Congrats to Argentina for winning the World Cup! What an incredible match to watch. Our children were in tears watching Messi finally take the crown making this by far our most memorable World Cup experience. We hope you all enjoyed it as much as we did.

It's been a wild few weeks in the stock market as we suggested it would be. We accurately sidestepped most of the volatility by removing our upside index trade 2 weeks ago, that we have been playing since mid-Oct, and managed to short the market near the recent Dec highs. We added some individual stock exposure and also managed to exit most of that trade into the Dec 13th post CPI spike last week while adding to our VIX call exposure. This was all written about and detailed for premium members. Here are two Dec 13th report excerpts for reference:

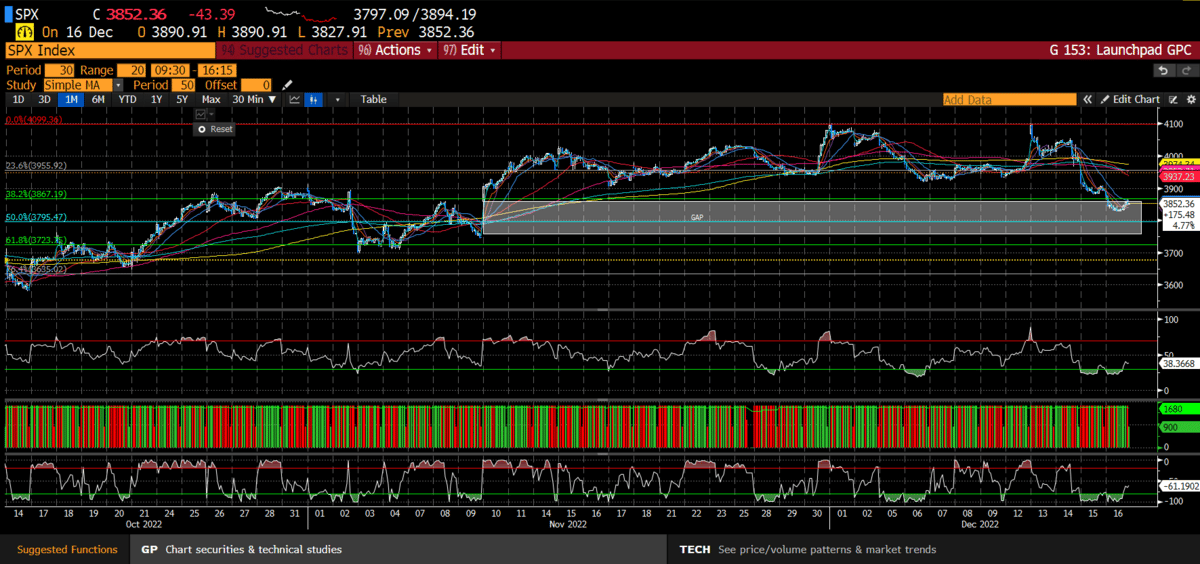

In our last weekend report, we discussed downside targets to consider for all the indexes post CPI/FOMC. Here is an excerpt for the SPX:

Where did the SPX find support on Friday? 3827 and in line with our support zone we discussed last week. Will it hold? We will expand below.

The parade of perma bulls ignoring simple fundamental inputs and market structure changes continues to confound us. CNBC was littered with perma bulls pre CPI/FOMC calling for face ripping rallies into year end. Their reality was premised on what exactly? +7% CPI? A Dovish Fed? EPS estimates that have much further to fall? We could go on and on. Coiled Spring Capital is market direction agnostic. We have our macro views but we take a weight of the evidence approach when it comes to deciding near term stock market direction. There were plenty of clues pre-CPI to suggest a weakening stock market structure to at least remove risk or consider hedges. We have been bearish all year on the macro, but we also have been trading the swings with incredible precision. We look at 100's of indicators and use proprietary analysis to determine if the market is reflecting our fundamental views. Markets don't move in a straight line, so why should we?

We find it comical that people still listen to these so-called pundits on CNBC to make investment decisions, and in some instances pay them exorbitant amounts of money to always clamor a similar message. When we are bullish, we welcome their commentary, but when we are bearish, we laugh at their ineptitude. Nothing in the market ever travels in a straight line, and always beating the drum to buy stocks is simply not intellectually honest. The reality is, the stock market goes up 70% of the time, so the odds are stacked in their favor, and the eventuality of them being right is historically a certainty. So why wouldn't they always bet on a rising market? They are playing house odds. The bigger question is, why is anyone listening to them?

If you aren't a subscriber to our premium analysis, you are missing the crux of our arguments. We purposely do not offer our conclusions publicly to protect the integrity of our loyal premium members. We do offer hints, but we never conclude our position. This is because one or two random pieces of information is not the mosaic that drives our conclusion.

If you would like to learn how to identify market swings or use our analysis to improve your chances in the stock market, we suggest signing up below before our pricing increases +25% by year end. Getting the market direction right will undoubtedly improve your chances of success with single stock exposure trading/investing.