Markets trend. It’s a simple truth worth repeating because it’s crucial: markets trend.

What breaks that trend? Structural shifts in the indexes, often triggered by news or expectations of an event.

Why does this matter? If you want to make significant gains in the stock market, you need to align yourself with the trend. While we aren’t strict adherents of Elliott Wave theory, the underlying principle is spot on: it’s far easier to make money when you’re trading or investing in the direction of the prevailing trend.

Our entire report revolves around identifying emerging or ongoing trends. We use a weight-of-the-evidence approach to determine when a trend is shifting and whether it will continue. It’s a powerful strategy—and that’s because it works.

Two weeks ago, the stock market disrupted its bull trend and reversed, plunging over 4% in one of the worst weeks we’ve seen in years. We quickly adopted a defensive stance in our 9/4 report, anticipating a poorly received payroll report. The SPX dropped another 2% on the day of that release.

Over the weekend, our analysis indicated that the market was set for a rebound, and while we missed the timing by a day, we successfully prepared our readers for that pivot. Preparation enables you to act when opportunities arise, rather than chasing moves or trading against the trend. That’s why we stress staying in sync with our weekly market analysis—the market regime can shift abruptly, and our goal is to help you execute with conviction when that happens.

This week, the SPX rebounded by over 4%, erasing the prior week’s decline. You know what’s not bearish? A sharp reversal of a sharp reversal. Try saying that five times fast!

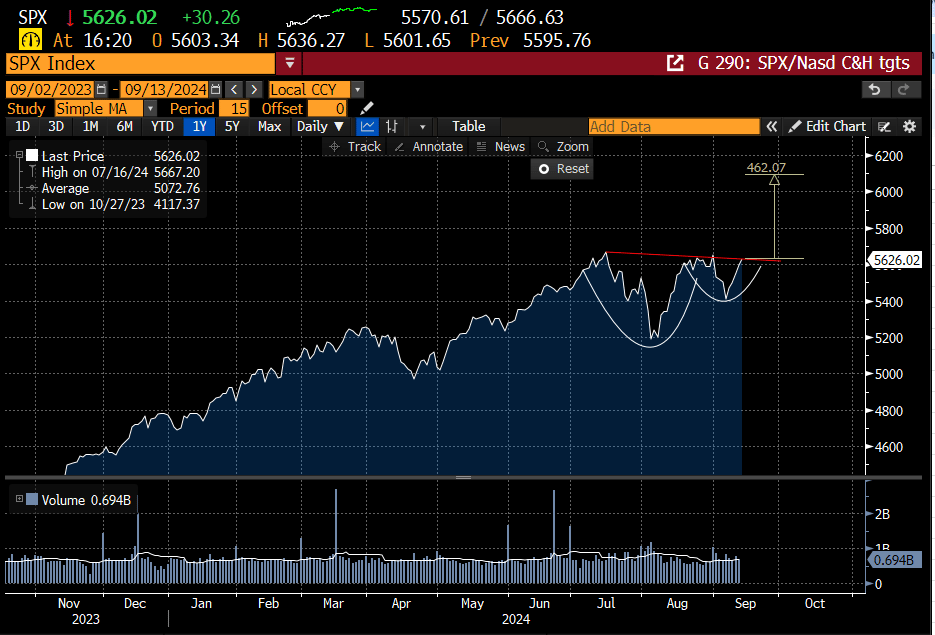

Here is the 10-day chart of the SPX. That’s almost a 9% move, only to end up where we started at the end of August.

We included this cup and handle chart of the SPX in our report at the end of August. Needless to say, we were a bit premature. Regardless, this potential is still very much in play. The measured move of this cup and handle pattern is around 6100.

After a short reprieve, the equal-weight SPX (SPW) is now approaching its ATH, which it forged at the end of August.

The weekly chart looks like a normal bullish consolidation in an ongoing bullish trend.

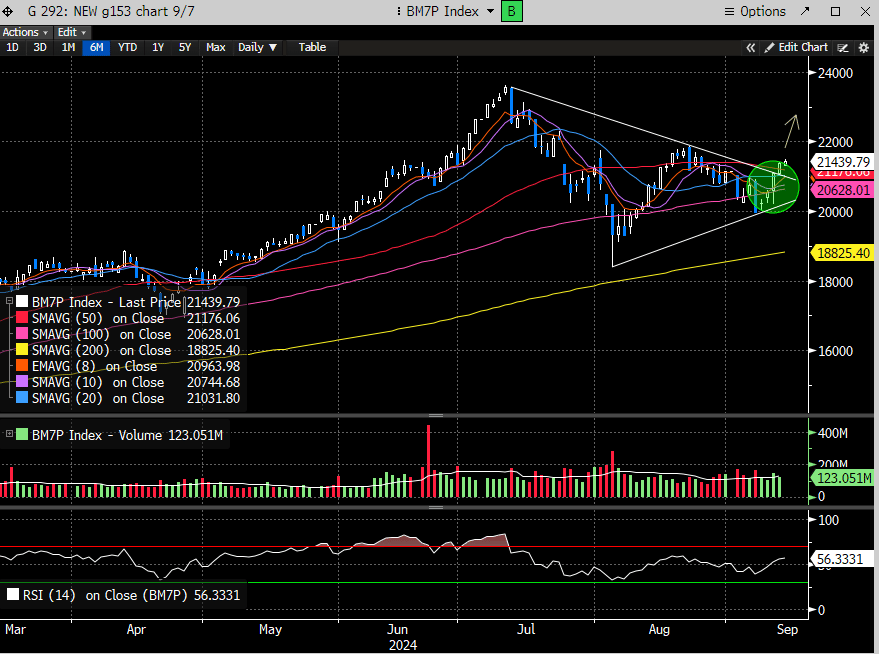

We highlighted the Mag 7 Index in our 9/11 report, discussing the likelihood of their resurgence.

And if the Mag 7 is breaking out, should we be bearish on the stock market? Likely not. The Nasdaq 100 Index just posted its biggest weekly gain since November.

Small caps stock took the baton Friday as the Fed Fund Futures increased the probability of a 50 bps cut at next week’s meetings. The Russell Small Cap (RTY) closed up almost 2.5% on Friday.

The probability for a supersized cut has now doubled from the prior week to 62% from 30% last Monday.

A potential disappointment looms for the FOMC if they opt not to cut rates by 50 bps, which could dampen enthusiasm for the Russell 2000 (RTY). However, a dovish 25 bps cut is still expected and should help keep the stock market buoyant. Gradual rate cuts are preferred, and a larger-than-expected cut may unsettle the investment community, raising concerns that the Fed might be seeing deeper issues in the economy than what’s currently visible.

The FOMC is one of several central banks meeting this week to address interest rate policy. Among them, the Bank of Japan (BOJ), meeting Thursday is particularly significant due to its influence on global liquidity. A strengthening yen could force further "carry trade" unwinding. There's a growing expectation among investors that the BOJ may signal a rate hike. The Japanese yen has recently hit fresh lows, even lower than the levels noted in our last weekend report and those from the August selloff. As the yen nears a key pivot, further declines could lead to heightened volatility across global markets.

The Nikkei Index has been struggling to reclaim the white gap window/200-day region but has seemingly found a floor for now.

This sets up for a potentially very turbulent week during one of the most notoriously difficult weeks of the year for the stock market. Here is a study by Wayne Waley that discusses weekly performance. In the last 50 years, the upcoming week is 16 for 34, with an average loss of ~1%. This doesn’t guarantee anything, but the probability is against the bulls, and given the current 5-day win streak, some volatility this week into major market-moving events should be expected.

This week’s events could fuel further bullish momentum, as a supportive Fed typically benefits the stock market—provided a recession isn't on the horizon. In uncertain times like these, it's often wiser to take a more cautious, wait-and-see approach to capital allocation.

Let’s examine the charts.