Last weekend we wrote about how difficult the stock market set up was heading into the inflation prints and the start of earnings. We wrote how difficult CPI prints have been for the SPX all year, post the readings.

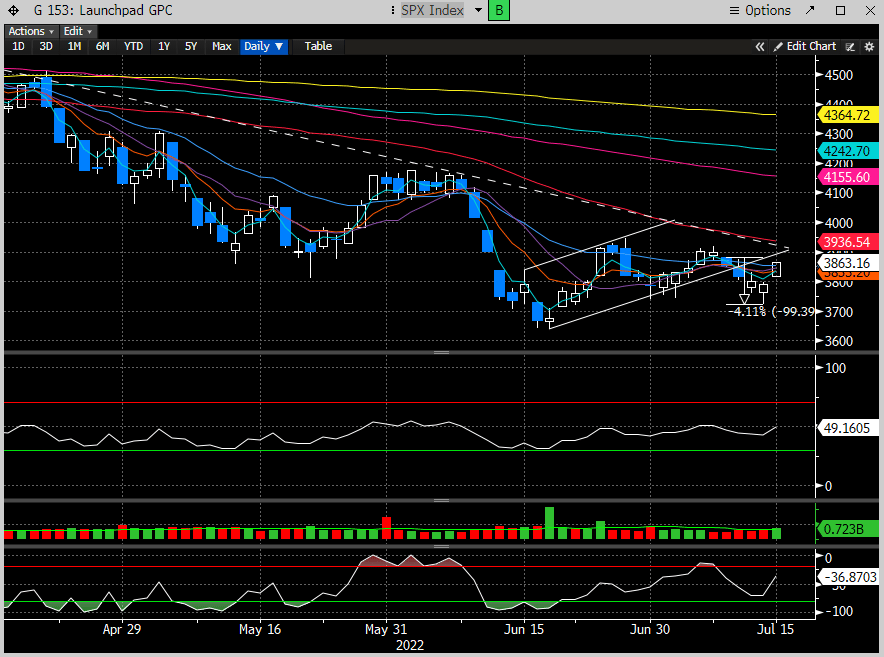

Post the CPI print & JPM earnings report, the SPX lost -4%. But like recent sell offs in this region, buyers showed up and we closed slightly below last weeks low.

We wrote in our last weekend report that extreme weakness was likely to get bought and thats what happened.

The issue for the bears is that this is the most talked about and discussed bear market in history. In fact, in areas of the market, the bear market has been raging for over a year. Here is a great article from a seasoned economist talking about this exact phenomenon.

He makes some great points and we are clearly on the ledge of staring down into the abyss. Here are the Google search trends for "US recessions" over the last 5 years. In mid-June it peaked and coincidentally that's when the market recorded its low for the year (Jun 17).

The market doesn't reward someone for thinking what everyone else already believes and why it pays to be a contrarian.

Here is the weekly picture of the SPX. Head and shoulders top, neckline break with retest and came within 50 points of the measured move target. Coincidentally, the 200 weekly EMA (light blue) caught the low. We love symmetry at Coiled Spring Capital, and why we thought that level was at least good for a counter trend rally.

But where does that leave us today? Earnings are going to be in full swing next week, and historically earnings are positive events, but there is little chance that companies' future guides will be positive. There have been enough big companies publicly pulling back expansion plans. AMZN, TSLA, META, JPM, GOOGL, etc....Their cautious tone on what the future holds will undoubtedly be echoed by their smaller peers. How stocks react could be telling. If last week was any indication, it's possible poor guidance is already discounted.

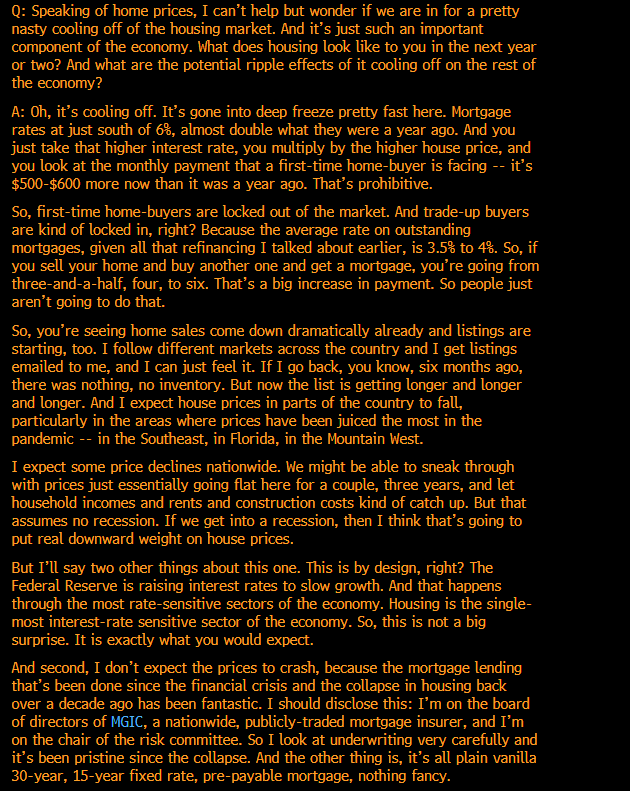

We also wrote this in our weekend report:

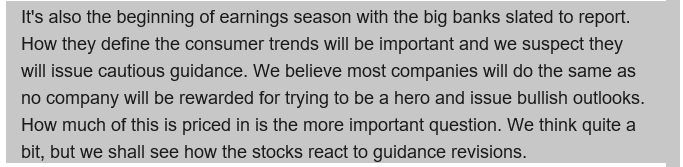

Their discussion of consumer trends were actually quite positive, but the overall tone on what the future looks like was not good.

So how did the stock do? JPM opened down materially but traded up +5% from its opening post earnings print.

So this tells us that our conclusion above, about a lot being priced, in is true, for now.

But if you are bullish on the market, you must consider what Nancy Lazar is saying (top rated economist). Spoiler alert: she is NOT bullish.

Its hard to see the forest through the trees. The set up here still seems very difficult. The market has discounted quite a bit and was pricing in this recession a lot earlier than my experience with past recessions. So does that mean the market will start pricing in the recovery sooner? I'd venture to say yes, but I do not think we are there yet.