The stock market giveth, and the stock market taketh away. What seemed like an uneventful FOMC meeting quickly turned into a major rout following a disappointing ISM report and a lower-than-expected payroll report. While we had been cautious since early July, we did not anticipate this downturn, expecting instead that the indexes would see more upside post-FOMC and Magnificent 7 earnings reports.

We have often suggested that the stock market might finally sell off upon realizing rate cuts were on the horizon. Recently, we highlighted the Yen carry trade dynamic as a potential warning sign. We've frequently stated that the Fed's restrictive rates were likely doing too much damage to the economy. However, these were merely opinions, and we rely on price confirmation before considering them anything more. In the world of systematic and algorithmic trading, warning signs can sometimes appear only after the fact.

Our recent tactical call was for a bounce into the FOMC meeting, which indeed occurred after our 7/24 report and reached the predefined levels we outlined in last weekend’s report. We suggested the market would need a positive catalyst to push higher, and we assumed the FOMC could be that catalyst.

However, the following day brought a dire ISM report, sparking recession fears that overshadowed all the positive news. This was compounded by a weak payroll report on Friday, an AMZN earnings miss, and a disastrous report from semiconductor bellwether INTC. The stock market, already fragile after already losing almost 6% since mid-July, was further destabilized, igniting a significant downturn.

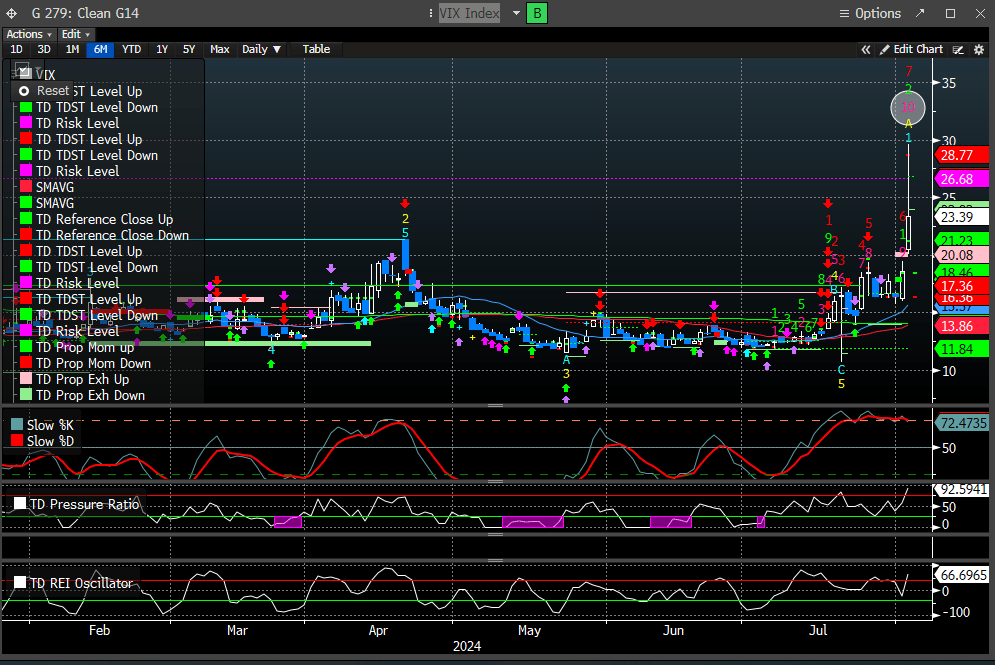

In the 2 days after the FOMC, the SPX lost almost 5%, peak to trough, and the fear gauge (VIX) catapulted 85%. That is the highest VIX reading since March ‘23 when the SVB debacle first surfaced.

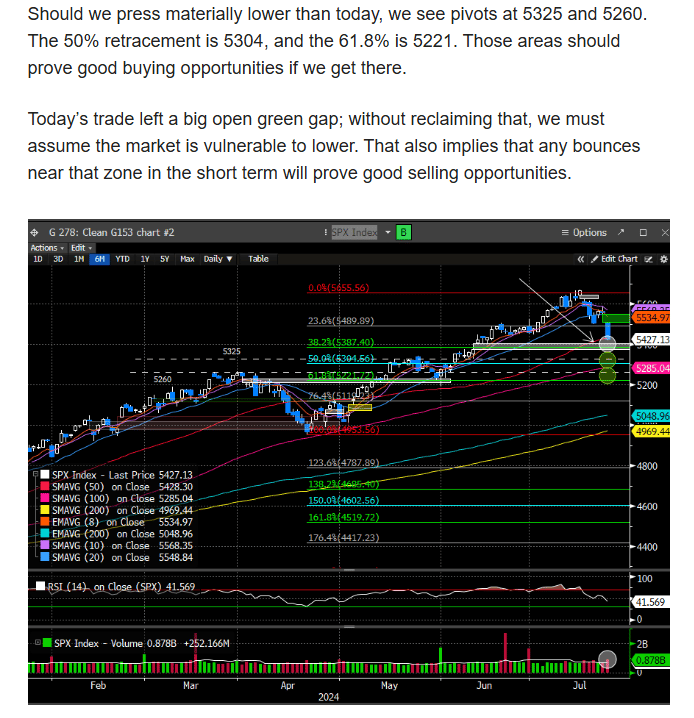

Our 7/24 report highlighted levels where we thought the SPX would find support in a drawdown scenario. Here is that excerpt:

The SPX traded into the green gap window and reversed, closing on Friday at 5346 after reaching a low of 5302, forming a hammer reversal candle. This implies that buyers showed up at that key zone. Confirmation of a relevant pivot zone occurs when the volume is elevated and closes off the lows; volume did see expansion from the prior day.

This doesn’t mean the lows are in, but it does imply that buyers stepped up at an important juncture, and we think that means something.

We are not economists, so we will not opine on the intricacies of the ISM or the payroll report, but the significant slowing did send the bond market screaming. We have been advocating that bond yields had peaked for months, and with last week’s action, we can put a pin in that prediction. The issue with the aggressive move in bonds last week is that big dislocations in prominent instruments cause disequilibrium in the balance of the markets. Those dislocations undoubtedly bring increased volatility into risk assets. The Fed Fund Futures market predicts a 76% chance of a 50 bps cut in September and a 100% chance of four cuts by December.

The specter of accelerated rate cuts is sparking fears that the Fed is behind the curve and that the economy is slowing too rapidly. This is evidenced by a 2/10 treasury yield curve approaching neutrality, which historically has been a reliable recession indicator.

While it is too early to make a determination whether the economy is headed for a hard landing, or just a step down in growth, the uncertainty injects volatility. Couple this with a topsy-turvy US election race and renewed flare-ups in the Middle East, and the cocktail for further volatility into August has been poured. Higher volatility regimes can be difficult to trade and are typically better suited to avoid, letting the dust settle before deploying capital.

That doesn’t mean there aren’t opportunities to add alpha at the extremes. Volatility can be hugely profitable if not overly exposed to one side and can be tactical with capital deployment. Let’s dig in.

Index Analysis

The SPX is now down over 6% since the peak in mid-July. The bounce into the FOMC was on schedule, and the failure occurred at the 20-day SMA/green gap window. Our prediction was for this to push higher, which was incorrect, as the macro trumped our opinion. This leaves the index in a very precarious position. The SPX gapped through the previous white gap window. Gaps through gaps, are never a good signal. Unless this is overcome quickly, we think this will be formidable resistance and cap any rally attempt. While buyers did show up on Friday at the pivot area detailed in previous reports, the technical damage to the indexes is real. It typically requires time or a catalyst to overcome. This would imply that attempts to clear the 5380-5450 range will likely fail, at least initially.

Something else to note is that markets typically do not bottom on a Friday. This means early week weakness can ensue, and we would defer to our lower SPX targets for support. This range of support is 5200-5277. This incorporates the bottom of the yellow gap window from March, DeMark Trendfactor levels, the 61.8% Fib retracement level, and the 5260 pivot. We prefer confluence when attempting to target trend termination levels, and there is quite a bit present.

The DeMark Trendfactor levels are illustrated below (5277 and 5203):

Friday also found support at the lower Bollinger Band (BB). While this can push lower, this indicates the stretched nature of the recent downtrend and typically argues for a snapback, especially if we see an early week move lower.

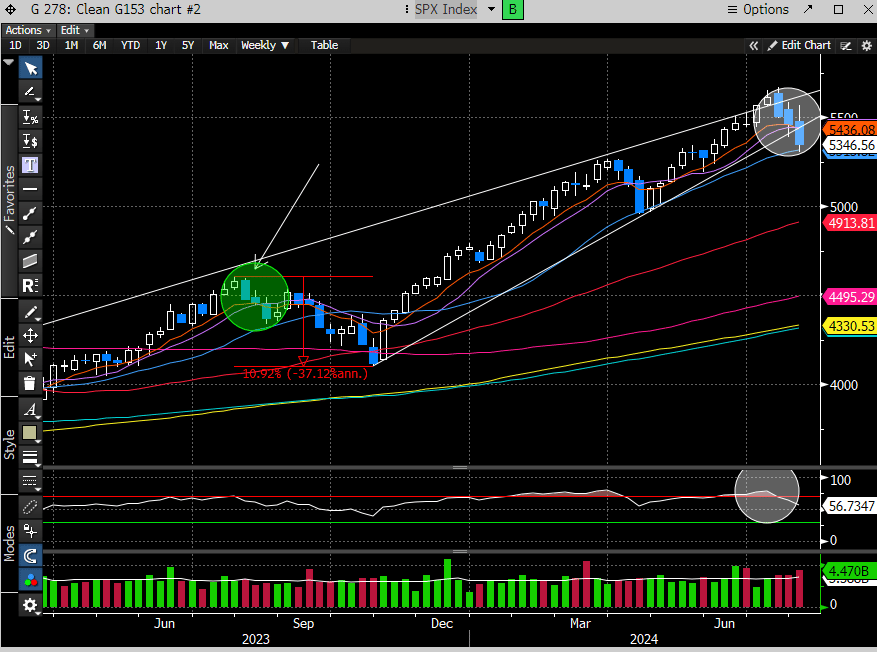

The weekly SPX chart illustrates a Three Black Crows reversal pattern, which also lost the lower bound of the rising wedge. The last time the SPX exhibited a similar pattern was in early August 2023, which rebounded sharply for two weeks and resumed the downtrend into October, ultimately losing almost 11%. It’s certainly possible that a similar scenario plays out as we head into the notoriously tricky pre-election months of September and October.

If we apply a Fib retracement from the October lows, the SPX found support on

Friday, right at the 23.6% Fib level (5300). It would make sense for the index to find some relief here as bulls defend an important level.

There is additional confluence to this level as it also represents the 138.2% extension (5325) from the Covid Crash low.

We think there is enough confluence to argue for support to come into play and a relief bounce to occur. We would caution that the upside for any reversal is likely limited to the range we cited above in the absence of a catalyst.

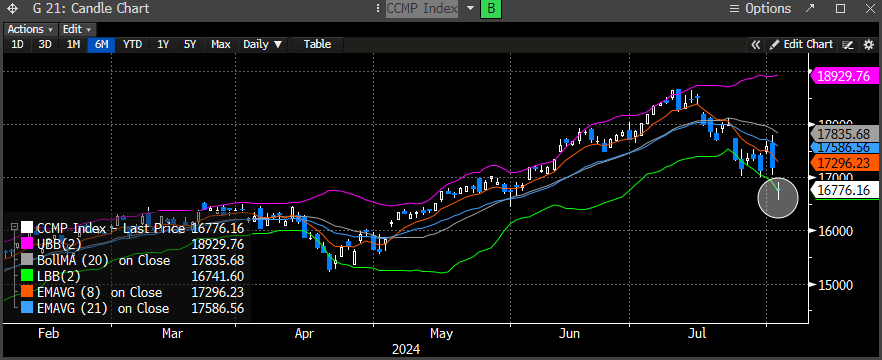

The Nasdaq has a similar Three Black Crows reversal pattern but is still at the bottom of its rising wedge formation. The previous ATH pivot from 2021 is not too far away and should be formidable support if we get there (16100).

If we apply a Fib retracement from the November ‘23 lows, the 38.2% Fib level (16340) proved a formidable area to eclipse during the March-May time frame. We sense that any push to test these levels will be defended.

The Nasdaq found support on Friday at the March high pivot/61.8% fib level on the daily chart. Friday’s candle was also a Doji and represents equilibrium, which can be found at the end of a trend; this occurred with volume. This increases the probability that a counter-trend bounce can occur in the near term. We think any bounce will find initial resistance in the 16900 - 17300 range.

Friday’s weakness also touched the bottom of the lower BB and another reason to expect a counter-trend bounce.

Applying a fib retracement to the October ‘22 low, the 23.6% retracement level is at 16645, and in the vicinity of Friday’s low, offering more confluence for a counter-trend move.

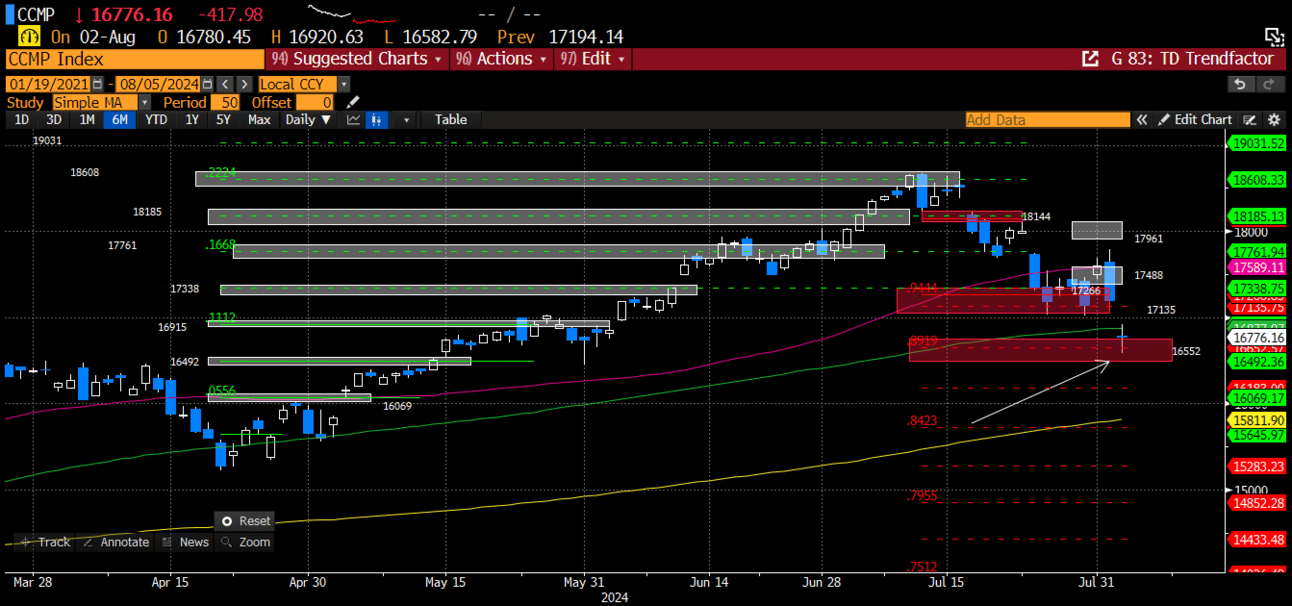

If you recall, one of the DeMark Trendfactor levels that we illustrated a few weeks ago was tagged on Friday (16552). This offers more confluence for a bounce.

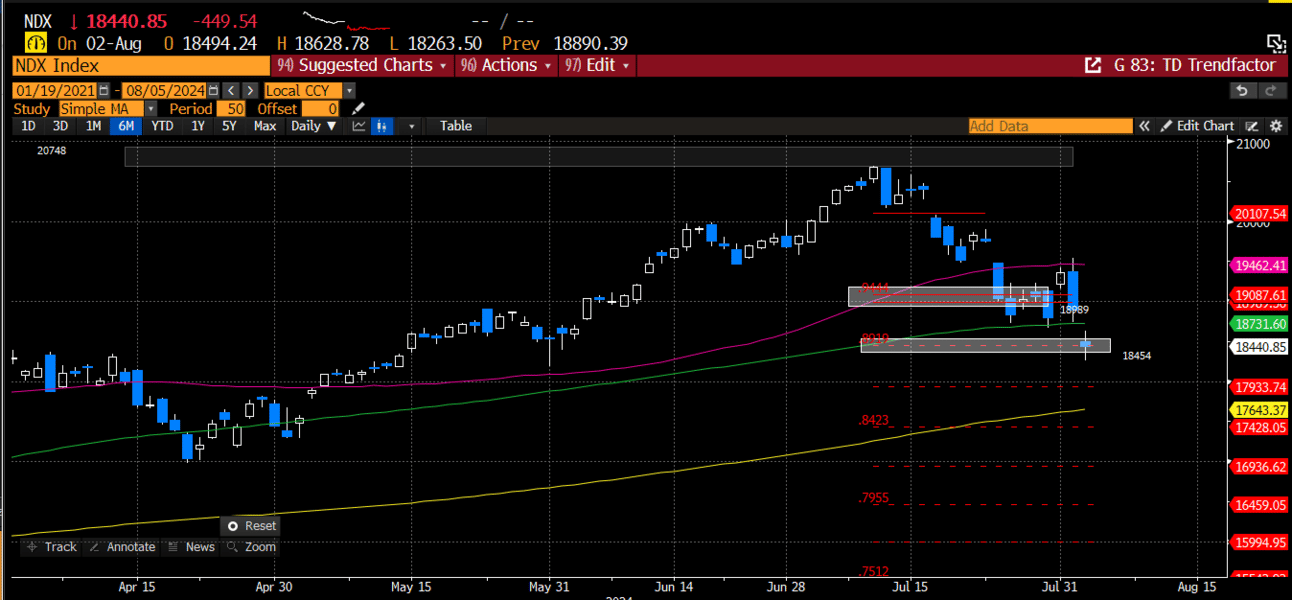

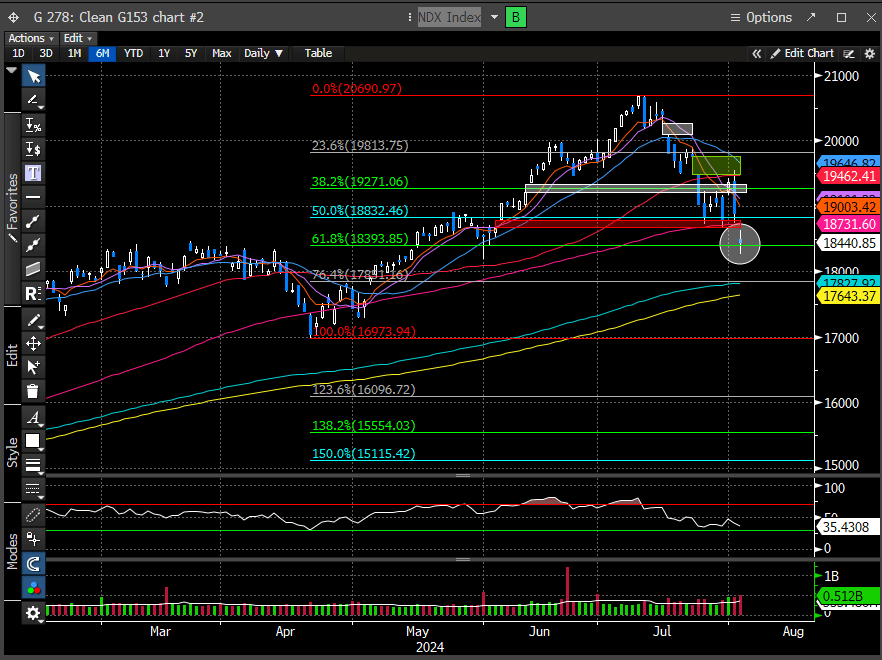

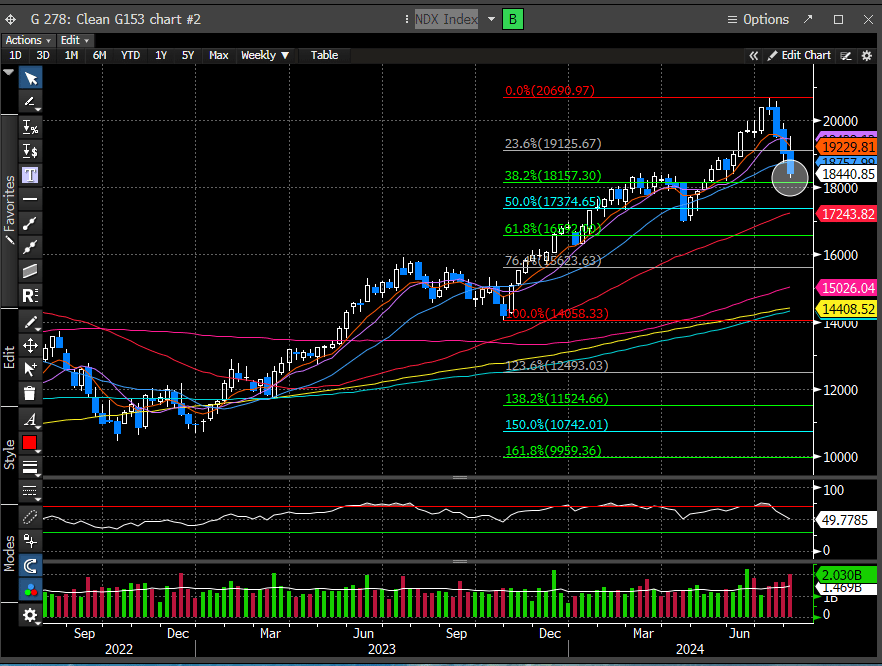

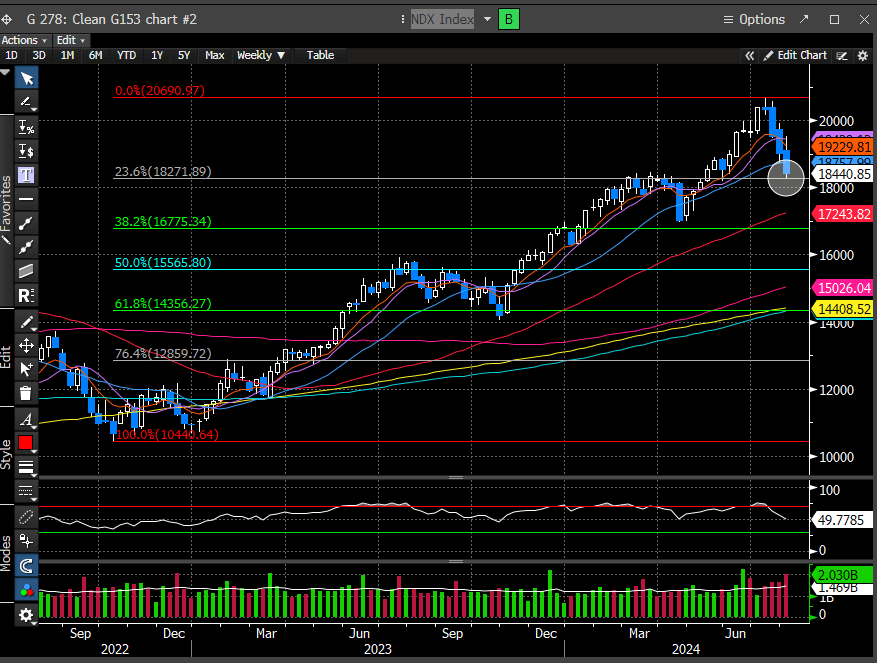

The Nasdaq 100 (NDX) also found support at its DeMark Trendfactor level of 18454.

Which happens to coincide with the 61.8% Fib retracement level from the April low.

There is additional confluence with the weekly 38.2% Fib retracement level (18157) using the October ‘23 low.

If we use the October ‘22 low, the 23.6% Fib level is at 18271, which lines up with the March ‘24 breakout pivot. The bottom line is there is significant confluence present in this area to support a counter-trend bounce.

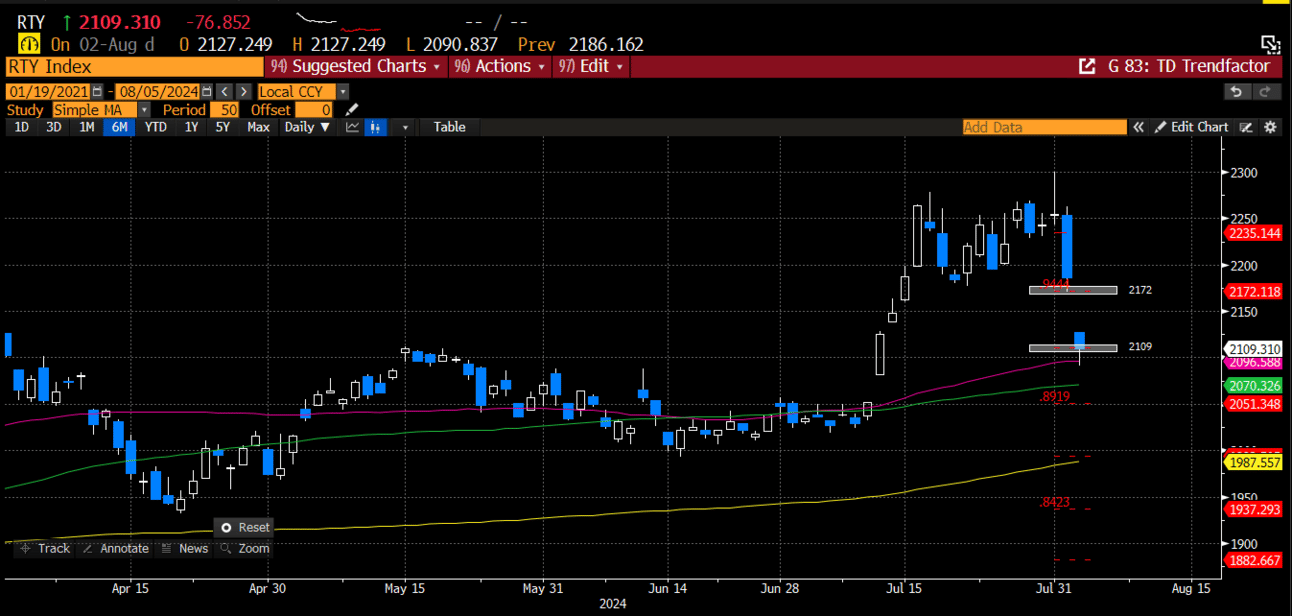

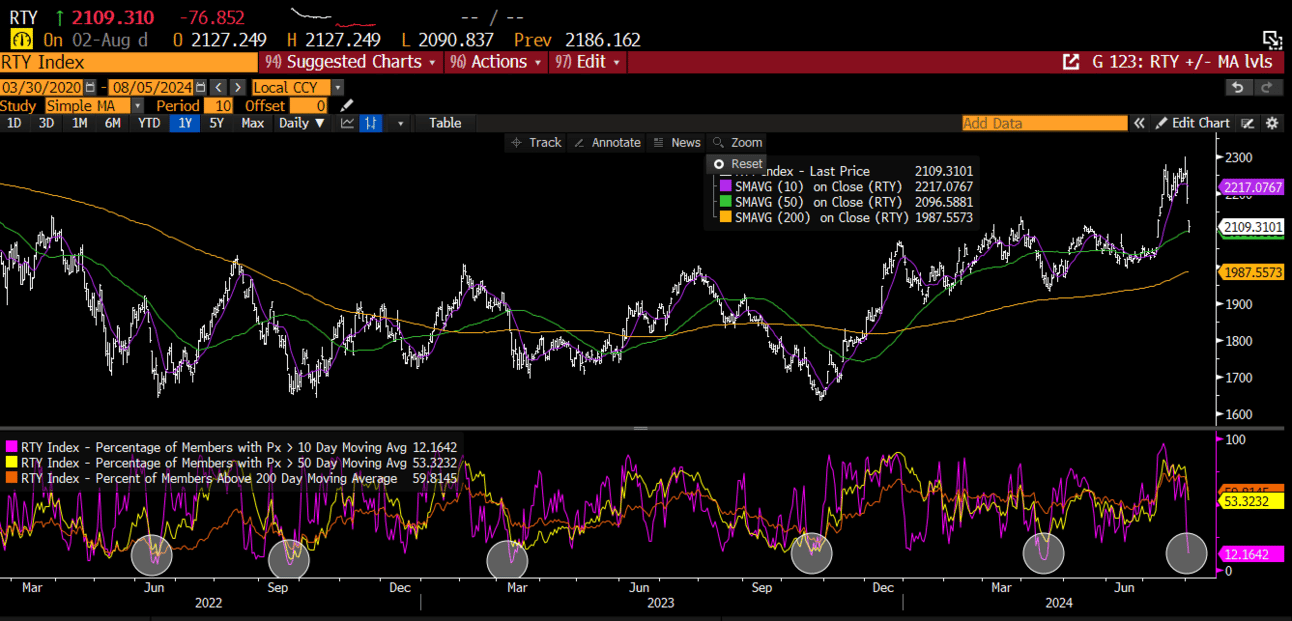

An unfortunate casualty of the recent drawdown was the Russell 2K (RTY). We have been recommending rotation away from the large-cap tech stocks into other market areas, using the RTY as a proxy for that rotation. While we had previewed that it would not be immune to any major drawdown in the larger indexes, the unraveling of the index has been much more aggressive than we feel comfortable with. Significant gaps in indexes are never good and, at the very least, require time to overcome. Friday, we did see the index find buyers at the white gap window/50-day MA, which produced a hammer reversal candle; it’s possible the selling is close to being completed, but without reclaiming the new green gap window, we suspect this will struggle. Bounces into this area will likely fail initially and may require a catalyst, possibly a macro release, to reverse the sentiment shift.

The weekly chart posted a bearish outside candle and suggests more near-term pressure is likely, and any counter-trend bounces will fail in the near term.

DeMark Trendfactor levels caught the selling intraday on both attempts. The current level is 2109, and where the index closed on Friday.

Taken together, there is quite a bit of confluence across the indexes on multiple time frames and indicators that suggest buyers should step in and defend the support ranges. This implies that an early week dip likely gets bought but struggles to reclaim the resistance areas absent a catalyst. Aggressive traders can attempt to trade the extremes with the caveat that this sort of degradation of the indexes is usually resolved by time.

Macro Updates

The weaker-than-expected macro reports on Thursday and Friday sunk the rates complex significantly last week.

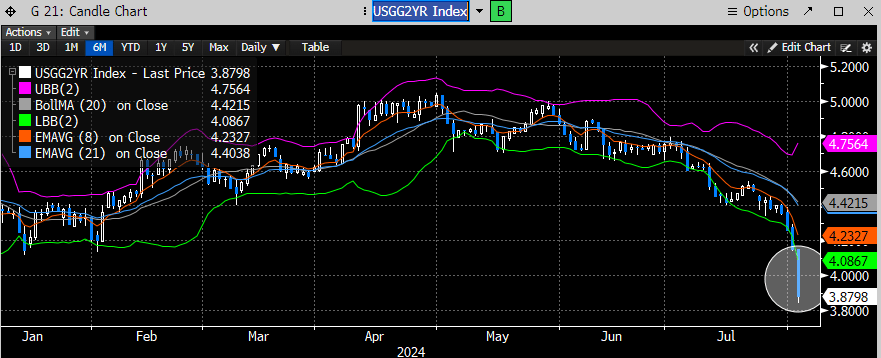

The 2-year treasury (a proxy for interest rates) looks capitulatory as the higher for longer trade has completely unwound. The 2-year treasury finished Friday’s session at 3.88 after finding some support at the 123.6% Fib projection. This is also testing the March ‘23 - May ‘23 zone where rates bottomed on the last collapse. RSI is now officially OS.

To put this in perspective, the last time the 2-year yield was this OS was during the Covid Crash.

The 2-year is now significantly below the lower BB, a rare phenomenon.

On Monday, the 2-year will post another DeMark 9 buy and can print a combo 13 buy in 4 days.

The weekly DeMark will also print its first 9 buy since January, coincidentally marking the low in yields for 5 months. We think the yield complex will reverse this week, as the press lower seems a bit extreme. Rising yields, while counterintuitive, will help stabilize risk markets.

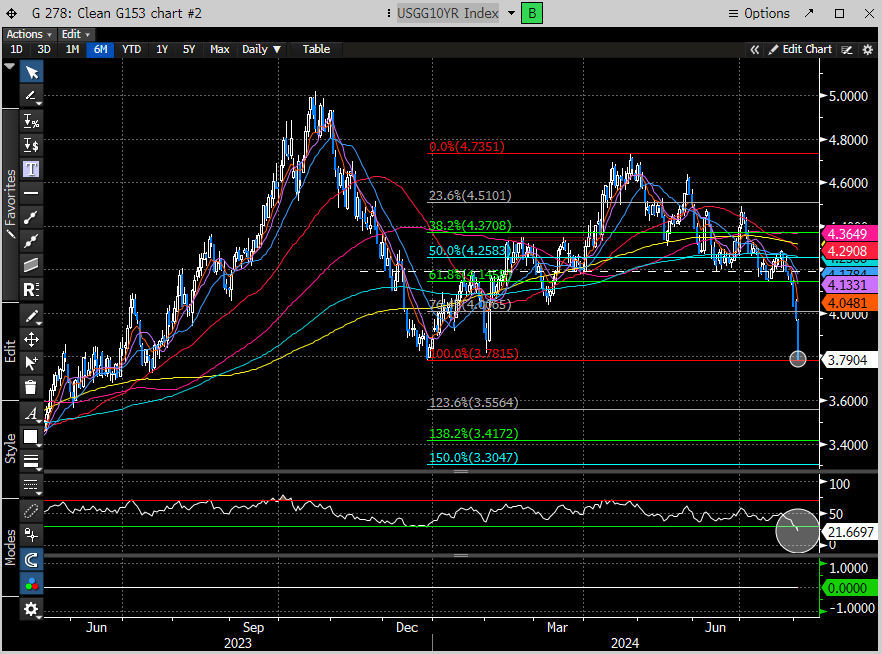

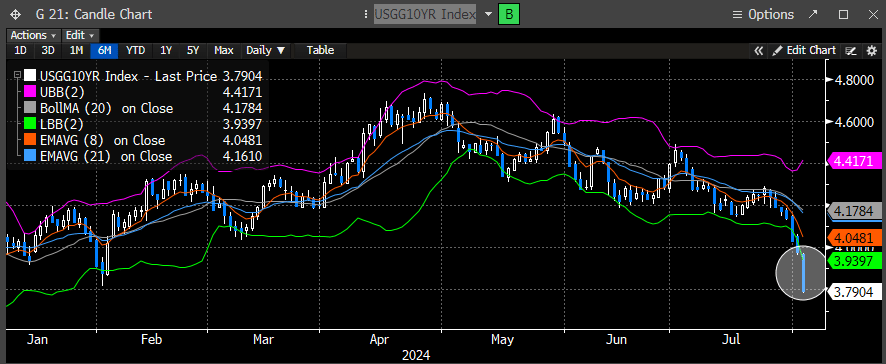

As mentioned earlier, the sinking two-year yield is outpacing the long bonds and is the reason for the 2/10-year curve barreling towards neutrality. The 10-year treasury yield also looks quite extreme, and we are now testing the December 23 lows. The yield is officially OS per RSI.

The 10-year yield also finds itself far below the lower BB.

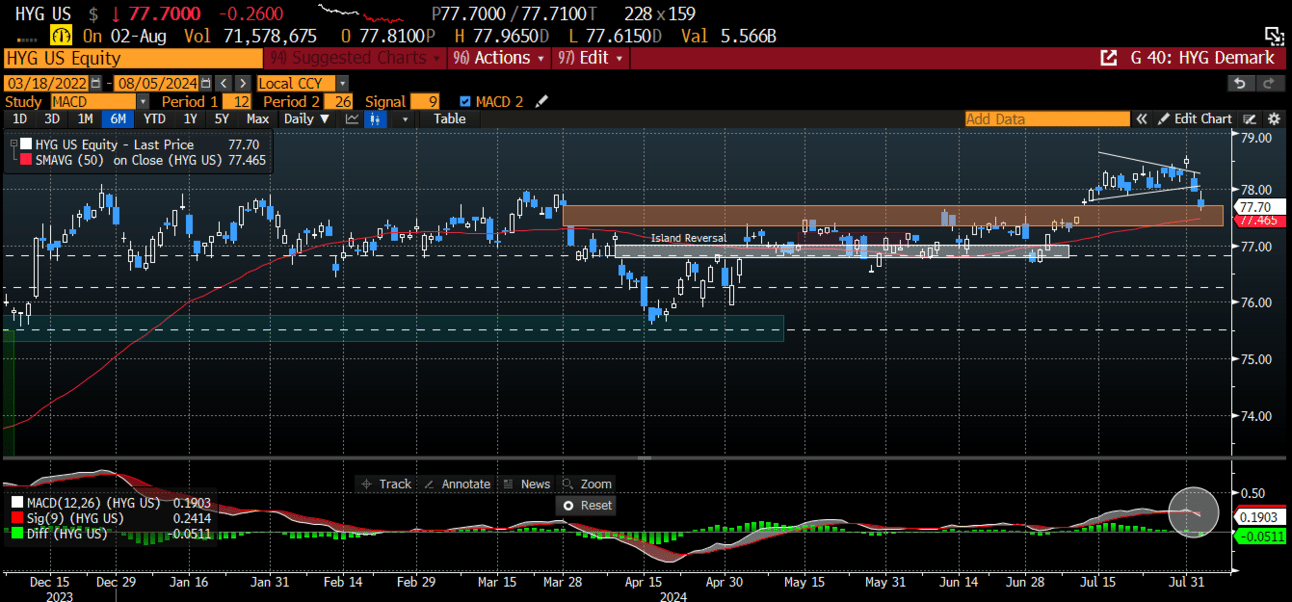

For such a large move in the yield complex, High Yield (HYG) hasn’t seen the same magnitude of a reaction and only finds itself back into the orange gap window. For now, we see this as a bullish consideration as it has not spread considerably into riskier segments of the bond market. Its MACD is crossing bearishly, suggesting this should remain pressured but to be expected after last week’s volatility.

The CDX HY had a much bigger move and is more worrisome, although still below more extreme readings. Regardless, this is a reason to remain very guarded when allocating risk.

This also led to HY spreads widening, which is symptomatic of a risk/off environment.

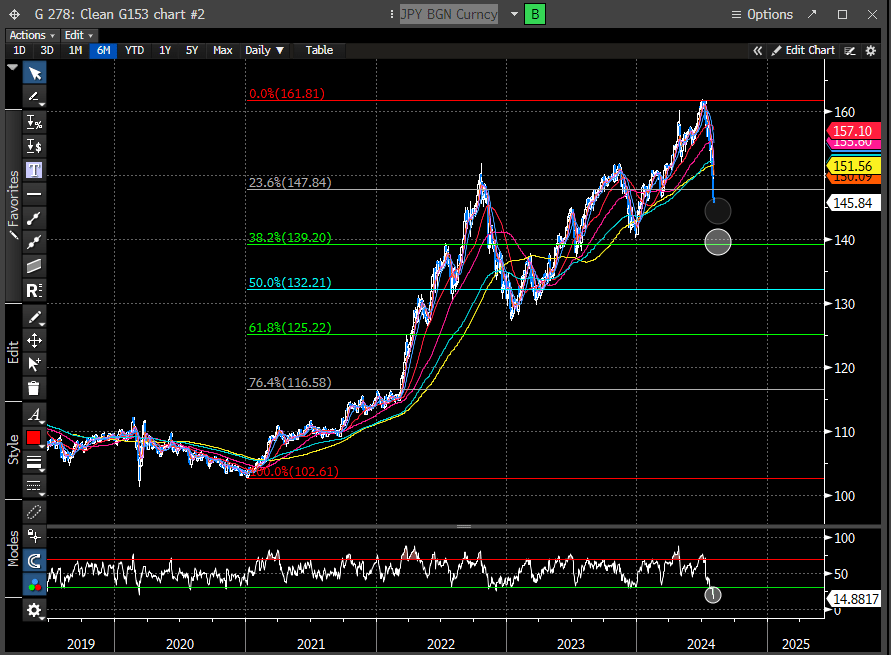

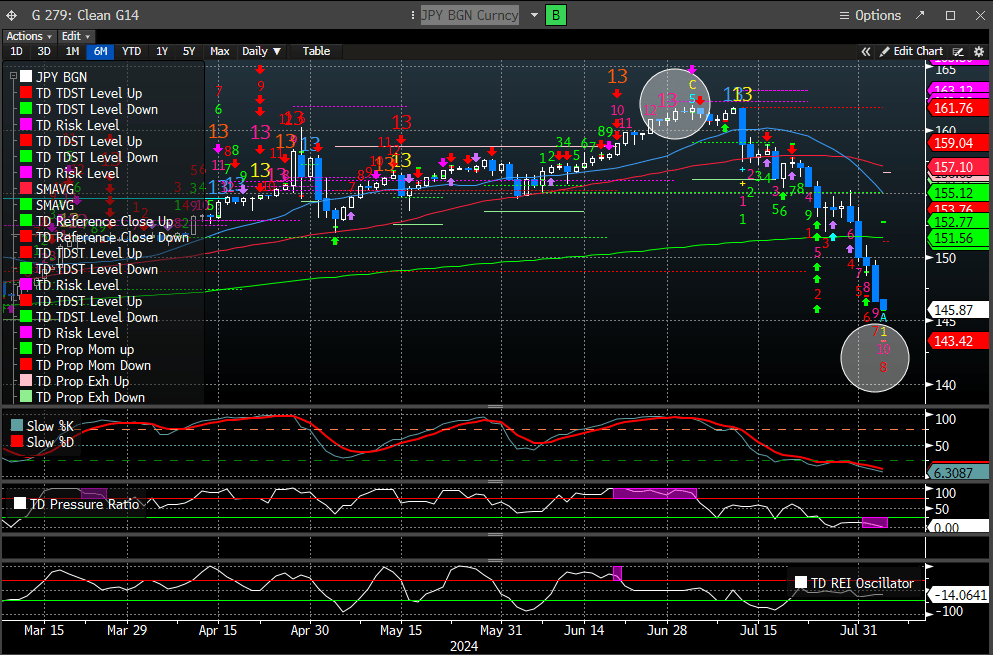

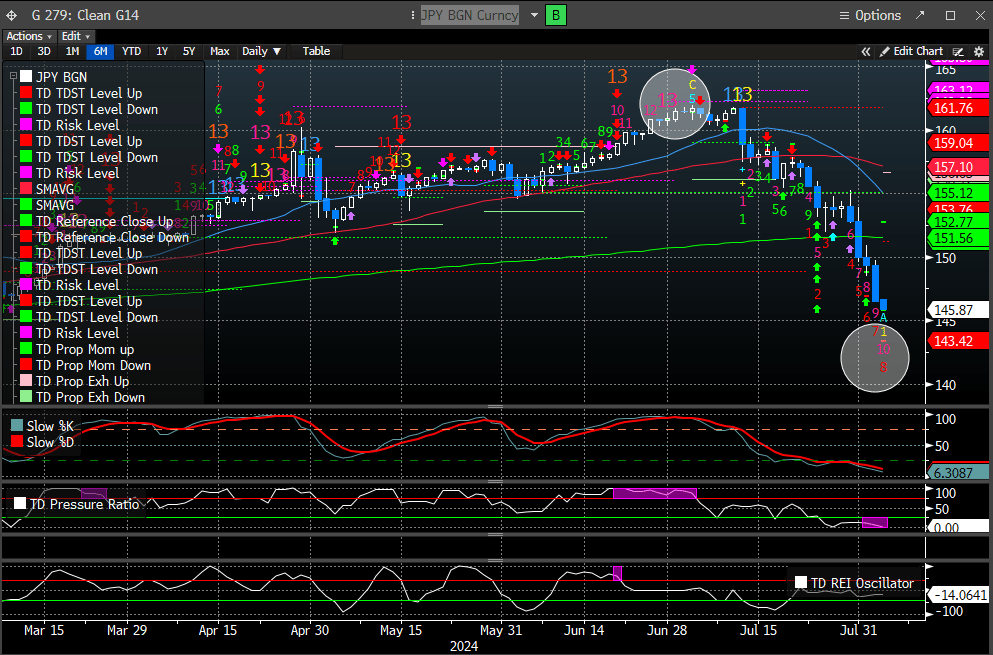

We don’t typically analyze JPY movements, but given the circumstances and their weight on the current stock market landscape, we must consider where the USD/JPY might find a floor. Using a Fib retracement from the January ‘23 lows, two levels may terminate the move (144.52 and 140.44). The 61.8% level is more formidable, and where this found a floor in December ‘23.

Applying the retracement to the 2021 lows, there is confluence building around the 140 level (38.2% Fib is 139.20).

A DeMark combo 13 buy can print in three days and the recent peak was marked with a combo 13 sell.

The DXY ($USD) is undoubtedly weakening with the FX trades being unwound and the yield complex getting obliterated. This is testing the 38.2%, which has decent support, but it’s possible this needs to test the March lows before terminating.

The weekly DeMark chart did print a seq 13 buy last week. The last seq 13 buy in 2021 marked the lows.

Oil continues to be under pressure and was rejected below the purple gap window support band for the first time since June and now testing the uptrend line (UTL).

The DeMark 9 buy that printed last week only produced a one-day reaction and failed at the 200-day MA. We continue to think this will remain under pressure.

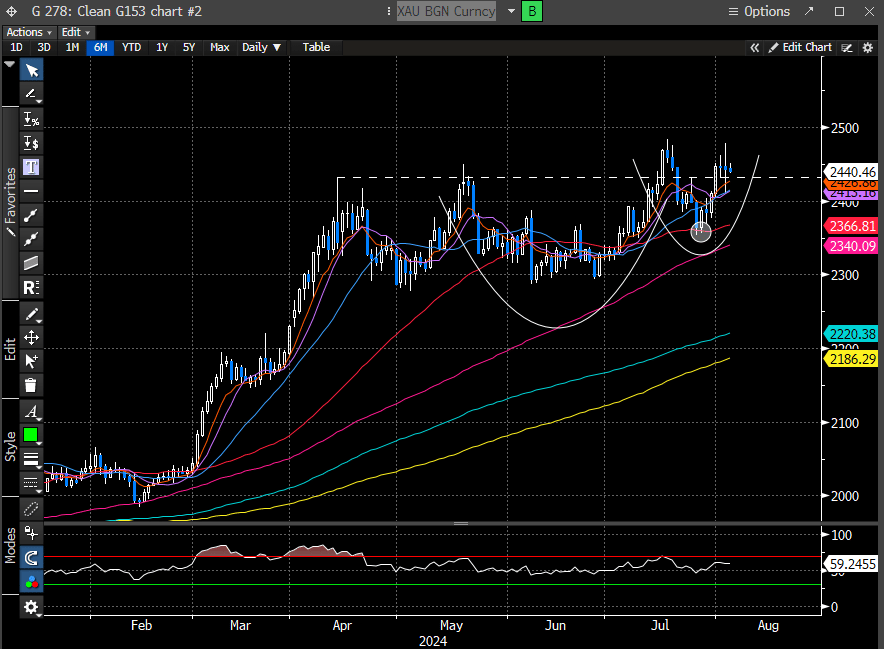

Gold (XAU Index) is finally getting its day in the sun as the safe-haven currency, breaking back above the April pivot after getting defended at the 50-day. This is forming a new cup and handle, a bullish continuation pattern. We would consider taking a long position.

Internals

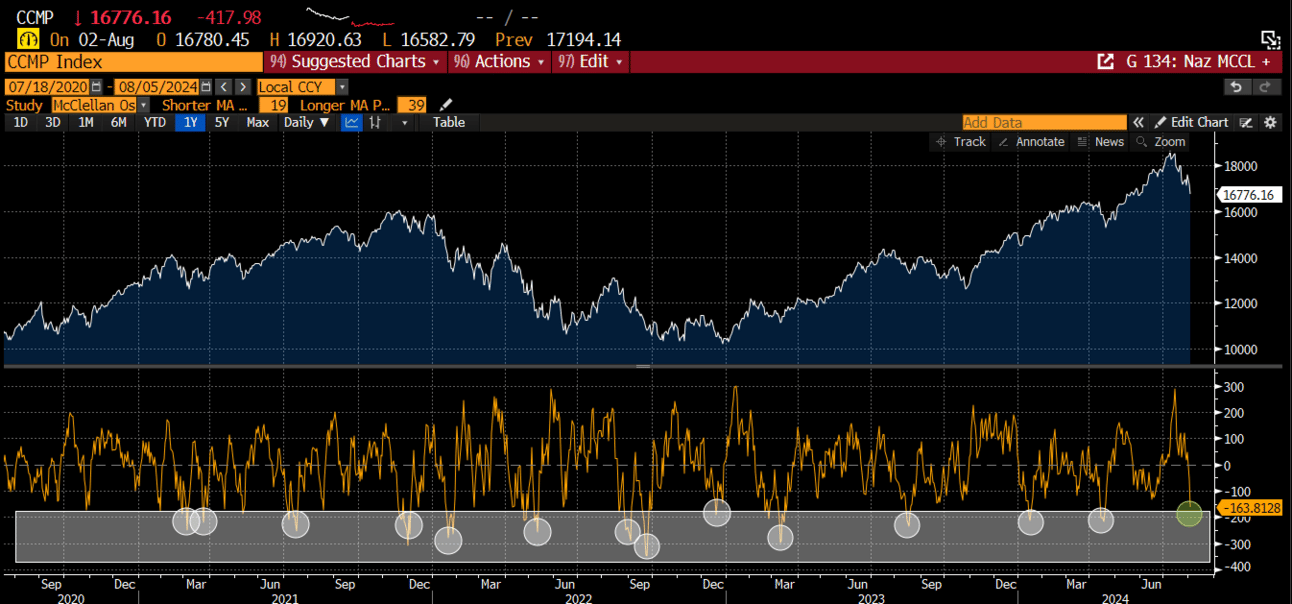

The McClellan Oscillator (MSO) for the Nasdaq is approaching the extreme zone but is not quite there. This likely happens early in the week and is another reason to consider a higher counter-trend trade probability.

The SPX still has quite a bit to go before reaching an extreme.

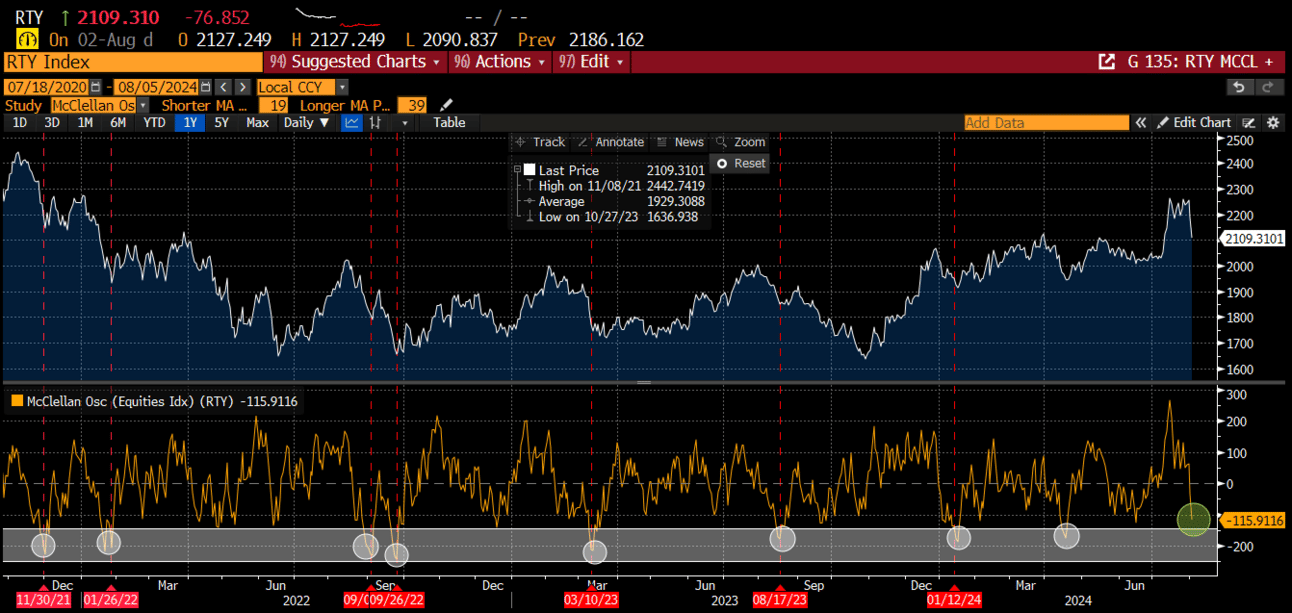

The Russell is approaching the reversal zone.

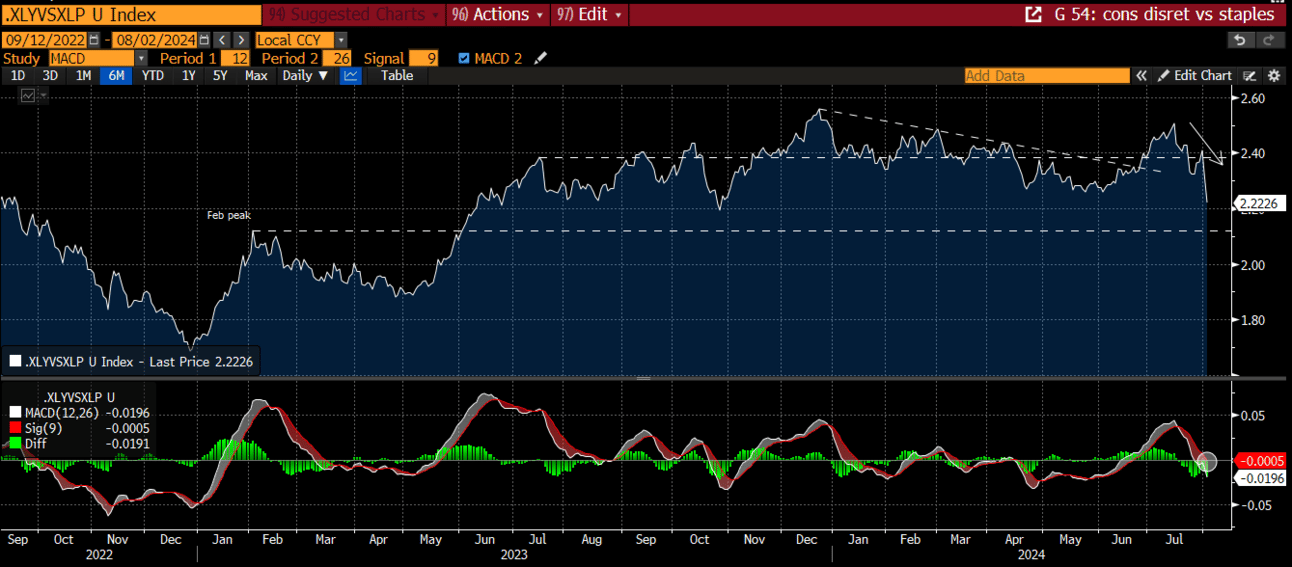

The consumer discretionary vs staples ratio continues to sink and is confirmation of the risk-off environment.

The staples vs. SPY ratio has also broken the DTL that has been in place since May 2023.

The Tech vs Financials ratio broke its UTL, back-tested, and failed. These ratios are indicative of a rush to safety.

The Nasdaq percentage members <10 day MA is approaching extreme fear levels and where bounces tend to occur.

The Russell is as well.

The VIX did reach fairly elevated levels last week, the highest since March ‘23. The topping tail suggests a possible lower high in volatility on the next pulse down for the stock market, which should be viewed as a positive divergence.

The VIX can also print a combo 13 sell in 3 days but would require higher volatility to complete.

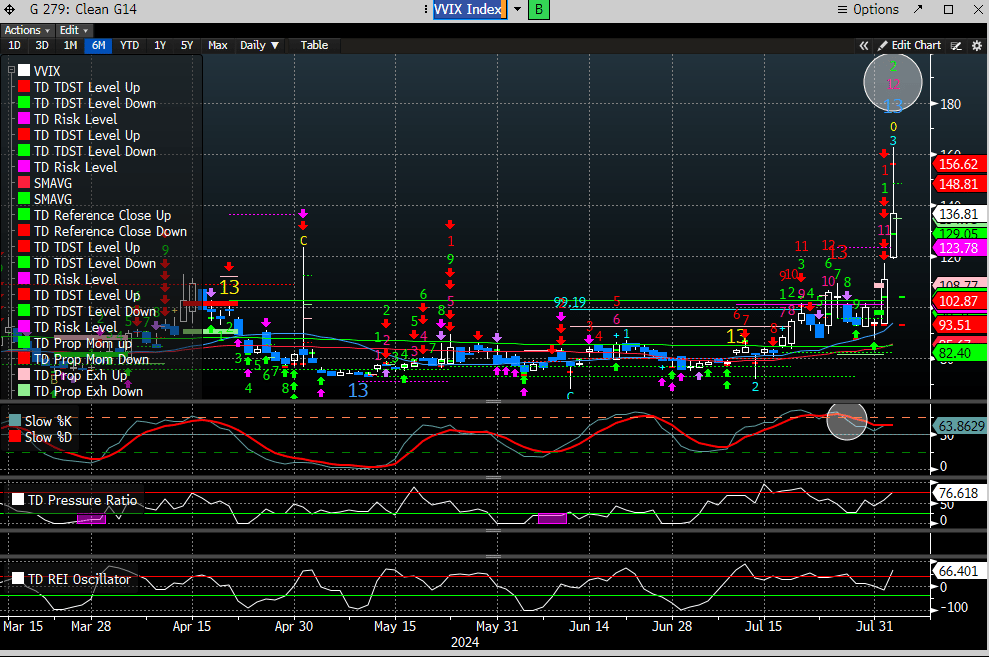

The VVIX (vol of vol) can print a combo 13 sell in one day and may mark the top for this volatility pulse.

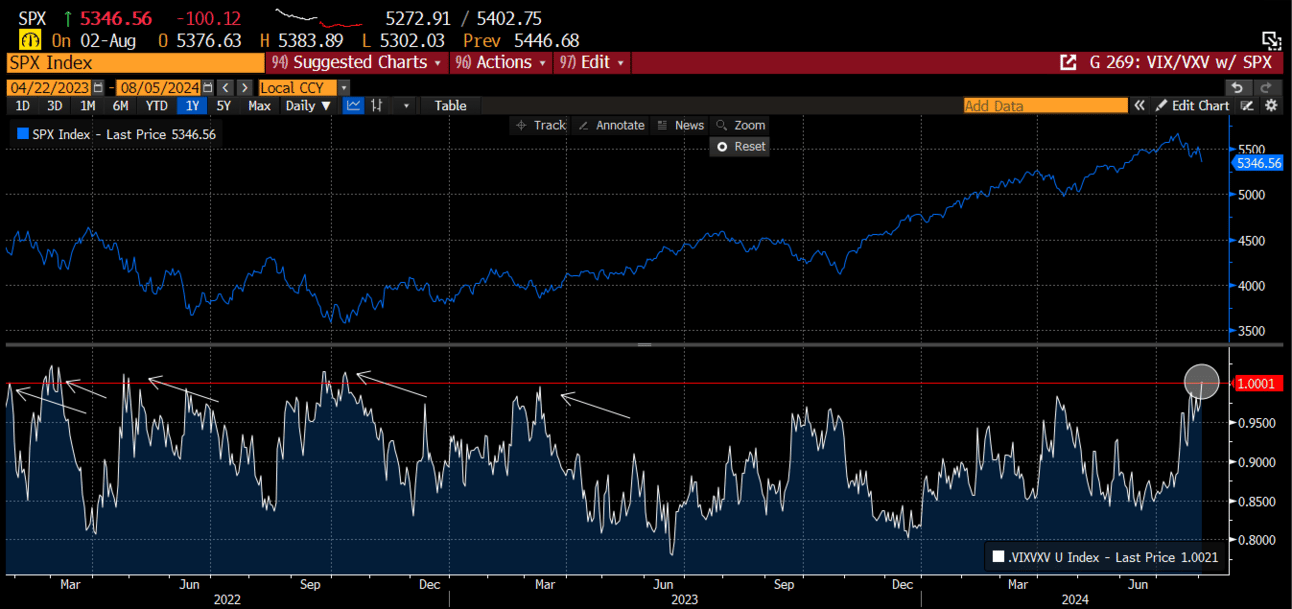

Spot Vix vs VIX 3-month contracts are approaching an extreme level, and where reversals in volatility occur.

This study from Fundstrat also shows that the pulse in the VIX suggests capitulatory behavior, where the market is positive 6 months later, 88% of the time.

This is a chart of the Goldman Sachs Panic index, a rolling percentile of four equity volatility metrics. This spiked to the highest level in two years.

The bottom line is volatility likely compresses after the initial panic, likely sometime this week. This should help put a short-term floor in the market.

Crypto

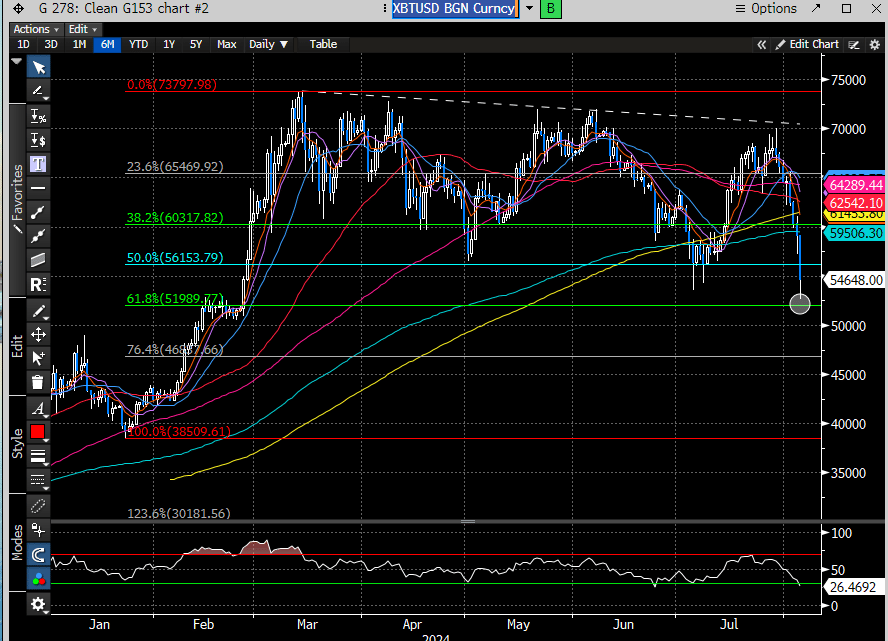

Bitcoin is getting liquidated with the rest of the risk complex and missed our target range by 1K. This is now testing the July lows. The close below the 50 day was our stop, which has been triggered. This is now coming into the 61.8% Fib level, which coincides with the February consolidation. It may find support here, but the price degradation is substantial, and we will avoid it until it settles in.

Bitcoin can print a 9 buy in 2 days, where the last 9 sell did mark the highs.

Last week, we suggested that Ethereum looked vulnerable and that we preferred Bitcoin. Ethereum has broken all recent support levels, finding buyers at the January lows.

Ethereum can print a 9 buy in three days. The last 9 sell did mark the swing high.

Conclusion

Our last weekend report specifically stated that the stock market faced several binary risks that could upset the equilibrium. This was an understatement, and we were not advocating for this sort of meltdown of risk.

Here is the excerpt:

While we feel vindicated for advocating caution, we regret not taking a more bearish stance. In our mid-week report following the FOMC message and a bullish Meta report, we predicted the stage was set for the election-year August seasonal tailwind. This was clearly incorrect.

Our system is designed to be predictive, but unforeseen risks can always emerge. Last week’s swift and punishing unwind disrupted our SMID cap rotational theme. Accepting these risks is part of investing or trading in the stock market. While we cannot anticipate all macro-related risks, it’s crucial to adjust our thinking. It’s okay to be wrong, but it’s not okay to stay wrong. This means being tactical and trading at extremes.

Are we entering an extreme moment? We think so, especially with futures plummeting as we finish this report. The Japanese market is down 6% overnight, with circuit breakers being triggered. This sets the stage for a significant US market drop at the open. We anticipate a major US gap down will attract buyers, but buying into the weakness means selling into the relief. The market will need time to navigate the negative cross-currents, leading to elevated volatility and continued pressure on the indexes. This could persist until the Fed and Powell provide clear direction at the Jackson Hole event later this month. The situation has become much murkier, and in times of uncertainty, we prefer to do less and play defense.

We don’t believe a recession is imminent. This means the current volatility will create incredible buying opportunities, though the market bottoming is uncertain. When we identify it, we’ll be sure to let you know.

That’s it for us. Have a great week.

*For more information on TD Buy/Sell Set up, TD Sequential or Combo Countdown, Demark Propulsion, please visit www.Demark.com

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.