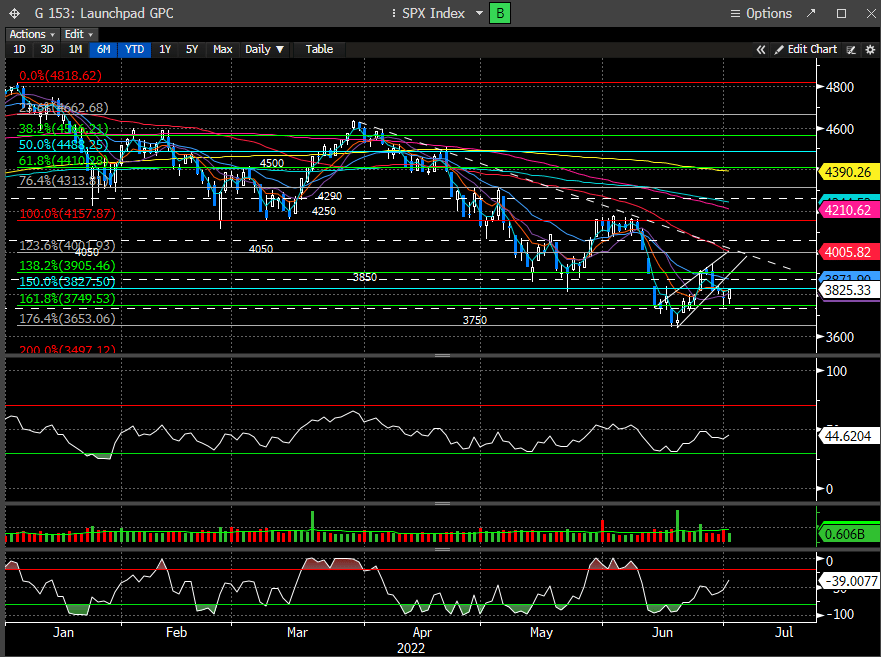

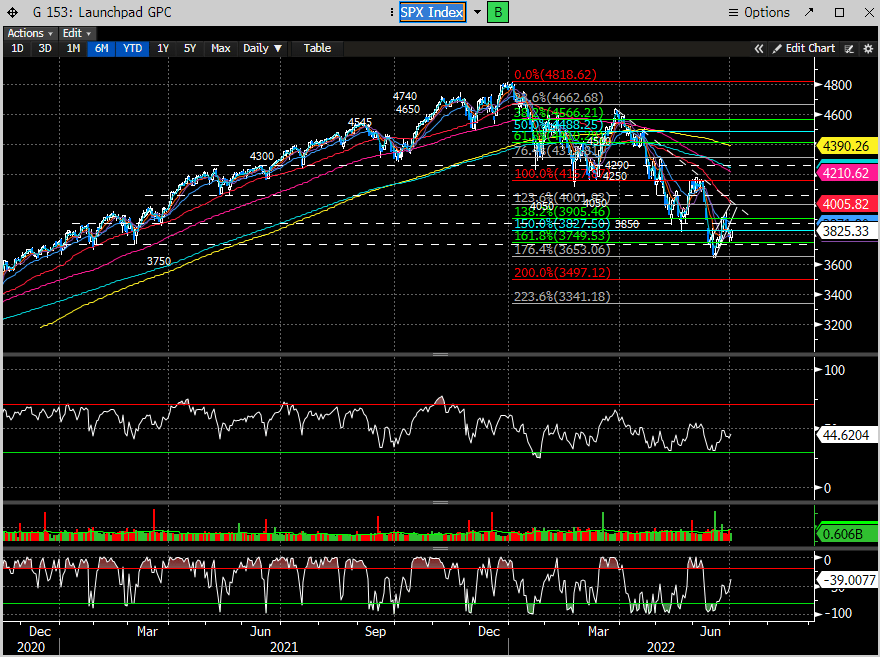

The best way to sum up the mess that is the SPX is this chart. The fact that it's this busy suggests a tremendous amount of upside resistance for the market to eclipse before we get any sort of sustainable rally.

Currently, there is a battleground brewing @ the 161.8% FIB level projection from the Jan high. While we did undercut that level 2 weeks ago, it has since regained. We correctly positioned for that rally suggesting a 3900-4K target for the first wave and we hit 3950 and failed, breaking this rising wedge @ resistance. 3750 is not only where the Thursday sell off halted, but it's also the 161.8% Fib level cited above, as well as a support zone from Jan/Feb of last year.

Technical charting offers clues to how the institutions are positioning, but they are not the holy grail. Most armchair technicians continually attempt to call bottoms in the charts without understanding the macro picture. Most of these so-called technicians, have never worked on wall street, have zero formal training, rarely (if ever) read the news, and god knows they know very little about macro-economics.

Coiled Spring Capital synthesizes major macro inputs, real technical charting (CMT charter) overlayed with DeMark analytics, and 20+ years working for major investment banks in NYC, to create a proprietary view on how to cross asset-trade and invest in markets. We offer this service for only $19.95/month (includes 1 major weekly report and 1-2 updates throughout the week with higher conviction trades to consider when the opportunities present themselves).

What's impacting the markets and the economy, are NOT transient. In fact, most of the data that gets reported is getting much worse. Recession odds have been increasing rapidly. By the time the Media reports the US is in a recession, the market will already have bottomed. Don't be a buffalo and follow the herd. Learn to navigate the market like a pro.

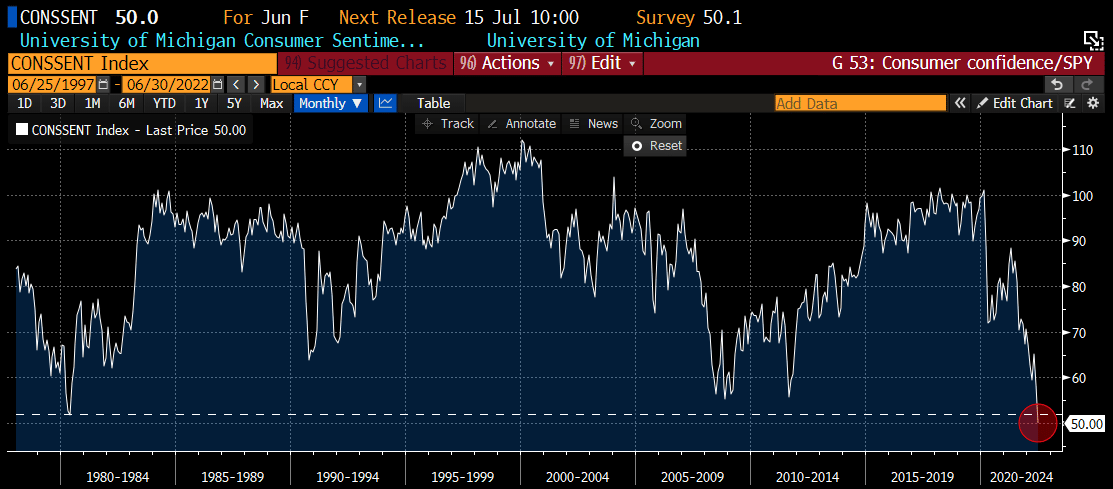

You don't have to be an economist to know that this chart screams recession.

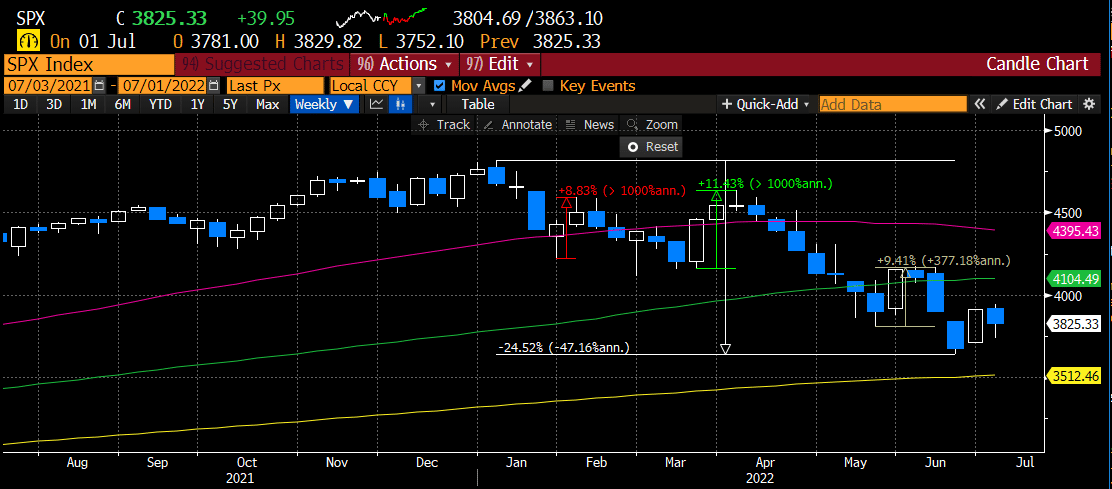

How about this?

This doesn't inspire confidence (no pun intended).

Stress is building and nothing says it better than this chart.

This isn't looking so hot either.

ISM falling off a cliff?

During recessions, job losses explode. If you overlay U-3 employment with DeMark signals, you can see that 13's have a fairly good track record of calling the tops/bottoms. During the largest Fed balance sheet expansion in history, the signals were recycled, but previous to that the signals nailed the turn in employment 3x. Current 13 printed recently, and new jobs report out on Jul 8th. We know layoffs have been picking up lately and will likely get worse. Could this be the start of a long cycle of job losses?

Are SPX earnings estimates achievable? Q2 Earnings season is upon us. Will management teams offer positive forward Q/annual outlooks or will they revise down their forecasts? MU just announced a 13% revision to their forecast for Q4. DRAM is a major input for consumer, smartphone and PC markets. This is not a good thing.

There are so many analogs out there to compare and we won't pretend to be historians, but as we have written in the past, we liken the current situation of elevated inflation to the 1970's. Inflation started creeping higher in 1973 and couldn't be tampered until Volker raised interest rates to 20% and forced the economy into a recession.

The market peaked in Jan of 1973 and did not bottom until Oct 1974, (22 months and (-48%) later). We count at least 6 different multi-week counter trend rallies of +6-10%.

The SPX peaked this year in Jan. We are currently 6 months into the current bear market and we have had 3 multi-week counter trend rallies of +8-11%. Assuming linearity, we are halfway there in terms of drawdown but only 25% there in terms of duration. No 2 periods are the same so take that with a grain of salt, but something to consider before pushing all your chips into the pile.

Coiled Spring Capital has been cautious on the market since Jan. That doesn't mean we won't counter trend trade. In fact we are quite good at it.

Is there enough confluence in our proprietary metrics to consider a counter trend trade from here or should we expect a retest, break of the lows?