Seasonality in the stock market can be powerful and this bout of recent weakness and choppy action is right on cue. There is never any certainty with respect to stock market direction, but probabilities matter to anyone trying to predict the future. When probabilities are stacked against us, we fade the tape. When they line up in our favor, we get aggressively bullish. Not every day or time period is favorable for trading/investing. Sometimes it’s simply better to do nothing.

August was a frustrating month for us as we made money, lost money, and accumulated stress doing it, only to end the month basically where we started. Aug would have been the ideal month to pack it up, sit on the beach and shut down the trading station. Of course, that’s not realistic for most people who earn a living trading the stock market, but sometimes in hindsight, it would have been the proper course of action.

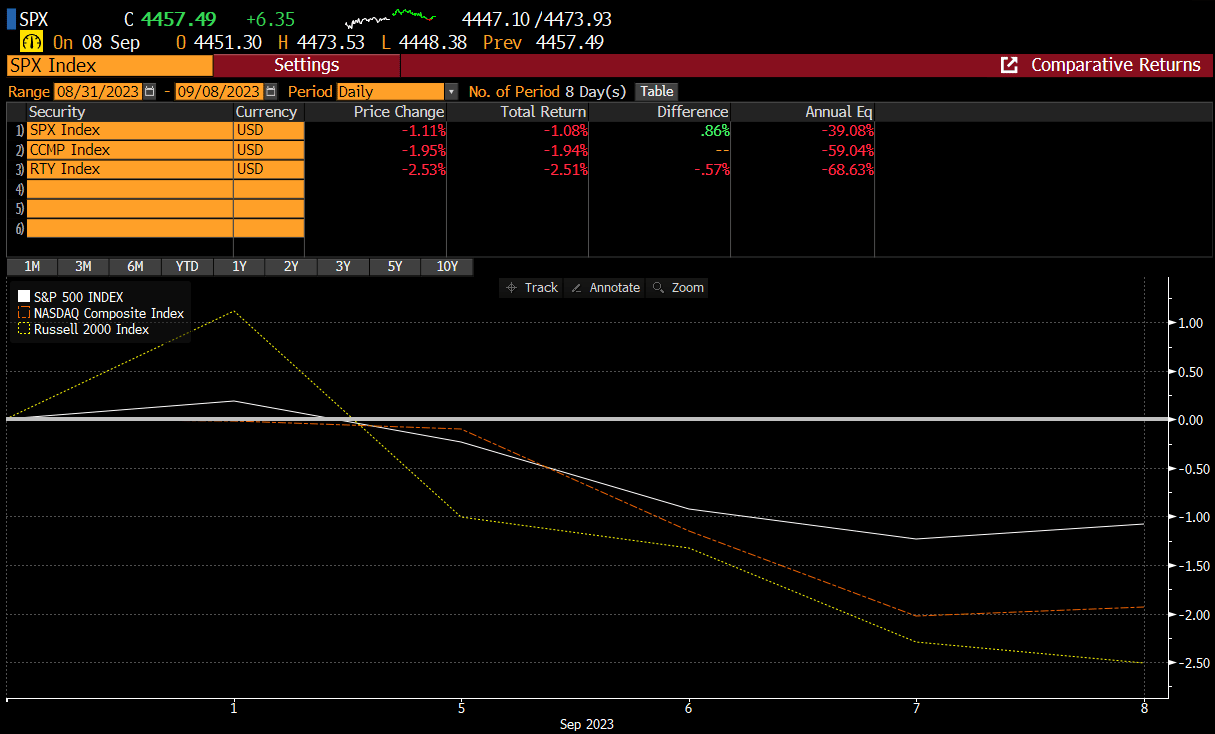

See August market performance below:

September is notoriously the worst month of the year in terms of performance and so far, that has rung true.

There are certainly enough things to worry about, as is usually the case in the stock market. Astute investors are always concerned about what could go wrong, vs. what could go right.

So, what’s going wrong?

The relentless climb in oil prices is sending shivers down the dovish camp.

Oil is now up +38% since the May low. With CPI being reported this week, how it could it show anything but a reacceleration of inflation?

2-year treasury rates are back hovering around 5% as the bond market is starting to price in another potential 25 bps hike.

The $USD is breaking out and now the highest since last March, when it peaked after the Feb stock market swoon.

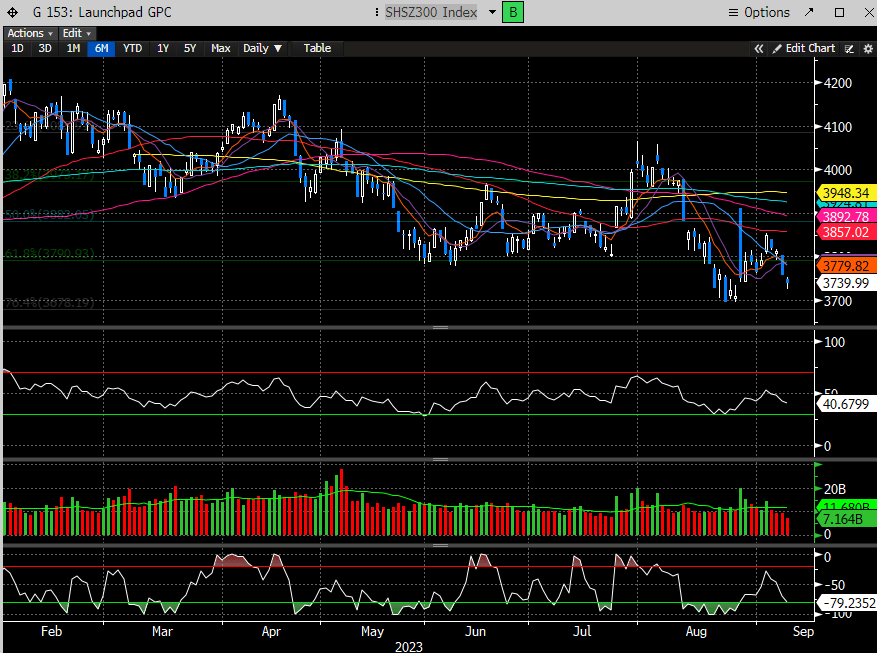

The worlds 2nd largest economy, China, is sputtering despite numerous attempts by the PBOC to re-ignite economic activity. Its stock market is reflecting the angst, now down -8% since the end of July, and almost -13% since the end of January. Couple this with seemingly escalating diplomatic tension with the US, the latest being the Apple iPhone ban within government entities, and it’s tough to get overly bullish on the country’s near-term prospects.

Nevertheless, the SPX has somewhat powered through most of this these lingering worries for the bulk of the year, to post a very satisfying +16% gain. Bears will have you believe it will all come crashing down, possibly starting this month, maybe it will, maybe it won’t. The stock market likes to climb a wall of worry. Why is that? Because it implies most participants are not positioned for further upside. In fact, most are still downright bearish. Sentiment is a powerful tool, and while gauging it is not a perfect science, it’s a signal that we take very seriously. We wrote at the end of July that the stock market was a bit too hot, entering a period of difficult seasonality, with a number of our signals flashing caution. We rightfully exited most of our tactical long exposure into July strength. That proved quite fortuitous as the last 6 weeks or so have been frustrating.

We wrote last week in our macro report that the reasons to be bullish in the intermediate time frame, are certainly present, if you peel back the onion a bit. Namely, corporate and personal balance sheets are not as bad as the media portrays.

Here is a quick snapshot from a Barron’s article offering another take on this notion that personal finances are in good shape:

“The Consumer Is In Great Shape (Really),” according to the title of a report from Mizuho Securities economist Alex Pelle. While lots of attention is paid to the notion of dwindling “excess savings,” a nebulous concept at best, household wealth relative to incomes has returned to close to its all-time highs. (And for what it’s worth, his estimate of those excess accumulated savings is between $400 billion and $1 trillion, a significantly bigger cushion than the conservative estimate of $100 billion from the Federal Reserve Bank of San Francisco.)

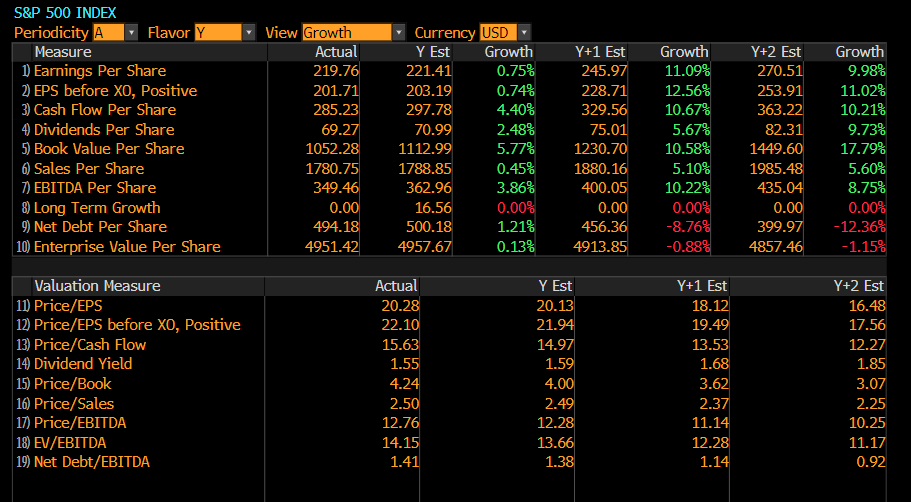

This would explain why the US economy is holding up and that Q2 saw an inflection in earnings. More importantly is what’s being forecast for ‘24. If, and that is a big if, earnings start reaccelerating next year, then the rally we’ve seen thus far in the stock market is completely justified.

Currently, the SPX earnings for next year are being forecast to grow. Now of course, these are just estimates which typically get adjusted, but the direction is more important at this juncture. That is because for the bear case to play out, these numbers will need to be cut drastically. For now, there is not enough evidence to suggest that will happen.

SPX earnings are forecast to grow +11% next year. This implies that the SPX is now trading at 18x next year’s estimates. Not exactly rich.

And much to the dismay of the bearish camp, these estimates have been increasing all year.

What this means is that for the bear cases to play out, we would need to see these numbers cut materially. That implies the economy experiences some massive shock, sending economic activity over a cliff and a large spike in unemployment. Presently, that sounds farfetched. Could that change? Definitely, as there are always exogenous, unforeseen events lurking that could send global economies into a tailspin. But predicting these events is a fool’s game. A simple exercise is to count how many of them have occurred in the last 25 years. We can count 4.

“Black swan events are rare and unpredictable occurrences that have a major impact on financial markets and the economy. They are, by definition, unexpected and outside the realm of regular forecasts.”

1. The 9/11 terrorist attacks in 2001, which had a significant impact on global financial markets.

2. The global financial crisis of 2008, which was characterized by the collapse of Lehman Brothers and the subsequent market turmoil.

3. The COVID-19 pandemic, which began in late 2019 and led to widespread economic disruptions in 2020.

4. Brexit, the United Kingdom's decision to leave the European Union, which was a surprising outcome for many.

The simple point is for us or anyone else to advocate exiting the stock market because some major event is about to occur, is comparable to guessing the right number on the roulette wheel.

Can we make an assumption that the SPX numbers are too high next year and need to come down, thus the stock market has seen the highs for the year? Yes, that is totally possible. Will a US recession next year, should it occur, impact these estimates drastically, definitely. But how many forecasts for a US recession this year and sub $200 SPX earnings proved to be premature or unfounded? All of them.

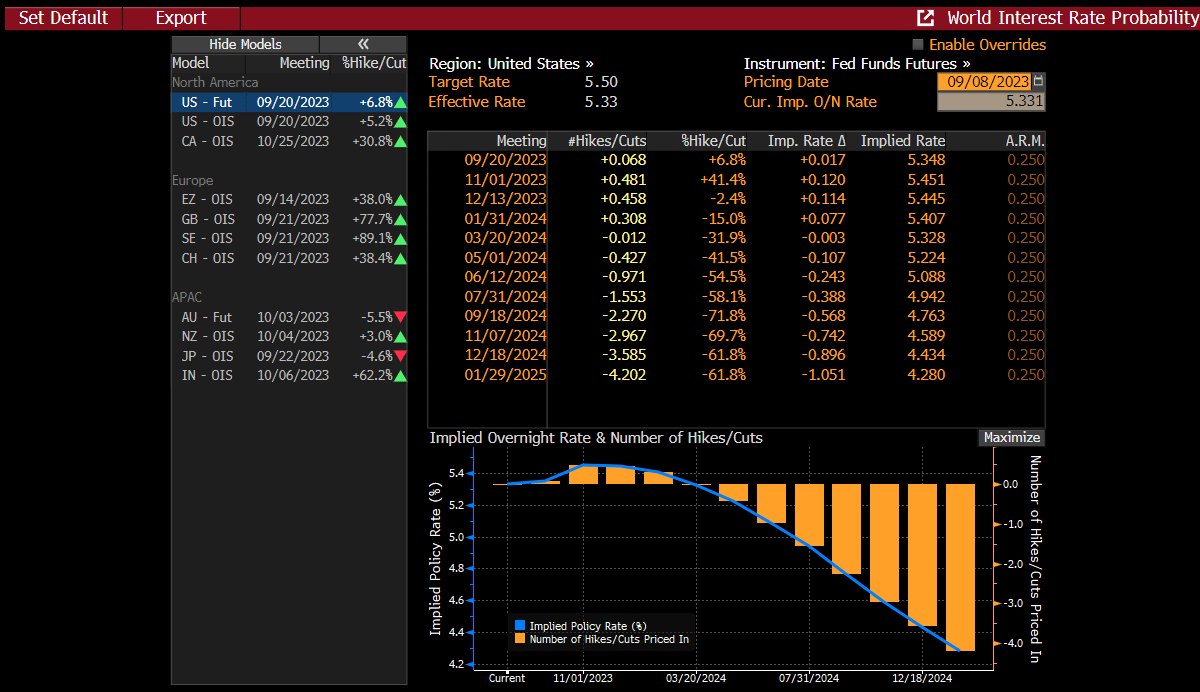

For now, we think the market is struggling with the narrative that the Fed is not done raising rates. Unfortunately, it’s impossible to know with any sort of certainty whether they are or they are not.

Currently the Fed Fund Futures Forecast is for a possible additional rate hike by the end of the year (48% at the Nov meeting and 45% at the Dec meeting). These probabilities have increased since the month began and is directly correlated to the softness in the stock market.

Guess the direction of rates correctly and you will likely get the direction of the stock market right, at least in the near term. We have always feared that rates getting too high will eventually break something, and a credit event can occur, much like in March with the regional banks. For now, we just don’t have enough evidence to support that notion.

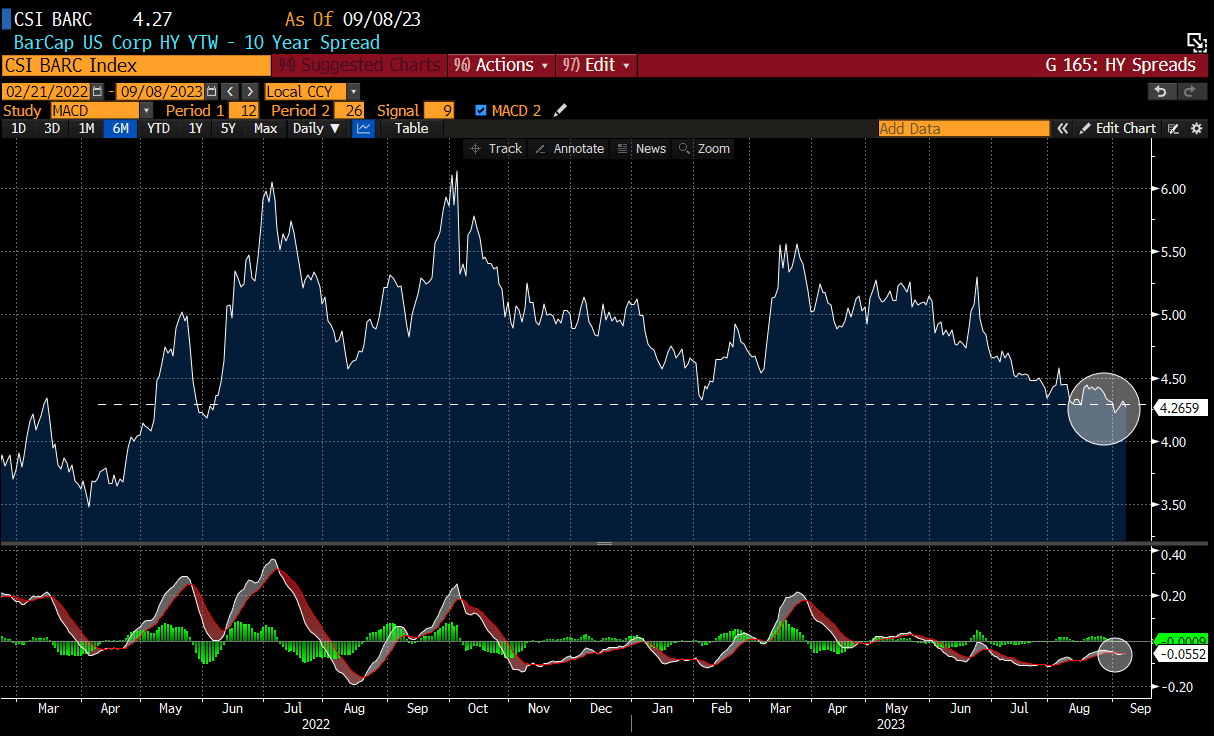

High Yield Spreads certainly aren’t painting that picture. See our comment above about healthy corporate balance sheets.

Back to our earlier comment on probabilities and looping in the discussion regarding earnings growth, we present this from Tim Hayes at Ned Davis Research:

…the earnings backdrop is becoming increasingly positive for stocks at home and abroad. Perhaps the strongest signal: While 82% of sectors in the MSCI ACWI world index have positive forward earnings growth, just 27% have positive trailing earnings growth, a gap of 55 percentage points. Over the past 20 years, the index has gone on to gain an annualized 11% when the gap has been greater than 50 points, Hayes says, far better than the 0.3% rise when it was less than 50. The current phase of the earnings cycle is a bullish influence on global equities.

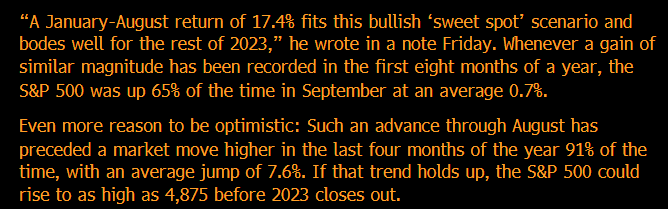

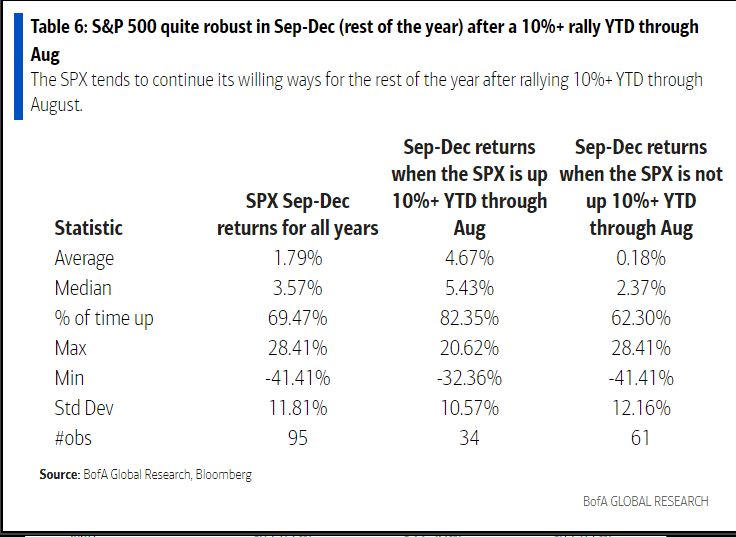

And since we are talking probabilities, here is a study from BofA discussing the notion of stock market strength in the preceding 8 months, typically leading to a positive Sept, and an even more positive last 4 months of the year.

Considering the aforementioned as a backdrop, it’s hard to be overly bearish as we move through the balance of the year. That doesn’t mean the market will move up in a straight line, as we’ve seen so far this month. Our job is to dissect the micro, while considering the macro, and find the most opportune time to put our chips on the table. Is that time now?

Consider subscribing below to hear our conclusions: