The SPX has now posted 2 down weeks in a row after a blistering start to the year. We correctly positioned for the Jan rally in growth stocks and side stepped most of the recent carnage. Here is an excerpt from our Feb 5th weekend report:

“We believe the next move in the market is likely lower and we would position for such, whether by raising cash, or using tactical index shorts.”

And also from our Feb 8th mid-week report:

We gloriously have exited all of our residual tactical long exposure into last week's strength…we would rather be short vs. long here.”

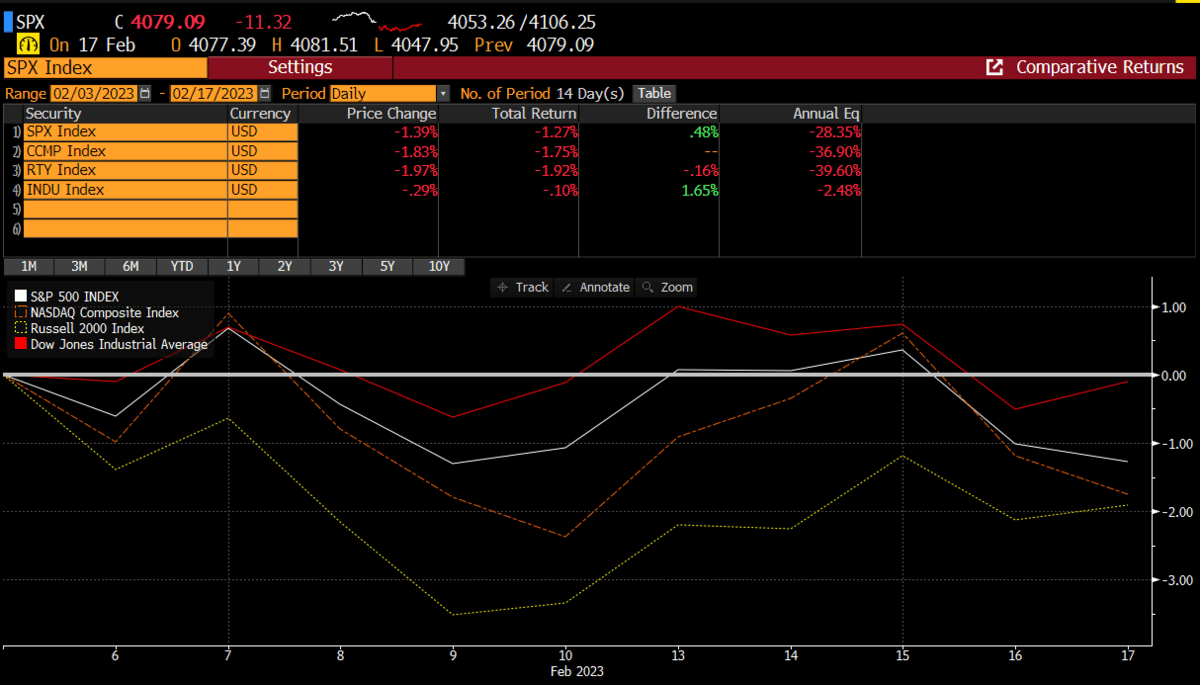

Here is the performance of the indexes from our tactical long entry (starting Dec 28th) into our Feb 5th report. Most of our exposure was in the growth-oriented Nasdaq stocks, which coincidentally outperformed all the other indexes by a wide margin.

And here is the performance since reversing that trade and going tactically short:

Our timing has been quite precise. As our avid readers know, we are agnostic as to which way the market winds blow and aim only to be on the right side of the market. As we always like to say, get the direction of the market right and picking stocks becomes a whole lot easier.

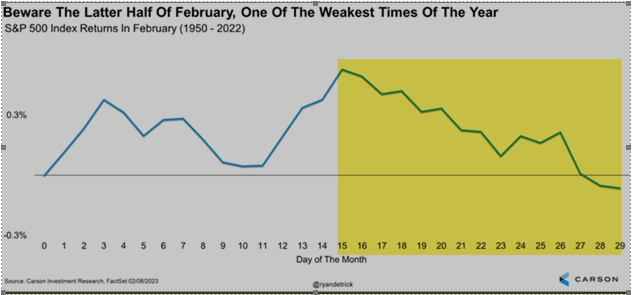

We’ve discussed many times that Feb is typically a difficult month. We have been through too many cycles to know that a good Jan usually sees a bit of hangover in Feb. We are seeing that now.

We have had some fairly hawkish rhetoric from the Fed since the last meeting, especially after hotter inflation statistics (CPI/PPI). We’ve discussed the notion of a repricing many times this year, and for the market to reprice lower, something needs to change. If you recall from our previous reports, we talked about the challenges for the stock market. Re-accelerating inflation and a higher terminal interest rate are 2 items that we explicitly discussed that can reprice the market lower.

The terminal rate is now approaching 5.3% with Fed Fund Futures pricing the peak in July. Cuts are not expected now until Sept. This is different than when we started the year and would classify as a material change in expectations.

This is also slightly different than the Feds Dot Plot.

Regardless, the bond market is quickly pricing in higher rates, but the equity market is not adjusting to this new reality. Typically, when you have disagreement between these two instruments, the bond market will win. This remains a major headwind for equities.

The 2/10-year curve made a new low last week. This level of inversion has to be a bit unnerving for any equity bull. Remember, the inversion is a warning sign of an impending slow down or even an upcoming recession, but the unwind of the inversion is where equities typically see the most pressure. This is because the bond market starts to price in interest rate cuts, and typically those cuts start coming after it’s too late and the Fed is behind the curve. Is it possible the Fed can engineer a soft landing? Of course, but their track record in doing so is abysmal.

Regarding the 2/10-year curve, the recent lows are coming on positive RSI divergence, and its MACD is about to cross bullishly. If this DTL on the curve gets taken out, it’s possible, this could be the beginning of the steepening. We will be monitoring, as trend changes have to start with a simple DTL break.

What’s also plaguing markets is the ratcheting down of EPS estimates. We have been talking about estimates for ‘23 being way too high since March of last year. The street and the media are just now waking up to this reality.

Profit growth is turning negative on a year over year basis, which has happened just 4 other times in the past 2 decades, and typically is a bad omen for stocks. That said, it’s worth noting that the other instances hadn’t already seen a -25% drawdown prior to turning negative. We have written many times that the stock market started discounting a recession much earlier vs prior cycles. This is proof of that, so it is conceivable that the opposite is true, and the market may be discounting a recovery much sooner. Time will tell, but this is something that must be contemplated.

The new narrative today is a “no landing.” We guess that possible, but we think unlikely. For now, the stock market is pricing in this scenario but any change to that narrative could cause a decent sized drawdown. Does that start now and into the summer or sometime in the 2H of the year? At this point it’s hard to know, which is why we will let our analysis drive our investment/trading decisions.

Here is an excerpt from a Bloomberg interview that discusses this notion of a “no landing.” We tend to agree, and maybe a hard landing was overly discounted last year and now the market is adjusting to the new reality that a hard landing is still a good amount of time away.

But all this being said, does that mean the stock market has to test the lows? No, in fact we are on record saying the market may just settle into a large trading range: Not making new highs and not making a new lows. This will undoubtedly frustrate both bears and bulls who will chase every swing thinking a bigger trade is a foot.

All the more reason why any trader/investor should use our work as a complement to their process on deciding when to exit and enter the market. We track hundreds of indicators to stay in front of or as close to the trend change as possible. We use our decades of Wall Street experience to analyze the fundamentals to make sure we keep an open mind to all possibilities. We have yet to find anyone out there for a similar price that analyzes the market as accurately as we do. We hope you will join us if you are currently not a premium subscriber.