It's been an incredibly profitable month for us and for our readers who stepped up and bought growth stocks in late Dec and in Jan. We identified early that the character of the market was changing, coupled with the turning of some of our proprietary indicators and a few notable DeMark signals, we correctly positioned for a large counter-trend (bear market?), rally. We opted to buy predominantly single stocks ideas which returned in the range of +20-50%. We positioned in over 25 stocks and all of them except one has worked out.

On Jan 24th we even wrote another note discussing possible new long ideas to buy on dips. This report was written after $MSFT had taken down their guidance and provided the opportunistic dip to buy into these ideas.

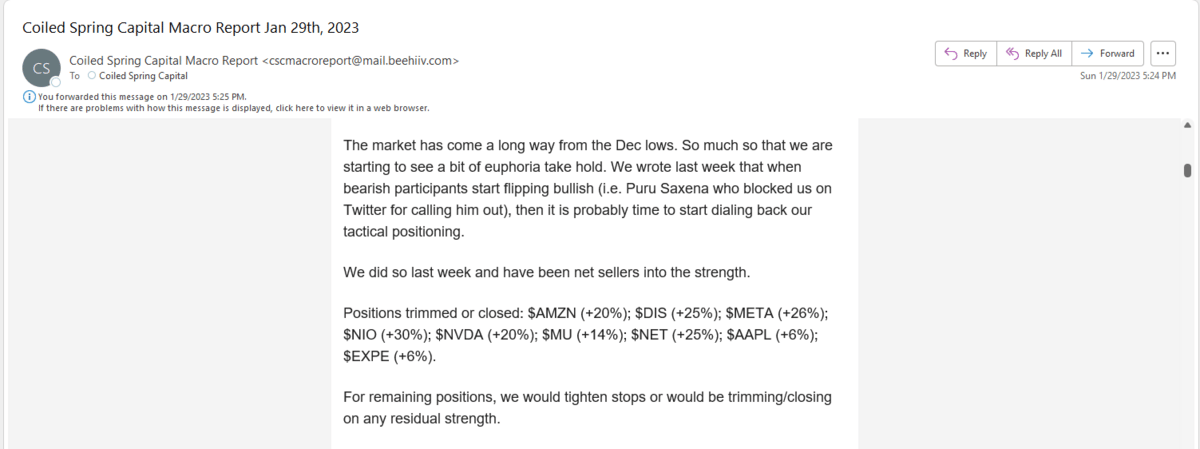

We wrote another report on 1/29 mentioning that we had taken all of our bullish tactical positions off into the market strength. Here is the performance of those ideas from 1/24 from inception to close:

$NET +50%; $JD (-2%); $MU +7%; $AMD +22%; $AFRM +60%; $UBER +15%; $DDOG +30%; $MDB +35%; $ABNB +20%. Here is an excerpt from last Thursday's report signaling the tactical change.

Remarkable gains for such a short amount of time. Get the direction of the stock market right and picking good long ideas is much simpler.

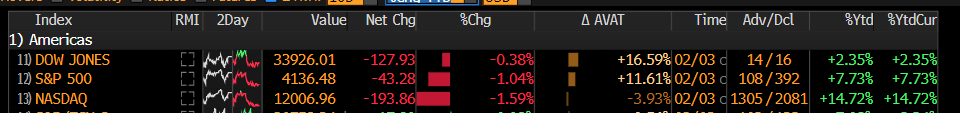

Year to date the Nasdaq is up almost +15%, outpacing the SPX by 700 Bps. We were one of the lone standing tactical bulls who decided growth would make a comeback this year and it has in a big way.

Here we are 5 weeks later, and we are already seeing signs of capitulation from those that thought the 1H of '23 was going to be a bloodbath. Price is a funny thing. It curbs even the staunchest of bears to reconsider their position. Here is Larry Summers recent pivot:

Last year Larry Summer was beating the bearish drumbeat talking about depression, and now 5 weeks into the new year, he believes we could have a soft landing.

And last Thursday, per GS, exhibited more capitulatory evidence, as Thursday was the single largest short covering event in the last 8 years.

This coupled with the largest ever volume recorded for call options.

Bears will still have you believe that this rally has run its course and it set to skid back to make new lows. Newly minted bulls will have you believe we are in a new bull market, and we will make new highs this year. Why does it have to be one or the other? What if the market is just going to be in a wide range as the narrative flip floppers chase each swing higher or lower, only to be disappointed? The reality is we have no clue how this plays out, nor do we really care. We are agnostic to the direction of the stock market and will play both long and short depending on how are signals line up.

We were aggressively bullish in late Dec/Jan when most of the investing world was underinvested and uber bearish. Fast forward 5 weeks, and is the set up as enticing to be long today as it was back then? Of course not. Can it still go higher? Certainly.

If you are sick of being on the wrong side of the market, or you missed the recent rally but are not sure how to position going forward, our analysis is the perfect complement to help you make better investment/trading decisions.

In our opinion, for this level of analysis and accuracy, our monthly price of $24.95 seems way too low. Subscribe below to read the rest of our analysis.