Another week in the stock market and another powerful rally in the books. The prior week was an inside week and this week we broke up. The same pattern existed for the Jun 23rd week. Inside week followed by a breakup.

At some point this strength in the market has to wane, consolidate or correct. We always tell our readers that markets do not move in a straight line, and pullbacks and consolidations are healthy in an uptrend. But to come into every week suggesting the end is near and the next move for the market is some apocalyptic crash is sensational at best. There is zero value for someone to slap directional arrows on a chart, telling their follower base to expect some 30% drawdown. They are merely posting this nonsense to appeal to the wrong side of market participants, who missed the rally, who are short the market and upside down, or to the cohort of people who just want to watch the world burn. There is a time to be bearish and a time to be bullish.

We have been constructive on the market since Oct ‘22 and have been predominantly long a plethora of market beating single stock ideas. It’s been a fantastic 9-10 months. Have we been short term tactical bearish at times during that span? Yes, of course, we sold the Feb highs and flipped bearish for a few weeks. There have been times where we flipped bearish and 2 days later admitted we were too early and reversed course. This sort of flexibility has kept us on the right side of the market for the bulk of this entire rally.

The stock market major indexes posted very respectable +2-3% gains this week.

And now the year-to-date performance is eye popping for the Nasdaq, and less so for the SPX.

For those that have been fighting the tide on the recent rally we feel your pain. We’ve been there many times in our career. Its only when we adopted our current model of market direction analytics that we found a better way to invest and trade. Being on the right side of the market will improve your success ratio considerably, and it’s only when you stop guessing, praying, hoping for a different outcome, is when you truly extricate yourself from the binds of stock market conventional wisdom.

Analyzing the stock market is extremely complex, and there are infinite factors that can affect price at any given moment. It’s being able to see though the noise and stay the course which defines your performance. Our rigorous analysis is designed to give you that comfort and confidence to execute.

Last week we got the last inflation readings before the Fed meets in 2 weeks. The deceleration is something we expected, and the market celebrated. The Fed interest rate hikes are clearly working. The CPI rose 3% in a year, which was the smallest price increase since March ‘21. Recall, the CPI peaked in Jun ‘22 at 9.1%. But as we discussed in our mid-week report, the CPI is set up to lap some more difficult comparisons for the rest of the year. The CPI was unchanged in Jul’22, which implies the annual change in the CPI will be higher next month if inflation is anything greater than zero.

This is why we also wrote in that report that the easy money for the rally has already been made. Any perceived reacceleration in CPI will undoubtedly cause a stir at the FOMC and will likely disrupt risk assets. This, of course, remains to be seen but will place more emphasis on any future inflation readings. Further disinflation will likely have to come from the labor market, which is cooling but still expanding.

But it’s not all doom and gloom for inflation. The lower PPI suggests a possible boost to company margins in the 2H of the year. Company managements were subject to the same fear inducing media coverage about an impending recession as they entered the year. If you recall, there were quite a few high-profile companies cutting their headcount. This was likely more a function of them trying to get ahead of a potential recession that never came. This implies that company’s most likely have leaner cost structures with revenues holding up and even expanding in certain sectors. With 2Q earnings season in full swing next week, we should get firsthand evidence if this is occurring.

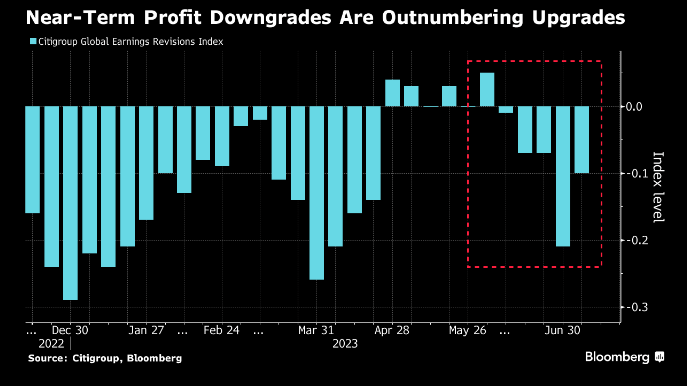

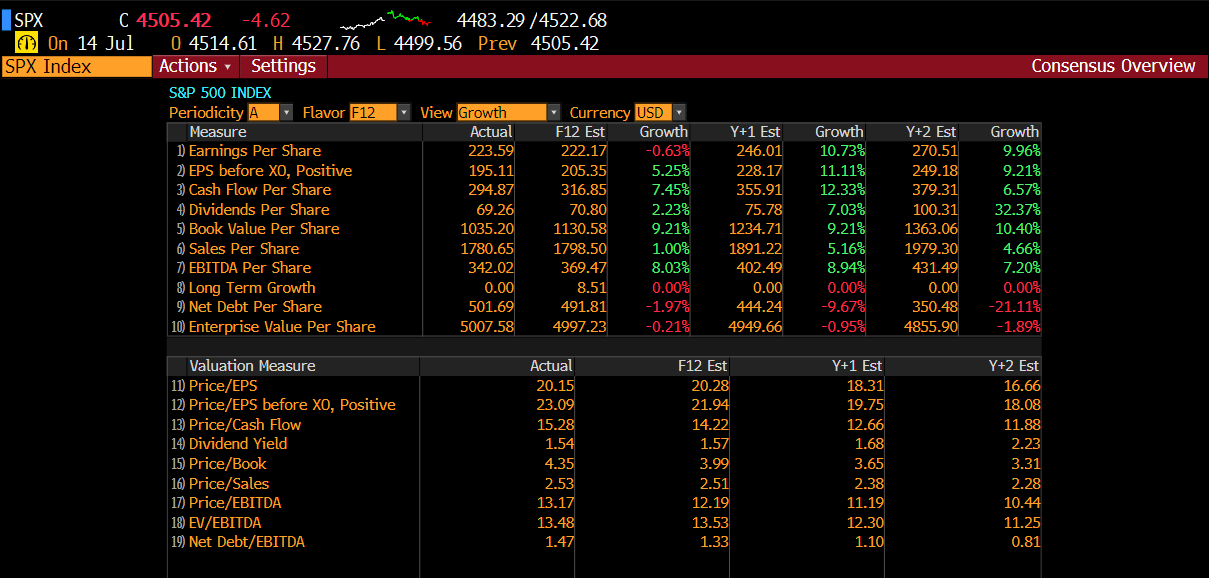

In some of our recent reports we highlighted the fact that earnings are always gamed as we enter the reporting season. This means the numbers from Wall Street Analysts have been cut down, so they are beatable. SPX firms are expected to post a 9% drop in profits for 2Q, making it the worst season since 2020.

But counterintuitively, this is in the rear-view mirror and has already been contemplated in stock market prices. What hasn’t been discounted yet is a big change in 2H earnings estimates. If we get a number of high-profile downgrades to the rest of the year numbers, then that could cause some retrenchment in the stock market as things get repriced. For now, it’s hard to determine what the eventual outcome will be. The bears will have you believe that the market is trading on hopium over a “soft landing,” and a day of reckoning is coming. Maybe so. But the stock market is not expensive if you back out the 7 largest stocks. It’s only trading at 15x next year’s earnings, which is low by historical standards. This implies that the market should be able to sustain some revision in estimates.

There has also been much debate over the top weighted nature of the market returns this year. While this is true and represent over 70% of the stock markets returns for the 1H, the equal weight version of the SPX and the Nasdaq 100 have actually outperformed over the last 3 weeks. The Russell, which represents the smallest 2000 stocks in the Russell 3k, is leading the charge. This implies the rally is starting to broaden out.

Why is this important? Because smaller companies are disproportionately impacted by macro-economic malaise. Given the recent macroeconomic data has remained strong, small cap companies should see multiple expansion and catch up to the larger cap peers.

We are approaching a pivotal 2 weeks in the market: 1) the 3 heaviest earnings weeks start tomorrow and 2) the FOMC July 25-26 meeting. This week is also OPEX so we should expect increased volatility. We will continue to analyze and provide guidance as things unfold.

Please subscribe below to read the bulk of our analysis.