The dog days of summer are upon us, which typically means to expect much lighter volumes and potentially higher volatility over the next couple of weeks. For that reason, we will keep this week’s report lighter than usual, as the true direction of the stock market may not reveal itself until after Labor Day, thus we are likely facing a week or 2 of frustrating chop.

Since the end of July, certain areas of the stock market have taken quite a beating. $ARKK which, is a good proxy for high beta growth, is down -22%. Thats quite the move but interesting how it found support at the 200 day with volume.

The Hang Seng Index is down -12% during that time frame.

The Russell 2000 is down -8.5%, which also found support on Friday at the 200 day MA, with volume.

We posted this on our public twitter handle as we thought Friday would see a gap down in the $IWM (Russell ETF) to go green. This proved to be correct has been a nice trade.

The FFTY (IBD 50 which tracks high growth stocks) is down -16.50%.

The bottom line is that these are fairly aggressive moves, and usually not what you would see in a healthy uptrend. This begs the question, was the Jan - July index move nothing more than a massive bear market rally? At this point it’s too difficult to make that determination. The current cross currents facing the market are quite unique, with treasury rates closing in on decade highs, and a Fed seemingly unwilling to bend on their inflation narrative. Couple this with increasing energy prices and a China Economy that is falling off a cliff, and the recipe for slower macro data in the ensuing months is significant.

We wrote in July that the easy money in the market has been made and the next 6 months will be more difficult. Thats because the market was pricing in a recession that never came last year, and the 1H of ‘23 was, more about repricing a “no imminent recession” scenario. To put this in context, investors entered the year thinking SPX earnings were going to come in around $190-$195 per share. In actuality, the results are looking closer to $220. Thats quite the delta and why the stock market is up considerably since Jan. The bigger question is, why are estimates now pricing in 20% growth next year with the current estimates for ‘24 @ $246? This seems a bit misplaced when considering some of the cross currents listed above.

We much prefer when the set up to get long is easier, but this set up is quite the contrary. In fact, it seems like the market may be stuck for a bit until we get clarity on further policy direction, the corporate earnings trajectory, and whether the PBOC is going to inject enough liquidity to rescue the Chinese economy.

This week we have 2 major events: one being $NVDA earnings and the other being the Fed Jackson Hole event. One company’s earnings do not usually have the sway to move markets considerably, but given they are at the center of the AI craze, we think their outlook is very important to the tech tape.

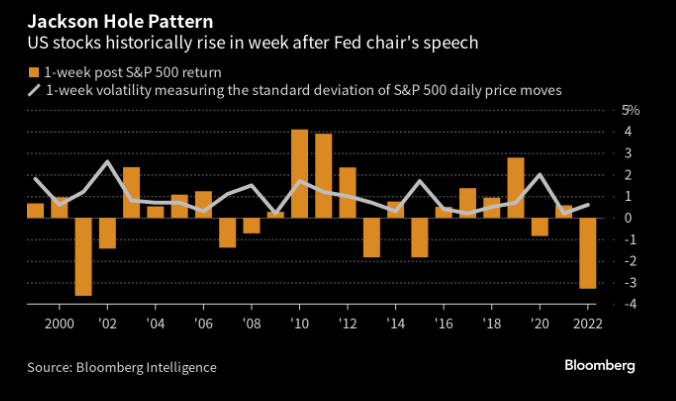

Powell will give his address on Friday. Typically, his speech has the potential to move markets. Usually it’s helped markets, with the SPX gaining .4% on average in the following week. But last Aug was a different story, where his commentary sunk the SPX -3.2% as he warned of restrictive policy to combat inflation.

While we have no real opinion on what he will say, we do think he will stick with his data dependence narrative and may even come across a bit dovish, given the complications coming out of the Chinese economy, and some evidence of slowing growth at home, despite recent robust retail sales data. Regardless, status quo should be perceived bullishly.

There are 3 more policy setting meetings left in ‘23, and none of them are being forecast to increase rates at this time. The Nov meeting has the highest probability of an additional cut with a 36% chance. May now has a 95% chance of a cut. Any material movement here post the Jackson Hole event does have the power to move markets.

On Friday we suggested a possible counter trend trade in the $IWM’s (see above). Should we expect multi-day upside or was Friday’s reversal a head fake?