Over the last month, the chord from the stock market bullish camp has been loud and obnoxious. It's always a good tell when the volume is high from people who do not agree with our views. We stuck to our guns, as the market was overheated...so we thank you.

Our call the last 2 weeks was very publicly cautious. We even wrote in this newsletter that we started shorting the market and exiting long exposure. This all occurred around 4250 on the SPX. We even suggested to our premium members that any short trip to the 200 day was an opportunity to add to those bearish positions. If you took consideration to our drum beat of cautiousness, you saved yourself from a lot of pain last week.

Those that believed the Fed would pivot, were highly misinformed. There wasn't a shred of evidence for Powell to step aside from his hawkish rhetoric. Hope is not a strategy....

Here are some of our excerpts that we publicly posted on Twitter; all timestamped:

Since we posted, the RVX is +27% and the IWM's are down -6.6%.

Here is our VIX post:

We love people who tell us you can't do TA on the VIX. We have quite a bit of success historically, so we disagree. The VIX is up +26% since our post. Our Vix calls were up +65%.

Divergences?

OBV for the indexes were showing negative divergences, as posted above, and while divergences can last for some time, we take a weight of the evidence approach when examining 100's of different indicators for confluence. This was one piece of the puzzle.

We also read that some Furu's were saying the move in High Yield (HYG) didn't mean anything because spreads barely moved. Thats one dimensional thinking and why we disagreed. Here is that post indicating such:

When the mountain of newly minted bulls is screaming for an ATH melt up, shouldn't they be looking under the hood for confirmation or are they just sticking their finger in the air and guessing? We know the answer because the internals started rolling over 2 weeks ago. Here is one piece of evidence that we shared on public twitter:

And here is our favorite freebie that we offered out as a reason to be cautious on the markets. Did you listen to what the undercurrent of the market was saying?

We posted quite a bit more but for brevity's sake we will leave it at that. The SPX and Nasdaq posted its worst week since Jun and clipped our first targets. Conversely, we were bullish on Energy. Here is snapshot of that energy excerpt:

How did those calls work out?

SPX -6%, Nasdaq -7%, RTY -6%, Energy ETF (XLE) +7%.

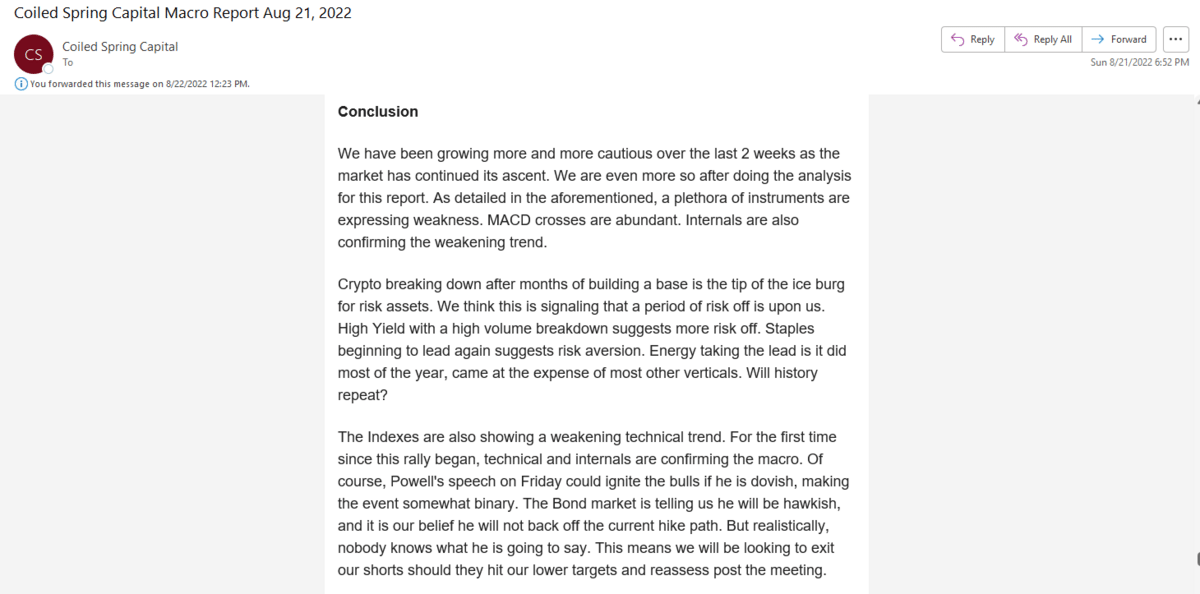

Our view last week couldn't have been more cautious. Here is the conclusion page from our weekly report published Sunday.

We will not be giving away the keys to the kingdom every week. If you like spending $100's/month on chart chasers, be my guest. For $19.95/month, we deliver 2-3 posts per week that are impactful and high conviction. There is no contract, so what do you have to lose?

To continue reading, please subscribe below.