Did you buy the dip?

Last weekend, we were clear that the conditions were ripe for buying the dip in the stock market. Our approach is calculated and methodical; we don’t just make assumptions about market direction. We rely on top-tier indicators that excel at pinpointing extreme moments, allowing us to make probabilistic bets with confidence. We've always believed that identifying bottoms is easier than spotting tops. Bottoms tend to be events, while tops are more of a process.

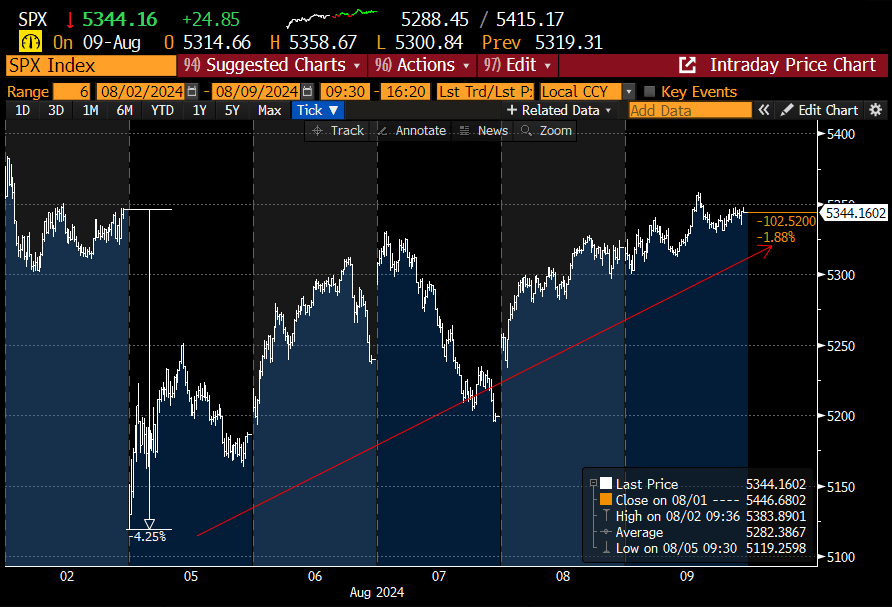

On Monday, the SPX nosedived after a severe overnight sell-off in the Japanese markets (-12.45%), marking the worst drop since the 1987 crash. The fragility of the U.S. markets was already evident, so a meltdown in the world’s third-largest economy sent everything spiraling. The SPX opened with a sharp decline of -4.25%, marking the low point for the week.

What a ride. By Friday, the SPX had rebounded and closed roughly flat.

A 4% swing in a major index is significant, and savvy managers and investors who were defensively positioned heading into Monday could have capitalized on substantial gains last week. Fortunately, our readers were well-prepared for the turbulence, as we've been advocating selling into the mid-July strength. As a result, our cash position was at its highest level of the year as we entered August.

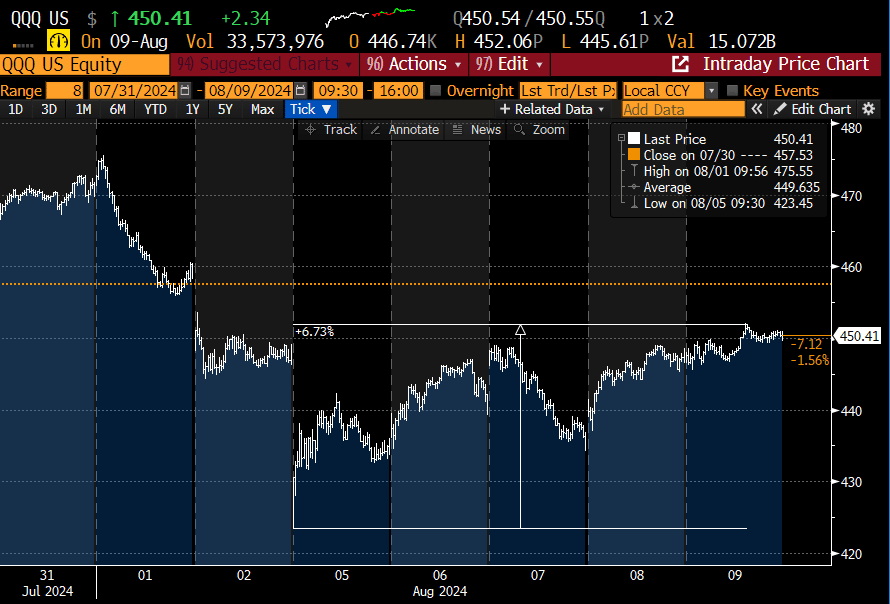

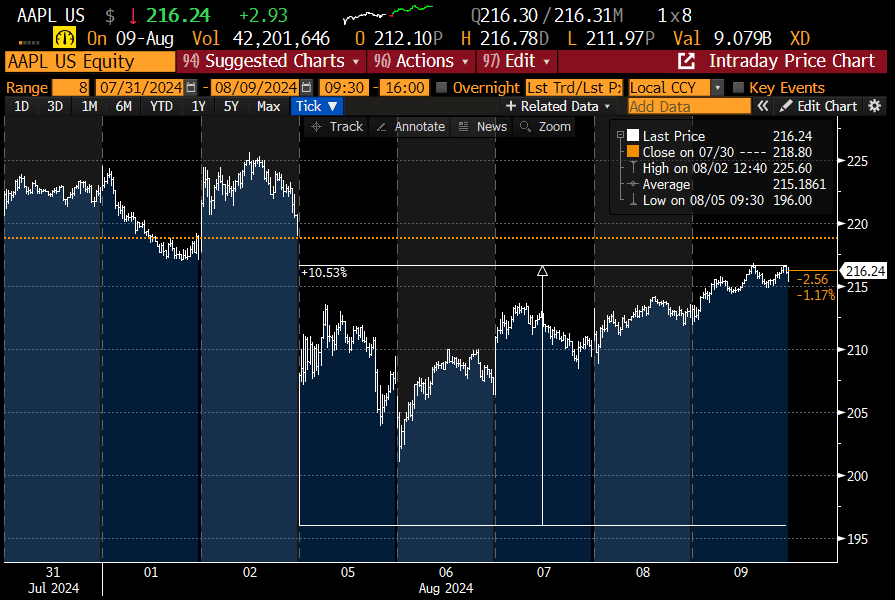

The previous bull market leaders have been among the hardest hit since mid-July, presenting a prime opportunity for those seeking to maximize gains.

Semiconductors (SOXX) were up almost 11% since Monday.

The Mag7 names were up over 9% since Monday’s low.

The Nasdaq 100 (QQQ) was up almost 7%.

Single stock ideas did even better.

NVDA was up almost 20% at its highest point.

AAPL was up 10.5%.

You might say we were lucky. We say we were prepared.

In our mid-week report, we noted that predicting short-term market direction based on a single day's trading is increasingly challenging in a high-volatility environment. Wednesday's market reversal was unsettling, but a surprisingly strong jobless claims report quickly shifted sentiment. Once again, good news is being received as good news. We're undoubtedly in a volatile period for investing and trading in the stock market. Jobless claims are inherently volatile on a week-to-week basis, and for the market to post one of its best days since November '22 underscores this reality. It's rare for a jobless claims report to trigger such a significant short-term move.

The major U.S. stock indices are now at a critical juncture where they could either turn down or push higher. The market never makes it easy, and with most earnings reports behind us, the indices may look to this week’s macro releases for direction.

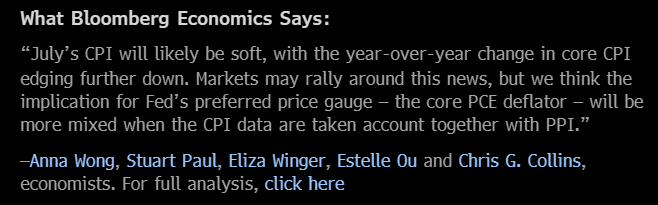

The upcoming CPI and PPI inflation readings are likely to provide the impetus to either break through resistance levels or reverse the current trend. U.S. inflation probably ticked up modestly in July, but we doubt it will be enough to derail the Fed’s intention to cut rates next month.

The expectation is for the CPI to have risen 0.2% from June for both the headline number and the core gauge. While this will appear as a reacceleration from June, it should still reflect a softening trend on an annual basis.

Couple this with the recent softening employment picture, and it should provide the Fed with enough ammunition to move forward with rate cuts. The PPI will be reported the day before and will provide additional clues for the PCE report, which is due in a few weeks.

Here is the Bloomberg Economist view:

Volatility, which saw some of the highest readings earlier in the week since the Covid crash, should remain elevated. According to Citigroup, options markets are pricing for the SPX to move 1.2% in either direction on Wednesday when the CPI is released. This is also in line with the implied move for August 23rd, when Powell is expected to deliver remarks at the annual Jackson Hole Economic Symposium. And contracts for crash protection are some of the highest since last October.

The Fed Fund Futures are still discounting 100% of a 25-bps cut and 50% for another 25-bps. On Monday, the futures market was discounting a 100% chance of a second cut at the September meeting.

This reversion is bullish for risk markets since the prevailing notion that started the August swoon suggested a Fed that was behind the curve and needed to cut more aggressively. That rhetoric has somewhat died down, with 50% of that probability being washed away this week. This implies the SPX is currently at the right level and below where it was before the softer ISM/employment report drove the market lower on August 1st. Should the CPI deliver a report that keeps things status quo, the SPX should push higher into the 5400-5500 range, erasing most of the recent decline.

The 2/10 treasury curve has been approaching neutrality this past week before the late-week reversal.

This creates angst amongst market participants since it occurred before the previous four recessions. While this needs to be considered a recession signal, the belief is that all the distortion created by quantitative easing muted the impact of an inverted yield curve.

At the very least, we should be prepared for some wild swings for the remainder of August. Heavy vacation schedules and lighter volumes position algorithmic trading as the primary price driver, implying that volatility should be that much more pronounced.