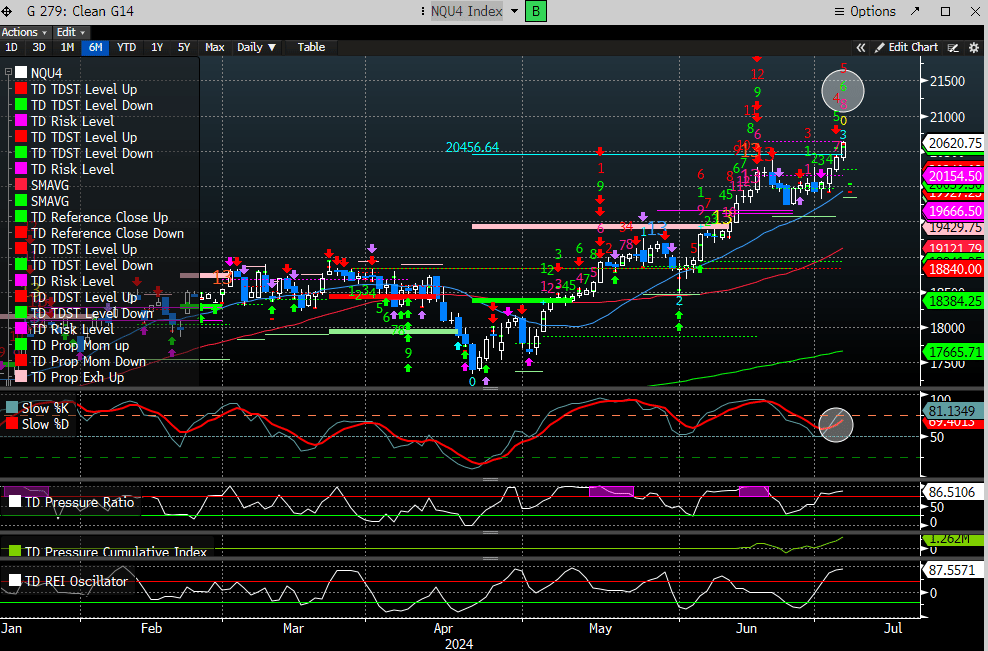

The Nasdaq tested the 8-day EMA multiple times in the last week and has found support each time. This is simply more evidence of momentum buyers using weakness to buy the market. The Nasdaq is now testing the 238.2% Fib extension. The RSI is OB and starting to diverge negatively. This would be a logical place to pause, but given the positive seasonality window, it’s possible this will press to the next level (250%/18513).

Similar to the SPX, there is also a weekly DeMark 9 sell to complement the recent, still current, 13 sells.

The daily chart has somewhat negated the recent 13 sells by marginally taking out their respective risk levels (DeMark version of stops) recently. A new 9 sell can print in two days.

The Nasdaq MACD with a new bullish cross suggesting more near-term upside is likely.

The monthly 138.2% Fib extension using the ‘22 peak to trough is 18551, which lines up with the 250% extension target mentioned above.

The DeMark Trendfactor 4x level is 18608, which also offers some confluence to the levels cited above.

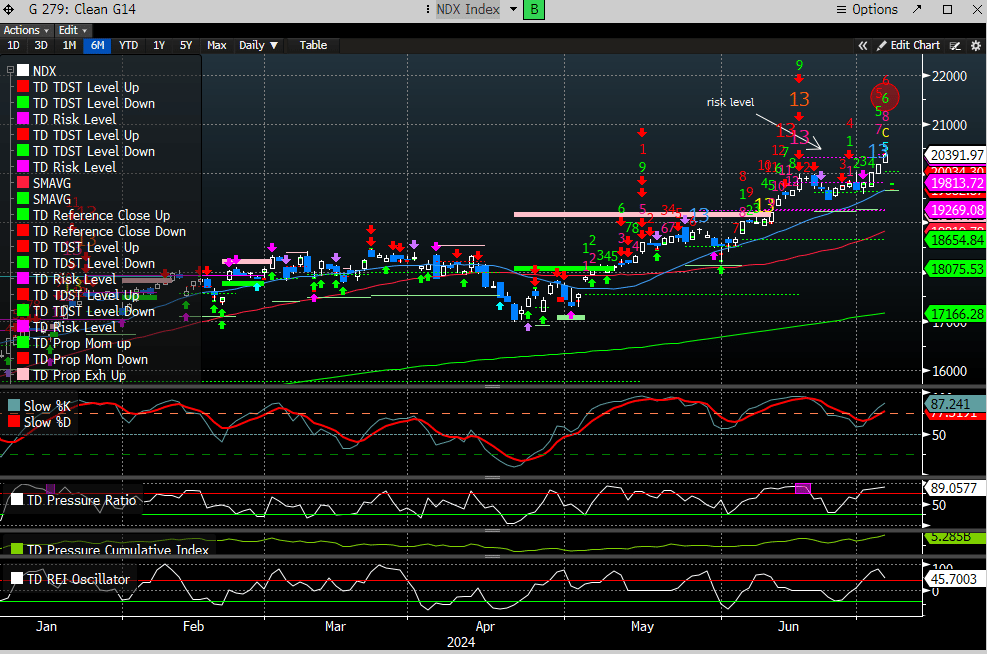

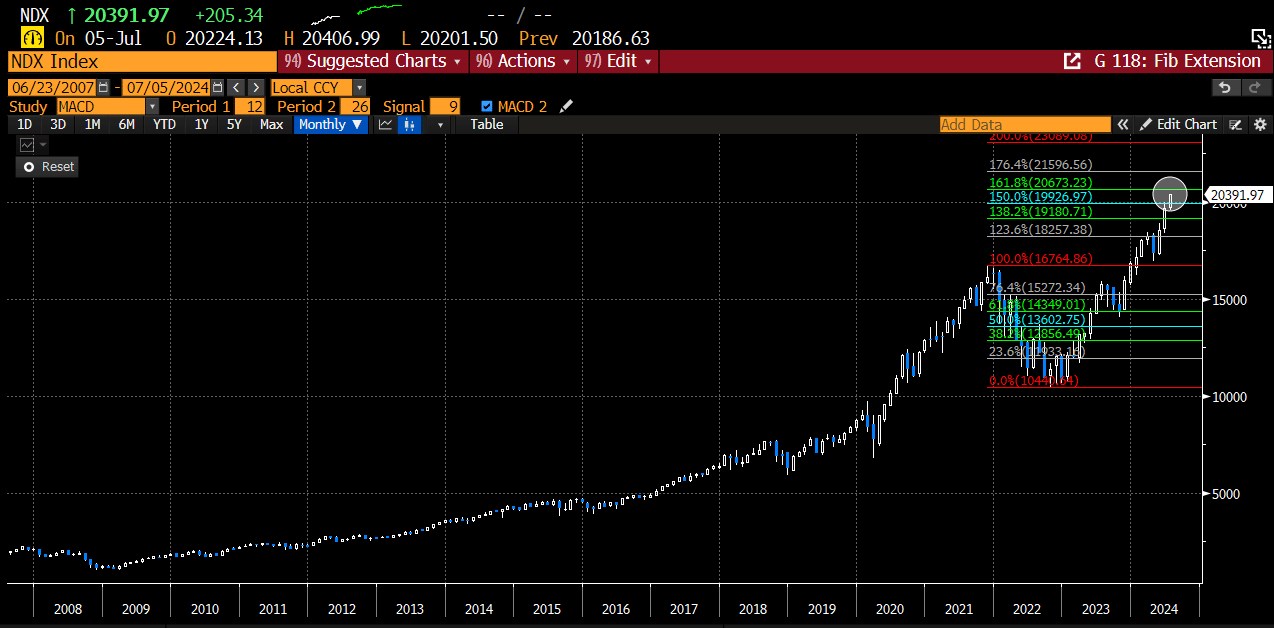

The Nasdaq 100 (NDX) has a similar weekly 9 sell, to complement the recent and current seq 13 sell.

The daily chart for the NDX has marginally eclipsed the risk levels for the 13 sells that printed in mid-June. A new 9 sell can print in 3 days.

The NDX has a monthly 161.8% monthly Fib Extension at 20673 and would be a logical place to find resistance.

The DeMark Trendfactor 4x level is at 20748, offering confluence to this region to find sellers.

SPX Futures printed a seq 13 sell on Friday to complement the combo 13 sell the day before.

This offers signal confluence with the weekly 9 sell.

The Nasdaq 100 futures, also with a new 9 weekly sell.

And a new daily DeMark 9 sell in possibly 3 days.

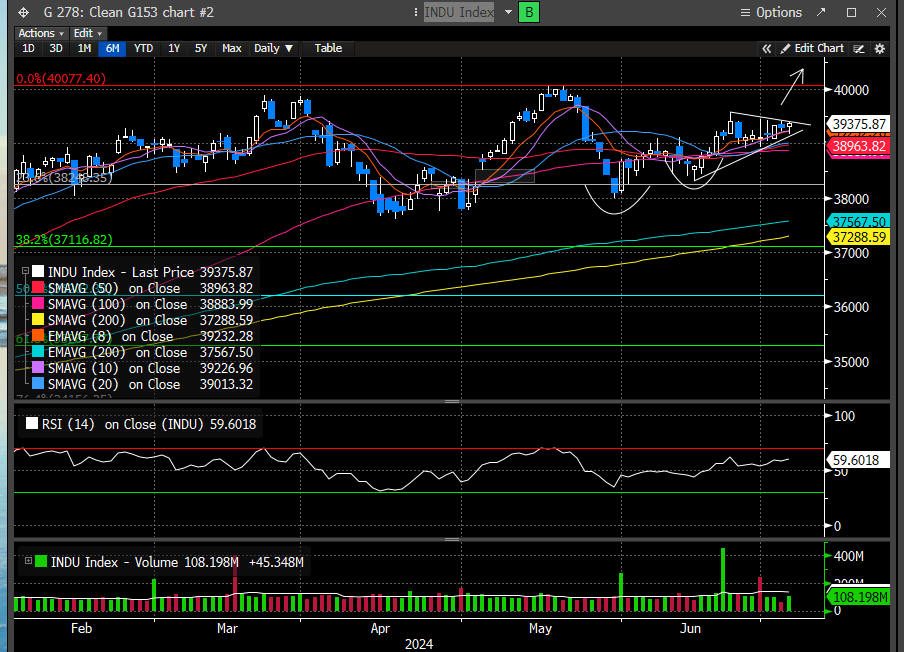

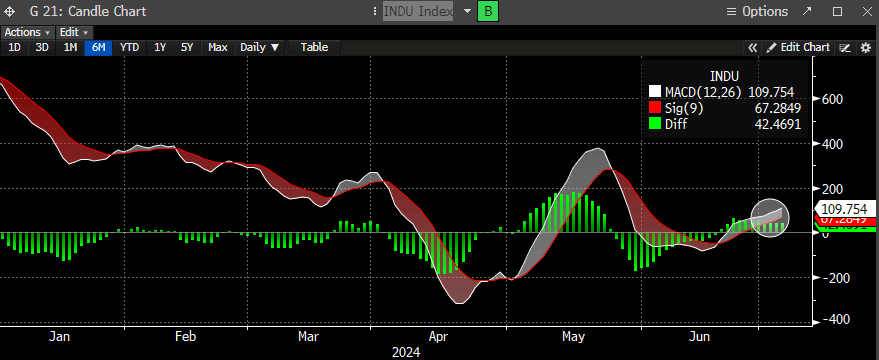

The Dow does look like a bull pennant forming over the MA support cluster. Bull pennants are continuation patterns, and we suspect this will break up. This is supportive of rotation into other large cap areas of the market.

The MACD now firmly above the zero line suggests momentum is supporting our thesis for more upside.

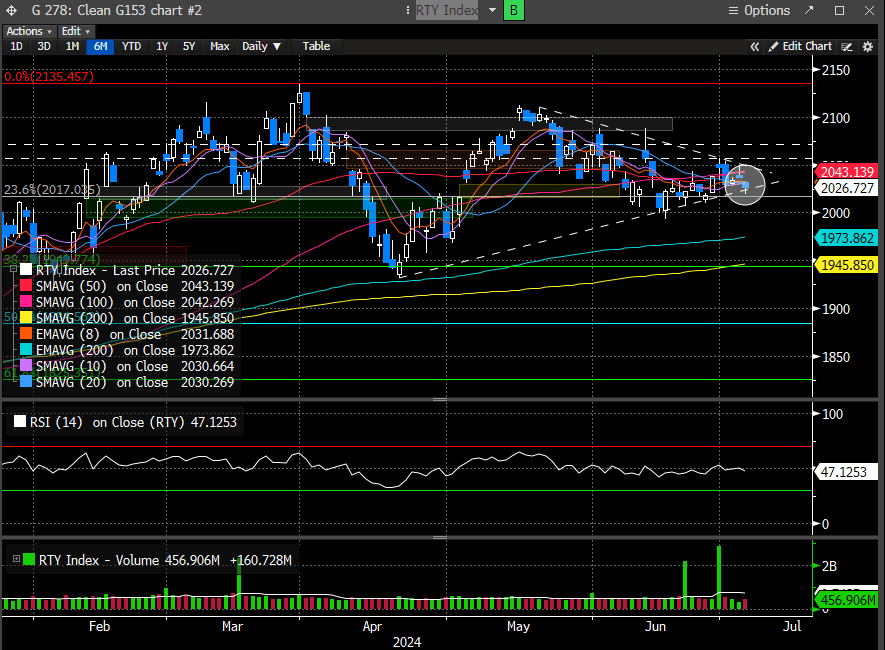

The Russell 2K continues to struggle, but holding where it has to. Should this break higher, it would be more supportive of further rotation into lagging sectors of the market.

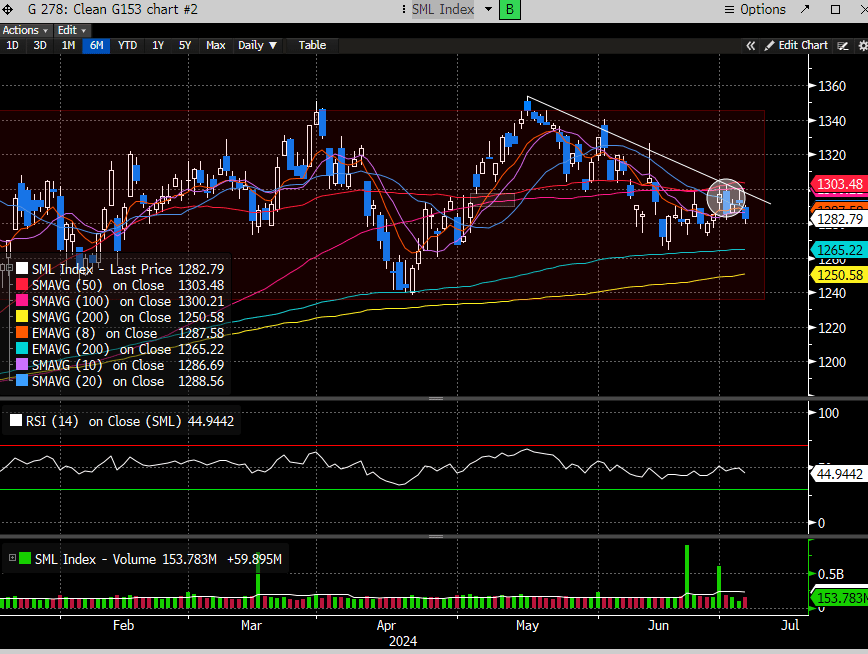

The S&P Small Cap 600 is not faring much better and remains stuck despite sinking yields.

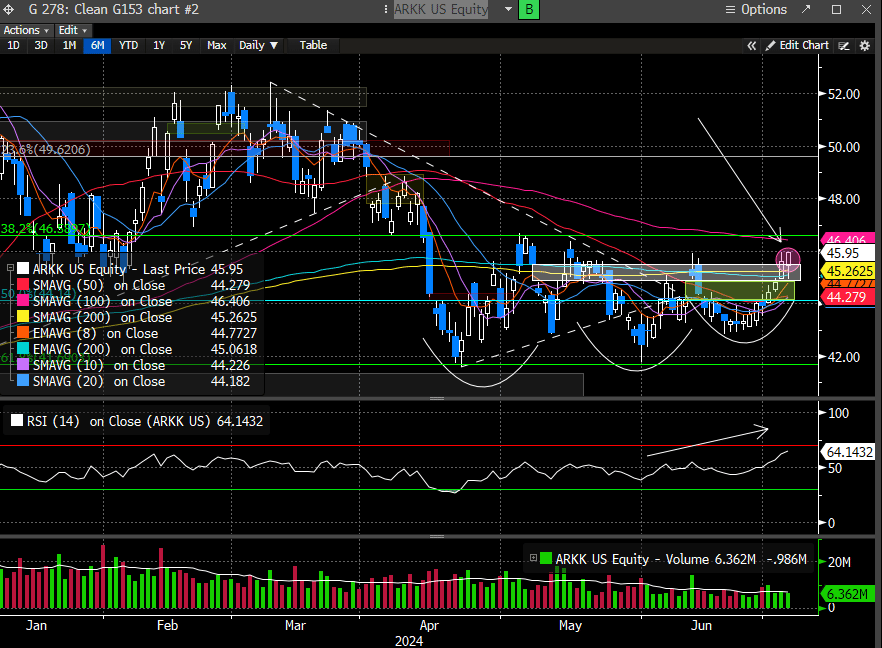

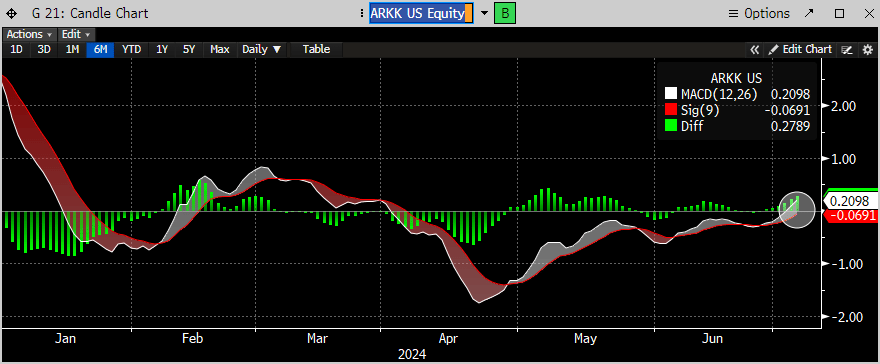

We did find it interesting that $ARKK (a proxy for unprofitable growth) has successfully reclaimed the 200-day MA. These peaks are coming on higher RSI momentum.

The MACD is back above the zero line for the first time since March. TSLA is the biggest holding so it’s possible it’s more related to its recent outperformance. Nonetheless, it is something to monitor as lower yields support higher valuations for growth stocks, even the ones that don’t make any money.

Macro Updates

The yield complex saw quite the reversal from the prior week, undoing all the momentum from the Presidential debate trade.

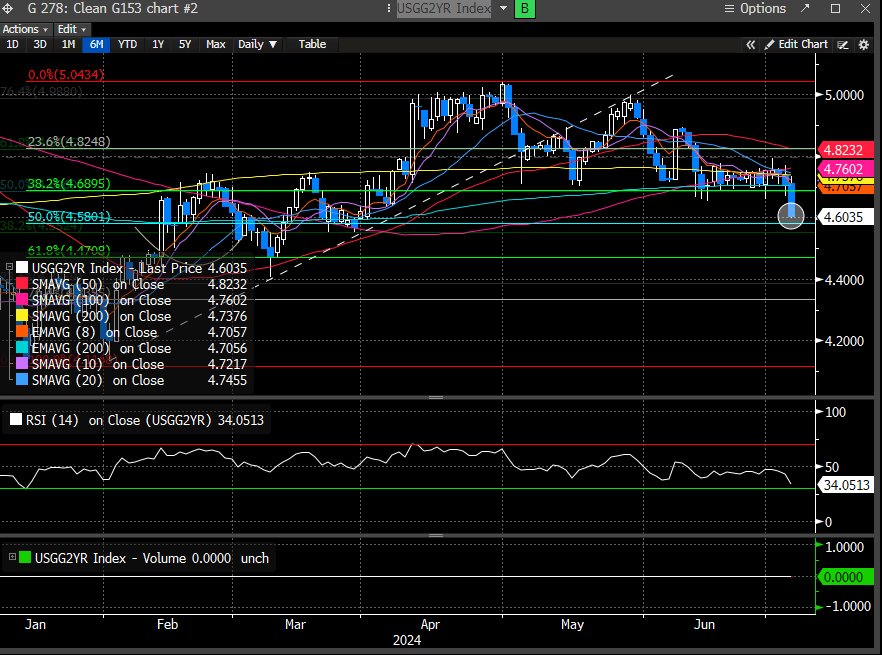

The 2-year yield has resumed its decline to forge a new swing low. This is quite important as the 38.2% Fib level was holding support for all of June. We are now testing the 50% level, but we suspect this will continue to grind lower. Our target remains 4.47 in the near term.

The weekly trend line, dating back to September 2021 has officially been cracked.

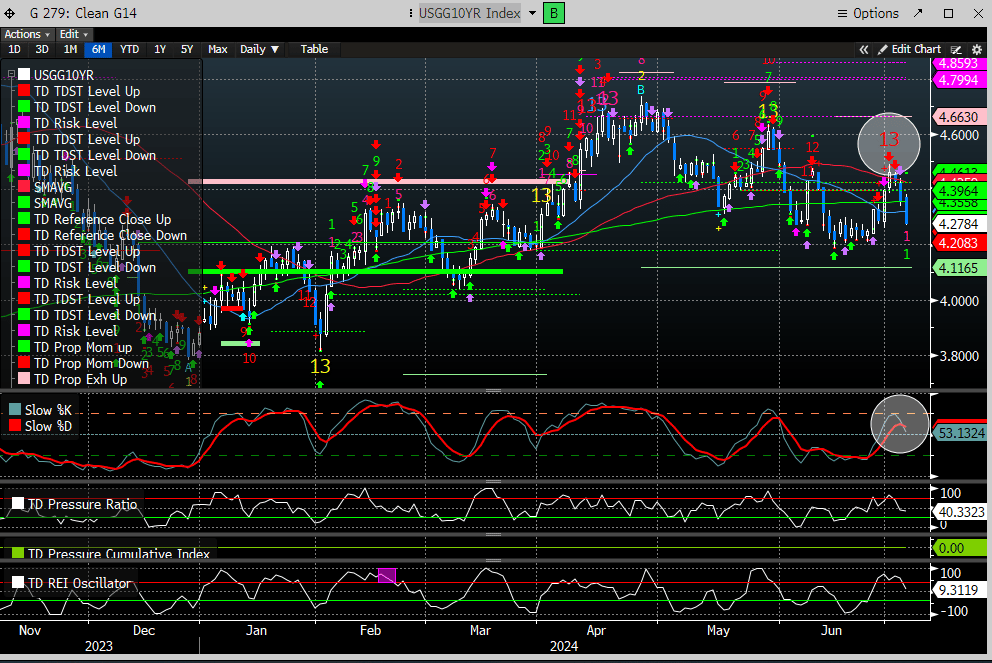

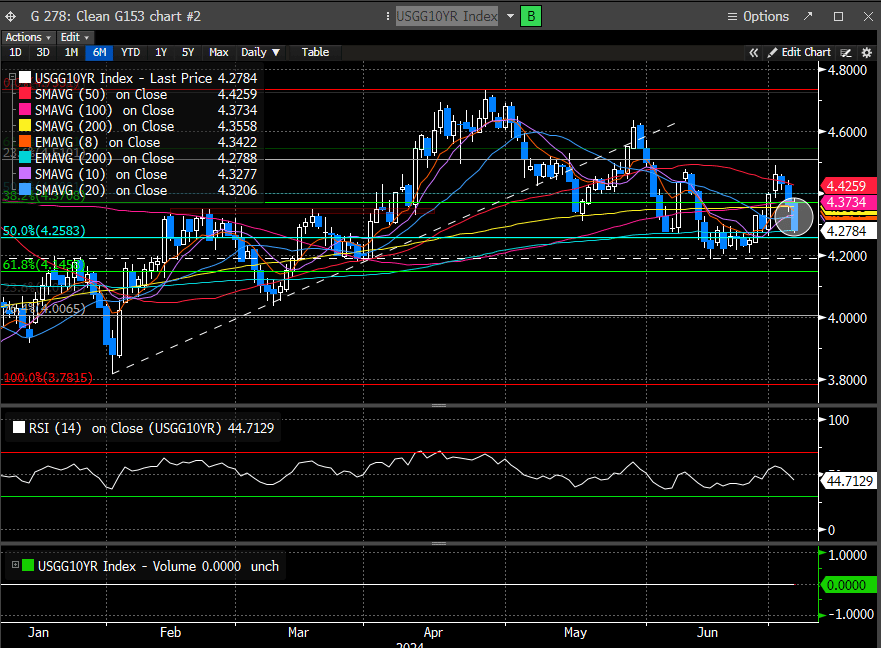

The 10 year is looking increasingly vulnerable.

Which fell apart after the DeMark seq 13 sell printed on 7/1.

The weakness last week brought the 10-year yield back below the 200-day MA. We suspect rates have seen the swing high.

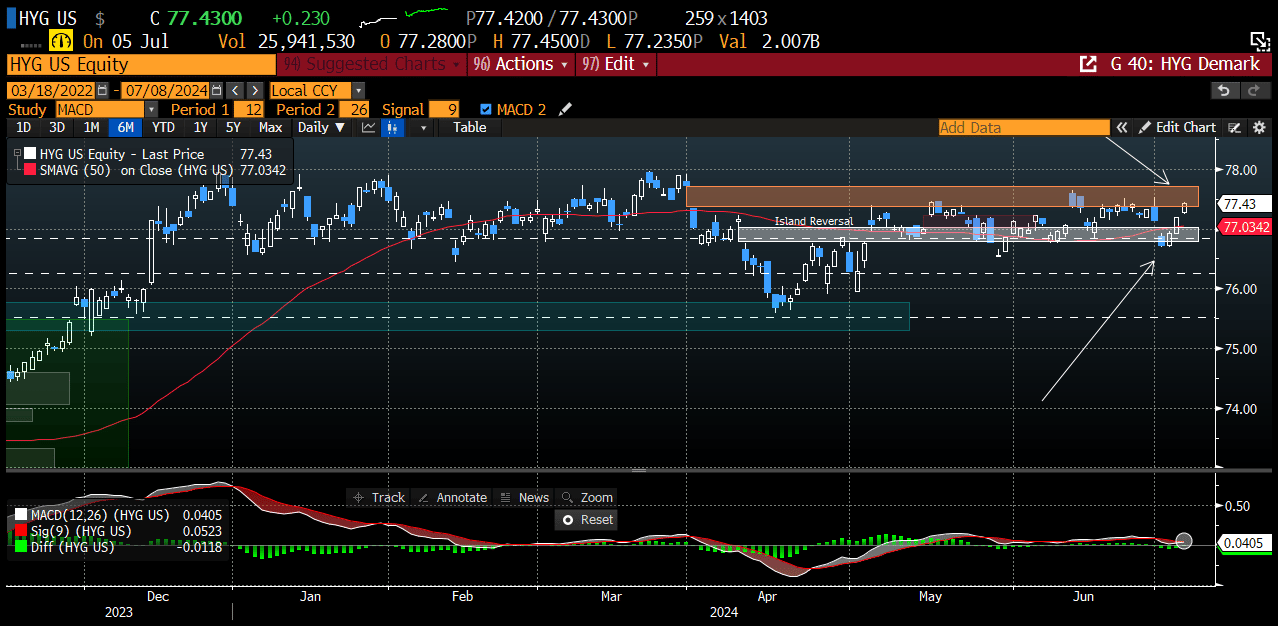

High Yield (HYG) continues to bounce between our two gap windows. The status quo is supportive for the equity markets. Its MACD is about to cross bullishly, implying positive momentum.

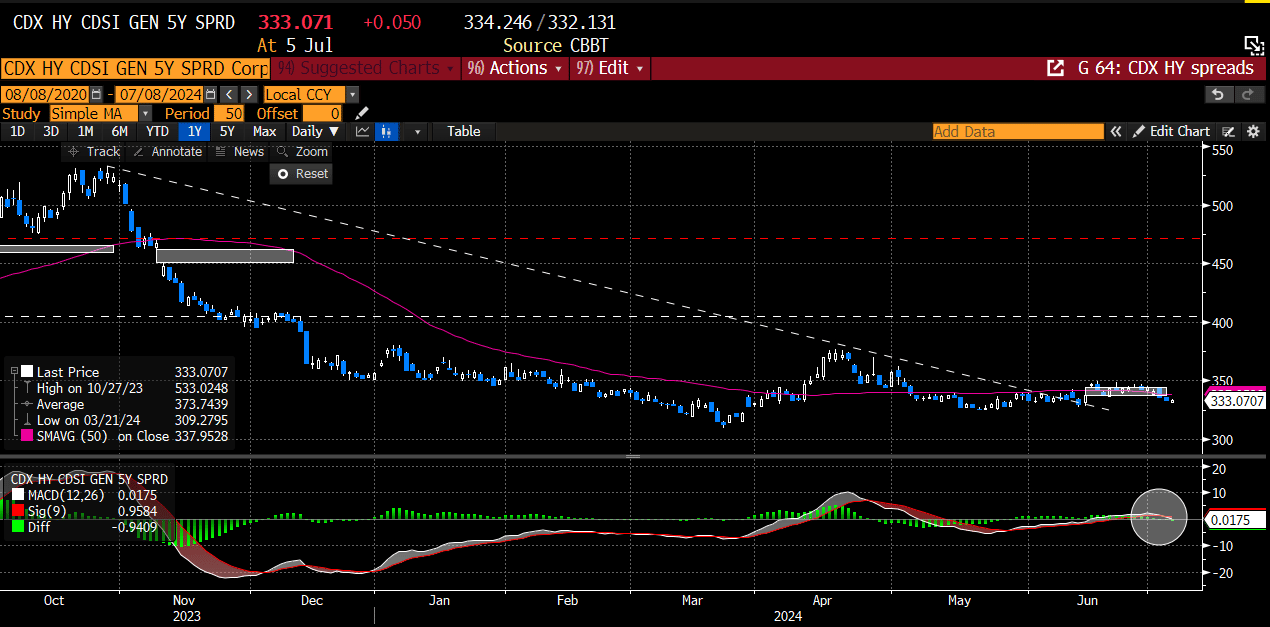

The CDX HY lost the gap window from the prior week, suggesting bears have lost power. Its MACD is now crossing back bearishly. This is also supportive of risk assets.

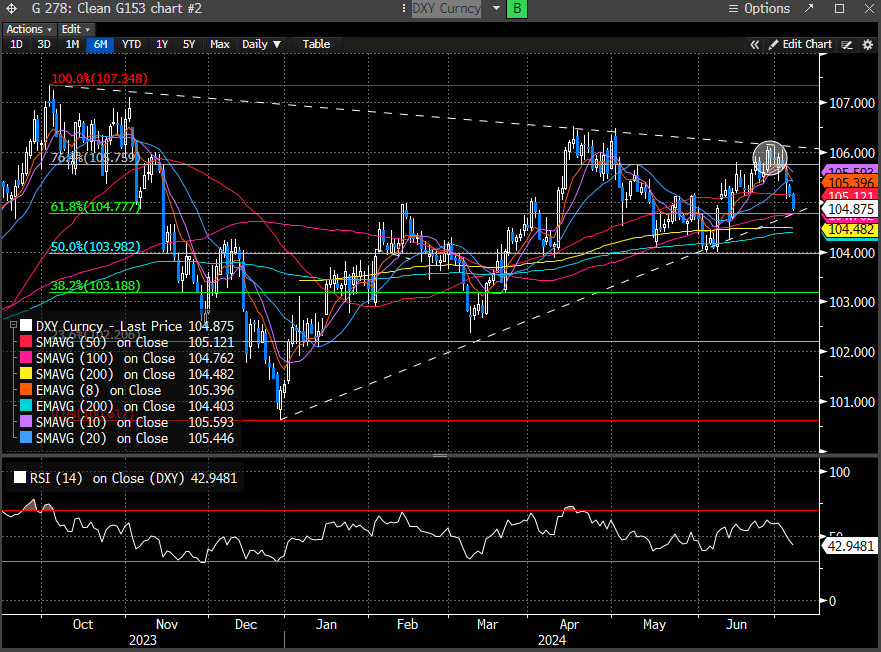

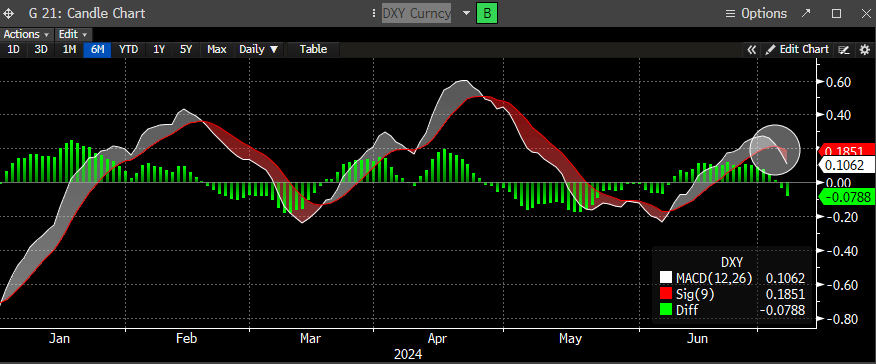

The $USD (DXY) was unable to break above the downtrend line (DTL) from October ‘22, and was rejected aggressively, breaking the 50-day MA and testing the lower trend line support.

Its MACD has just crossed bullishly. Lower $USD and lower yields are supportive for risk markets.

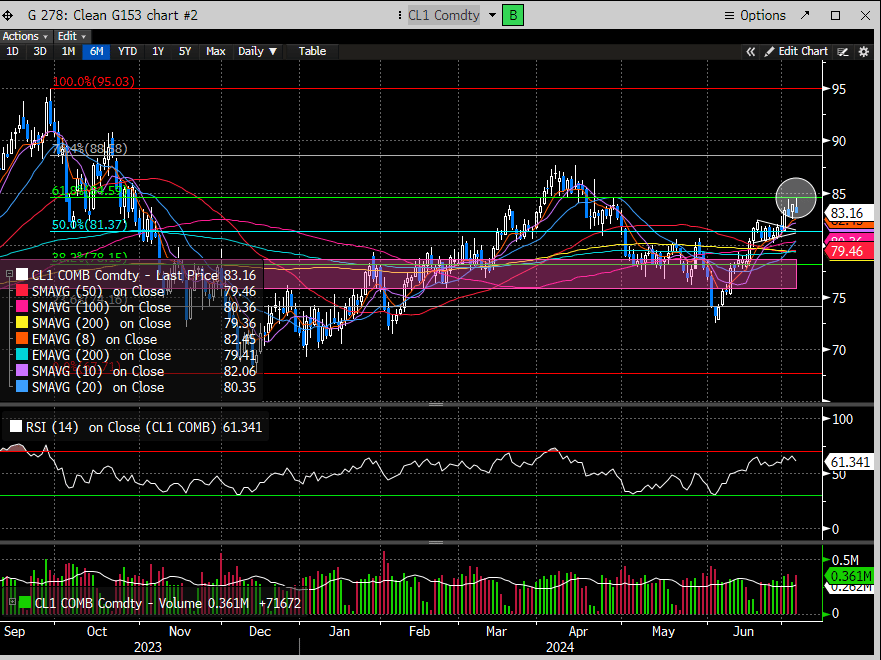

As we suggested, Oil did end up breaking the bull pennant pattern to test the 61.8% Fib retracement level. It has since been rejected, but those rejections appear mild. Breaking up would argue for a test of the 76.4% fib level (88.61). We remain bullishly biased.

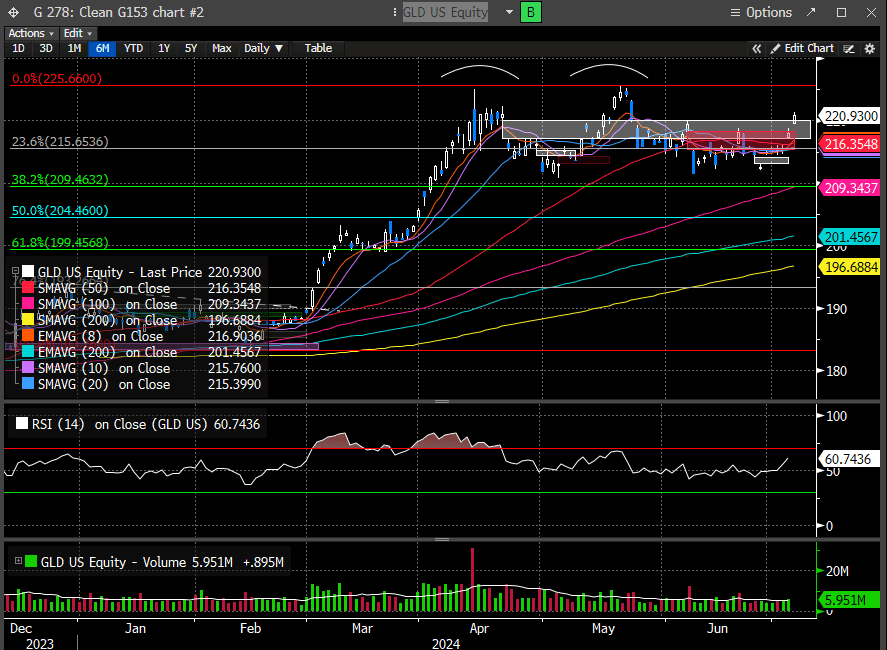

Gold (GLD) did see a resurgence with the retreat in the $USD and was forecasted by the island reversal we highlighted last week. This does appear bullish.

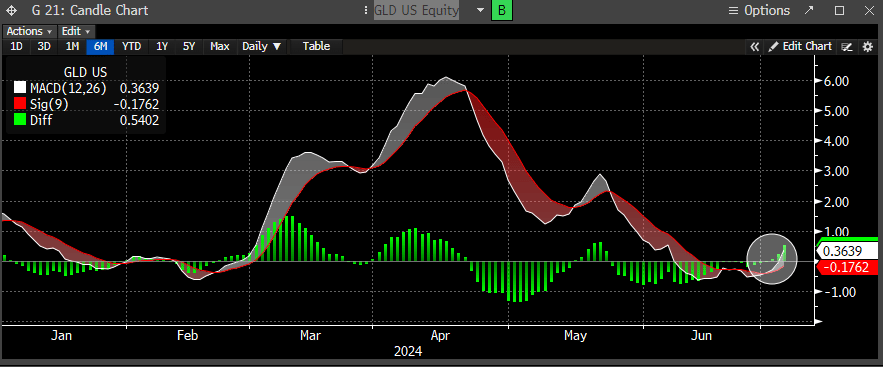

Especially with the MACD now crossing bullishly and back above the zero line.

Normally we would be interested in getting long, but GLD can print a DeMark seq 13 sell in one day. GLD typically reacts to DeMark sell signals so we will be patient with re-considering.

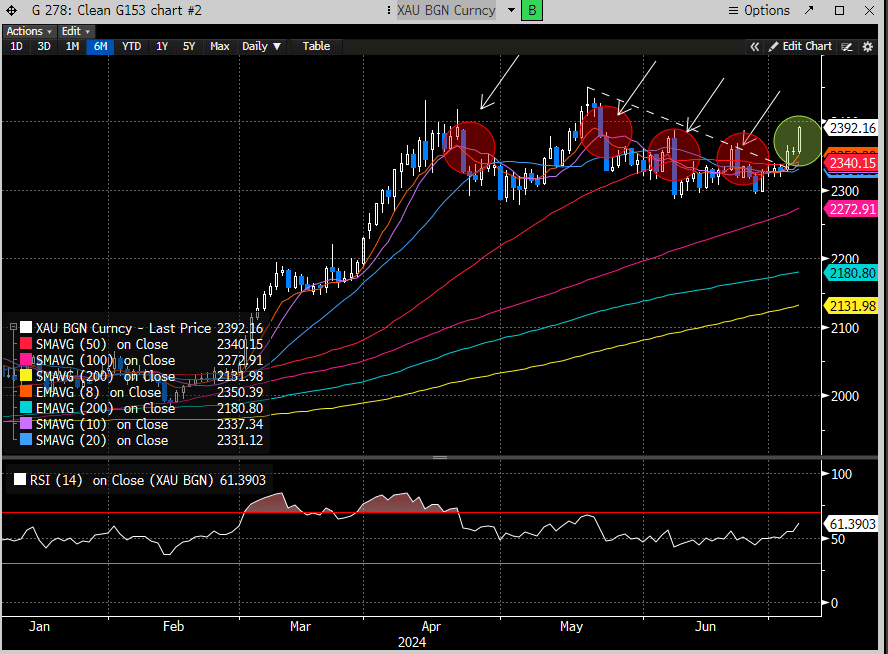

The XAU Index chart is quite bullish and reminds us we may need to be opportunistic, and thus, we will be monitoring.

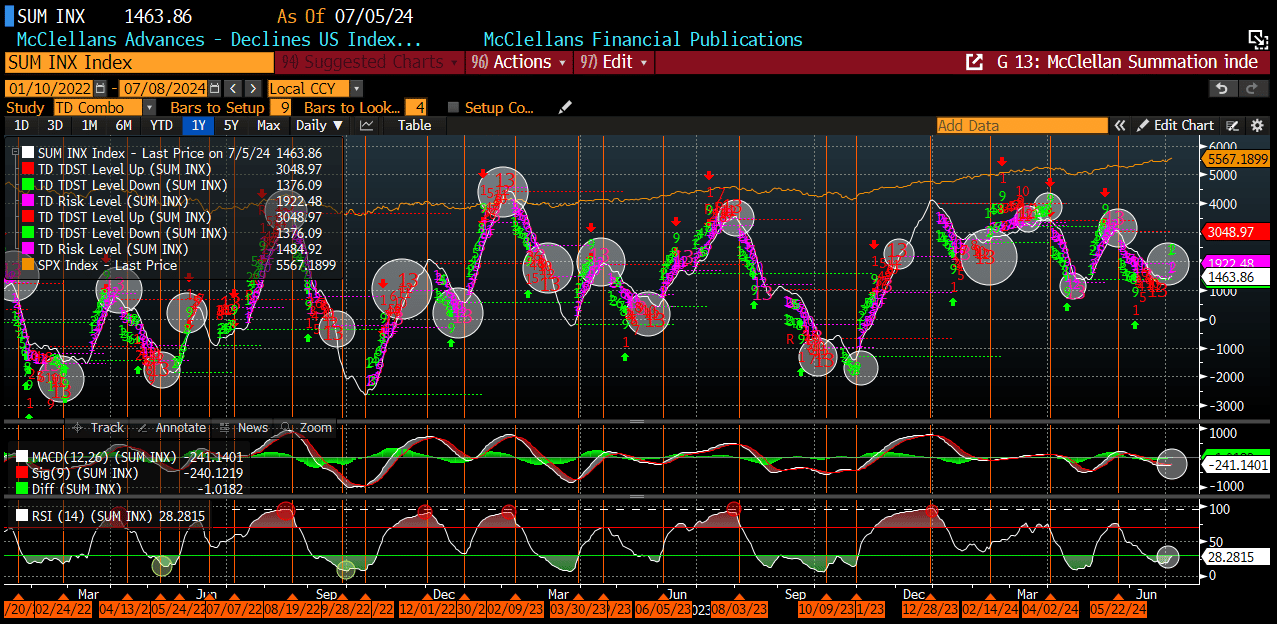

Internals

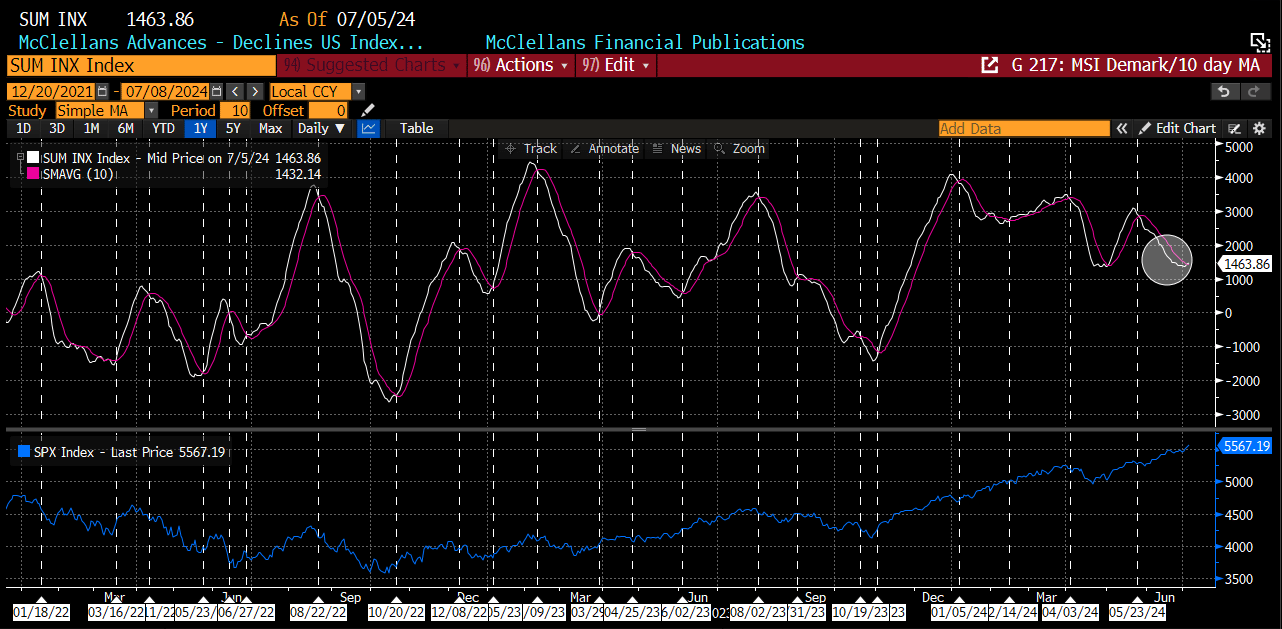

Recall our McClellan Summation Index (MSI) with DeMark signals, printed the seq 13 buy in the last week of June. This served as a reminder that market breadth could turn in the near term. The count has now flipped back up (day 2), and its MACD is about to cross bullishly.

And has now crossed back above the 10-day MA. This implies we should look for the market breadth to expand and for the rally to broaden.

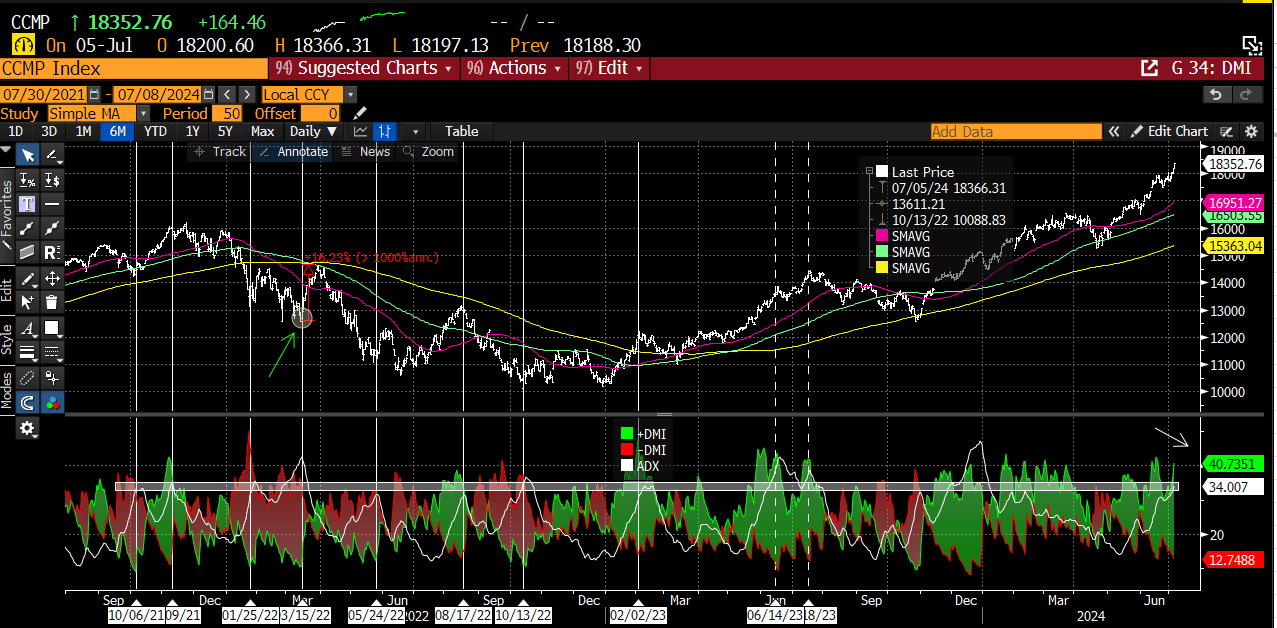

The Directional Movement Index (DMI) negative divergences we pointed out last week for the Nasdaq are beginning to get erased, but the ADX is still elevated.

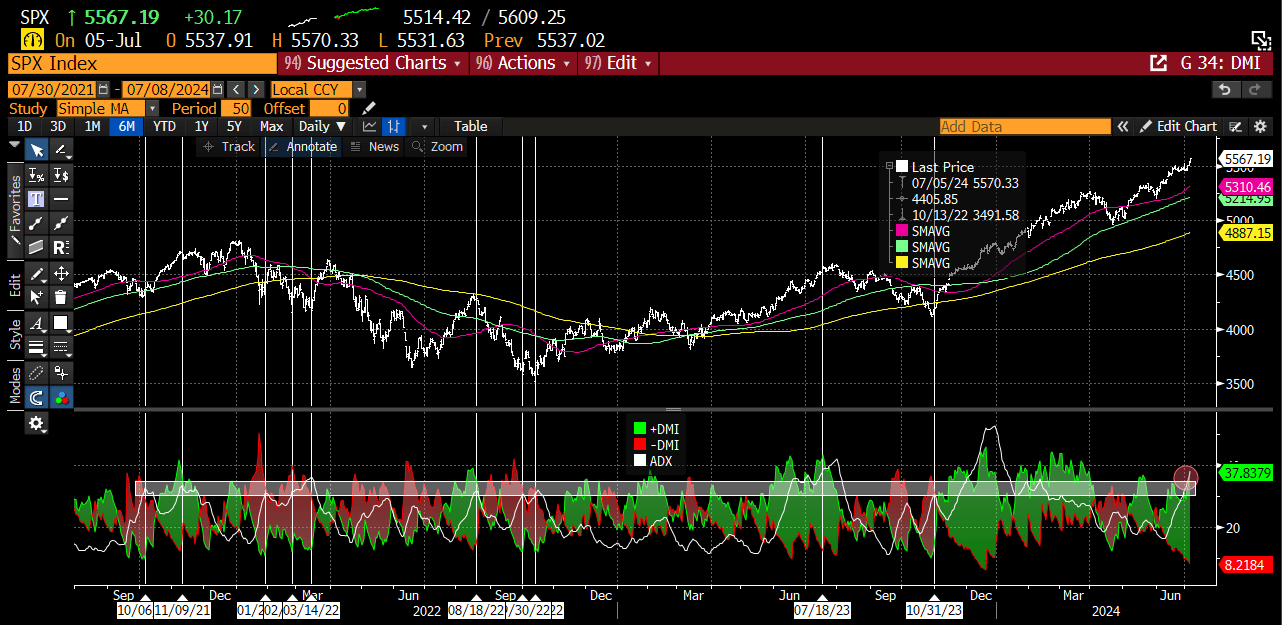

The SPX DMI has wholly negated the negative divergence. This is bullish confirmation of the current rally, although much like the Nasdaq, the ADX is stretched. This is not a signal to sell but a warning that the indexes are trending too strong and subject to reversion.

The Smart Money Index suggests that institutions are still supporting this rally.

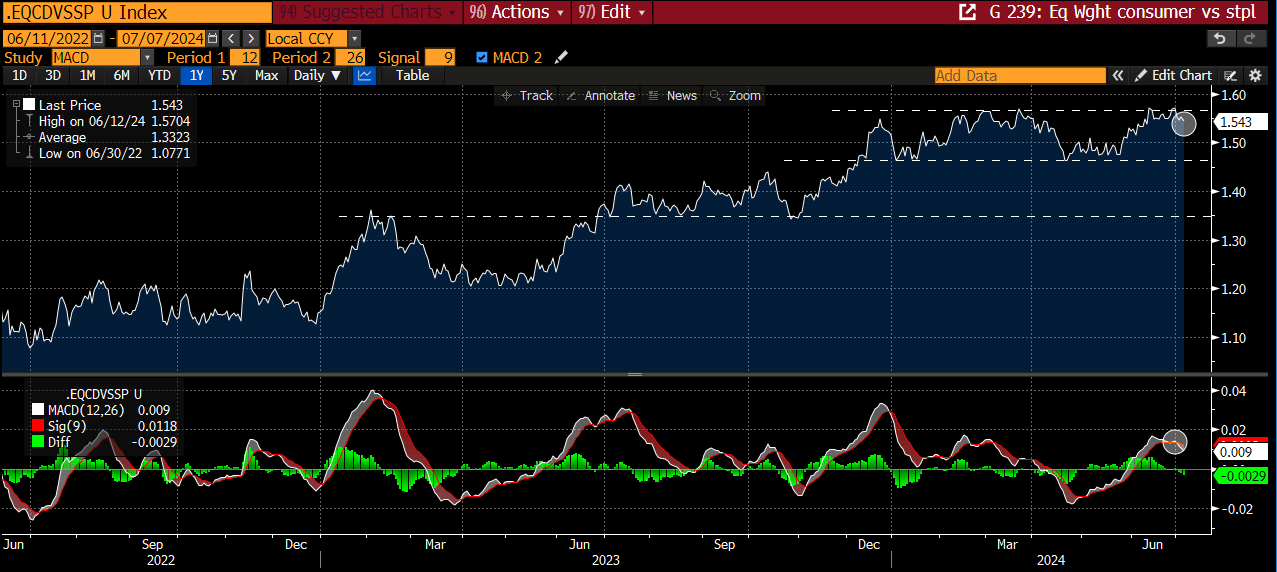

The equal-weight consumer discretionary vs. staples ratio failed to make a new high with the indexes last week, and it turned down. The MACD is also crossing bearishly. This could be an early warning sign that a defensive posture is building under the surface.

The Nasdaq 100 Equal Weight (NDXE) did forge a new ATH last week. ATH’s are bullish.

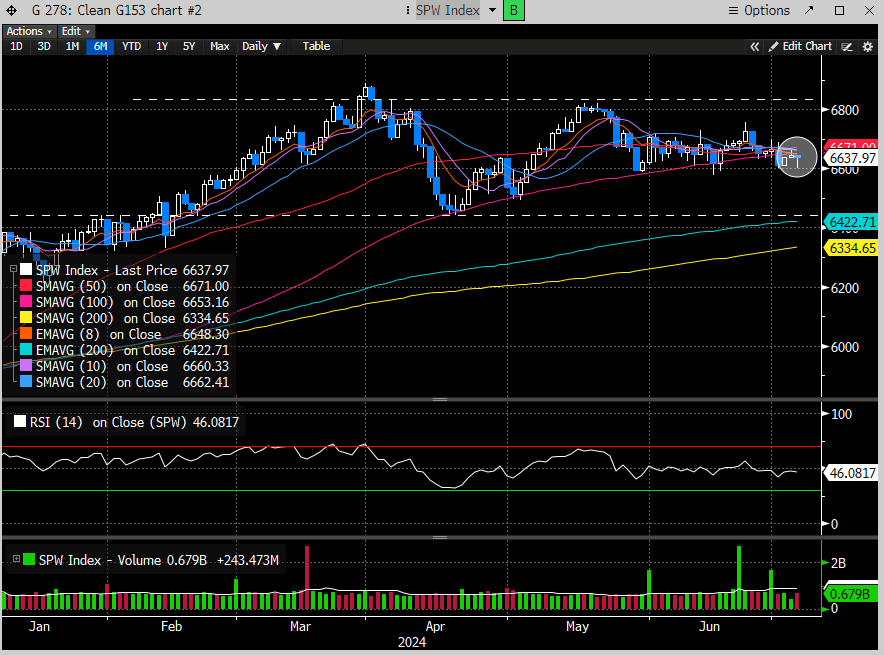

But the equal eight SPX (SPW) continues to struggle. This is truly a tale of two tapes and still favors large-cap growth.

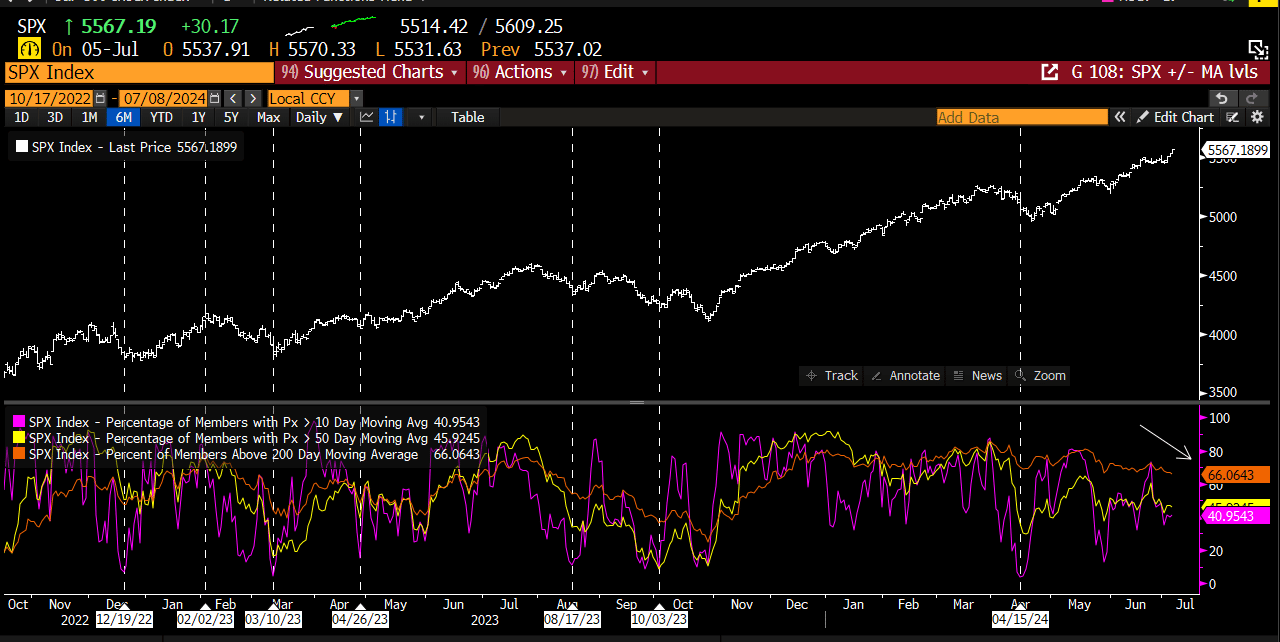

SPX stocks closing over their major moving averages spiked the prior week but have since been trending lower. This is not a great development.

The Nasdaq is similar.

The VIX continues to find support at the lower pivot, but all recent volatility spikes have been contained to very short-term moves. Friday’s candle is suggestive of a possible early volatility spike this week, but the sustainability is undetermined.

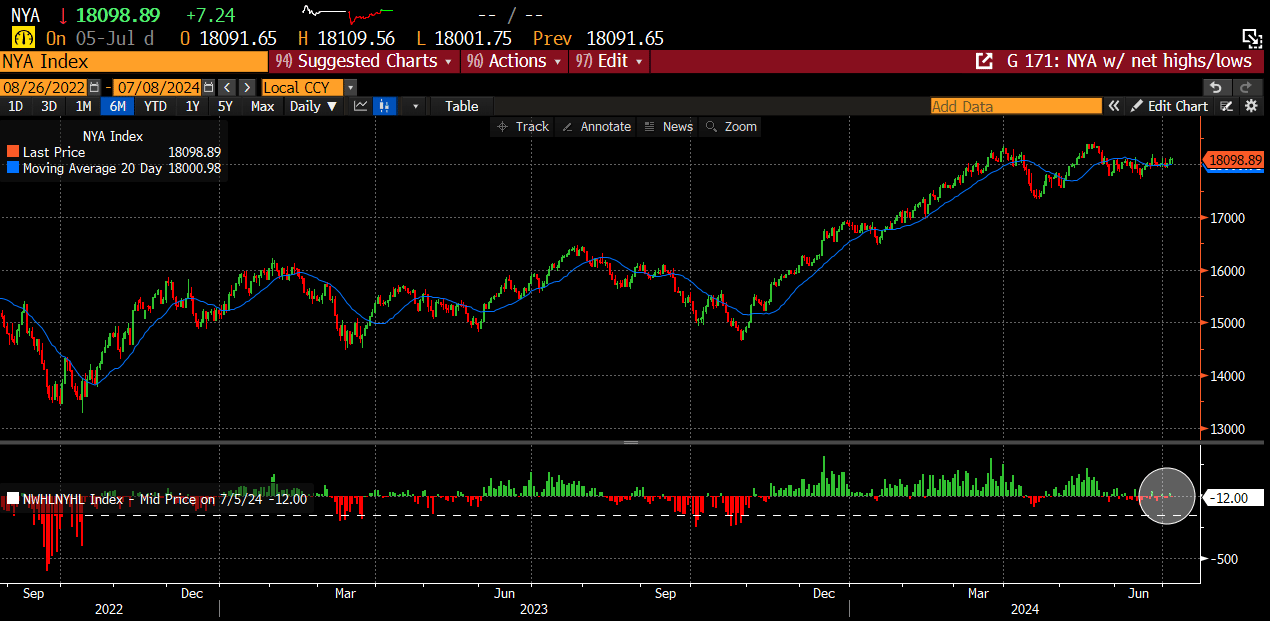

The NYSE Net New Highs Index continues to oscillate between positive and negative readings, indicating no sustainable trend.

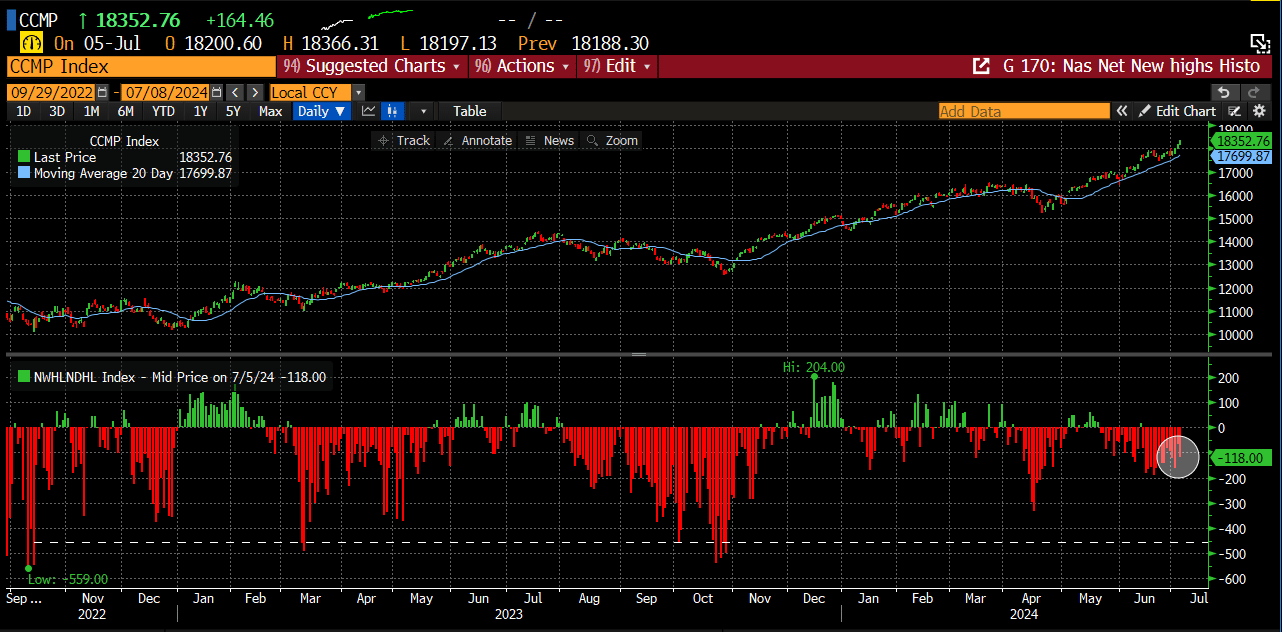

The Nasdaq Net New Highs Index remains hideously underperforming the index.

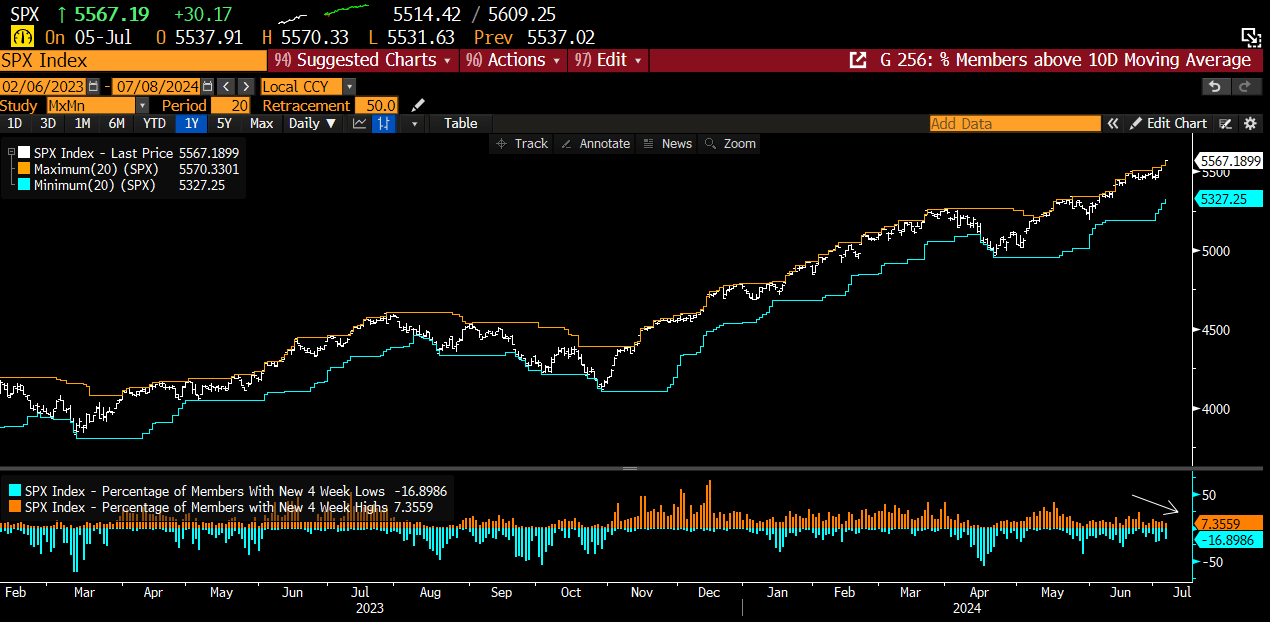

Nasdaq new 4-week lows continue to outpace new 4-week highs and continue to illustrate how bifurcated this market is.

The SPX is similar.

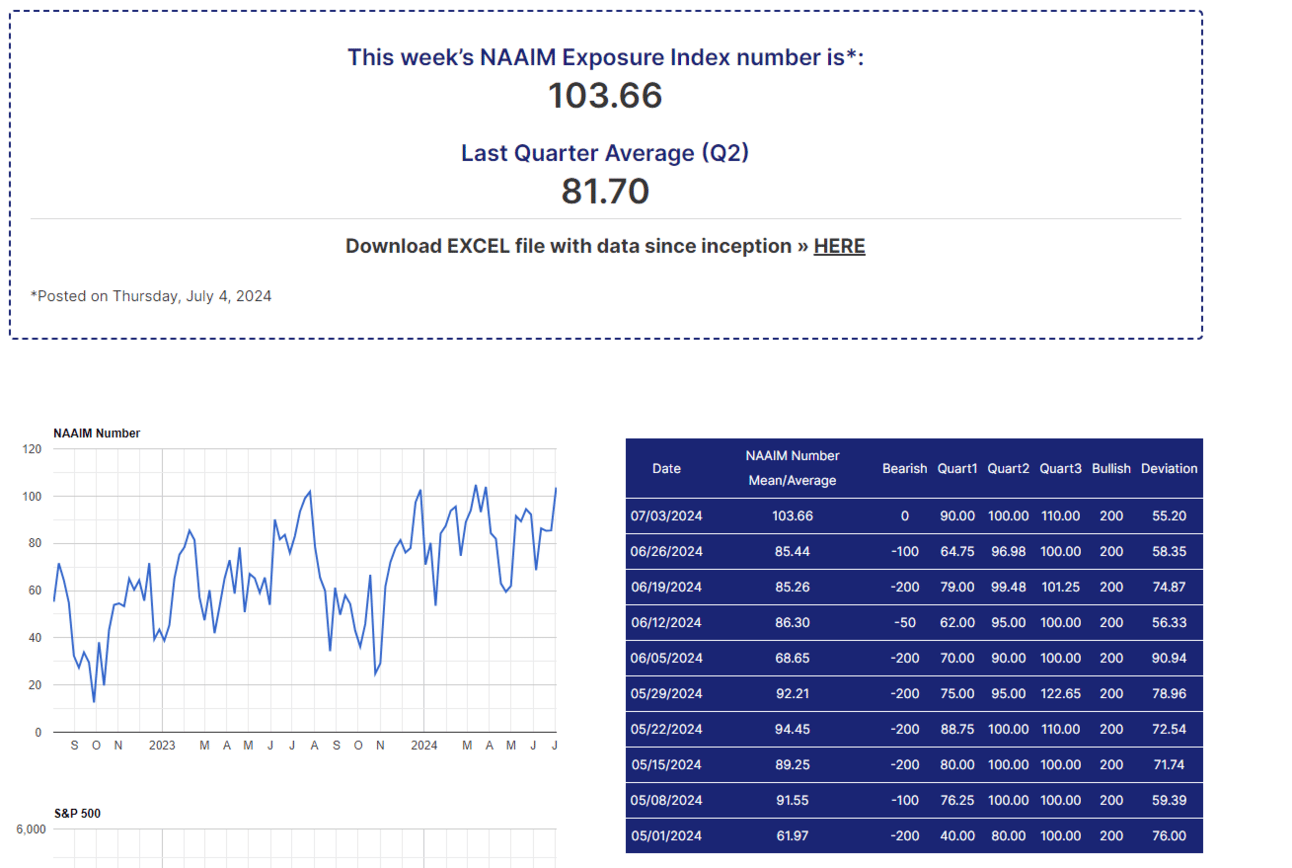

The NAIIM Exposure Index is officially in the danger zone. This suggests everyone is loaded on one side of the boat. The last time we were this elevated was on March 27th. The next day, the market peaked and proceeded to lose almost 6%.

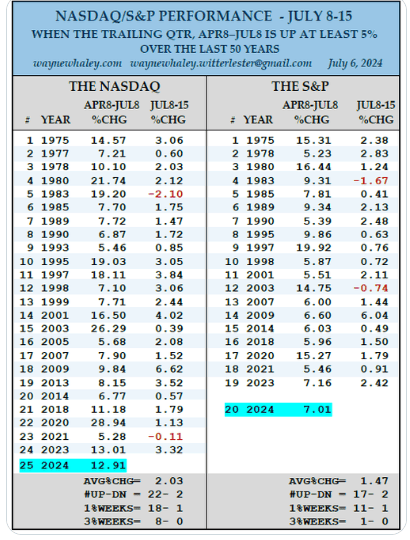

That said, the seasonality for this week remains quite positive. Here is a fun study from Wayne Whaley discussing the previous strength in the stock market and the ensuing record for this week; It’s overwhelmingly positive.

And as we have shown multiple times in election years, the middle to the end of July is where we start to see softness enter the picture.

Crypto

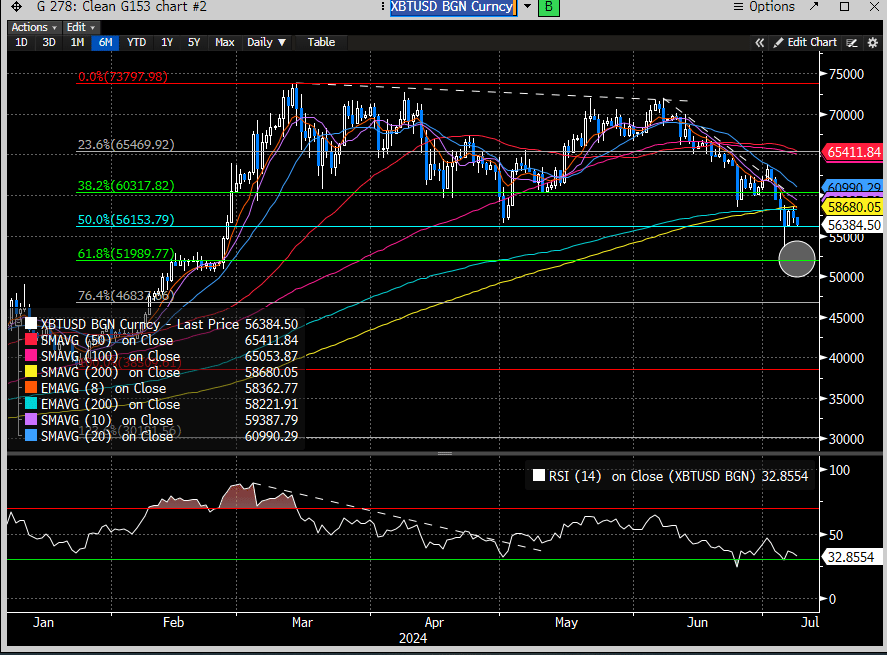

Our long idea on Bitcoin last week did not pan out and we were stopped under $60K. This is now finding some support at the 50% retracement level but looking increasingly vulnerable. The 61.8% Fib would be our first target to consider for re-entry.

Bitcoin can also print a seq 13 buy and a 9 buy in 3 days. We would be more inclined to buy the lower levels if these signals are present.

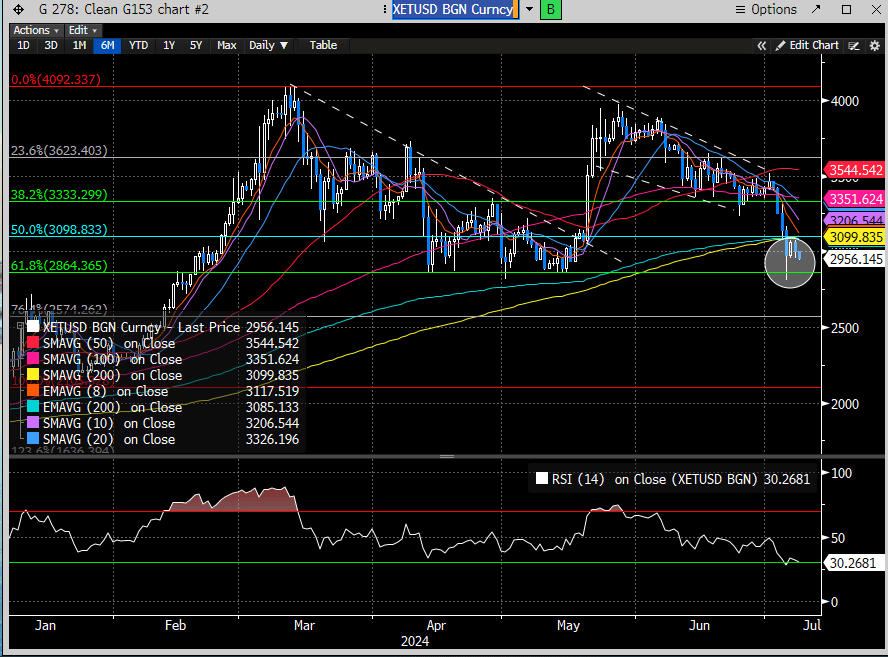

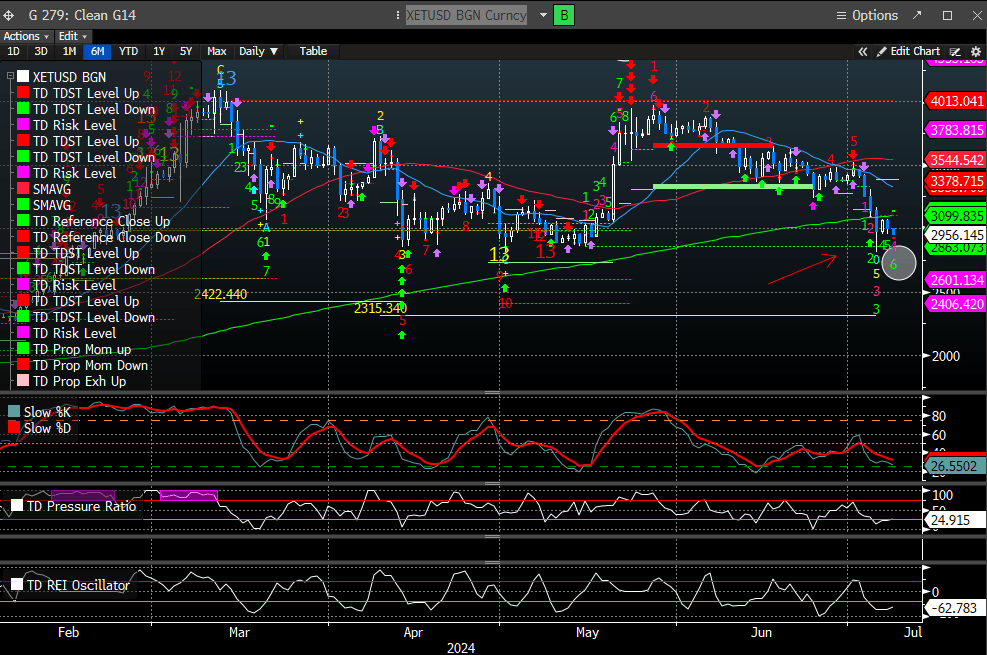

Ethereum also stopped us out last week under 3234. This has already tested the 61.8% Fib and is finding support.

Ethereum can also print a 9 buy in 2 days and is currently around the TDST (DeMark version of support). 9’s printing around a TDST are usually good R/R’s. The TDST is also the same level as the 61.8% Fib, offering decent support to trade against.

Conclusion

We have always maintained that calling tops in the stock market is infinitely more difficult than calling bottoms. We have a precarious setup with the stretched indexes being primarily driven by mega-cap stock outperformance. The DeMark signal confluence is getting louder, yet the rally is showing very few signs it wants to slow down or broaden out. We see green shoots appear in the lagging growth sectors, but most stocks continue to sit out the enthusiasm. This makes it very difficult for active managers to keep pace with their benchmarks and is forcing unusual crowding in some of these stocks, mainly the Mag 7.

Was last week’s push to ATH’s for this ordained group of stocks a capitulatory moment, or was it a rush to add in front of what needs to be a stellar earnings season? We cannot offer any intelligent response because we don’t know, but we venture to say it is probably a little bit of both.

The NAAIM exposure index and sentiment readings remain too elevated to consider making large allocations to the long side at this juncture. Our internal analysis remains mixed, yet breadth green shoots are revealing themselves. The macro inputs that we track are beginning to be cooperative, but the lagging parts of the stock market are not responding. Will we see a delayed reaction and a resurgence in the equal weight and small-cap indexes, or is the market trying to signal that macroeconomic pressures are too significant and biting into their businesses? The weaker macro releases could indicate an economy that is slowing too rapidly, and with rates too restrictive, the Fed may need to act sooner.

This week, we will get CPI/PPI inflation readings, and a softer showing may be the ammunition needed for the Fed to become more aggressive with its rate cut plans. Whether this comes in the form of a surprise July cut or strong signaling from the FOMC at the meeting that September is definitively a go remains to be seen. We suspect that this is what’s needed to kickstart the lagging areas of the market.

This means that growth stocks should remain at the forefront of portfolio allocations until we get a more precise signal to broaden our scope.

This week's goal is to pare some of our large cap and growth positioning into any residual market strength while continuing to hunt for lagging growth stocks in the early stages of a trend change.

That’s it for us. Have a great week!

*For more information on TD Buy/Sell Set up, TD Sequential or Combo Countdown, Demark Propulsion, please visit www.Demark.com

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.