Clear and Present Danger is a great book by Tom Clancy, amongst the series about Jack Ryan as a CIA operative. If you are not into books the movies are quite entertaining as well. While the story line draws little parallels to the actual stock market, the title most definitely does. Since the Fed began raising interest rates last year, we have been bombarded with opinions and headline grabbing news stories by the financial media that the Fed was going to send the economy and stock market off the proverbial cliff. This opinion was so pervasive that it knocked well over -20% off the major indexes from the peak last year. This by definition is a bear market. We admit, we were in that camp that the economy would not be able to handle the onslaught of excessive monetary tightening. We were correctly bearish for most of last year but turned tactically bullish in Oct. Does turning bullish mean we were bullish on the economic outlook? No, in fact we were quite bearish. But fundamentally bearish and technically bullish are not mutually exclusive.

We are technical analysts first and follow a strict discipline of proprietary signals to guide our decision making. We have been at this game for over 2 decades and have learned that fundamental biases only get you in trouble and usually result in a lot of missed opportunities. We reserve the right to change our technical bias at any point if our signals tell us to do so. This by definition means we are agnostic to market direction. Is it easier to make money in a bull market? We think it is. But knowing when to pull chips off the table when things turn sour is how you keep most of what you made during a bull phase. We are not afraid to short and consistently do so, but the bulk of our returns tend to come in bull phases. There are many reasons for this, but mainly because bear phases tend to be abrupt, aggressive and difficult to time. Bull phases occur over many months, offering a plethora of entries and exits along the way.

If you are one of those with a stubborn bias, we welcome and congratulate you, for taking the next step to freeing your mind.

The job of an investor is maximizing returns and thus being married to any particular bias will only serve as an obstacle for significant outperformance.

We love reading the posts by so-called Furus that say they will remain bearish during any counter trend rally. These posts started at 4K on the SPX. The SPX was +450 points over this threshold last week. This implies they need at least a +10% correction in the stock market just to break even. And this assumes they weren’t already forced to cover or capitulated (mostly likely). Our favorite bear, “Diamond Mike,” has literally called for a market sell off for every week since the beginning of the year. We guarantee this individual isn’t bearishly positioned and has no skin in the game on the short side, otherwise he would be out of business. He insists his fundamental bias is correct and has no problem charging hundreds of dollars for his advice a month to steer people down an incorrect path. Maybe his clients like flushing their capital down the toilet. For reference, there have been 27 weeks since the start of the year, and 10 of them have been negative. His hit rate is 37%. This means you are better off going to the roulette table then heeding his advice.

Our intention isn’t to criticize these individuals, as some of their analysis has merit, it’s just that their process is flawed. The first rule in the “Stock Market Fight Club,” is don’t get married to your bias. The second rule is don’t get married to your bias.

We have had a stellar year and a fantastic 2 months. Have our fundamental concerns evaporated? No. But who are we to argue with price action? Price action is the most important of all metrics we track. Price action is the collective wisdom of $trillions of capital, of some of the most well-resourced and sophisticated participants in the world. Who are we to argue with them? The bigger question, why are you?

Moving on….

Last week we certainly saw some cracks in the armor. We have been in print talking about seasonality shifts post July. Was last week’s stock market action the first shot across the bow? We know the market is wrestling with the prospect of higher rates and last week the 10-year broke out of this ascending triangle pattern. This move came on higher weekly RSI momentum confirming the breakout.

In our report last weekend, we highlighted this as a higher probability outcome.

Here is an excerpt:

The best part of rates breaking out, is that all the bears who have been clamoring that this rally is based on hopium the Fed would stop raising rates and start cutting, are being vindicated. But are they? They have been saying the same argument all year and meanwhile the stock market just posted its best first half in decades. I’d say they all have eggs on their face. 😁

Like a good surfer, we prefer to ride the wave, wherever it may be going.

What if this is the last gasp for rates? What if the Fed doesn’t increase rates at the next meeting? While the Fed Fund Futures are indicating otherwise, the employment picture, as per the payroll number on Friday, is clearly decelerating.

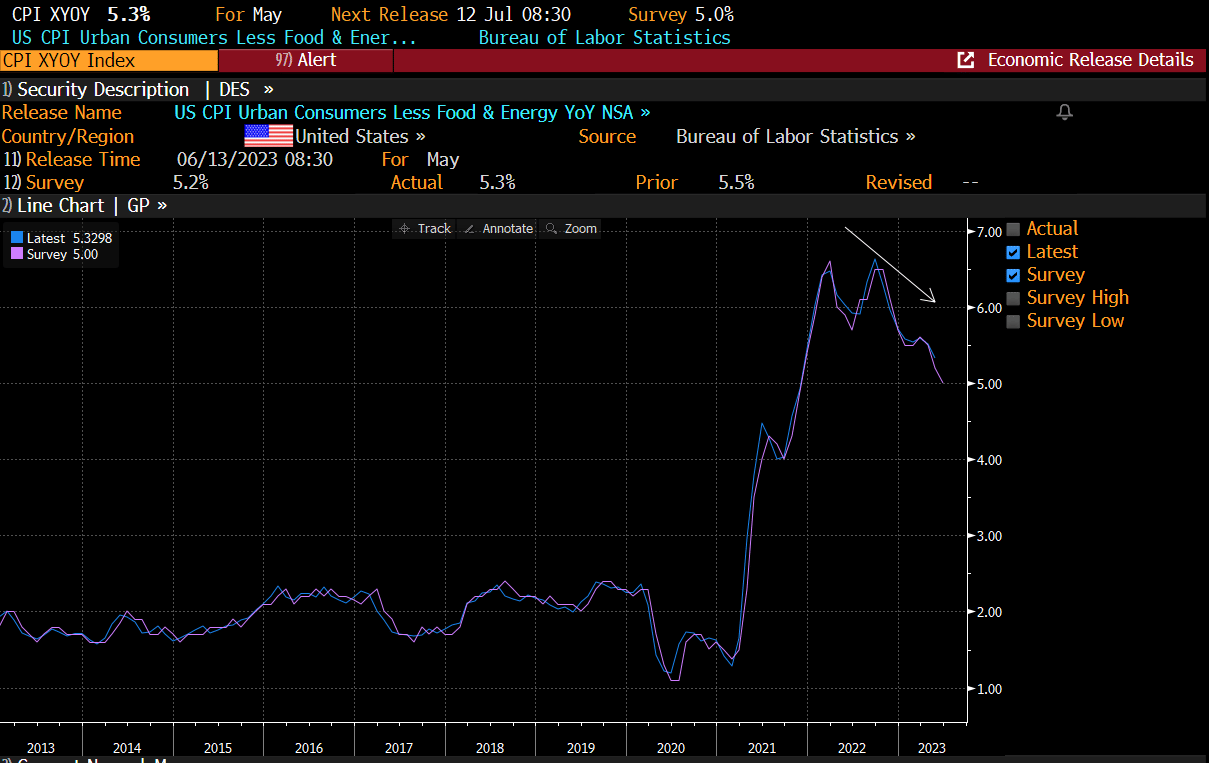

The last major pieces of the puzzle before the FOMC are inflation readings this week. CPI is being reported on Weds and PPI on Thursday. What if these follow the path of the PCE and also show deceleration? We actually think they will, but this is just us hypothesizing.

At the end of the week, we will get consumer sentiment, which has clearly bottomed and moving back up. If the consumer is feeling the effects of cooling inflation, and they are willing to spend more as result, shouldn’t we expect that earnings outlooks this Q will actually be better than estimated? Another hypothesis, of course.

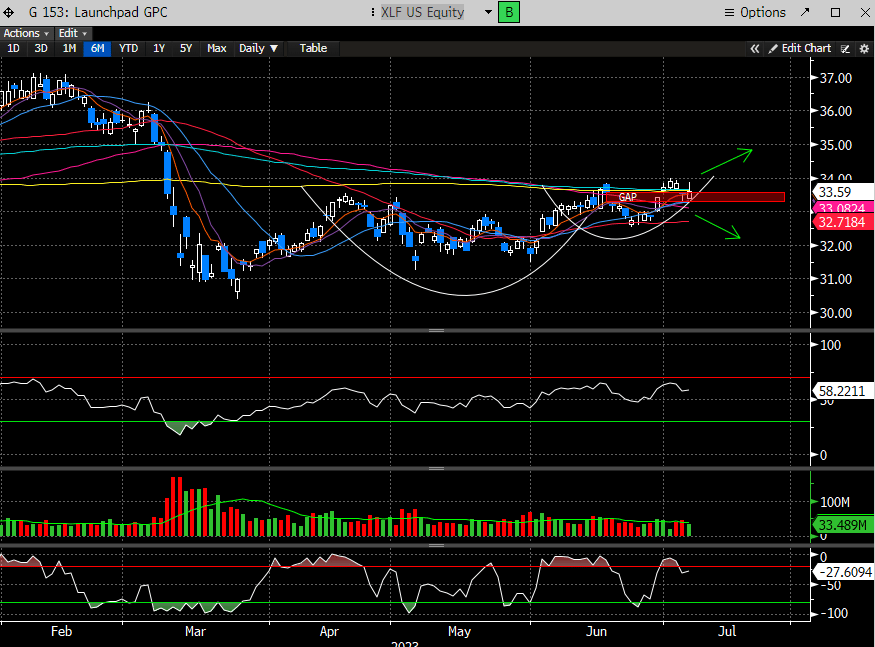

2nd Q earnings season will also kick off this week with the major banks. Using the ETF as a proxy (XLF), this looks like a large cup and handle. While tough for us to make a call on the Q’s, XLF is sitting in the gap down window and right under the 200 day. Early week action could send us a clue here as to how earnings season shaped up.

Despite all the macro cross currents that should create some voaltility, we know this week and the month of July are typically bullish. Currently the month is off to a slow start with all major indexes in the red.

We have referenced Wayne Whaley’s work in previous weeks which have proven quite prescient. This post suggests a rebound this week, especially for the Nasdaq. While we do not make decisions solely based on cycles, we certainly pay attention.

Last week in the market could very well have been the start of a topping process, if not an interim top. Our work is designed to identify possible turning points and look for confirmations. There are some very Clear and Present Dangers facing stock market bulls, and its our job to decipher when those will be expressed in the market, instead of shouting incessantly that the stock market has it wrong. Maybe it does, maybe it doesn’t, our goal is to profit either way.

For a more in-depth view of our stock market analysis, we encourage subscribing to our very reasonable premium content below ($24.95/month). We will be dissecting a new sector at the base of this report which should provide a number of positive trading/investing ideas over the short to intermediate term.