For all the incessant bearish banter every time the stock market nosedives, what do the perma bears calling for a crash have to show for themselves?

Quite the opposite turn of events. Last weekend we suggested that sentiment was simply too bearish, and when everyone is in the pool expecting a crash, prepare to be surprised.

From last weeks’ report:

“Everyone is bearish and positioned for a collapse and rarely does the herd get rewarded.”

Why we are showing this again? Because those that fight the market when sentiment is so lopsided are asking to get steamrolled. The stock market is a complicated mechanism, and when everyone is bearish, and positioned for a crash, this implies the downside has largely been contemplated in the market. We are not suggesting that some exogenous event can’t knock the stock market down if everyone is positioned for such, but the probability of those types of events are low. In fact, we did have bank contagion fears enter the market, but the Fed stepped in quickly enough to thwart any spillover. Do we think the fallout from last month’s bank issues have largely evaporated? No! We think the reverberations from bank contraction could come back to haunt the economy over the next 6 months and at the very least, will cause more volatility. But for now, the stock market believes the Fed has its back.

What most strategists neglect to discuss is that the banking crisis, for all intents and purposes, was a bullish event. Why? Because it forced the Fed to back off its rate hiking campaign. What if the Fed back stopped the contagion, inflation continues its downward trajectory, and we are at the end of a rate hiking cycle? That seems like a bullish set up for the market. This is why tech is outperforming. Rate hikes are in the rear view and inflation is moderating. This is the very opposite of what impacted tech valuations last year.

This is a chart of the PCE (Fed favored inflation metric), which was reported last week. The trajectory is very clearly down. Is it stubbornly high? Yes.

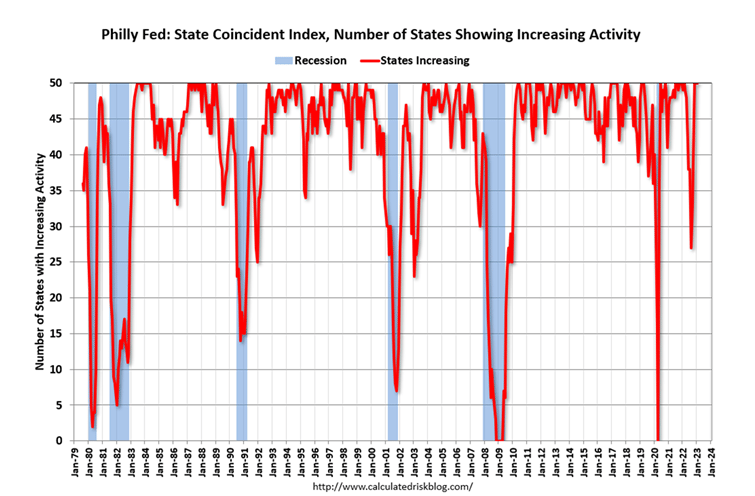

Here is a chart showing that the individual state activity is actually increasing. Typically, this sort of dip in activity leads to a recession before it recovers, but in today’s case it has bounced meaningfully, yet no recession.

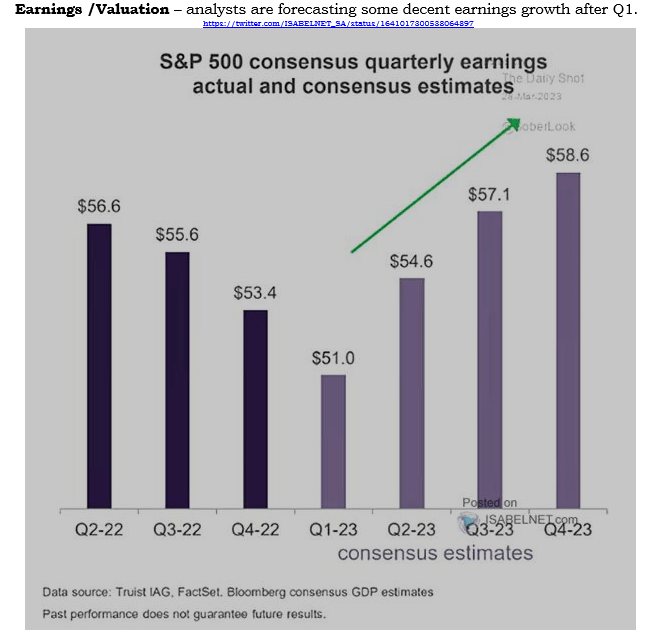

Here is a chart of SPX earnings estimates for the next 4 quarters, including the one we just finished. Earnings estimates for this Q continue to come down, which means the hurdle to beat them is much easier. Also notice that the estimate for future Q’s is on the rise again. Stocks simply do better when their earnings trajectory is moving higher.

Here is another way too look at earnings growth Q/Q. Q1 is a low point, with the next 3 Q’s showing acceleration.

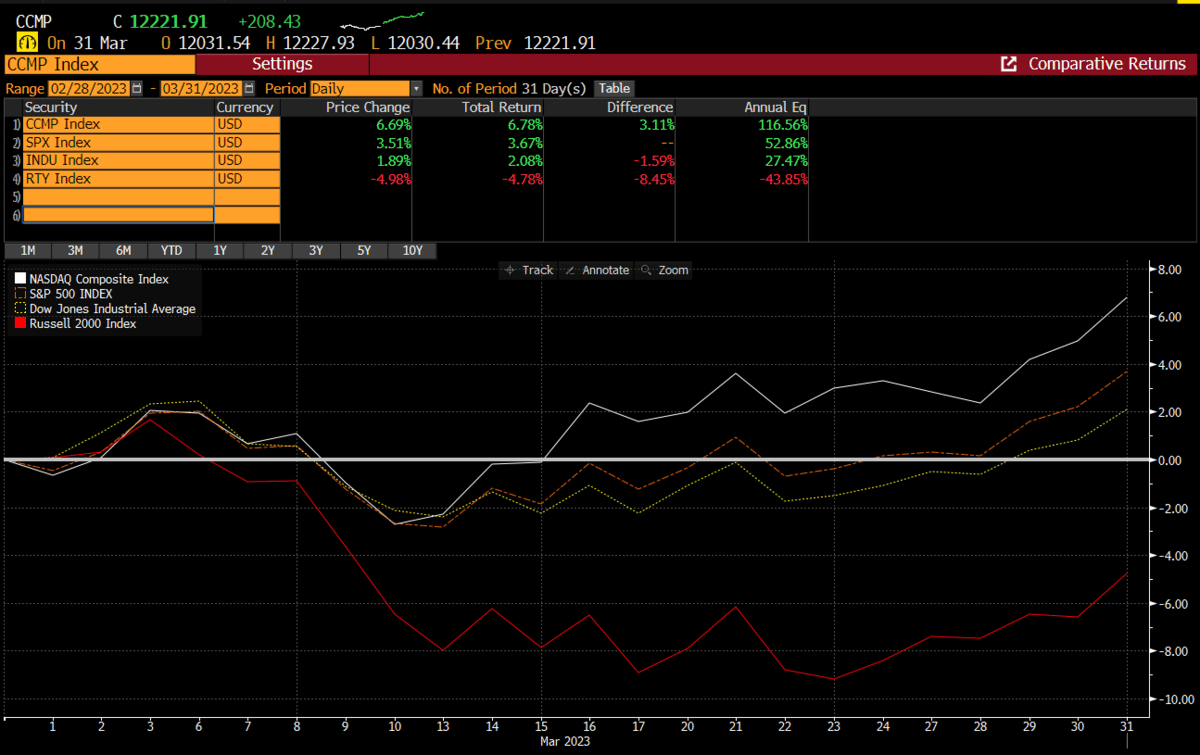

The index strength last month surprised the masses, including us. March turned out to be robust for growth and awful for the Russell (small cap). The Russell is where the small cap banks reside, so underperformance is to be expected. Typically, bulls want to see some sort of alignment within the indexes, and the Russell being the outlier would normally throw up caution flags. But given the circumstances, this can be explained away, for now.

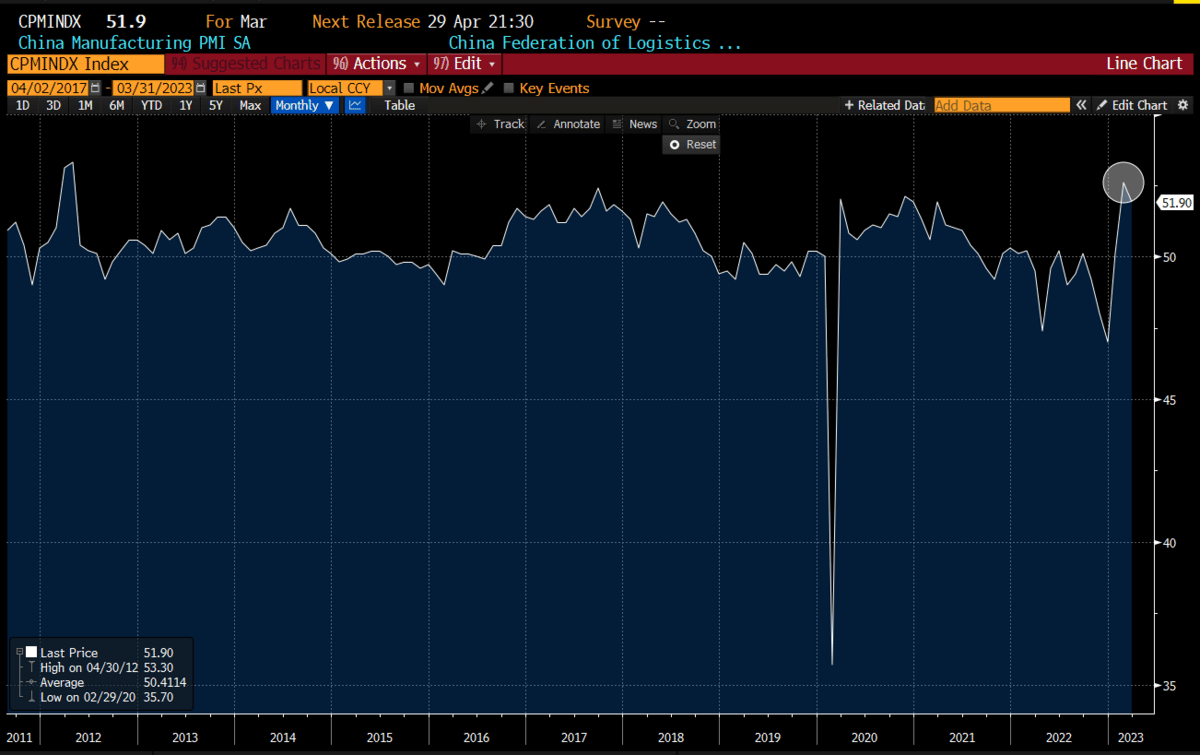

Chinese PMI’s are expanding brisky. It’s no surprise that when the Chinese engine is humming, it is a boon for global industrial production. While the US is slowing and Europe is having issues, China growth can mitigate any slowdown domestically. This is another reason why we have been bullish on China growth names.

We have identified a few Chinese stocks leveraged to their expanding economy. We will add a few more in this report. We initiated $BABA 2 weeks ago and is now up +22%.

Consider becoming a premium sub below to read more of our analysis and new idea suggestions.