There's a Green Day song called "Wake Me Up When September Ends." While the song is a heartfelt tribute to the singer’s late father and not about the stock market—no disrespect intended—the title seems fitting for how investors felt after the post-Labor Day drawdown. The stock market, like a skilled magician, thrives on misdirection. That week, which looked like a signal of poor pre-election seasonality, turned out to be a classic illusion. If you grossed down in hopes of buying back in October at lower prices, you will likely be sorely disappointed.

With one trading day left in September, the performance of the major indexes has been quite solid—especially considering September’s usual reputation as a down month. Let’s not forget two major indexes even hit new all-time highs this month.

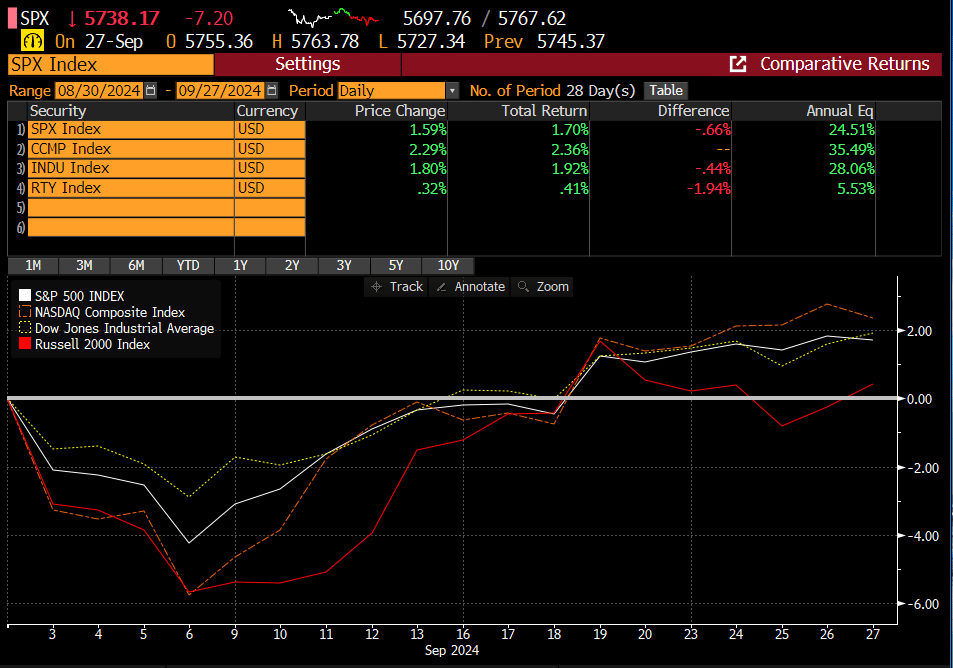

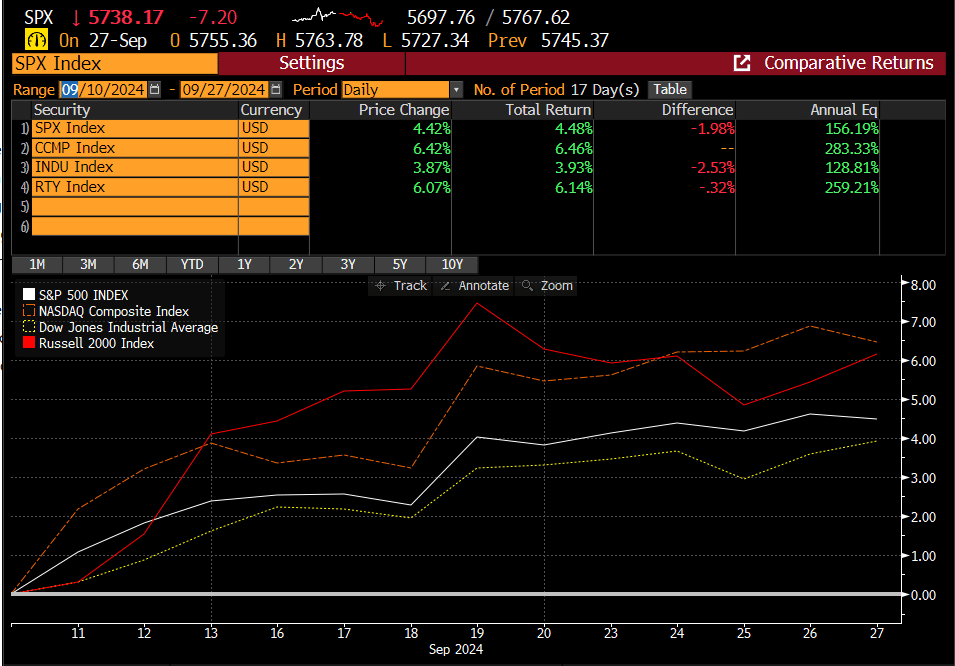

If you sold during the September drawdown expecting to outsmart further weakness, you missed the mark. On the other hand, if you followed our 9/8 recommendation to buy the middle of that week, you're likely enjoying solid gains.

SPX +4.4%; Nasdaq +6.4%; Russell (RTY) + 6%

Still feeling bearish? Look what happens when September is positive after the year we have had:

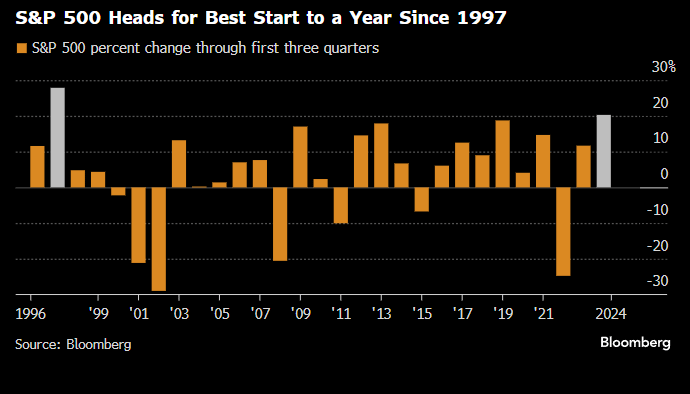

The SPX just wrapped up its third straight winning week and is currently up 5.1% for Q3. According to Bloomberg, this puts the stock market on track for the best start to the year since 1997.

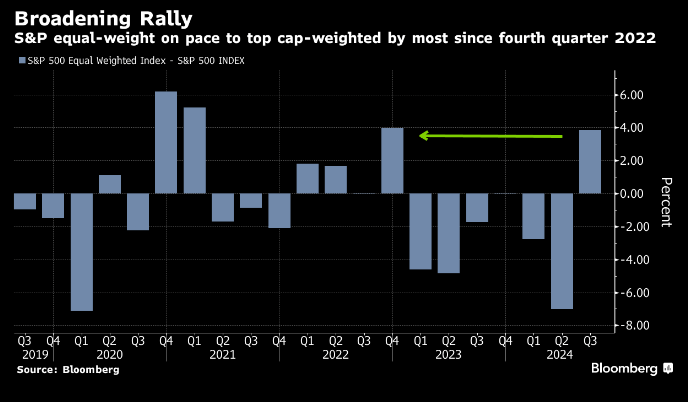

What’s interesting and extremely satisfying is that the indexes are pushing new heights without the help of the large-cap tech stocks or Mag 7 names. In our early July reports, we specifically wrote about selling the large-cap tech names in favor of rotational plays.

The Equal Weight SPX Index (SPW) and the RTY are up almost 9% for the quarter, compared to the Nasdaq 100 Index (NDX), which is up a paltry 1.66% and the Mag 7 Index (BM7P) up only 4.69%.

This is the largest outperformance of the SPX equal-weight version compared to the cap-weighted since Q4 2022. How is that for alpha?

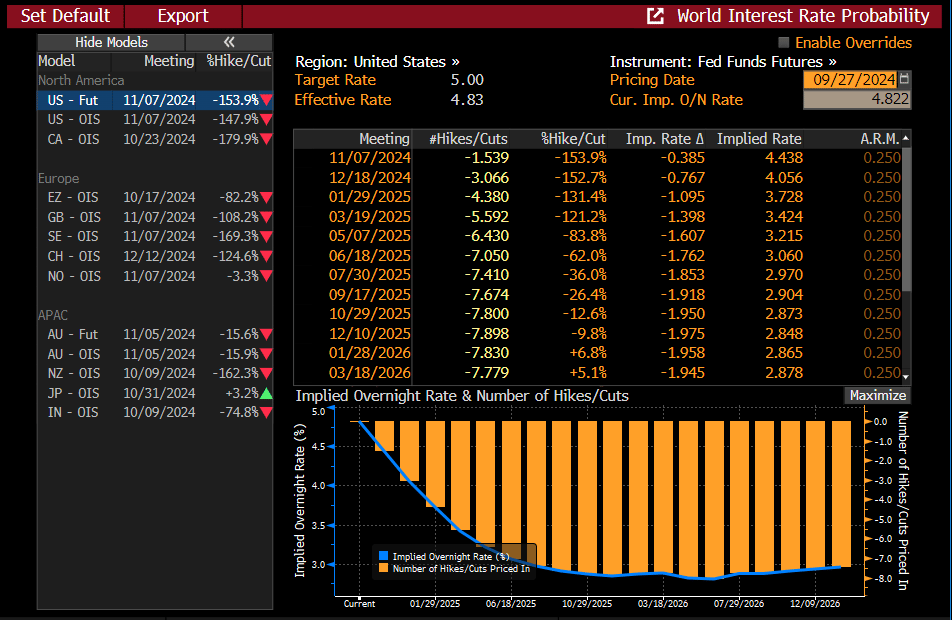

October is just around the corner, and it still holds the potential for some market turbulence. On Friday, the September payroll report will be released, serving as a key factor in determining the size of the Fed’s rate cut at the next meeting. Currently, Fed Fund Futures are pricing in a 50% chance of an additional cut. However, if softer economic data emerges this week and pushes that probability higher, we could see some market dislocation.

ISM will also get released this week, which has caused quite a bit of volatility as of late. Couple that with a contentious election in the final stages, and October can certainly cause some reversion to the recent enthusiasm.

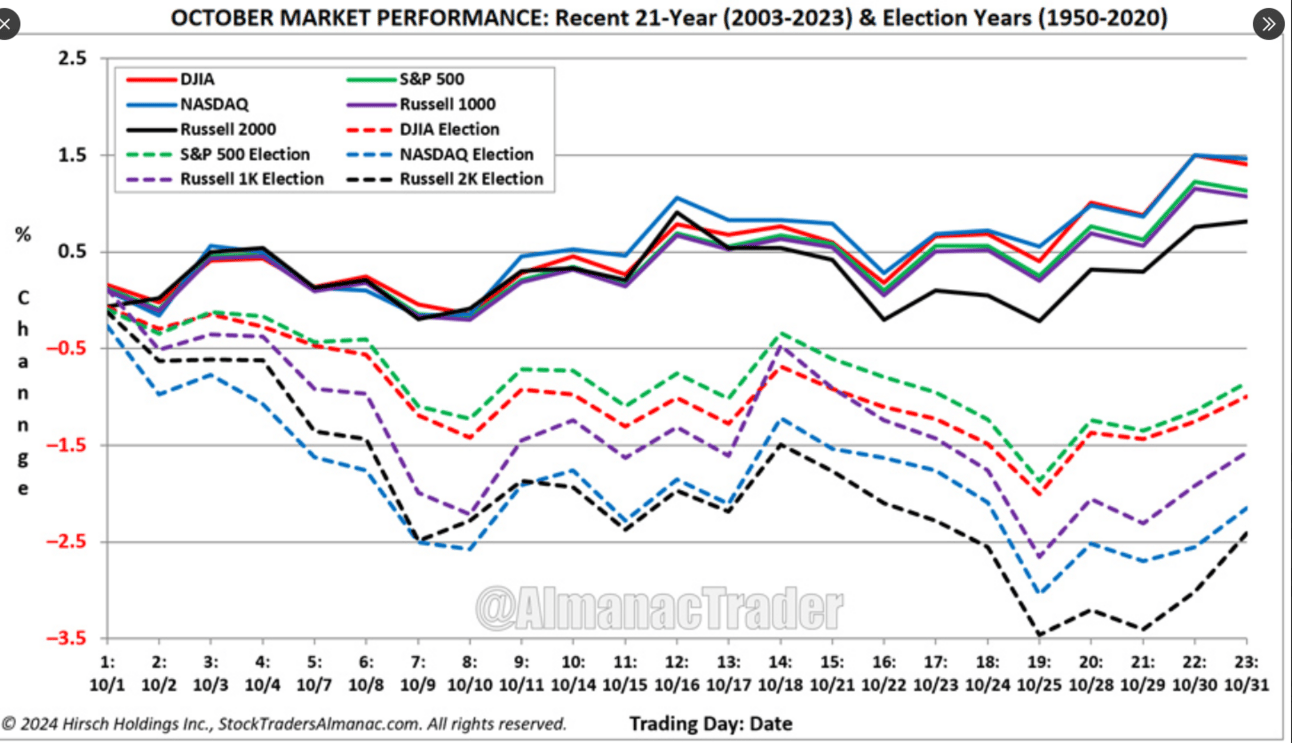

According to the Stock Traders Almanac, October’s performance is typically quite poor prior to an election.

We don’t make determinations solely based on seasonality, but we consider it when weighing the evidence.

Our rates for this new letter will be increasing at the end of the month (tomorrow). Whether you are an active trader or a passive investor, our newsletter is designed to help you maximize your returns for a very reasonable price. As evidenced by the outperformance highlighted above, we think we have the most actionable and precise stock market timing newsletter for the available price. Don’t miss out on the next big opportunity. Join today!