There was no shortage of confusion and frustration this week for us as the stock market week began as we suspected, powering higher into the NVDA report. We were appropriately positioned for that move and prepared to sell into the post NVDA rally but alogos and “sell the rip” traders were eager to spoil that party.

As soon as the cash market opened on Thursday morning, the sellers showed up in full force. We wrote in our mid-week report that the SOX Index (semis) would undoubtedly eclipse the 50 day and do wonders to heal some of the tech wounds inflicted in Aug. That lasted for all but a few minutes before sellers took the opportunity to distribute shares. Distribution days are typically where institutions use the market strength to reduce risk. They are defined when indexes fall .2% or more on higher volume then the previous day.

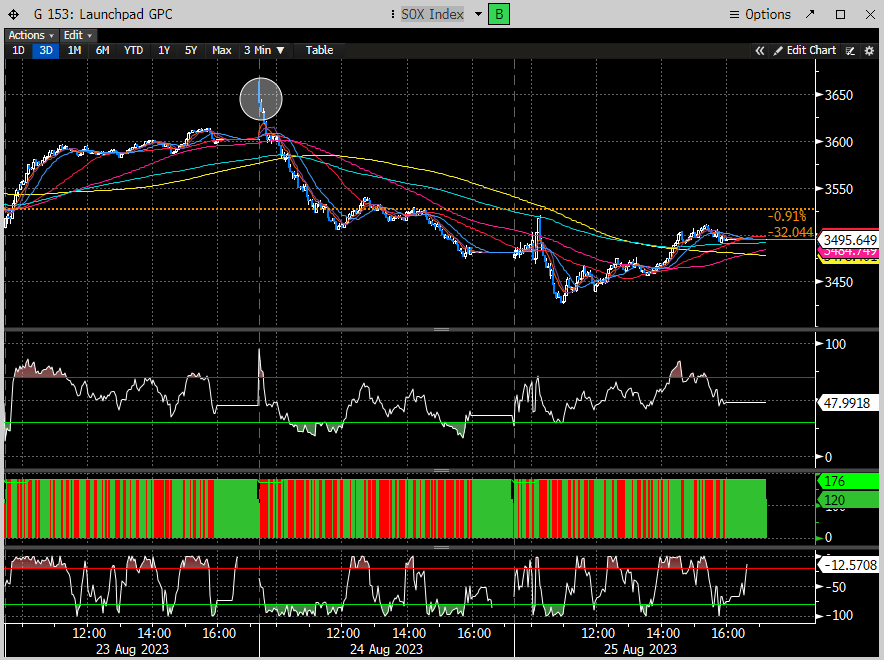

Here is the 3 day chart of the SOX exhibiting the selling pressure that came into the market right at the open.

And the daily candle for the SOX shows a clear failure of the 50 day MA (red) on significantly higher volume.

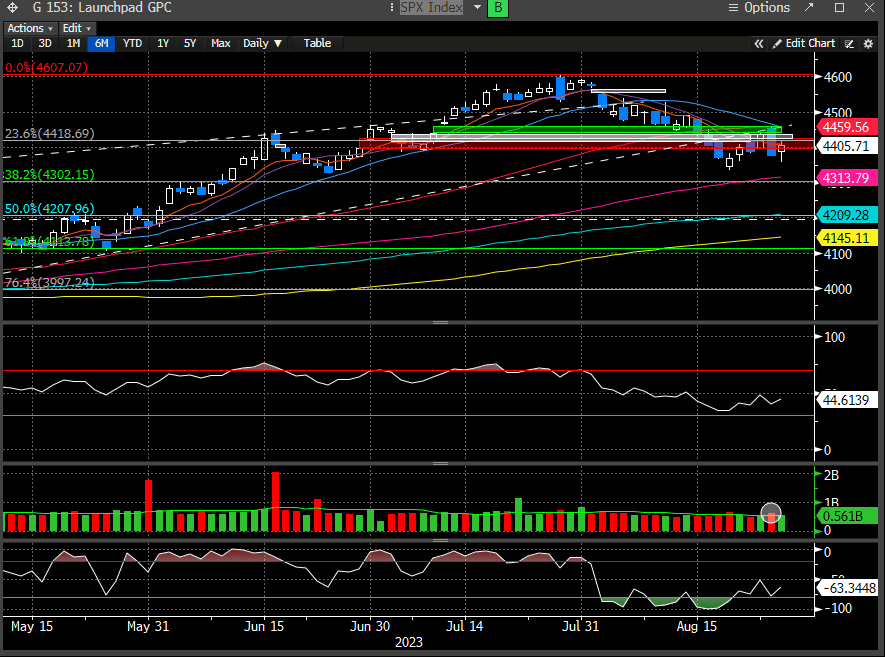

The SPX and the Nasdaq were similar. The SPX failed to reclaim the DTL and failed in the gap window resistance levels we have been writing about.

The Nasdaq also failed to reclaim the gap window and the 50 day.

While the bears were reveling in their victory on Thursday, a more hawkish Powell on Friday still couldn’t deliver the wipeout the bears were clamoring for. We admit, we were concerned that Friday had the recipe in place for a larger down move. Alas, the market confounded the bears and took back some of the weakness back from the previous day.

And just like that for the indexes, a potentially disastrous week for the bulls, actually ended positive for the week, and was the first up week in 3 for the SPX and Nasdaq.

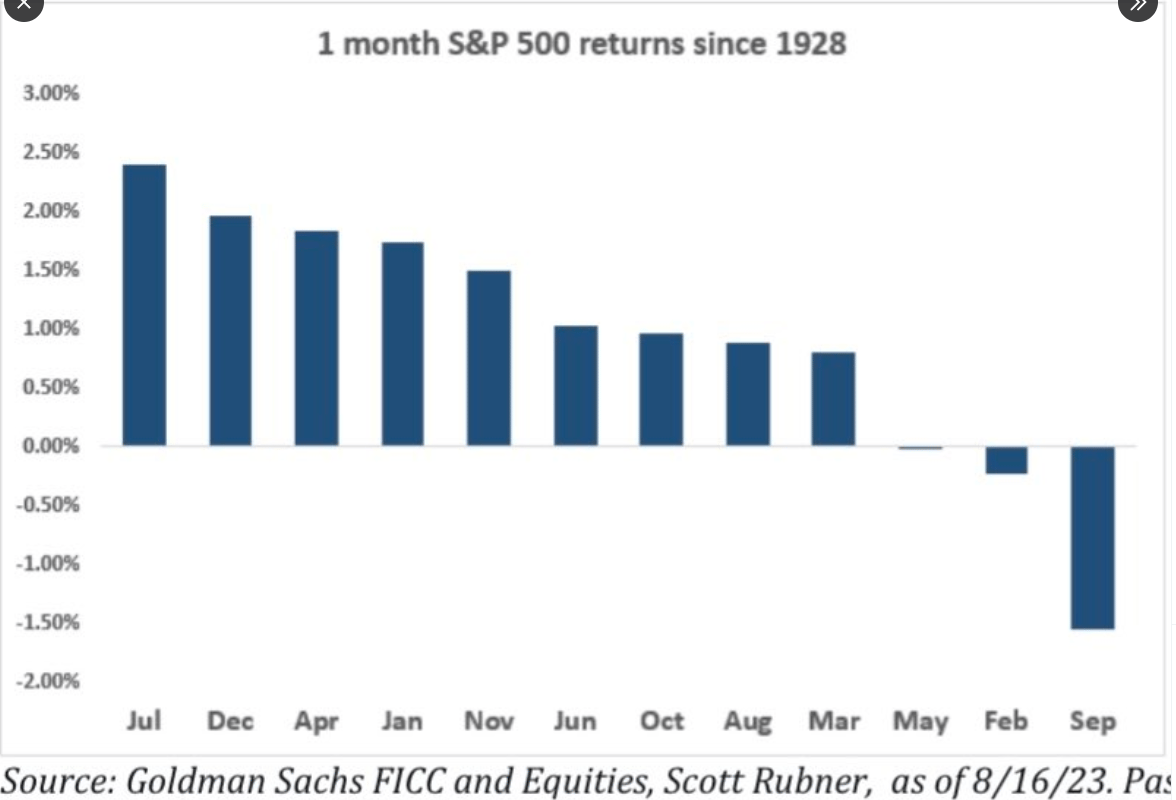

We know that Aug is a notoriously difficult month in the stock market and this month has certainly lived up to that hype.

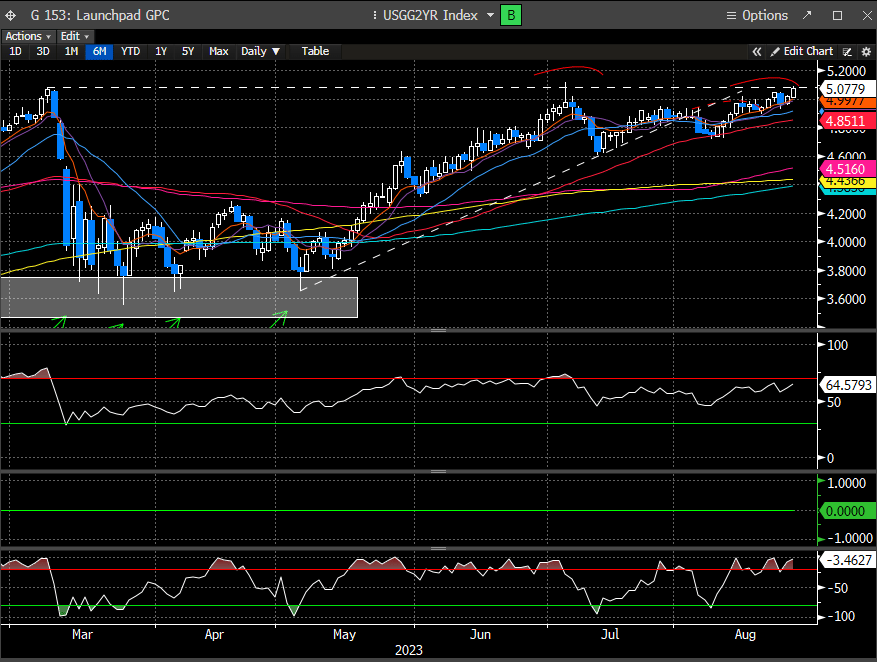

We always find it interesting that Aug tends to bring an unusual amount of Global macro issues to contend with, which undoubtedly has caused chaos in the FX markets. FX market dislocation, much like treasuries, has the ability to wreak havoc on risk assets. Last week’s Jackson Hole symposium signaled that US and European policy makes are sticking with their higher for longer narrative. This pushed yields on 2 year paper to 5.09%, while the real yield on 5-year notes surged to its highest level since ‘08.

The 2 year remains in breakout formation, now testing the top of the range since March of last year.

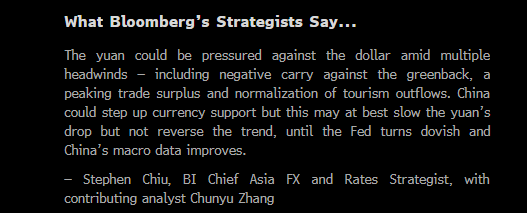

The Japanese Yen also broke to year-to-date lows, renewing concerns over potential FX intervention. The Chinese have already stepped in to prop up their currencies this month. Asia Currencies have dropped -2% this month vs. the $USD, with the Yuan the weakest in 9 months.

The Macro data in China continues to soften and the calls for more stimulus so far have gone unanswered. Here is the Bloomberg’s economist view of the Yuan.

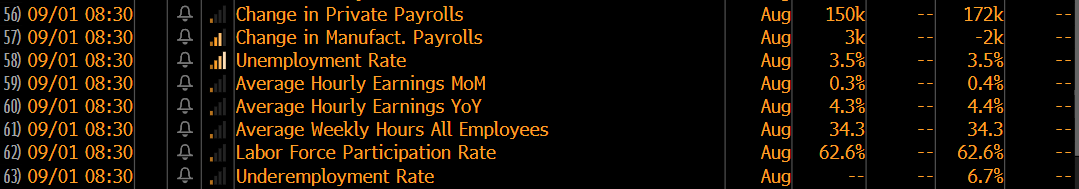

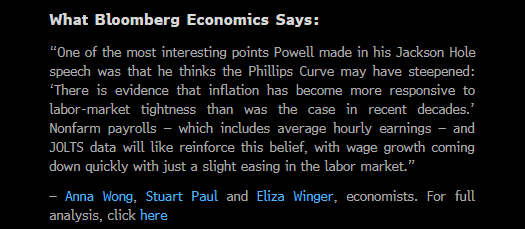

The next big piece of US macro data that can move the treasury curve and possibly get the Fed to drop their hawkish rhetoric, is the upcoming employment report for Friday.

The employment trajectory is undoubtedly cooling. Fed policy does have a significant lag effect and a weaker than expected number, could push the Fed to adopt a more wait and see approach.

This is evidenced by Powell’s commentary at Jackson Hole, discussing the sensitivity of inflation to employment trends.

Needless to say, this week should stay volatile and confusing. As much as Aug is a tricky month for investing/trading, Sept is typically the worst month of the year in terms of performance.

Next week is also a big vacation week and we expect very light volumes and higher than normal market swings due to the low liquidity. This implies to stay light and nimble as September could be full of fireworks.