A few weeks ago, we started writing about the 3 biggest issues facing the stock market, and penned them the 3 horsemen (Treasury rates, Oil and the $USD). We very clearly have been advocating caution until these show signs of a weakening trend, or some sort of reversal. Unfortunately, outside of a few intraweek reversals, the dominant trend remains in place for all 3. And since expressing caution this month for the equity market, the indexes have been getting hammered.

In our mid-week report, posted the day of the FOMC decision, we discussed that treasury rates across the curve were at decade highs. This makes for a very difficult environment to be long risk as the alternative to risk is a very attractive 5% risk free return on treasury paper. The equity risk premium is the extra return that investors expect to return from an investment based on the additional risk, or in this case the comparison between the risk-free return (treasuries) and the return of being invested in the stock market. That premium has been shrinking, and thus for a large swath of investors, the added risk of investing in the stock market for a potentially marginally better return, are not warranted. This is part of the FOMC’s plan, to reduce speculative investing, whether in the stock market or in the economy. Speculative investing with a low cost of capital, is much easier to earn a satisfying return with a lower margin for error. When that cost of capital increases, the investment rate of return hurdles become higher to attain, and thus result in less speculation or activity. The same phenomena exists at the corporate level, when considering investing in their business. Higher cost of capital becomes a deterrent and projects gets shelved. We can anecdotally attest to this as one of our businesses are involved in development and construction, and we are seeing project cancellations as a result of higher borrowing costs. We are also seeing banks unwilling to lend in the higher risk segments of the market. Again, this is what the Fed is partly hoping to achieve, a slowdown in economic activity, resulting in a slowing in hiring trends and even higher unemployment, ultimately allowing the inflation genie to be put back in its bottle.

Unfortunately, the Fed has been unwilling to achieve this in mass, as businesses are reluctant to let go of workers, and arguably are somewhat immune to higher borrowing costs (something we discussed in a previous report). Sure, we are seeing pockets of weakness in the economy that are being disproportionately impacted by higher borrowing costs, most notably those that are directly correlated to higher costs of capital, and most specifically, in the housing space.

Housing starts are now the lowest since July 2019:

And housing affordability continues to make new lows:

Higher borrowing costs also impact consumer spending which is 70% of US GDP.

Revolving credit continues to explode.

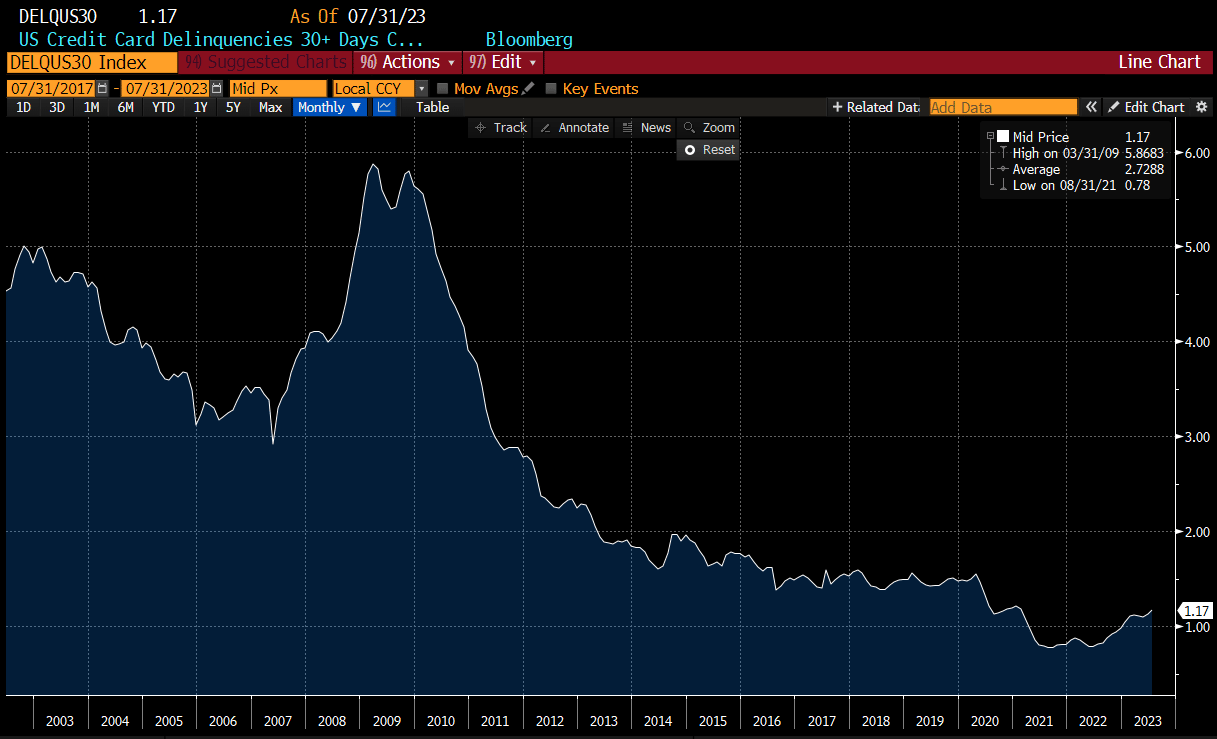

And now delinquencies are starting to trend higher, but still a long way from the mean. Does this imply that a day of reckoning is upon us as a wave of defaults is inevitable? It’s possible, but for now, sensationalizing this delinquency trend seems a bit misplaced.

And here is the latest quarterly charge off data which shows a rising trend but still nothing alarming. Again, this is certainly a concern, and undoubtedly will get worse, but still within the range of what’s normal.

But we must not dismiss that credit card tightening standards are getting elevated, and approaching levels seen in prior recessions.

We are not economists, and we can certainly paint a picture where the economy can escape a recessionary period, but it is becoming increasingly difficult to believe that a drastic slowdown won’t eventually be achieved given the persistent rate cycle pressure on consumers and businesses. The Fed is trying to thread a needle whose opening keeps shrinking.

Bloomberg economists are now forecasting a mild recession by the end of the year. Official designations of recessions are not delivered until after the fact by the National Bureau of Economic Research (NBER), regardless, the stock market is a discounting mechanism and will reflect this reality much sooner than what’s being reported.

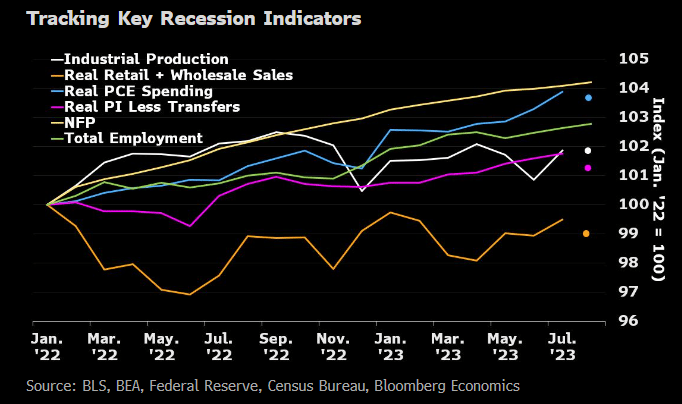

Here are the 6 indicators they track to determine whether we are in a recession:

While not all of these are starting to turn down, Bloomberg thinks we will see retail spending, industrial production, personal income and personal consumption dip in the next reports.

*Retail and wholesale sales are already off their peaks and likely to keep trending lower.

*Personal spending and income have been resilient, however softening wage growth and the end of the student loan moratorium certainly create headwinds.

*Industrial production is a source of concern

The bright spot for NBER indicators, payrolls and employment have been stalwarts but the UAW strike could change that and might even produce a negative payroll number. Couple that with the threat of a government shutdown, and payroll trends will likely be challenged into the end of the year. Undoubtedly, this will add further pressure to consumption trends.

The issue facing the stock market isn’t that the economy will see a step down in growth if a recessionary environment reveals itself, but how long that period lasts.

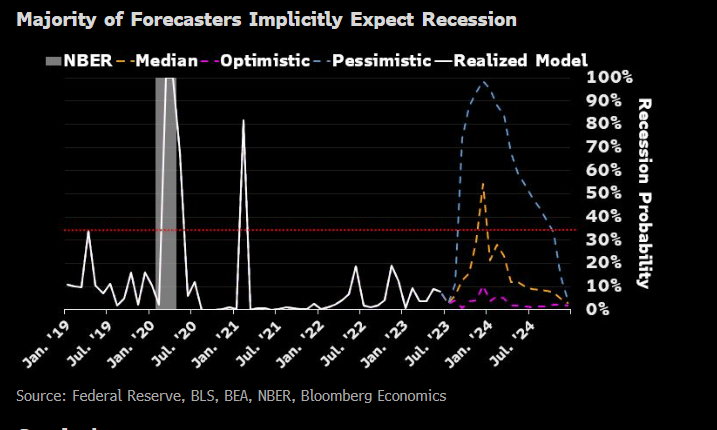

This is a chart from Bloomberg discussing 3 probability outcomes, with the median forecast of +50% for a recession to begin by the end of the year.

But notice how quickly the recession recedes with the sharp spike and an equally sharp spike down. They believe that any recessionary period will be swift.

To us, the point of this exercise is not to make some broad conclusions about where the economy is exactly headed, but to paint a realistic picture of how to think about the balance of the year. As we stated above, the stock market is a discounting mechanism, and if we are entering a recessionary period that is swift, then the recent stock market malaise is discounting the slowdown currently and likely will rebound as quickly as it fell apart. But if the slowdown is more pronounced and lags into next year than the current downcycle in the stock market will likely be maintained until estimates for next year are adjusted low enough to warrant market participants to re-enter.

We are not here to decipher all the macro data to make big determinations about where the economy is headed, but mainly to profit from the ensuing price action. If the stock market is going to bet on a swift recession and rebound in ‘24, we will be one of the first to advocate an aggressive long position. If the aforementioned latter scenario were to unfold, we will avoid being aggressive on the long side and be more tactical. This is the beauty of our system; we catch the trends before most participants, and we know when to sit out the chop. We have largely been avoiding the stock market since the end of July, outside of tactical positioning, which has served us well. We will continue to monitor our signals rigorously to determine the next move.

Which is….reserved for our premium subscribers.