What a week in the stock market and quite the week for readers of our newsletter. Not only were we bullishly positioned for the move on Friday, but we suggested buying the dip on a potential gap down post a hot jobs report.

Did it play out exactly as we had hoped? Of course not, but precision in the stock market is non-existent. This is why we have multiple plans with different scenarios to consider.

Let’s review some of our conclusions on our Weds night report.

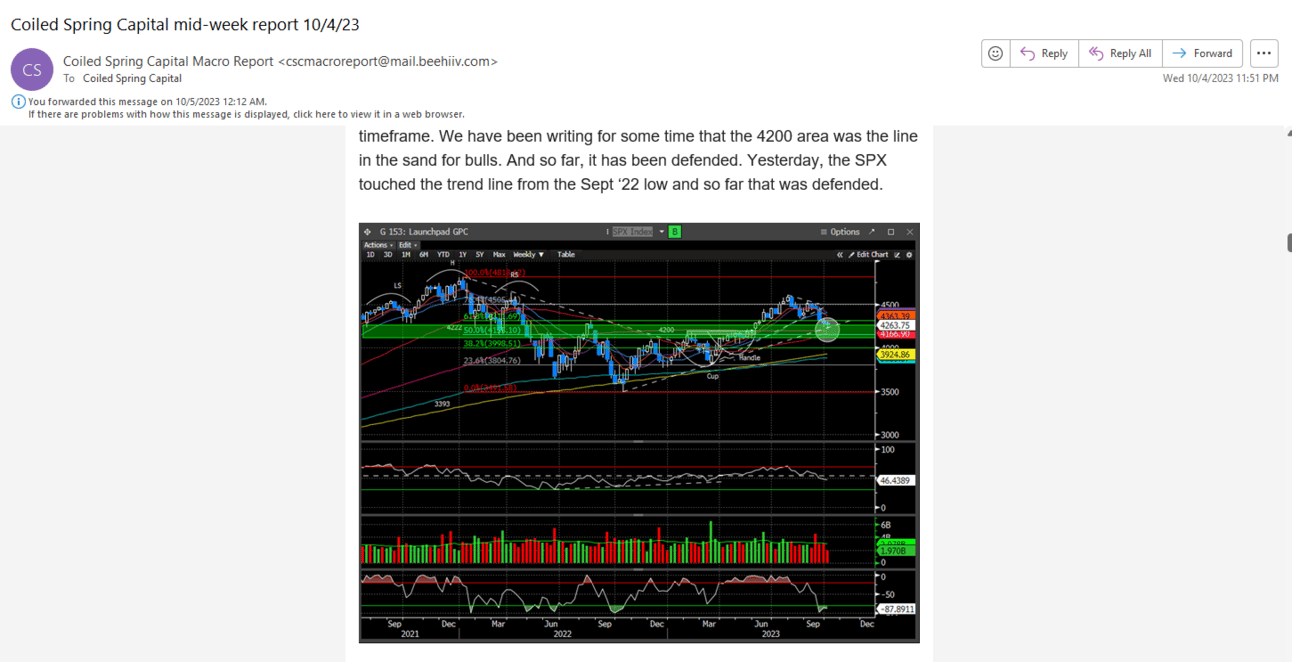

We highlighted the SPX weekly UTL from the Sep low as an area of confluence that possibly could break if the payroll number came in too hot. The payroll number did come in hot, but this UTL held its ground. 4200 remains the line in the sand for the bulls, which was also defended on Friday with a low of 4219.

Here is the excerpt:

We were wrong in assuming this area would break with an overthrow reaction, but we were correct in calling for a recovery post the gap down.

Here is the excerpt:

And here is our conclusion from that report:

“we are comfortable starting to add back some capital here with the caveat that more turbulence could ensue, especially if rates continue higher. We would be a little careful being overexposed to Friday’s payroll as it could produce some more volatility. That said, we would likely buy that dip.”

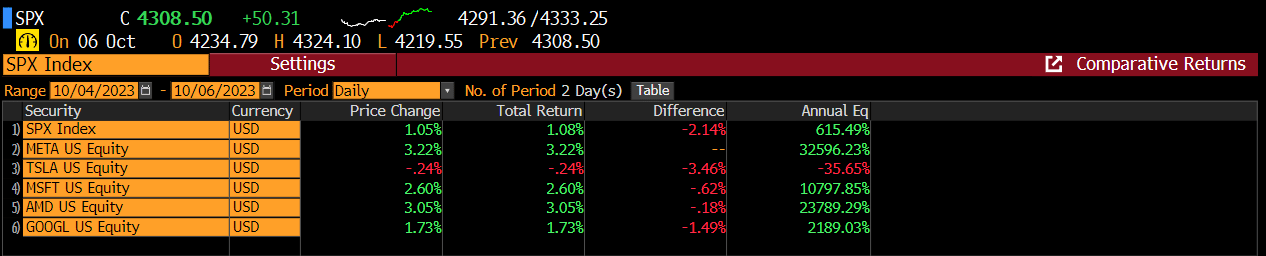

In that same report we highlighted large cap tech as place to consider for longs. This is how those ideas fared since that report when comparing returns to the SPX:

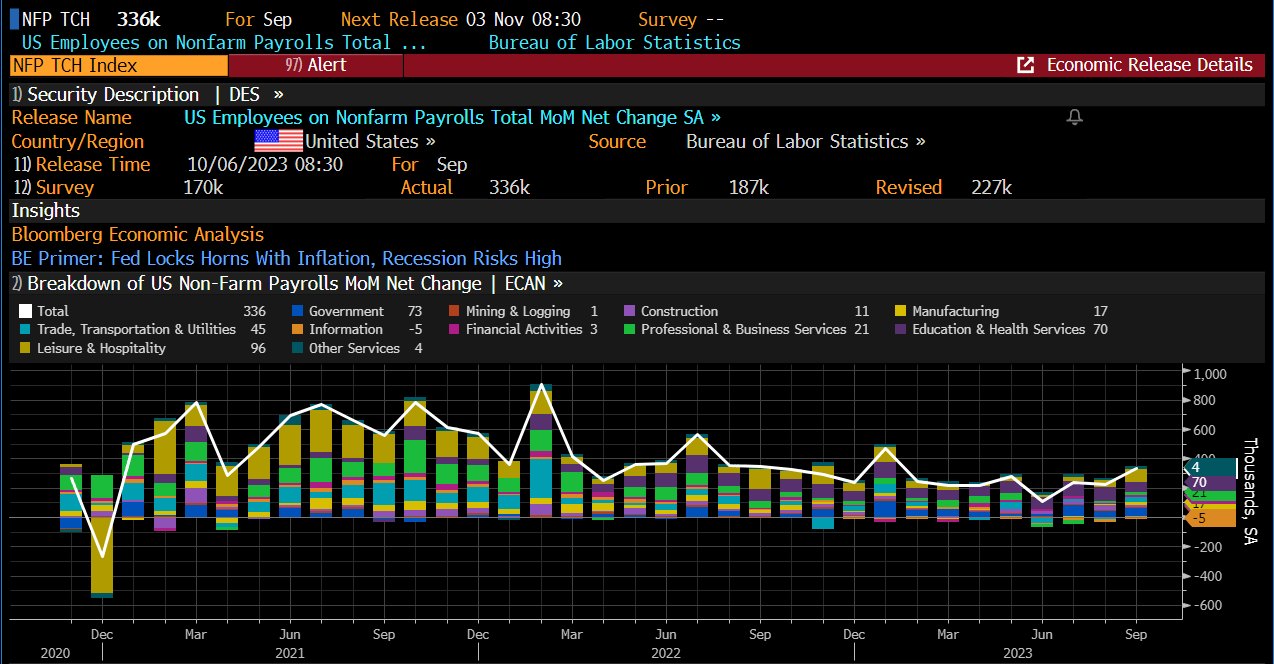

Let’s dissect the jobs number and why the market reversed the initial Friday slide. For one, the market was anticipating and pricing in a hot number. The slide from the middle of Sept in the stock market has been relentless. There are many reasons to consider why this happened, but certainly an overheating economy in the face of excessively high yields is at the top of the list. The employment numbers and revisions were substantial and way above the estimates.

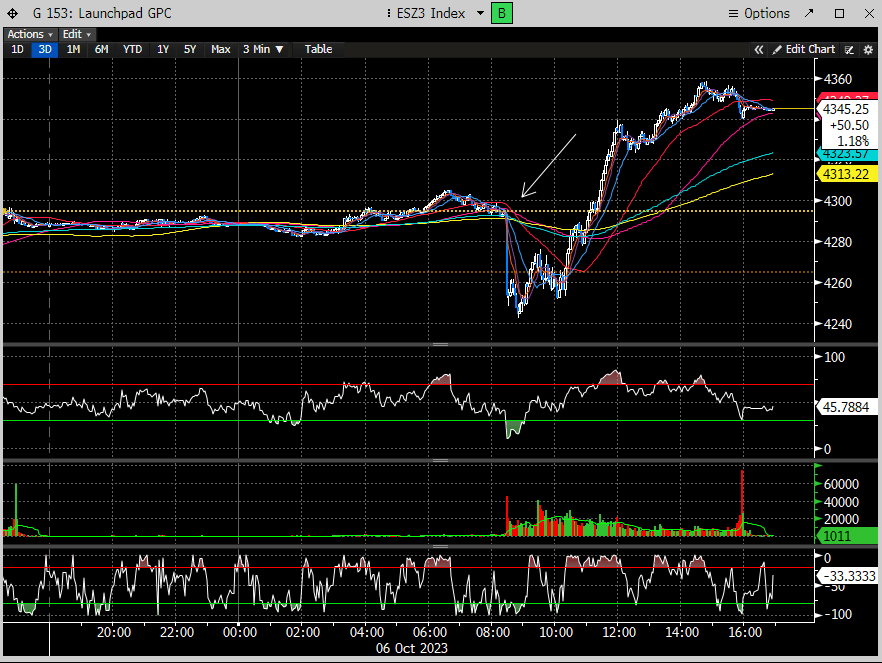

The futures reacted as expected they would with quite the nosedive.

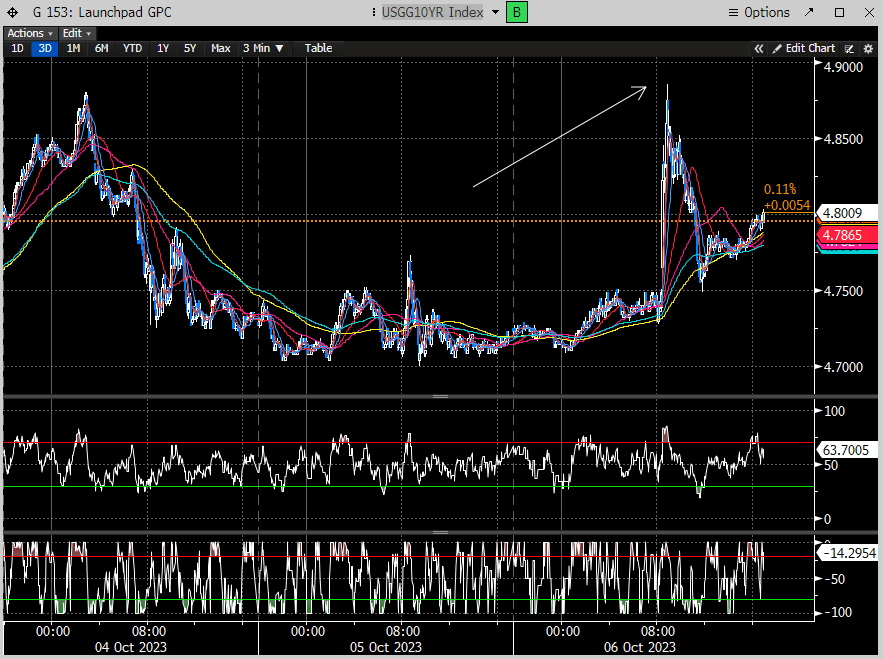

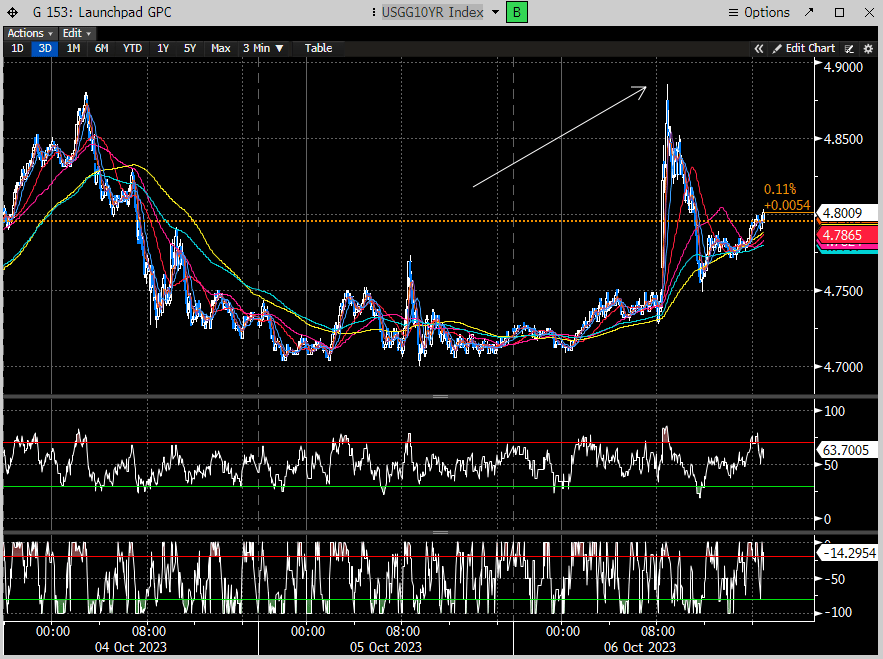

Which also sent LT yields higher with the 10 year yield topping out near 4.89%.

And the 30 year topping out over 5%.

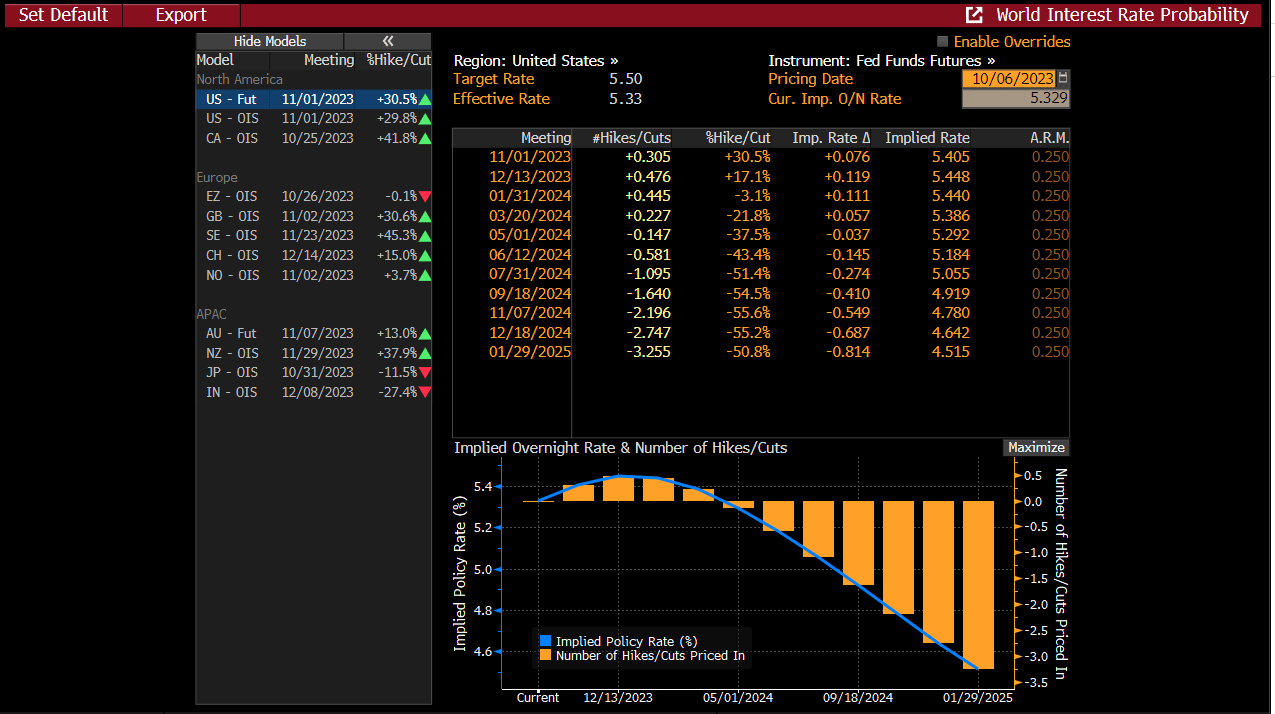

This has inherently caused the rate hike forecasts to increase as well with the probability of another hike by year end jumping back close to 50% from less than 40% before the payroll report.

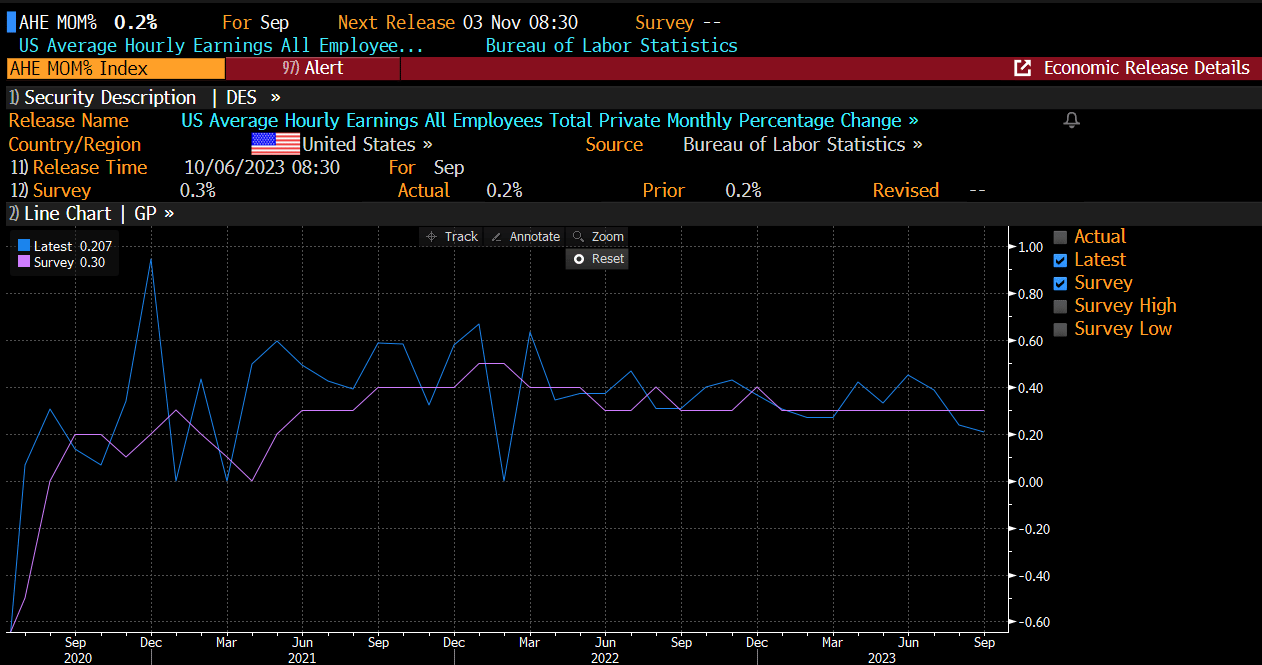

The sobering reality of the employment report was that wage growth has ground to a halt, posting a miniscule .2% growth for the 2nd month in a row, and only +4.1% compared to the year prior.

The key takeaway is that the economy remains strong with aggregate demand expanding. According to BCA Research it would take much smaller gains of 105K per month to lift the jobless rate to 4%, and in line with the Fed’s median projection. This still doesn’t solve the problem of increased demand with the additional jobs, which is a component of inflation. BUT, wage growth is a leading indicator, so the positive reaction in the stock market does makes sense.

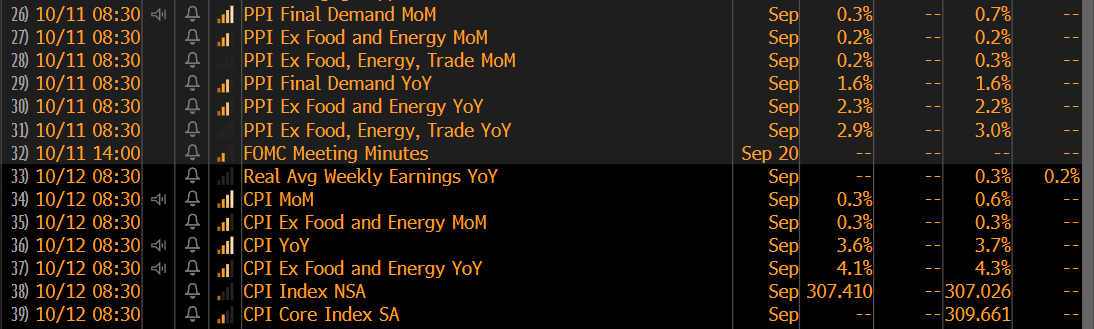

The next big macro news will come from the Fed Minutes on Weds, although we suspect very little change in what’s already been contemplated. More importantly, the PPI/CPI on Weds/Thursday has the ability to rattle markets. Too hot could be the spoiler for Friday’s rally to sustain. Here are the estimates:

But what we think will trump the macro, is the upcoming earnings reports. We wrote back in July that 2Q could be the last good Q as comparables get less easy and we are 3 months further into the Fed tightening regime.

The other issue we see is that earnings estimates have been running in the wrong direction. We like to see them get cut into earnings as it sets up for an easier hurdle to overcome. This was occurring in July, but this time around, earnings estimates have been increasing. Third Q profits are expected to rise by .05%, with some expectations of a beat, much like they did in the 1st and 2nd Q’s of this year. A disappointing earnings season may squash any hopes of a year-end rally. This certainly sets up the market for a stumbling block should the market rally into the heart of earnings season. Earnings start getting reported this week. At the very least, we should expect some volatility around these events.

As if we needed another reason to expect volatility, the events over the weekend in Israel are sure to create some fireworks. At the very least we should expect a significant rebound in oil, which is one of our “Three Horsemen” indicators.

More on that below and the current week’s stock market set up.

Subscribe below to read the rest of the premium content.