The first sign of real weakness hit the stock market this week. It has been an incredible run for the bulls as they’ve thwarted every piece of bad news the macro had to throw at them…until last week. Fortunately, our positioning was quite light as we have been suggesting to sell stocks into the July strength, and even consider tactical index shorts. While the US debt downgrade news was not something us or anyone had forecast, sometimes the market just needs a reason to sell off. We have been writing since mid-July to sell into residual rallies and prepare for a bout of volatility as the seasonal weakness window was opening, we had significant DeMark signal alignment, sentiment had flipped bullish, interest rates were on the move again and rising commodity prices (notably oil) would undoubtedly strike fear into the FOMC hawks.

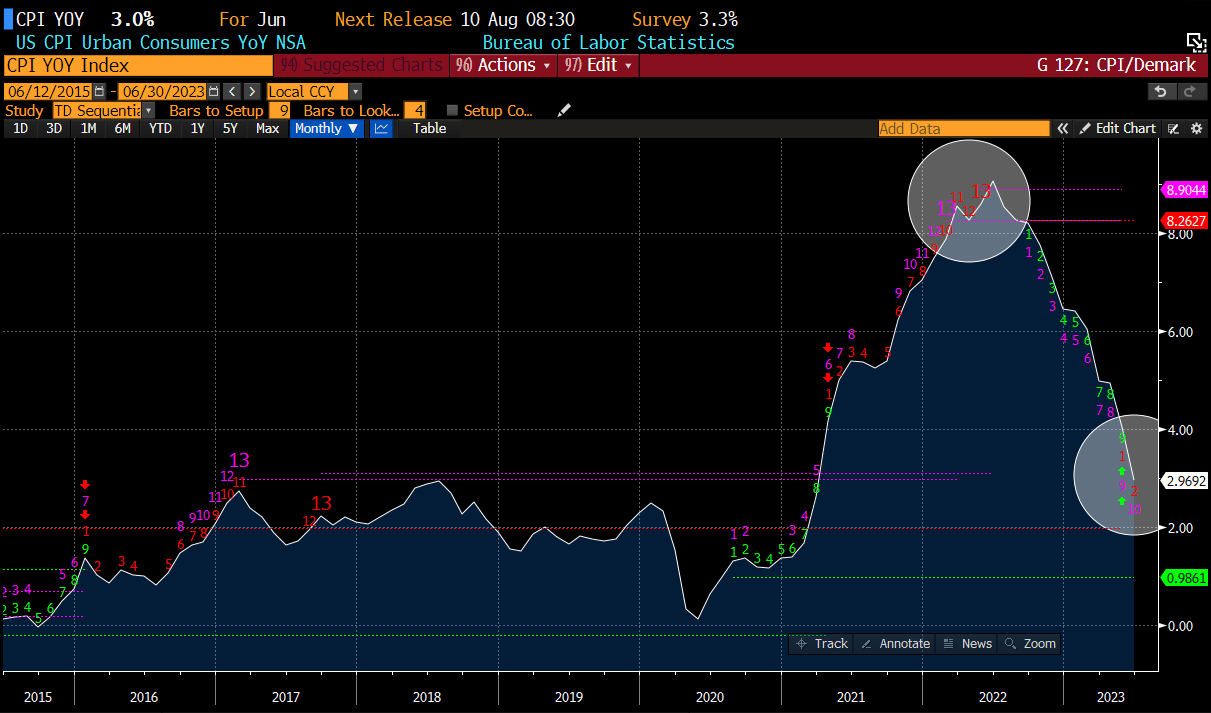

This week we will get our first CPI reading since the last FOMC meeting. While we are not economists and do not forecast macro data, we have been fearful the next few prints may see a re-acceleration. That will likely be met with more risk-off for markets. Could the market already be reflecting this reality? As technical traders first, we think it is. We have our fundamental views, but we also require confirmation from the many instruments we track.

An example of confirmation would be the directional trading of a basket of commodity futures. DBA is commodity basket ETF, and you can see that commodities have been on the rise since bottoming in Dec. We are now hovering around last year’s peaks.

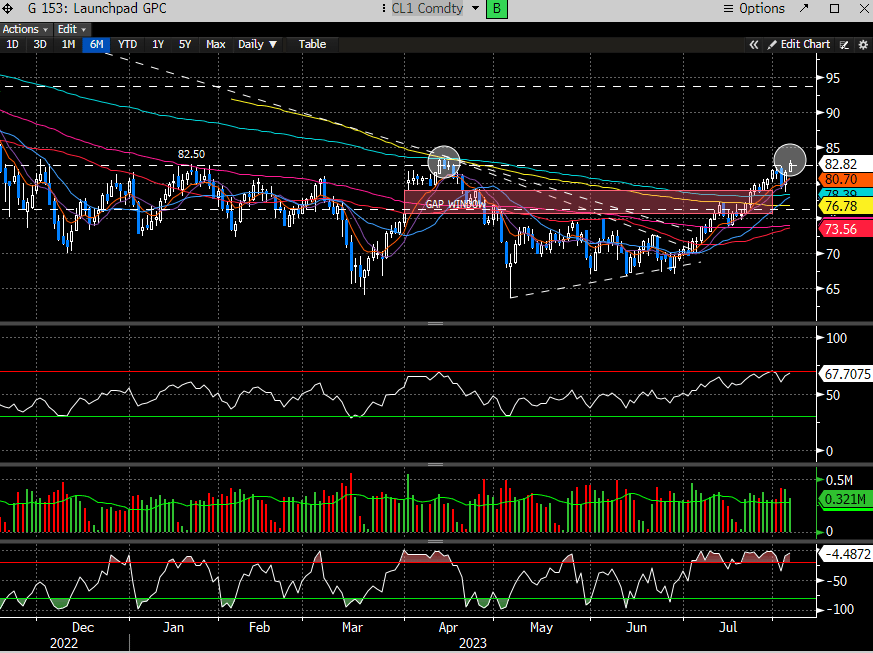

We’ve been bullish on oil which is now threatening to break out of our $82.50 pivot/tgt. Similarly, this is also back to levels not seen since last year.

Here is the CPI chart overlaid with DeMark signals, suggesting a bounce in inflation either comes this print or in Oct, should the combo 13 print. Either way, higher inflation between now and Oct will undoubtedly be reflected in the market before the actual print.

The stock market discounts the future, which implies changing in macro reads should start to get priced in before the news actually comes to fruition. We made this argument all year long as the high paid Wall Street macro strategists, chorus of perma-bear Furus and media told the world why stock markets would revert back to the lows. We couldn’t pinpoint exactly why the stock market was ignoring the negative news-cycle but we knew it was discounting something. We follow price first and price was not confirming the negativity. We posited that a discounting of an economic recovery in the economy sooner, as a possible thesis, which wasn’t precisely right or wrong but close enough, as the stock market was simply repricing a “no recession” scenario. 2022 saw the markets price in a recession that never came, and this means that stocks need to reprice a different future. This has been evidenced by unusually strong employment and GDP re-acceleration in 2023.

Some ask how this is possible since the FOMC has been pushing the fastest tightening cycle in history. At first, we were a bit perplexed at the resilience of the macro statistics, but slowly realized that there was simply too much stealth government stimulus to counter the weight of the FOMC’s intentions. What do we mean by this?

Bidenomics is alive and well. The bulging Federal budget deficit is fueling a resurgence of infrastructure spending and increased investment in the green economy post the Inflation Reduction Act (IRA), while a new construction wave of manufacturing facilities relocating from Asia, back to the US, is keeping demand for goods and services alive and well. Couple this with a shortage of housing, and demand for labor and materials is still creating bottlenecks and price inflation. We can attest anecdotally that construction spending on infrastructure projects across the US is real, and showing little signs of slowing.

The spending wave is injecting over $1Trillion worth of support and occurring in a pre-election year. Make no mistake, this is usually timed this way as it sets up the incumbent to run for office with strong economic tailwinds. We have written many times at the end of last year and the beginning of this year, that the 3rd year of a presidential cycle is typically quite strong. It’s hard to argue against that this year as the stock markets are having the best start to a year in decades.

This notion of increased government spending is likely masking some weakness in the economy under the surface, and why this year has been a bifurcated stock market of the “have’s and have nots.”

We admit, we were a little skeptical of the Fed’s ability to engineer a soft-landing scenario, but the reality is, the Biden administration seems to be padding the runway for the Fed.

Of course, does the strong government spending pave the way for higher inflation later? We’d argue it is already occurring.

We think the biggest question from here is where is the terminal Fed Funds rate? Will the Fed continue to press rates higher, or will they back off? While we cannot determine at what rate their policies become too restrictive, we do know that there is a level that is too high and where economic momentum will halt and revert. We do think the FOMC committee is keenly aware of this and thus threading the needle from here is not going to be an easy task. This implies the upcoming inflation reports are extremely important.

We have our views on interest rates and also on NT stock market direction. Please consider subscribing below to read the balance of the analysis.