What an interesting week in the stock market and a very good one for us and our readers. Why? Because we were positioned tactically long while the masses were positioned for a bear pennant breakdown.

Here is the pre-payroll chart for the SPX. A very obvious and logical conclusion after the ADP number on Thursday would certainly have you positioning for a break. We admit, it looked dire.

But that's why we conduct rigorous analysis to determine probabilistic outcomes vs one dimensional analysis that only looks at price (most of FintTwit). Even if we got a knee-jerk reaction post the payroll number, we had levels where we were prepared to buy. Despite what seemingly looked like a hawkish number, the slight dip in wage growth ignited the market for +2 to 3% index gains.

Here is the current SPX chart post the payroll report. The bear pennant formation actually resolved to the upside. This also occurred on higher volume then the previous day, triggering a follow-through-day:

Overloaded on one side of the boat, rarely ever works out and clearly this one-sided positioning fueled Friday's rally.

What do we mean by that? Everyone was loaded for a wipeout last week. We were reviewing our public twitter feed on Thursday night as we awaited the next day's payroll, and the bearishness was palpable. We can't recall a prior time when everyone was so convinced a breakdown would occur.

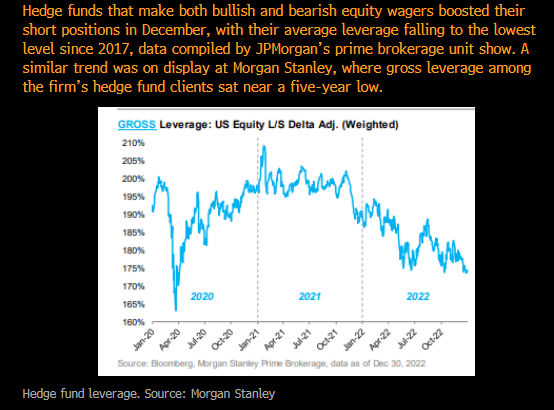

This is corroborated by reports out of JPM and Morgan Stanley regarding positioning:

Not convinced our analysis was in front of this overarching bearishness? Here is what we wrote in our Jan 4th mid-week report for premium subscribers:

"I suspect it will be difficult to break up from here and may need a catalyst to do so. Breaking down seems logical, but too logical?"

"...there is nothing to deter us from our current bullish tactical bias. If anything, there is more affirmation of our cautiously bullish stance."

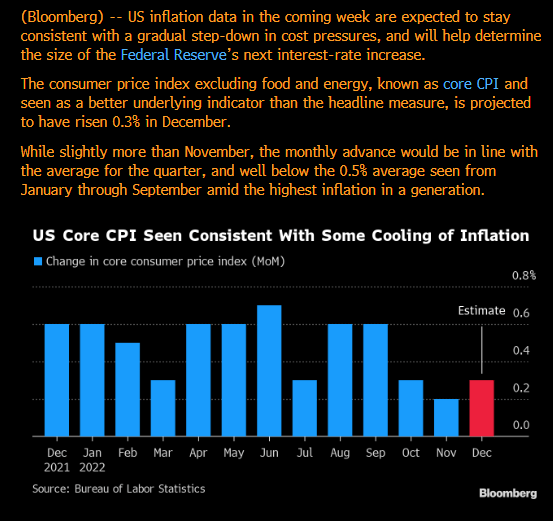

This week we will get the CPI report for December. Does this report have the potential to inject major volatility into the stock market? Definitely. This is the last CPI report before the next Fed meeting at the end of the month. A cooler reading could really get the market moving but coming in hotter could certainly undo Friday's enthusiasm. We will be watching.

Current expectations are for the CPI to drop to +6.5% from +7.1% last. This is a decent fall m/m, so a disappointment could certainly cause some reverberations. Core is also expected to fall. Estimates are below:

This Friday will also kick off the start of earnings season which should provide more fireworks, given a good many companies could use this quarterly report to adjust their earnings estimates lower for the year. Remember, the market has been discounting earnings cuts so the magnitude of those cuts is more important than the cuts themselves.

Earnings dates for this week:

Current top-down estimates for the SPX in '23 are $214 vs the bottoms up @ $230.

Excerpt from Barrons:

We have been calling for '23 estimate cuts since March of last year when the numbers were greater than $250. It seems the market is now getting closer to that reality. Recall what we wrote about in our 1st weekly report for the new year, regarding the 3 most important questions for the stock market in '23.

Here is that question:

There are many factors at play that go into EPS estimates bottoming for companies, one being how deep would any recession be if one were to occur (coincidentally that is also our 2nd question for the stock market in this report).

Consider if the Fed is correct about them being able to engineer a soft landing, then it's possible this Q could mark the end of the number's cuts, and in that case would mean the lows of Oct will most likely hold. We think this is a low probability but an outcome we must consider, nonetheless.

We think the opposite is true if numbers cuts are phased slowly and not haircut enough. This would imply, at the very least, lots of push and pull in the market and possibly new incoming lows.

Handicapping this outcome at this point is not possible so we will have to see what this earnings season delivers.

If you wish to read more of our analysis and stay in front of emerging trend changes instead of reacting like 99% of investors/traders, we highly encourage subscribing to read the rest of our analysis.

It's one of the most affordable and accurate stock market newsletters in the market today. There is no contract so what do you have to lose?