Last weekend's report highlighted this important SPX battleground @ 161.8% projection from Jan high.

We suspected we would get a countertrend bounce early in the week as the VIX was giving clues. From last week's report:

But the bounce last week occurred on very light volume. Not exactly inspiring...

Heading into the CPI/PPI prints this week with earnings beginning in earnest, has the making of a very volatile set up. Here are the last 1.5years of CPI prints:

Here is how the SPX did following the every CPI print this year....not so good. From Feb the index recovered a bit before the next CPI print pushed higher again and wrecked the market. Current estimate is +8.8%, which implies upside to last month. If we come in meaningfully below than we would expect the market to rally. But we have little confidence in that occurring. This makes trading this week a little bit of a guessing game.

Last week was a good week for our individual set ups. We highlighted in last weekend's report to focus on biotech for longs. From last weekend's report:

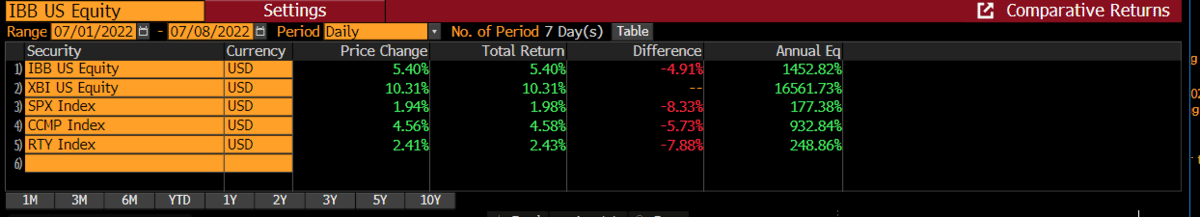

IBB and XBI had a phenomenal week. IBB +5.4%% and XBI +10.31%. Both trades completely trounced the indexes.

We also highlighted how vulnerable oil looked @ $109.

July 5th saw the commodity sink over -10%.

A few of our other ideas we posted mid-week (which we still like), were up +2%, +2%, +10%, +5%, +3%, +5%, +3%, +4%, +3%. We also highlighted in our Thursday pre-mkt update for the indexes to possibly breach the DTL's, and could yield higher prices: the SPX moved up another +50 handles and Nasdaq +300 in 2 days.

If you would like to learn more about these ideas in real time and the evolving market set up, please sign up for premium service for only $19.95/month.