The stock market drawdown of the last couple of weeks was something we explicitly wrote about leading up to the end of July. We were selling most of our long trading exposure and preparing for a choppy period ahead.

Here is an excerpt from our conclusion section of our report from 7/30.

Since the end of July, the stock market indexes are down -2% to -5%, while energy is outperforming.

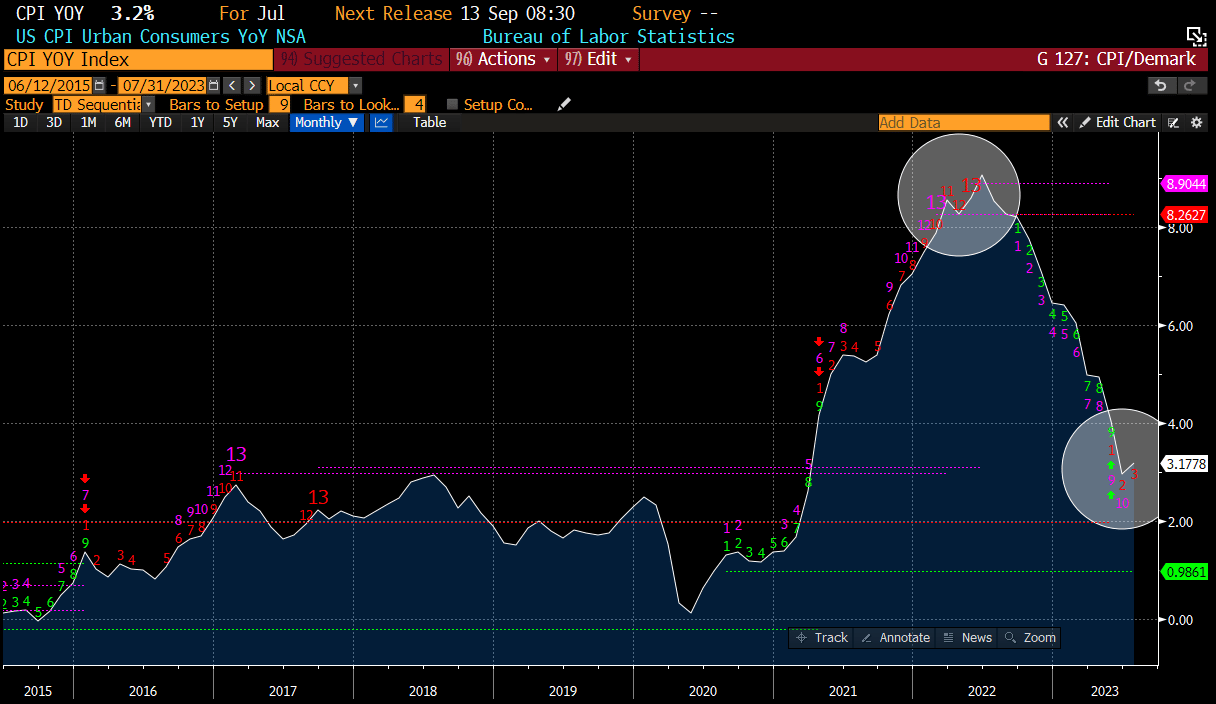

Last week’s report we discussed the notion that inflation could start to see a reversal in the next couple of months. We use DeMark signals to help determine inflections in most instruments. Low and behold, the reported CPI last week actually ticked up. The easy money has been made on the disinflation trade as supply chains start to normalize, but at current levels, further meaningful disintegration is likely going to require wages and payrolls to revert, which they haven’t.

PPI also saw an uptick on Friday. This is to be expected as the PPI is quite sensitive to changes in energy prices which have been on the rise.

These mild upticks in inflation are not yet overly concerning, as the fed is unlikely to move considerably from their pause narrative. Fed Fund Futures are still pricing in a relatively low probability of another hike.

But future inflation readings still have the potential to murky the water for the bullish trade, and something that should be a growing concern.

Currently a new crop of worries is surfacing within the bond market. Longer term yields are starting to break out as the bond market is waking up to the reality of re-accelerating growth. When LT yields rise faster than short term, this is referred to as a bear-steepener. Typically, this implies higher future growth for the economy and could be a good thing, but the move could also be a function of poor demand for the treasury auctions as investors are demanding more yield for the long-term risk. Effectively this drops bond prices in the long end of the curve and raises yields. Bear-steepeners occur only 10% of the time, according to Ned Davis Research. This is a relatively rare and unstable condition, especially when late in the cycle. The implication is that rates may end up higher down the road as growth re-accelerates. It also implies that the Fed has not over-tightened. While this sounds a bit concerning, the reality is it’s bullish for the stock market historically. Per Ned Davis, the SPX climbs +9.5% a year during bear-steepeners.

The counter to this argument is that the steepener is more a function of the overwhelmingly large supply of bond issuance, which means a credit event could be looming. At this point it’s impossible to know, but as we always discuss in our reports, any sort of dislocation in the largest instruments in the world (i.e. treasuries or the $USD), have the ability to cause major dislocations in the risk markets.

No doubt the poor treasury auction from last week took the SPX down post the premature celebration of the somewhat benign CPI report and adds a new layer of complexity to deciding stock market direction. This is occurring in the weak seasonality window to boot.

The Fed is slated to meet at the yearly Jackson Hole composium at the end of the month, which historically has the ability to cause fireworks. That said, we haven’t seen enough new information for the Fed to get derailed from their current data dependent stance.

This week is also OPEX and usually associated with increased volatility.

We see a potential short-term trade in the market indexes but remain somewhat vigilant to the growing risks of the bond market action.

Let’s review.