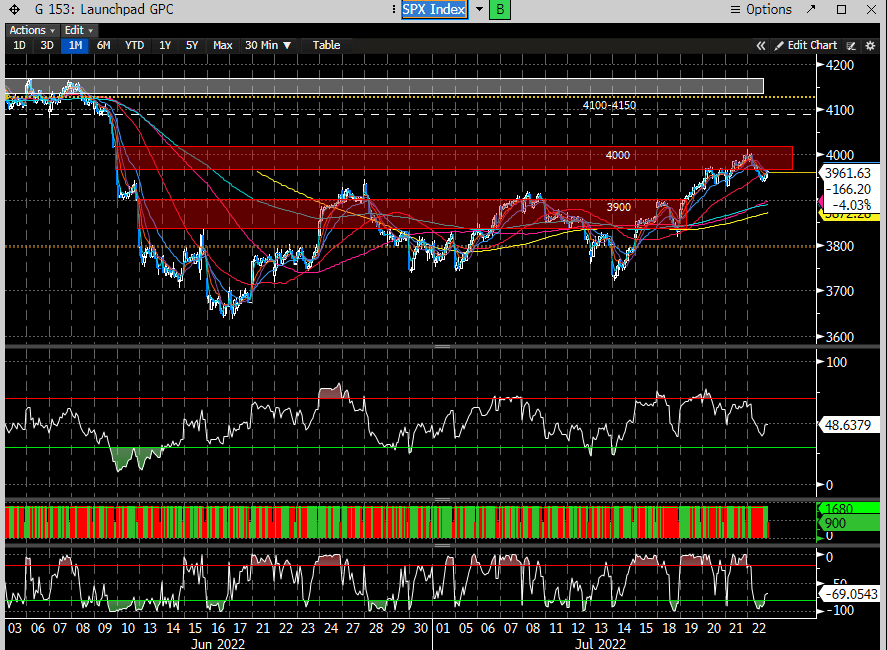

Last weekend's report argued for more upside into some of the upper targets as our work suggested so. The market had a strong week up until Friday. Our July 20th mid week report discussed the stock market rally was hitting upper resistance levels while some key timing signals were posting exhaustion. Here is an excerpt from that report:

The SPX gap Jun 10th was tested and failed.

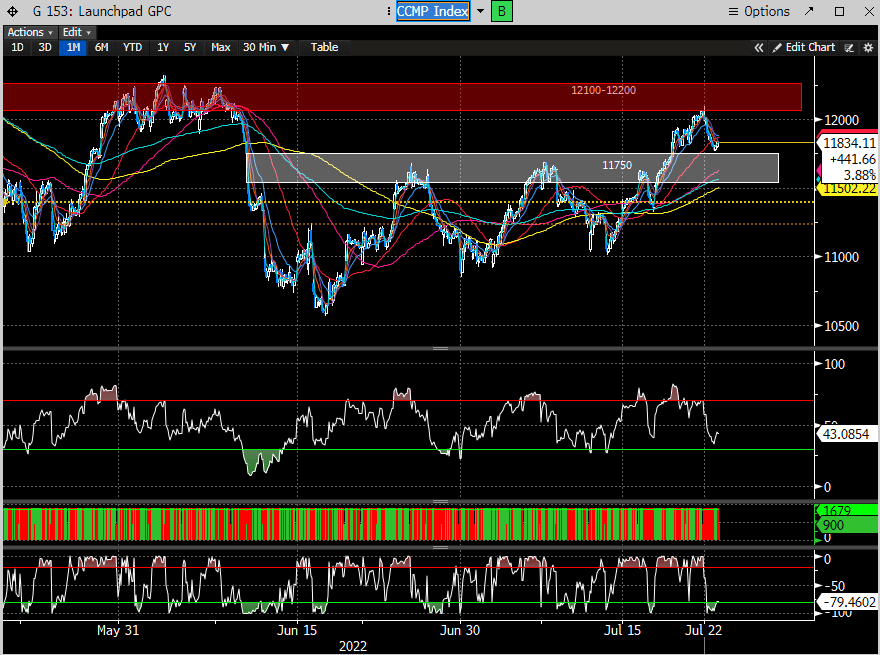

The Nasdaq also tested the 12100 pivot and ran into trouble.

Here is the Nasdaq daily chart which shows confluence and the importance of that 12100 pivot.

After a strong week the reversal on Friday stumped many a new bull. The positivity leading up to Friday on Twitter was quite loud. In our last weekend report we discussed many of the issues facing the stock market. One being that earnings numbers on the street are simply too high and need to come down. We painted various scenarios for SPX fair value and all of them are for lower SPX. This past week we saw a glimpse of this as guidance was ratcheted down for lots of different companies in different industry groups (VZ, ISRG, SNAP, CLF, NEE, STX etc). The reality is the market will have a tough time holding any rallies until numbers get adjusted low enough to where they are beatable. This week we will hear from a hundreds of companies and I suspect the tone will be similar.

We also received some pretty ugly Macro data. The US services Composite PMI broke the 50 level. This is a 26 week low and <50 signals contraction.

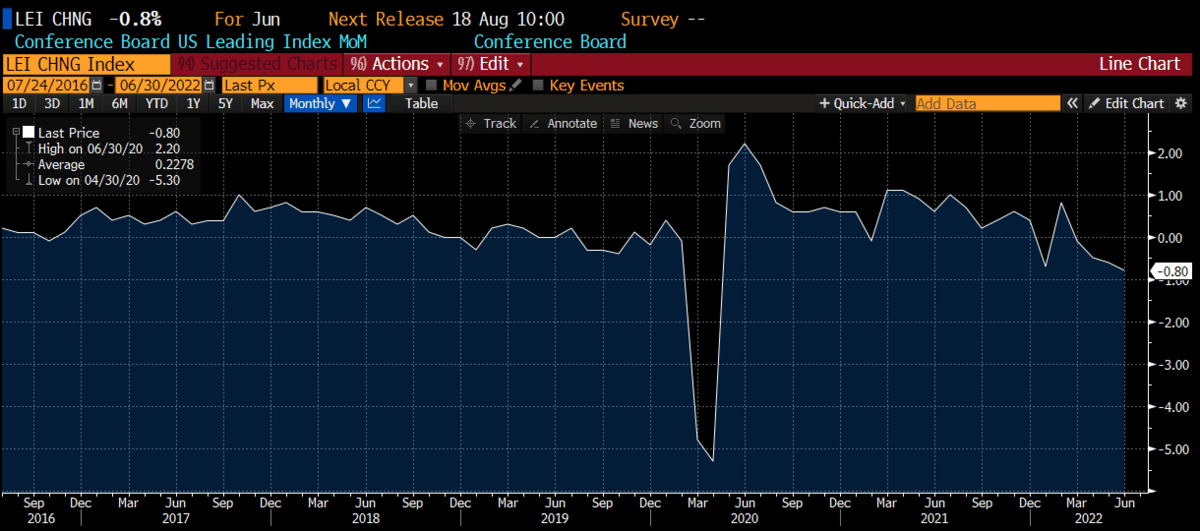

The Conference Board of leading indicators also turned negative.

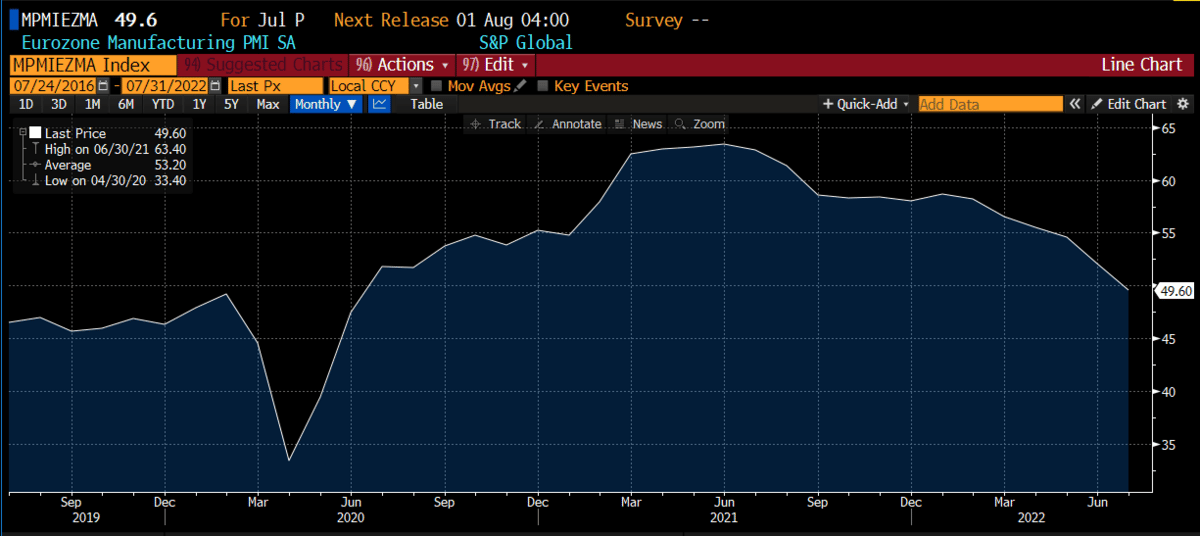

Even the Eurozone flash PMI dipped below 50 for the first time since Feb 2021.

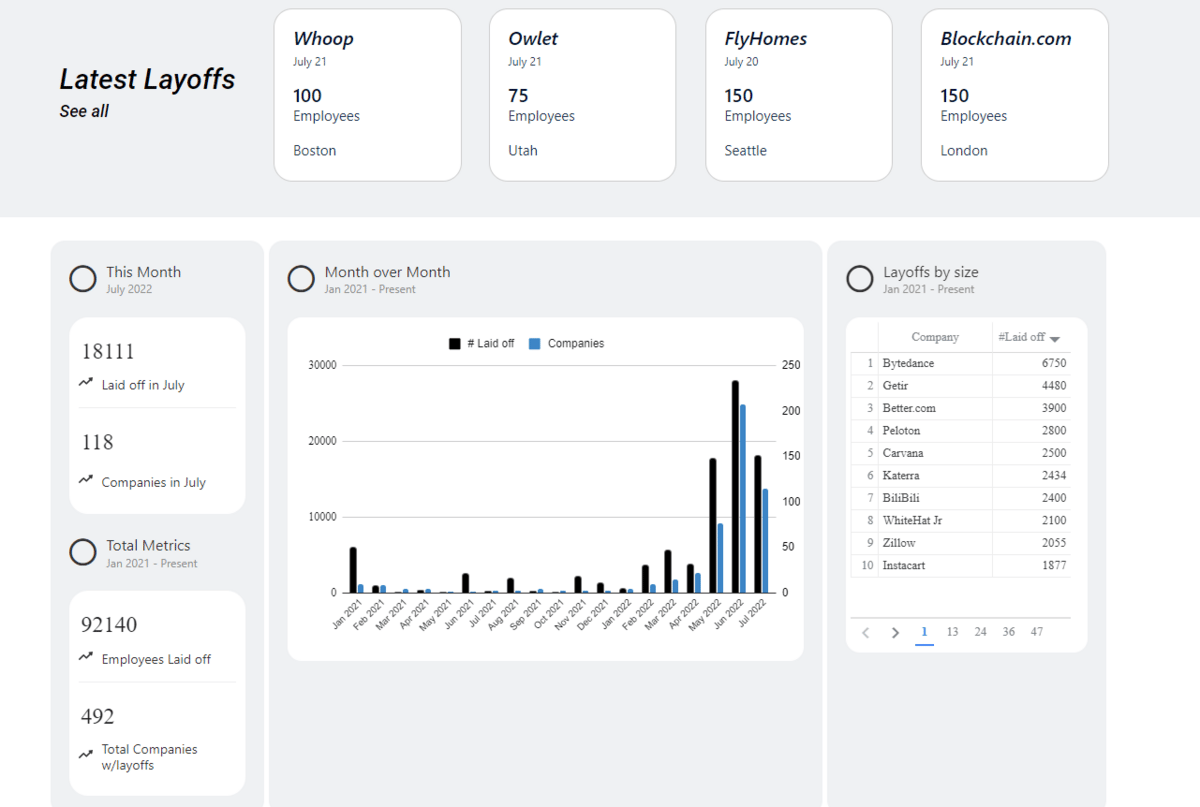

Jobless claims rose on the last report and is a leading indicator for unemployment trends. Here is the current lay off tracker:

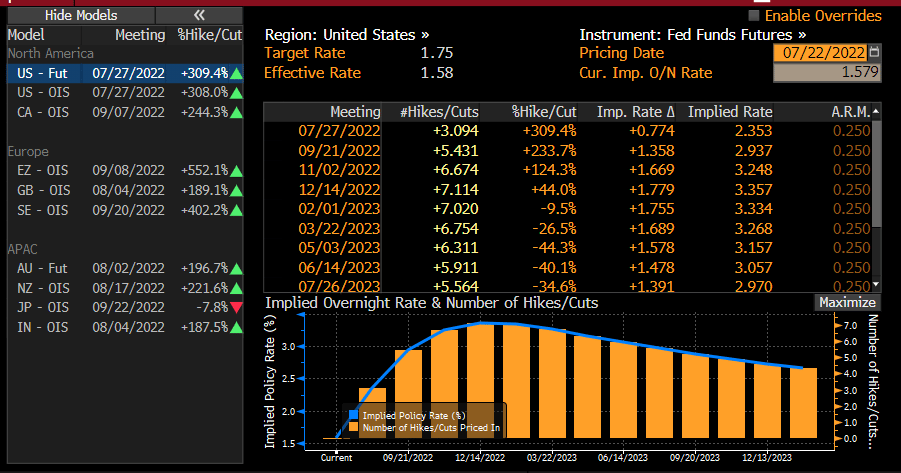

This is the desired goal of the Fed and it's working. They are engineering a slowdown by raising short term rates to cool inflation. How far will they go is the bigger question. Will they back off soon as the economy is clearly slowing or will they keep pushing rates higher? The Fed meeting this week should offer up some clues. There is an almost 80% probability the Fed raises rates by 75bps on Weds. But as you can see the forward rate path is slowing according to Fed Funds Futures and they actually start to decline in early '23.

This is precisely why the curve is inverting, and suggests the Fed will be forced to start cutting rates to offset a rapidly slowing economy. The 2/10 yr curve is -20bps and now deeper than the last 2x this has inverted. As we have written many times, curve inversion is a very good predictor of recessions.

This week we will also get GDP, and while its backward looking, it may solidify that we are already in a technical recession (2 consecutive quarters of negative GDP). Does being in a recession mean the stock market needs to go down materially more? No, it doesn't. We posted last week that stock markets actually tend to do ok during recessions. The reason for that is that the market is a forward looking instrument and thus a recession has been largely discounted in the market by the time the macro data confirms it. The bigger question is how long will this recession last? If it's a very mild recession than its conceivable that the bottom is in. If its going to last more than a 2-3 Q's, than likely not.

It's possible this week that the market has a few more headwinds to deal with outside of what's already been discussed.

If you like our analysis and want to see how we are viewing the trading week, please subscribe below to receive the premium content.