In last weekend’s report, we emphasized the significance of follow-through days (FTDs), noting the improvement in market breadth and the positive divergence in the advance/decline line, which reached new all-time highs even as the indexes remained below their peaks. We also highlighted the critical importance of gaps over major resistance levels. These aren’t minor technical adjustments—they’re crucial shifts in market structure that demand attention.

As technical analysts, we strictly follow the discipline of listening to the market. We don’t argue with price just because it might contradict our fundamental views. That’s the beauty of technical analysis—it’s often clear-cut and straightforward, leaving little room for debate when significant structural changes are unfolding in the market.

We compare these structural shifts to the conviction a fundamental analyst or portfolio manager might have in their investment thesis. When market structure changes occur in clusters, it strengthens our confidence that the market is primed for a directional move.

Since last weekend, the major indexes have added another 1.3%, with the SPX up 10% since the August 5 low, where we recommended buying the dip in this publication.

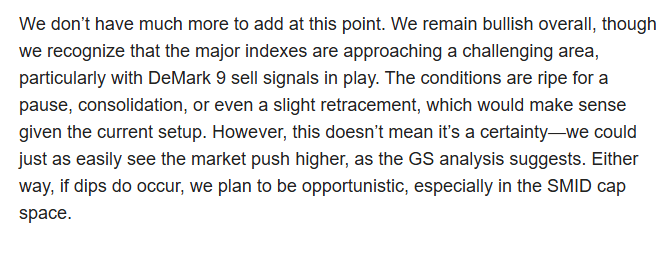

In our mid-week report, we noted that the major indexes would likely encounter sellers at current levels, making a mild retracement or pause probable.

Here is an excerpt from that report:

“We remain bullish overall, though we recognize that the major indexes are approaching a challenging area, particularly with DeMark 9 sell signals in play. The conditions are ripe for a pause, consolidation, or even a slight retracement, which would make sense given the current setup…if dips do occur, we plan to be opportunistic, especially in the SMID cap space.

The SPX failed on Thursday, right in the zone we specified as resistance.

Here is the excerpt from our Wednesday report:

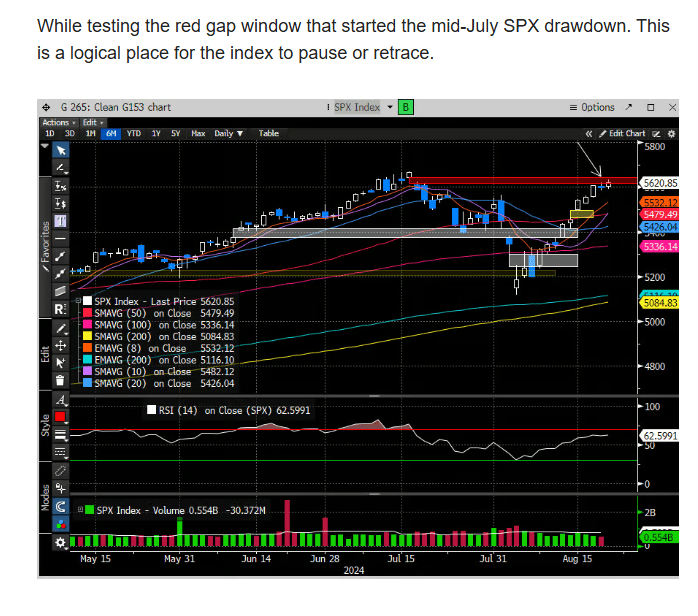

The Nasdaq also failed in the zone we detailed:

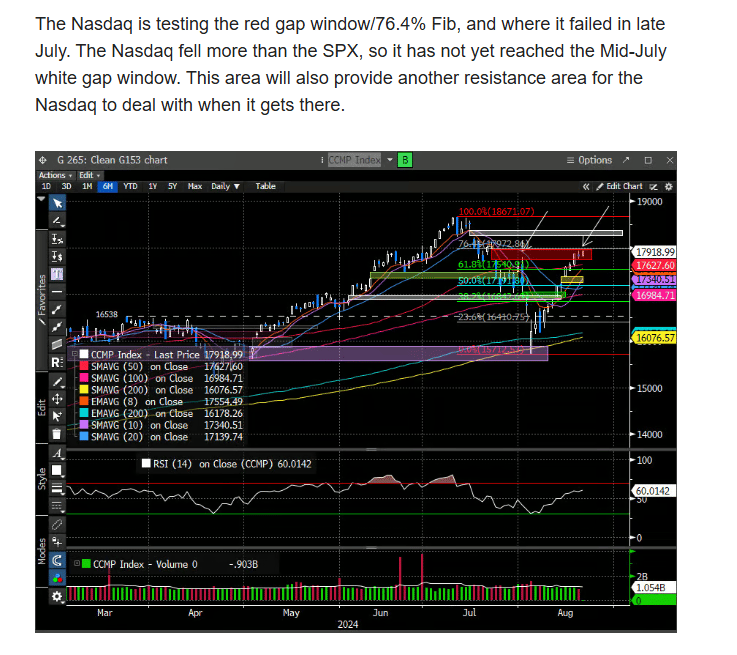

Both indexes dropped over 1% on Thursday, forming bearish engulfing candles. However, we anticipated that the Russell Small Cap (RTY) could outshine the large-cap indexes if Powell struck a positive tone during his Jackson Hole speech. Sure enough, the RTY surged over 3% on Friday.

Here is that excerpt:

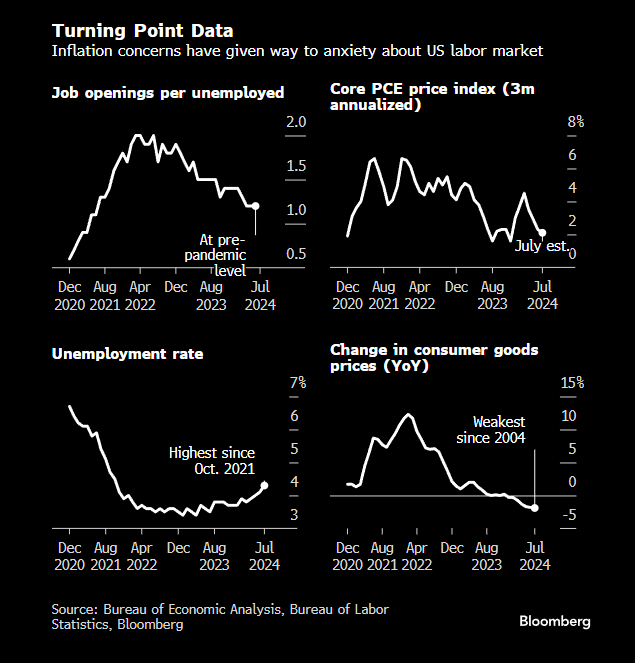

Powell’s speech today was the final boost for the bulls. He emphasized the Fed's commitment to supporting steady economic growth, reaffirming the anticipated rate cuts starting in September. What stood out, however, was his focus on preventing further cooling in the labor market and his willingness to consider accelerating cuts if the data warrants it.

This implies that inflation is on the back burner, and the jobs data will now take center stage.

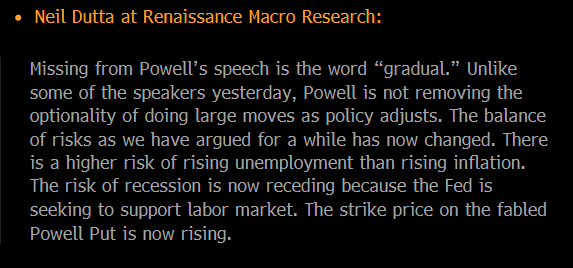

The key takeaway from this meeting is that the Fed is now backing the economy. For the past two years, they’ve been relentlessly battling inflation, intentionally slowing the economy with higher rates. But now, the Fed is no longer the stock market’s adversary. Early in our careers, we learned a crucial lesson from Marty Zweig: "Don’t fight the Fed." That advice is more relevant now than ever.

Neil Dutta at RenRac seems to agree:

This week we will get the all-important NVDA report. NVDA certainly has the power to pull-in the market’s enthusiasm should it disappoint. The PCE will also be reported on August 30th, but as mentioned above, we think the payroll report the following week holds more clout.