Another good week for our subscribers, proving our analyses effective for bigger inflections in the stock market but also for shorter term swings. We entered the year bulled up in the short term, letting us exit some of our swing longs into the CPI but keeping most of our single stock exposure. Most of our peers were bearish coming into the year, calling for a first half wipeout followed by a rally into the end of the year. So far, the masses who believed such an outcome are being stuffed by Mr. Market, who rarely does what the majority are positioned for. If you are a premium subscriber, you were NOT on the wrong side of this move, and most likely profited nicely from it.

Recall what we wrote about in our report 2 weeks ago, a Santa Claus rally and the first 5 days of the year, historically have proven decent indicators for full year positive SPX performance if those periods finish in the green, which they have. Here is an excerpt from the Jan 2 report:

The other statistically important calendar effect is the January Barometer. If Jan closes positive, the SPX generates positive returns, 75% of the time.

If bears don't come out of hibernation soon, the probabilistic outcome for a continued bear market continues to shrink meaningfully. Here is the YTD performance for the indexes.

Presently, we have now hit some of the index resistance zones we cited in previous reports, where sellers have emerged but not travailed. The Nasdaq has taken out our first target zone and approaching the next two, one of which has stopped every rally since breaching in Sept.

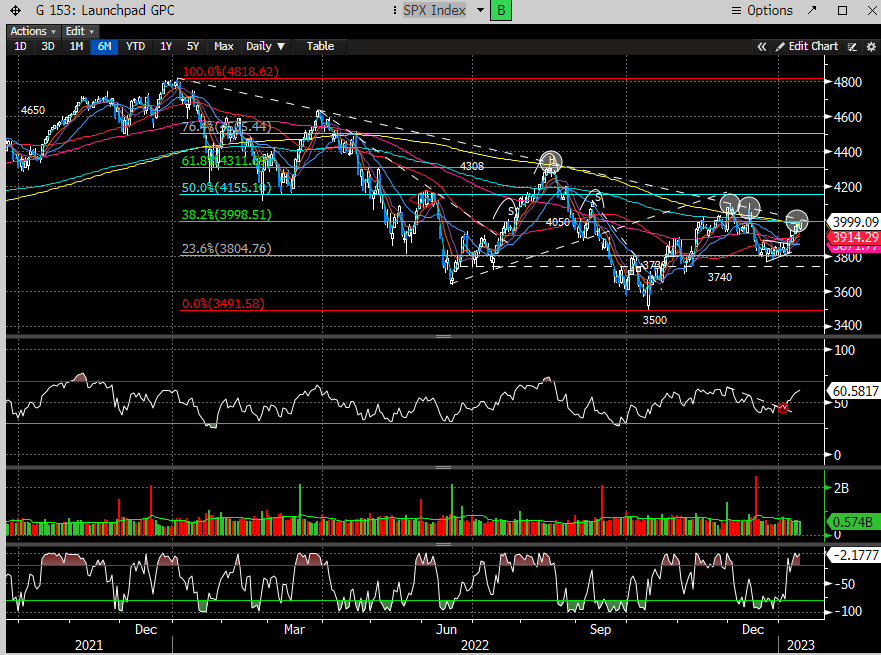

The SPX managed to close right at our major resistance zone (200 day MA, DTL from the high and the 38.2% Fib level). It is no coincidence we got stuck here given the confluence. The DTL has mimicked the 200 day at key junctures. This is now the 4th time since the Jan '22 peak where a similar confluence zone has stuffed the bulls, and then proceeded to make new lows. Will this time be different?

The Russell 2000 (RTY) has pierced the 200 day and broken the DTL from the high. If I was a bear, I would be very concerned if this doesn't turn around quickly. The Russell is a much broader index vs the SPX, predominantly small and mid-cap domestic focused companies, and considered riskier and more impacted by macro/micro forces. Bottom line, if the US economy was going to fall into the abyss, would this index be acting this way? We'd venture to say no. This index also did not make a new low in Oct like the SPX and the Nasdaq did. In hindsight, that was the tell for bears to start sweating. Currently the RTY is approaching a key resistance zone (more analysis in our premium section).

Something else for bearish viewpoints to ponder: While the SPX is still battling some overhead resistance, the equal weight version of the SPX has broken through its DTL and is now +4% above its 200 day. Recall, the SPX is a market cap weighted index, which means the largest companies are driving index performance. Putting all the index constituents on the same playing field, offers a more real representation of what's occurring under the surface of index price.

The equal weight SPX is outperforming the SPX the most since 2019.

But the plot thickens. Not only do we have some instruments sending powerfully bullish messages, but we now have fresh statistically significant new information to consider.

Sometimes NOT being on the wrong side of the market, is just as good as good as being on the right side. If you struggle to know which way the winds are blowing, we can help.

To read more of our analysis, please consider subscribing below for $24.99/month.