You have to admire the stock market's resilience. In our mid-week report, we anticipated some weakness following the NVDA earnings, viewing any dip as an opportunity to be seized. While the SPX and Nasdaq futures initially pointed to a soft open on Thursday, overnight trading reversed course, and the market showed surprising strength by midday. However, a late-day sell program quickly pushed the major indexes lower, ending the session down. Welcome to late August, where thin liquidity and end-of-month maneuvers can dictate the market’s direction.

The vocal bearish community was out in full force on Thursday, forecasting much lower prices while ignoring simple market health indicators. Beneath the surface, Thursday's action showed unusual strength, with robust breadth readings. These bears tend to overlook critical details, focusing solely on index prices to fit their narrative.

For weeks, we've been highlighting that breadth metrics are strong, and while some may appear overheated, the underlying broadening of strength is a bullish leading indicator, not a bearish one. This is why we've been advocating for an opportunistic approach on dips. While those dips didn't lead to significantly lower prices, they were still present intraday if you knew where to look.

Most investors are trained to focus on large-cap tech stocks, but as we've been saying, we see them as a source of funds to fuel SMID cap rotation.

Here's a chart comparing the major indexes to the equal-weight version of the SPX—the Mag7 Index underperformed by over 100 basis points last week.

And recall what we said in the 8/28 report:

“…the most crucial aspect will be how the market finishes the week. Daily trading can be quite volatile, so the difference between where we trade tomorrow and where we close out the week will be more telling…we should see support emerge at the levels we’ve identified, potentially setting up a more constructive weekly outlook than what we’re seeing after hours today.

As noted, most of the damage to the indexes occurred in the overnight futures, which had already turned green by Thursday morning. In a bullish market, buying opportunities are rarely handed out patiently, often resulting in forced chasing.

While the major indexes didn't show significant movement this week, they closed with strength, finishing at their highs for the week. There is little bearish about the SPX structure; it is displaying a typical, bullish consolidation after a strong rally from the August lows. The SPX now sits just 21 points away from an all-time high.

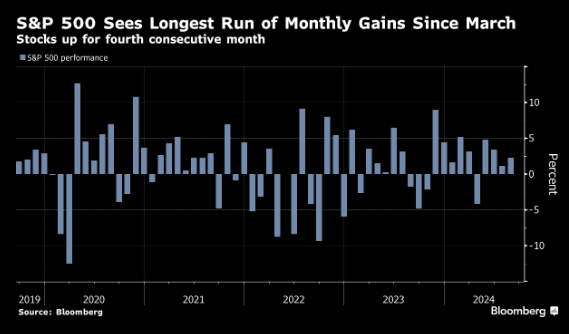

Despite what initially appeared to be a challenging start to August, traditionally a tough month, the election year seasonality window we’ve highlighted throughout the summer proved its merit, with the SPX closing out the month with a +2.3% gain. Remarkably, major asset classes have been highly correlated, resulting in four consecutive months of gains for treasuries, stocks, and high-yield bonds—something that has never happened before.

While we’re enjoying this bullish momentum, it's worth noting that seasonality typically turns negative in September, particularly in the second half. This is important to keep in mind, especially given how accurately the election seasonality trade has played out so far this year.

September is typically a tough month for the stock market. Since 1950, the SPX has generated an average loss of .7% in September. The last four September have also been notably weak, with the index posting respective declines of 4.9%, 9.3%, 4.8% and 3.9%. As mentioned above, the 1H tends to be okay, but the fireworks begin in the back half. The timing is interesting as it also aligns with the September FOMC, which is setting up for a sell-the-news reaction.

Given the SPX is on a 4-month win streak, some digestion is certainly in order.

But nothing is written in stone. The recent macro releases have had far less impact on the market and have only strengthened the case for rate cuts starting in September. The PCE report on Friday showed a mild uptick (.2%, which was expected), while personal spending picked up, but income growth was more sluggish, with the savings rate declining.

Most importantly, the report strengthens the case for unwinding the restrictive rate policy. The 2/10 curve is now approaching neutrality. We interpret this as a return to normalcy, but the bears will surely use it in their narrative to explain any dislocation in September.

The stock market is constantly flooded with opinions on how the future should play out, but those opinions are often misguided. Our approach relies on confirmation through price action, and until there is clear evidence of a breakdown, we assume the prevailing trend will continue. This methodology has served us well, consistently keeping our clients aligned with the market's direction.

Our analysis is designed to help our readers make better decisions with their capital. When is the right time to invest, and when is the right time to be defensive? If you struggle to answer this question, or you want a guiding hand to help you make better decisions, consider becoming a premium member.

We will be raising prices for our extremely undervalued newsletter next week. Prices will increase by 20%. Lock in the low rate today!