Last week was riddled with macro-economic landmines that didn't de-rail the market. The stock market powered higher post Powell's speech, into some key technical resistance levels. The bears who are still left after continuing to short the market at every turn, were out clamoring the end is near, and finally got their catalyst to push the market lower. The payroll numbers on Friday were significantly higher than then the estimates, signaling that the interest rate campaign has done little to stop companies from hiring.

The U.S. added 263,000 jobs in November, higher than the expected 200,000 but lower than the upwardly revised October jobs gain of 284,000. The unemployment rate remained at 3.7%. Wages grew 5.1% year over year, up from 4.7% last month.

Friday morning futures were off significantly as the rhetoric shifted to higher rates for longer. But much to the dismay of bears hoping for a reversal of the Powell speech rally, the stock market rallied back and closed near the highs. In fact, it gapped below the 200 day MA on the open, but managed to close back above. This is not the action of a weak market.

We wrote in our mid-week report that the stock market structure argued for consolidation into a difficult level, and we surmised dips would get bought. Thats exactly what happened on Thursday and Friday.

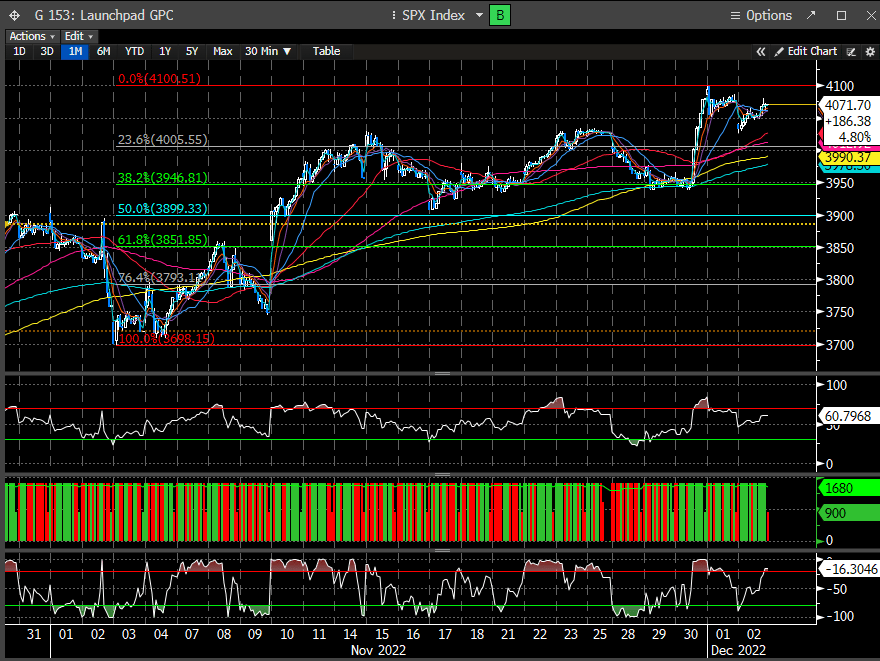

Using a simple Fib retracement from the Nov low, and you can see that the retracement was into a healthy level (38.2%).

Consolidations into difficult levels are normal and expected. How they react and trade around them is what's important. We posted this SPY chart recently and talked about the $408 target being relevant. The YTD AVWAP (yellow) is also in the vicinity at $410, so no coincidence that it reached there on Friday before retracing a bit. There is also a decent sized volume shelf in that area making this an even more formidable level.

What's even more interesting is that the yields fell further on Friday after spiking post the payroll number and now into a critical level. We pointed out the weakening structure in early Nov and even suggested in early October that a possible top in yields would occur over the next month. Yields are now down -20% since the Oct peak.

We also posted about the weakening structure for the $USD and how it rolling over would be positive for risk assets. Thursday the DXY broke its 200 day and continued to press lower on Friday.

The FOMC meeting in Dec is in 7 trading days, with Nov CPI to follow. Will these events finally be the straw that breaks the recent market rally? It's certainly possible, but for now, the bulls have the bears running back into hibernation.

How should we interpret the recent signals in the stock market? More continuation or is the rally on it's last legs?