Our Macro report last weekend, predicted to expect range bound trading into the FOMC and likely some resolution post. We were quite surprised by the strong reaction post FOMC as highlighted in our mid-week report. The perceived belief that the Fed is pivoting still seems a bit misplaced. Powell's specific comments below are the reason the market believes the pace of rate increases will slow:

In other words the market is betting the Fed will slow down the pace of rate hikes by the end of the year, and then completely pivot to rapidly easing. 1 word: DOUBTFUL. For the Fed to maintain any sort of credibility, they must remain on course to reduce inflation. They are on record saying their target inflation rate is 2-2.5%. The last CPI reading was 9.1%. Thats quite the delta.

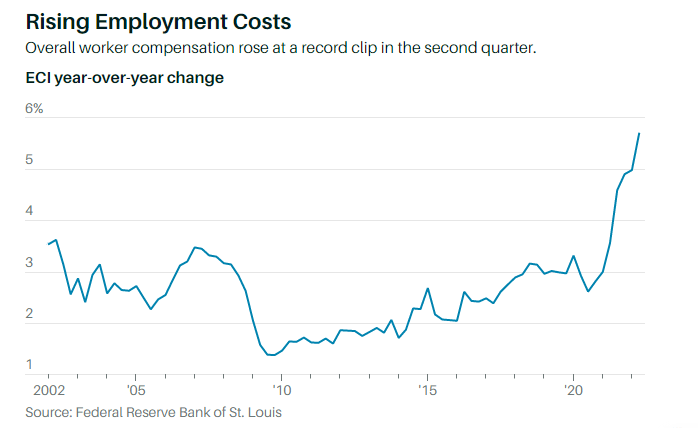

Inflation data on Friday was not supportive of this notion that inflation will be under control anytime soon. On Friday, we got the Employment Cost Index (ECI), which measures worker compensation. This showed salaries jumped to a record 5.7% yr/yr.

The personal consumption expenditures price index, an inflation measure followed by Fed officials, grew an annualized 7.1% for 2Q. If we strip out food and energy, the index rose 4.4% after rising 5.2% the prior Q.

While headline inflation could indeed be peaking, the Fed has a long way to go to get back to neutral, and everything we look at is suggesting this could take a lot longer than the current prevailing narrative.

2Q GDP was also released last week, suggesting we have met the threshold for defining that we are in a technical recession. GDP fell at a .9% annualized rate after a 1.6% decline in Q1.

There is also widespread evidence of slowing household spending, business investment, government outlays and housing. Large retailers are already reporting these issues: WMT, TGT slashed their earnings forecast. T mentioned that customers are falling behind on their wireless/internet bills. SHOP is cutting workers and even the largest FANG companies have slowed or frozen hiring. Office space expansion from the largest companies are also being put on hold. Here are a few excerpts from major companies' earnings calls:

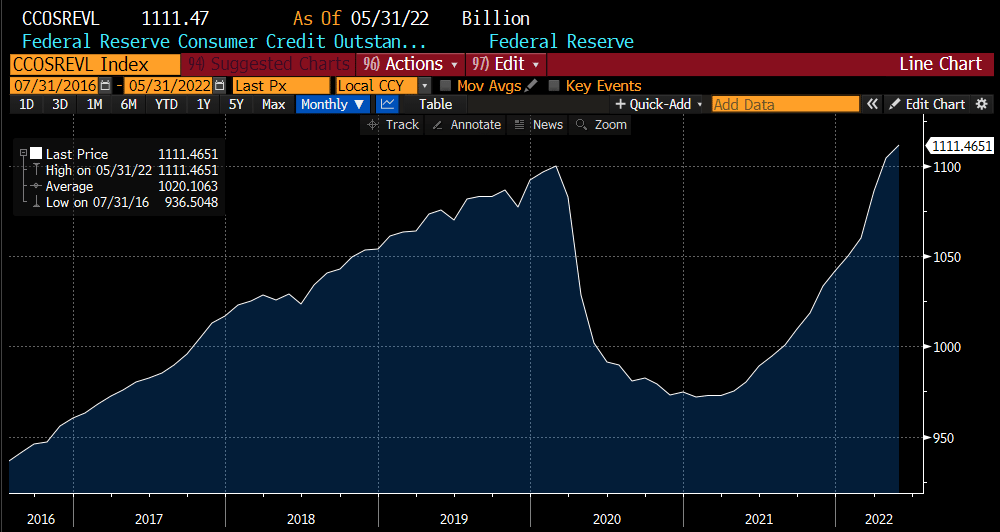

The only thing that seems to be holding things above water is that employment remains quite tight. But for how long? Consumers are dipping into their savings to close the gap in their wages. Revolving credit (i.e. credit card debt) is back above 2019 peak.

These can be very troubling issues, depending on how long a downturn lasts. Consumers can only play defense for so long before they get tapped out. Businesses will be forced to shed workers as their sales slow, which means less spending on anything that isn't crucial.

The Fed is walking a fine line trying to jawbone the market higher despite the material headwinds the economy is facing. In turn, they are exacerbating the inflation issue. Jawboning the market higher, effectively is a form of easing monetary conditions (as stock prices rise and bond yields fall). Also recall that QT is set to ramp to $95B/month in Sept, which is almost double the current pace. Seems like a dangerous cocktail as we approach the most treacherous 3 month seasonality stretch for the market.

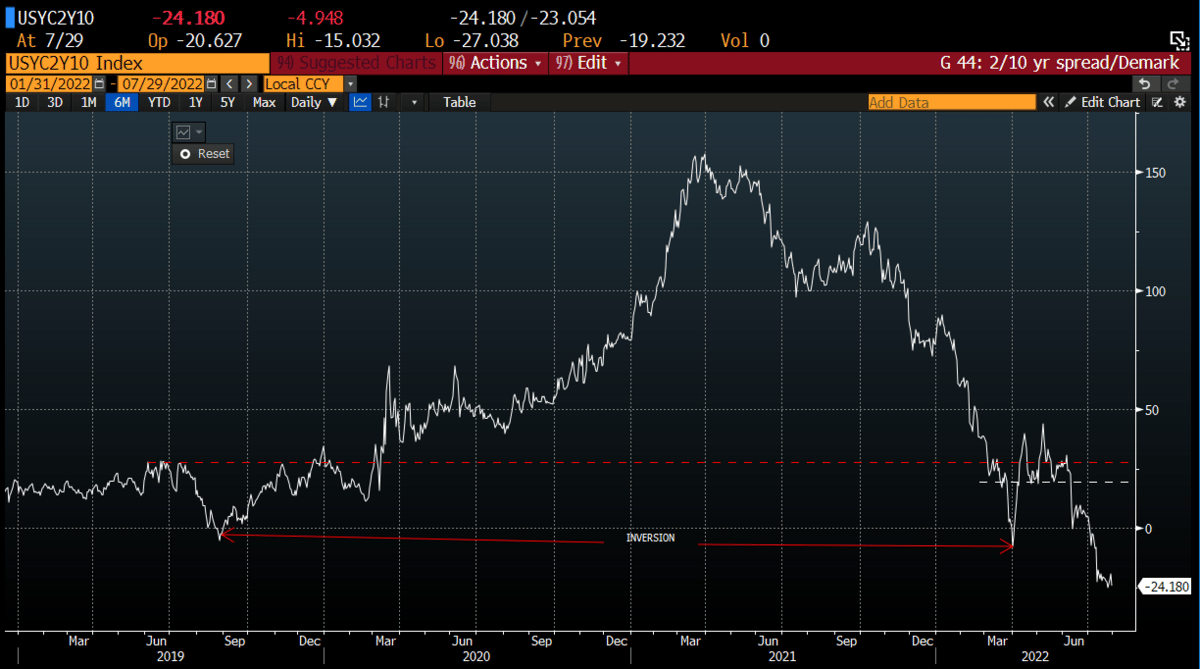

We have written many times to expect a tough year in the stock market with the treasury curve inverting. This first inversion occurred back in March. We are now well below that level of inversion and still below 2019 levels. This is concerning. The implication is that the short bond believes the Fed will NOT pivot, but the long end believes the economy is pivoting from growth. Not sure how this can be interpreted as bullish. Effectively, Powell is tightening aggressively into a meaningful slow down. What could go wrong?

Bull markets build excesses. Bear markets tear them down. We haven't seen many dislocations yet, outside of the drubbing in the stock market. We are fearful for what the future holds.

All that said, the economy is not the stock market and there are some very interesting things happening. We suggested to consider a number of ideas for counter trend trades, as July is typically a strong month for the stock market and our work suggested that divergences were building, especially in tech. Here is an excerpt from our Jun 20th report:

Here is the performance of the market over that time frame (+12.6% for the SPX and +14.84% for the Nasdaq.

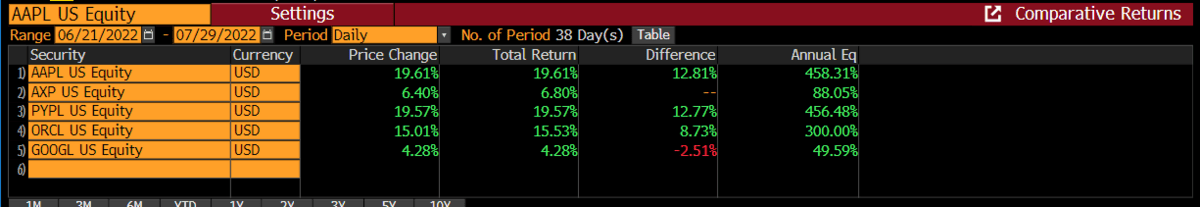

On Jun 21st, we highlighted these names to consider for a rebound trade: AAPL, AXP, PYPL, GOOGL, ORCL. Here is the performance of those stocks since:

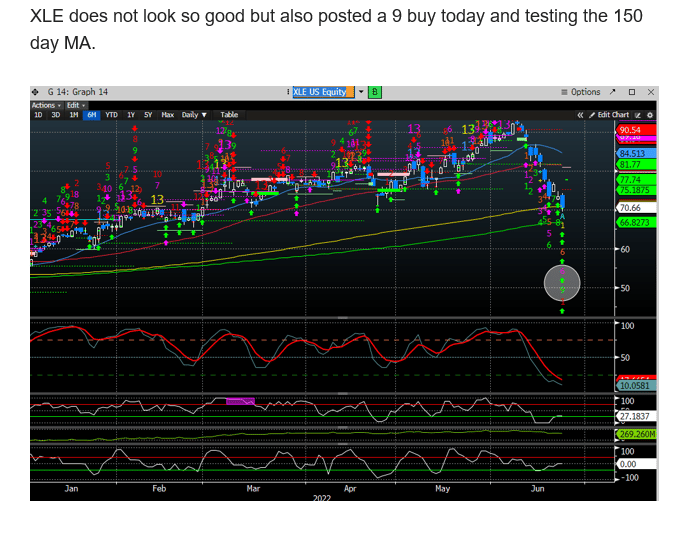

On Jun 27th, we argued that energy stocks had gotten to beat up and we suggested considering XLE. We were early here but now up +6.5% since. Here is that excerpt:

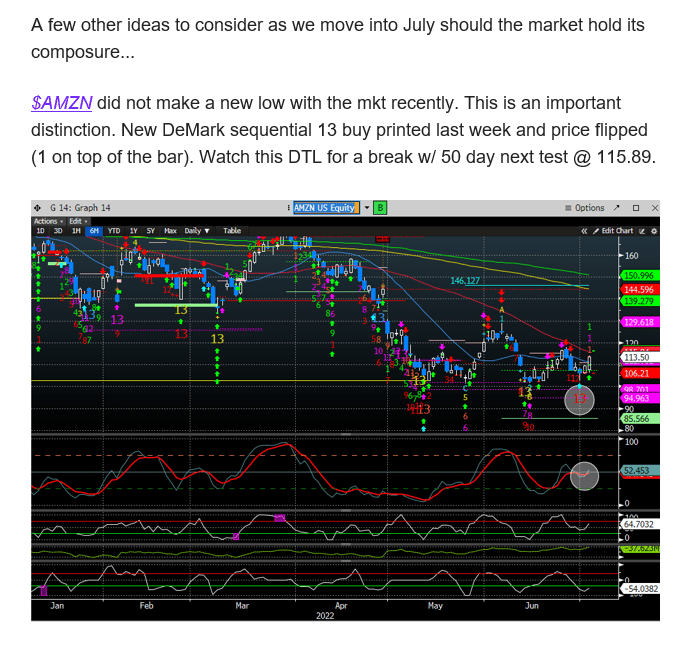

In our July 6th mid week report, we highlighted AMZN and MSFT as something to consider. Here is that excerpt:

Since that report AMZN is +16% and MSFT is +6.8%.

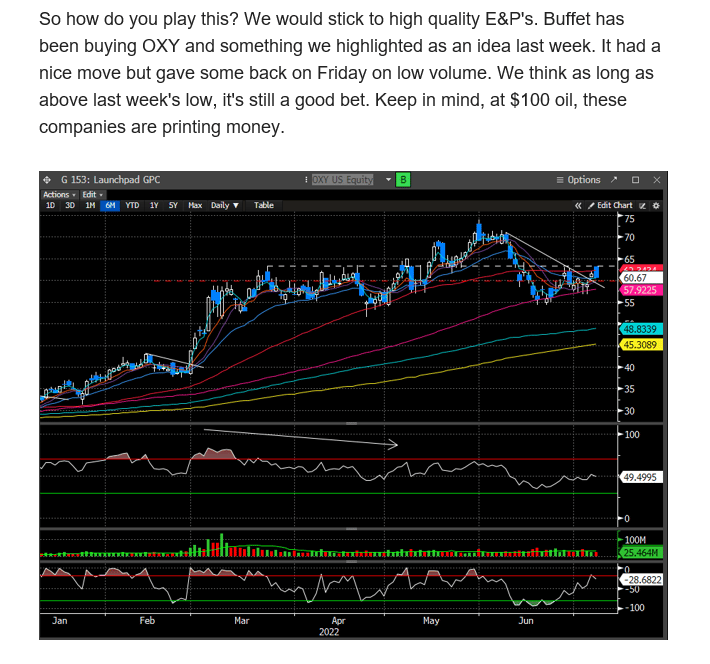

On July 10th we also pivoted back to considering a few energy longs: OXY & DVN. OXY is +8% and DVN +15%. Here are those posts:

It's important to be directionally correct with the market when considering where to position, especially in a bear market. We positioned long into July and added some ideas to consider for that move. Its been a good month.

For more analysis to consider what comes next, please see below....

We deliver these premium posts for $19.95/month. We do not day trade and our ideas are for patient consideration. We are not an alert service and only seek to publish high quality, differentiated macro research, that is proprietary and non-conventional. Please consider trying our service.