We had some interesting FinTwit discussions this week where we ended up blocking a few people. We'll never understand the need for people to be inexplicably mean with little factual substance. We have always been humble in our approach, and attempt to dissect the many market machinations, synthesize them and deliver them in an easy-to-read format for readers to digest and use to complement their own process. Making directional bets in the stock market is one of the hardest tasks around, and undoubtedly one where everyone will be wrong a good portion of the time. If we were right 100% of time, we'd be writing this report on the deck of our superyacht in the middle of the Mediterranean. Alas, we are not. We think our market calls are predominantly correct but believing that every wiggle in the market should be called with precision, is simply not feasible.

That said, we have reviewed most of our calls over the last 2 months, and we've been right. Directionally, we pivoted right near the low in Mid Jun to get long for a trade into the 2 gap pivots of 3900/4K. We also mentioned 4150 as the next level up where the market could go if the rally had enough momentum. The market closed on Friday at 4145.

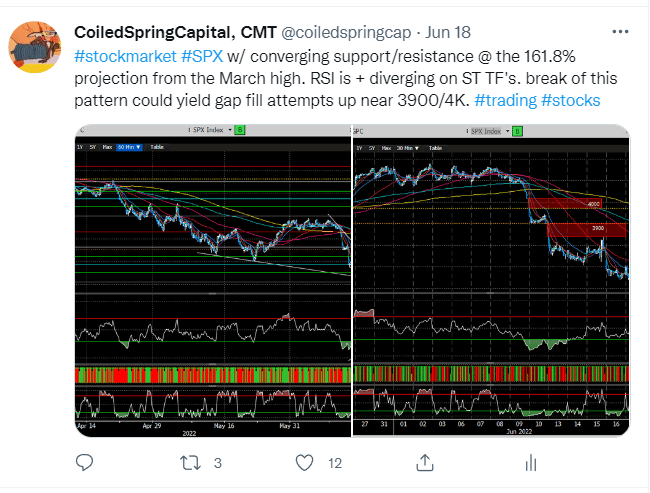

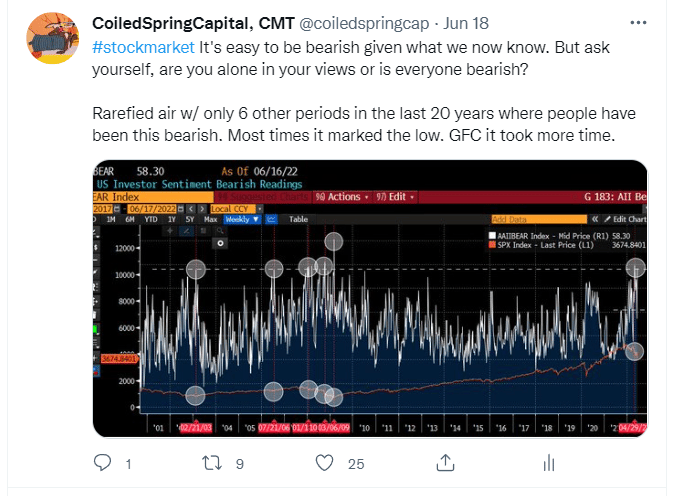

We wrote extensively in our report that week why we thought so but we even posted publicly on Twitter, which supported these views.

We also posted this chart discussing to consider long in this region for the IWM. The IWM is now up +17% since we posted this.

I'd venture to say most were running for the hills in Mid-Jun where we were advocating a long position. Here is another post from that same day suggesting that positioning was too lopsided....Everyone was bearish.

So now with the major indexes up considerably from our Mid-Jun pivot, what comes next?

Last week we saw employment scream higher, defying the Fed intentions to slow spending down. Jobs came in 2x what was forecasted. This certainly takes the Recession talk out of the equation, at least in the near term. Shortly after this reading, the Fed speakers came out in force talking about the Fed Funds rate target should be as high as 4%. The treasury bonds immediately sold off and the $USD ricocheted higher.

Last weekend's report we wrote that a DeMark 9 buy could post on 8/2 and it did. That marked the low. Now with propulsion up active with a target of 2.91%.

What's worse is the 2/10 year curve is now more inverted than during the GFC and approaching levels from the internet bubble.

Lots have been debated on whether this indicator means anything. Considering inversion has preceded every recession since 1980, we'd say it shouldn't be ignored.

Is it possible that the worst is yet to come? It's conceivable that this is the case as most of ensuing carnage from inflation and higher rates has not infiltrated most aspects of the economy.

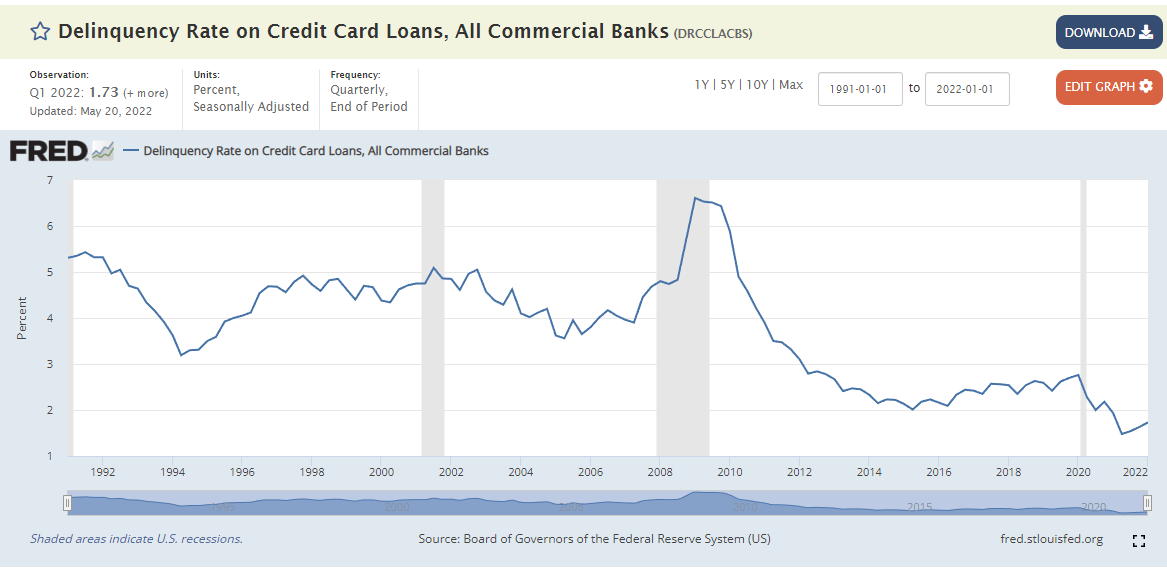

We've written recently about exploding Credit card debt.

But delinquency rates are still historically quite low...

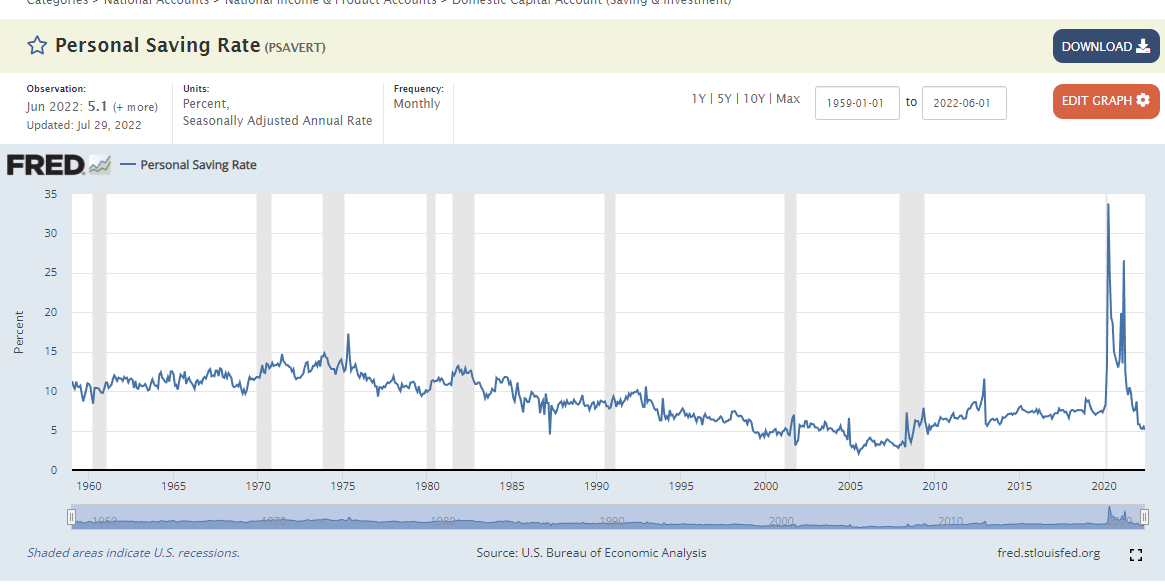

And personal savings rate is collapsing.

Put together, you can infer that the worse has not been felt yet by the consumer. The eventuality of higher rates, larger loan balances and the possibility of job loss next year could create some real issues for the economy.

We showed this chart last week of the Fed Fund Futures probability matrix. It now has probability of a rate cut in May of next year. This is later than where it was pre-jobs report.

The bond market believes the economy won't be bad enough for the fed to cut rates until later in the year. The curve inversion is screaming that growth is slowing, yet the Fed isn't being forecasted to take their foot off the gas. It's possible the market overcorrected the timing of the recession. This would explain why the markets had such an abrupt pivot from Jun. But that doesn't mean we are out of the woods. In fact, we believe it sets up more pain later.

Recall that this week we get the CPI. Ex-food and energy, the core CPI is forecast to be up .5% in the month and +6.1% yr/yr. Thats quite alarming and something we doubt will be taken lightly.

We've posted this chart below as well. It shows every CPI print since Nov and how the SPX did post the report. Can the CPI print shrink meaningfully, and the market rally? Sure, but it's not a bet we are willing to make.

Oil certainly is forecasting a larger issue. We highlighted in our weekend report this looked vulnerable on the weekly chart.

And voila...bear flag break.

It's possible this week we see a resumption of the downtrend in the stock market but likely will que off of the CPI print.

Remember, bear market bounces can look and feel as if the bottom is in. They are designed to suck in the most people at the wrong time. Here is an excerpt from Hedge Eye to put things in perspective. Can we still go higher from here? Of course.

For complete analysis of this week, please subscribe to our newsletter. You will receive 2-3 reports a week to measure and map the stock market and to help navigate the macro-economic picture. All for $19.95/month.