It's been a tough stretch for the relentlessly bearish stock market pundits who have been predicting a wipeout since the October 2022 lows. As the market continues to climb, their doomsday scenarios have been proven wrong time and again. Yet, rather than admitting they missed the mark, they simply shift their reasoning for why a collapse is still inevitable. This approach seems intellectually dishonest. Their latest narrative had the makings of a macroeconomic storm that could severely undermine any bullish outlook. With slowing macro indicators as the appetizer and the Japanese market crash and Yen carry trade unwind as the main course, the bears were poised to feast as the SPX plunged another 4% on August 6th.

However, August 6th marked the ultimate low for the major indexes, which have since rebounded by 8.6% (SPX) and 12.5% (Nasdaq) in just ten trading days. If you weren't aggressively opportunistic, the market has left little room to join the rally.

Fortunately, we were advocating for buying the dip that Monday—a calculated and probabilistic bet grounded in our analysis.

Fast forward two weeks after a blistering rally, and the macroeconomic concerns from early August now feel like a distant memory. The latest inflation data (CPI/PPI) indicates that the trend remains favorable for a Fed rate cut, and Friday's retail sales report suggests that consumers are holding up well, albeit with a more selective approach to spending. This hardly points to an economy teetering on the brink of collapse.

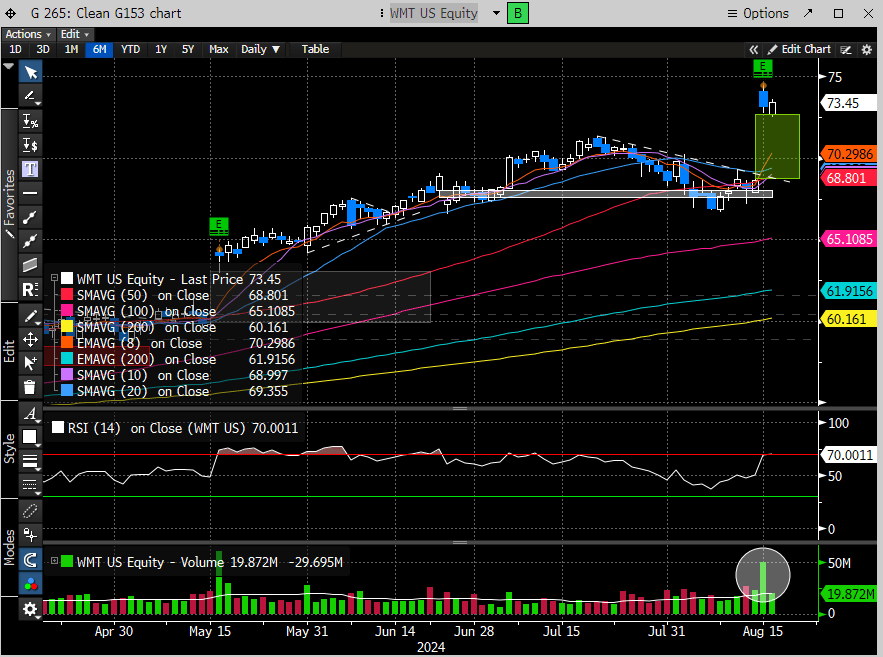

Adding to the positive sentiment, Walmart's strong earnings report highlighted that consumers are still spending, and AI-driven enhancements are boosting both customer buying productivity and company efficiency. Suddenly, the "hard landing" narrative has done a complete 180.

WMT stock had a good day as a result, printing a new ATH. It’s not something you usually would see if there was concern over a recession brewing.

We have often written that the stock market is hanging on to every macro release and whipsawing traders if it supports the hard or soft-landing narrative. Tactically, this is a very tough environment since macro-releases are published almost daily.

This past week saw an additional follow-through day (FTD) on Thursday after the retail sales release. In our last report, we discussed the FTD on Tuesday and its importance to defining bottoms in the stock market. Two FTD’s in the same week is quite a powerful construction change and certainly makes a statement for those bears still hanging on to their Armageddon scenario.

This week is the occasional momentous Jackson Hole Fed confab. Historically, these meetings haven’t meant much, but they tend to be quite volatile when they occur near a shift in interest rate policy. The average performance of the SPX following the meeting (since 2000) is .4%.

Option traders are pricing in a swing of 1% on Friday (when Powell is slated to speak). While Fed Fund Futures are still pricing in over 100% chance of 25 bps cut in September, any volatility around that path will likely be met with some dislocation.

All this positive macro news has now caused Goldman Sachs to lower their US recession risk next year from 25% to 20%. How accurate their assessments of economic risk are is up for debate, but directionally, it’s an important change, and the stock market is in agreement after posting its best week of the year.

As tactical analysts, we follow price first, and price is telling us to ignore the bearish rhetoric. Maybe you should too.