Quick housekeeping item. We apologize for not issuing a mid-week report. We were traveling in Las Vegas for the RE+ Solar Conference and hackers debilitated the Wi-Fi for large parts of the city. We were unable to log into our Bloomberg application for more than a few minutes without being disconnected. Subsequently, our return flight was heavily delayed on Thursday night, and we didn’t have enough time to issue a report.”

“To be or not to be, that is the question,” a famous Shakespearean quote from Hamlet, comes to mind when we ponder about the FOMC’s next interest rate move. This week we will hear from Powell and Co, to deliver his interest rate decision, for what is sure to be an overhyped event. While we did see some acceleration last week in the CPI (as we posited in our last Macro Report), was it enough to pull Powell forward with his intentions to keep rates steady? We’d argue no, as Powell rarely likes to rock the boat. But as the media always does, they will overdramatize the event to scaring every one of the possibilities of another hike. They will litter in commentary that the back half of Sept is the worst 2 weeks of the year for the stock market.

The issue we have with these statements is that they have been beaten to death over Fintwit and the Media. Everyone is aware of these facts and is positioning for this supposed drawdown into the end of the 3Q. We are not here to tell you that it won’t happen, we honestly have no idea. Surely, the stock market will see quite a big step down should Powell decide to surprise markets.

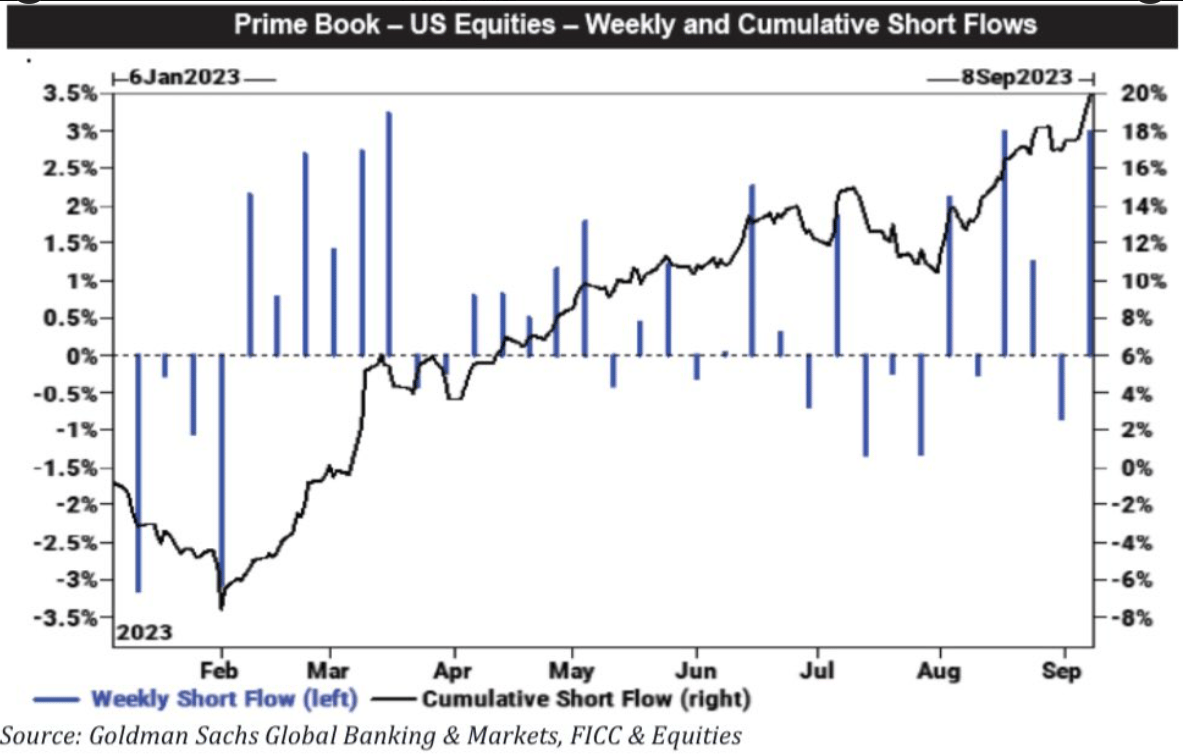

Positioning for hedge funds being short into September is exploding. Since when does the market ever reward the masses for piling into the same trade? Rarely in our experience.

According to Ned Davis, during pre-election years, the cycle actually is positive into Oct and then remains choppy into the end of Nov before lifting in Dec. We think cycles are important and shouldn’t be ignored.

We know if the economy falls off a cliff into next year, the chances of a Biden re-election are not good. So why shouldn’t we think that Powell has to be a bit more careful from here on out, as to how far he wants to push the needle? We think being cognizant of this tailwind is important.

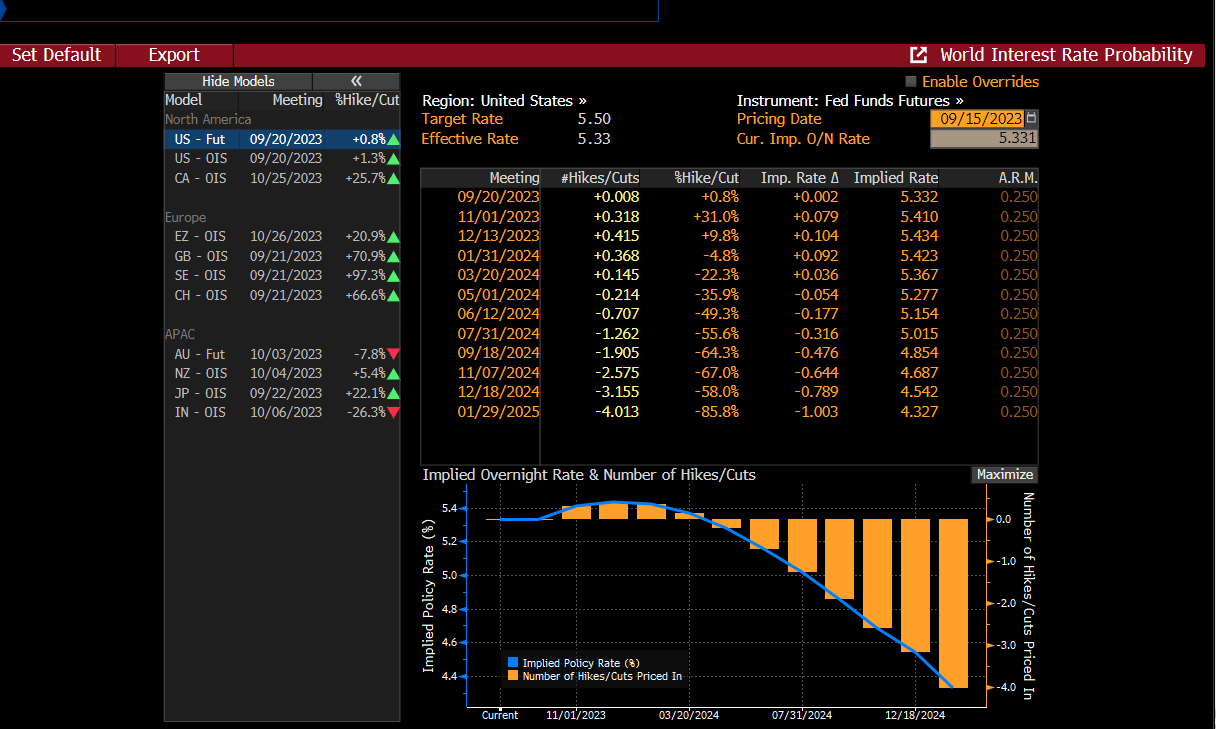

Fed Fund Futures actually agree. Nov and Dec rate hike expectations have dropped since the CPI/PPI was reported last week. By Jan ‘25, the bond market is forecasting a 100% chance of 4 rate cuts.

Current Macro economic data is supportive of a resilient economy in the face of all the rate hikes. Are there pockets of weakness surfacing? Certainly, housing is one of them. But as we have written about previously, most of corporate America and consumers are not as impacted by the higher rate regime. This explains the lack of job losses and fall off in personal consumption trends. Certainly, this can change should the Fed continue to press their bets, but we do not think the current administration will support it. This means that the hiking cycle is likely finished.

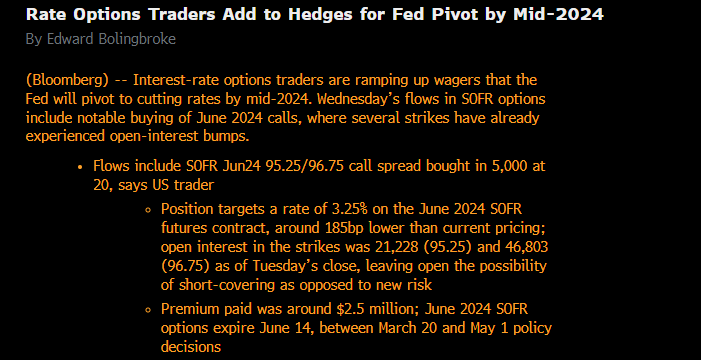

There have been some fairly notable SOFR (Secured Overnight Financing Rate) option trades for notable cuts next year, as well.

It’s possible that these traders are hedging for a recession in ‘24. We are not economists so we will not opine on that possibility, but we do think any whiff of increased weakness in the macro and the Fed’s hand will be quick to assuage the administration, who cannot afford a recession.

Bloomberg economists do agree with us that the notion of the Fed being done hiking is high:

Putting the Fed aside, when we consider the stock market, we always have a watchful eye on other markets and instruments, as the narrative around what’s driving stock market anxiety is important to consider when thinking about inflections.

For the last 2 weeks we have been in print discussing the 3 largest factors driving the stock market narrative: Oil, Treasury yields, and the $USD.

All of these instruments did not ease concerns for stock market bulls last week as they all appreciated.

We believe short term direction for the indexes will be driven by how these instruments trade. Treasuries and the $USD could see quite a bit of action with the FOMC this week, but again, that will be determined by the messaging and actions of Powell.

Last week we painted a picture for bulls to think about as we head into next year. This doesn’t mean we are bullish; we are simply presenting an argument to think about. As always, we remain agnostic, and only call it like we see it. Does that mean we have a strong opinion every week as to how things will unfold? Absolutely not. The stock market is a complicated animal, with lots of conflicting moving parts affecting it at any given point. We let price be the arbiter of our fundamental bias, supported by 100’s of indicators we track. We look for confirmation before acting aggressively, and sometimes that means we need to be extra patient and let the solution reveal itself. This time is no different, and fighting the stock markets internal conflicts is a battle we don’t want to engage in. Sometimes this means to be overly patient, trade smaller, with less exposure. Put simply, not every week has a fat pitch.

That begs the question, is that fat pitch set-up upon us?

Consider subscribing below to read our take.