We remember posting a few times last year and earlier this year, that a possible treasury curve inversion was something the stock market needed to worry about and was setting up for a difficult period. The amount of push back and disagreement over those statements were loud and staunch in their rebuke. While we understand that no two inversions are the same, the odds of the stock market navigating unscathed, after a period of unprecedented monetary expansion, was unlikely and at best would be unpredictable and fraught with volatility.

We dug up one of our reports from Jan of this year where we highlighted this slide in our weekend report:

"The curve continues to flatten - breaking back below the dotted line could spark recession talks."

Interestingly enough this level was still far from the actual inversion. Look what happened after that fateful week. The curve was decimated and now has managed to fall just under -200 BPS, which currently stands at -77.

How has the stock market done since that 2/10 year inversion level warning we posted almost 12 months ago? No surprise but NOT GOOD!

In that same report, we reviewed some of our internal measures which were clearly signaling to get defensive and to sell into any strength, especially since the FED seemed hell bent to raise interest rates to curb inflation. Here is a portion of that report's conclusion:

Were we perfect in our assessment that the market would horrendously come unraveled the way it has this year? Of course not. But our work was telling us to be very cautious as the picture was certainly becoming murkier.

In Feb (see excerpt below), we also wrote in our report that FTM (forward 12 months) multiples for the index were too high, and assuming an average multiple would imply at least 3700 on the SPX. In Feb the SPX was trading above 4300 and reached a low in Oct at 3500.

In the current landscape the talk of inversion is widespread and is no longer a mystery; so, what should we expect going forward? Remember, the biggest stock market concern during inversions is the actual re-steepening of the curve. This is when the market realizes before the Fed, that they have overtightened and are about to start cutting short term rates. This has not occurred yet, but are we close?

Here is the 2/10 year curve which seemingly looks like a falling wedge possible break. These patterns are not precise so we must take that into consideration before drawing too many conclusions. That said, if we deploy a simple RSI and MACD overlay, we can see that these lows are coming on +RSI divergence and the MACD is crossing up from on oversold level.

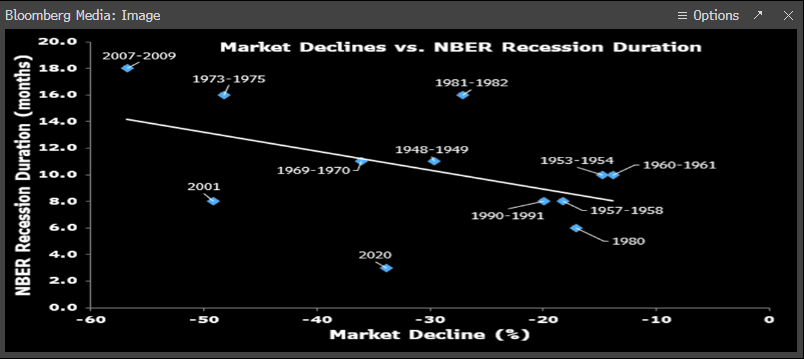

Inversion implications for the economy are that growth will slow. Couple that with stubbornly high inflation, and it's fairly easy to think a recession needs to occur in '23 to drive unemployment higher to tame inflation. Does the stock market have to follow the trajectory of the economy? Not necessarily. The length of any recession is directly correlated to the size of any decline.

Bottom line, is the curve inversions imply a recession is coming. How long is that recession is more important than how deep.

We've noticed a few correlations in the last 2 weeks start to de-couple. Is the market setting up for a change in course?

Markets move in phases, and just because short term rates may have the specter of getting cut soon, doesn't imply the stock market will cheer. This may have been the case this year but heading into '23, should we assume a similar correlation?

Our goal for our readers is to be in front of meaningful inflections and dissect the information into a deployable strategy.

So ask yourself? Do you want to stay on the right side of the market? Premium subscription pricing will increase 25% after December for new subscribers only. Existing subscribers will not be affected.