We could spend hours dissecting and dispelling the noise and nonsense that some of the so-called stock market Furus selectively publish to further their own bias. This is the problem with most published research. There usually is some sort of confirmation bias associated with what they are writing. None other than our favorite bear, “Diamond Mike,” who has consistently called the market wrong for the last 6 months, by telling his readers every weekend, that the market is doomed for the ensuing week. And like clockwork the market keeps trouncing higher despite the persistent warnings he publishes weekly.

Just for fun, lets count how many down weeks there have been since the start of the year.

The Nasdaq has had 5 down weeks out of 23, for a whopping +21% hit rate. The SPX has had 8 for a +34% hit rate.

You are probabilistically better off going to the casino every week and betting on red at the roulette table. Yet this guy actually charges money to run peoples hard earned capital, and also charges more money for exclusive access to his premium newsletter just to further disseminate his bad advice. We are not trying to criticize his work or his analysis, but only trying to point out that you have a choice on what to listen to and internalize, and being stuck listening to bad advice thinking somehow it will eventually be right (broken clocks are right 2x a day, so inevitably he will be right), can be mentally exhausting and comes with opportunity cost.

Let’s start by addressing all these poor breadth concerns that he and many others continually discuss. We admit we were concerned by the bad breadth for months, but it did not keep us from finding good single stocks to trade and profit from. We discussed in our last weekend report that bad breadth, more times than not, catches up with index price.

We wrote this in our last weekend report regarding breadth:

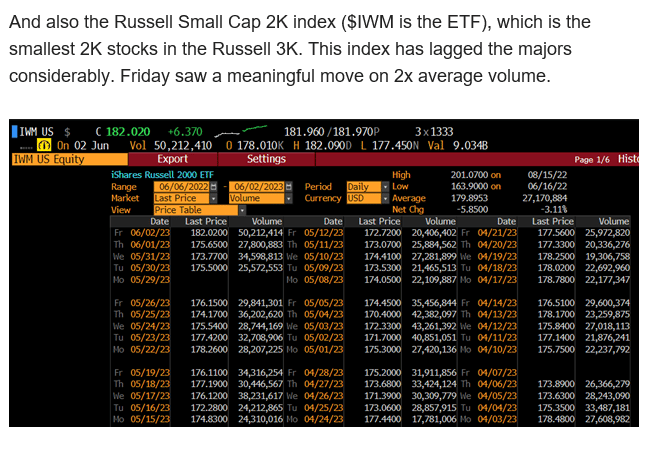

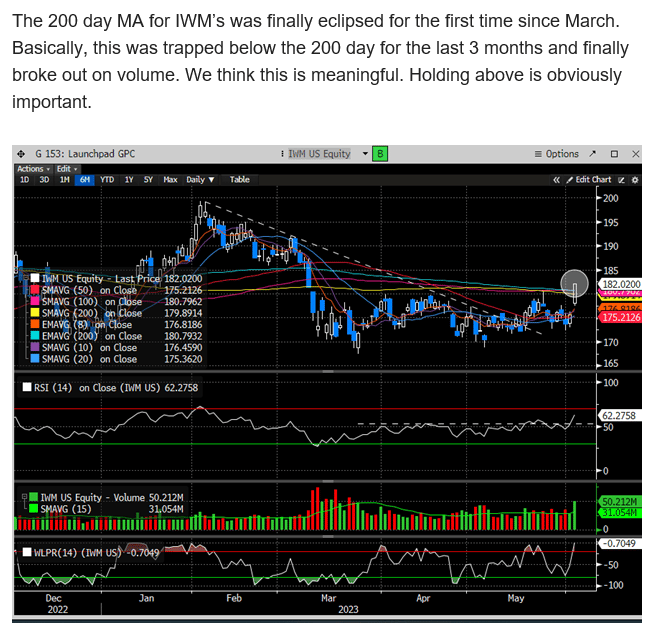

We must have been on to something because we saw decent follow through in small caps and breadth last week. The Russell was +1.9% on the week and the $IWM’s were up +1.65%.

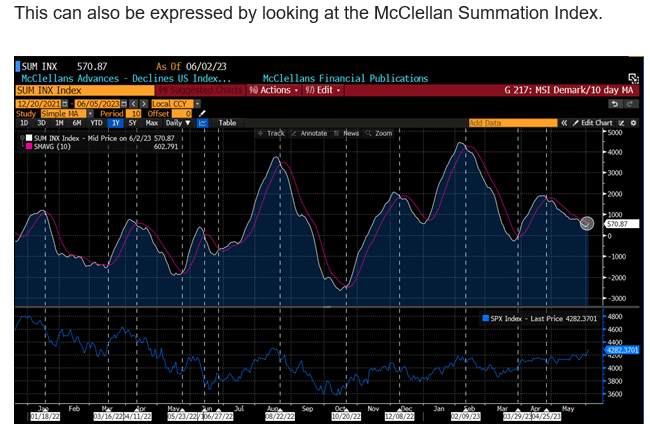

This is evidenced by the updated chart of the McClellan Summation Index, which showed meaningful improvement over the week.

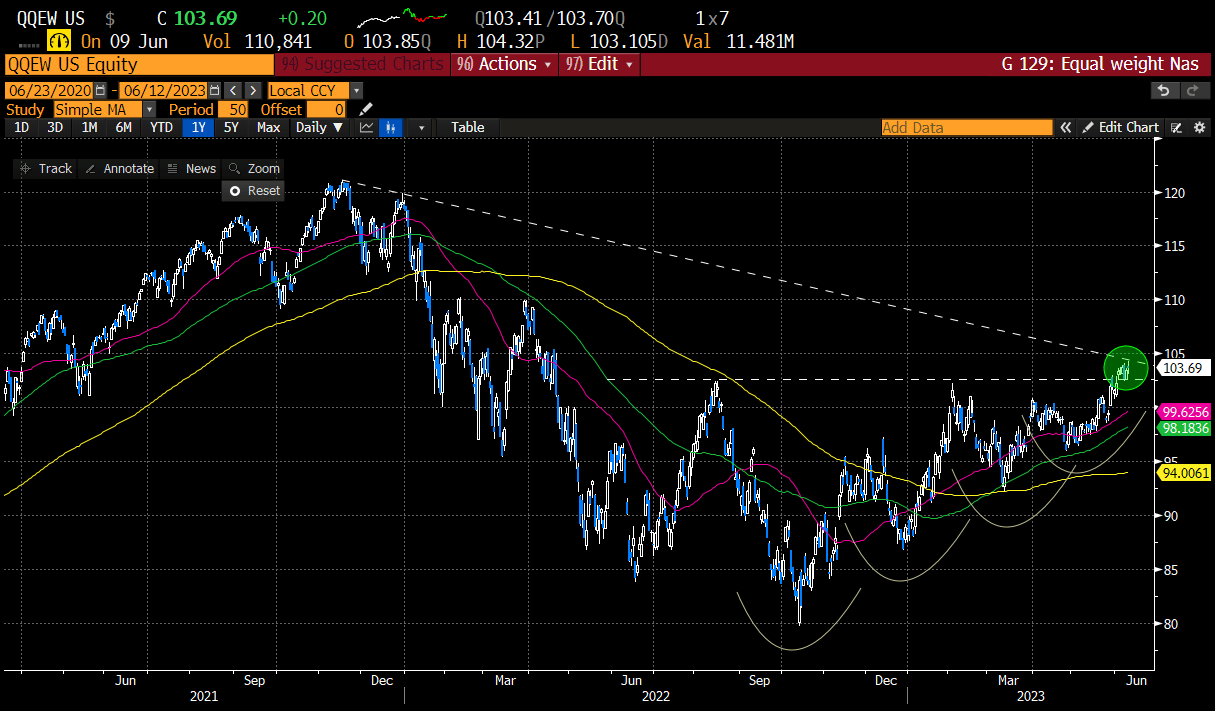

The Equal weight Nasdaq not only has exhibited a series of higher lows and higher highs since the Oct low, but it also made a new 52 week closing high the Friday before last (6/2). This breakout was also successfully back tested on Weds, and now threatening to take out this DTL from the ATH. But we digress, since we must assume Diamond Mike and his troupe of perma bears will ignore this reality and tell their readers/followers that the breadth is abysmal. Sorry Mike, 52-week highs are NOT bearish.

And just for the record, the elapsed time from the ATH to today is 392 days. Guess what happened after 392 days post the peak in ‘07 for the equal weight Nasdaq? A new bull market was born. We are not suggesting we are in a bull market, but time heals all wounds in the stock market, and there is precedence that the worst may be behind us despite the pervasive macro-economic uncertainty. Remember, the stock market is not the economy.

The Equal Weight SPX is not as clean as the Nasdaq but has broken multiple DTL resistance lines from the ATH and now approaching an important pivot that extends over 2 years. Breaking up here would NOT be bearish.

There is also the discussion that the consumer discretionary stocks are being led by 2-3 names. While this is true, why not examine the equal weight version before claiming how narrow the rally is? The Equal weight consumer discretionary ETF ($RSPD) is now approaching the DTL from the peak, after a confirmed double bottom in June/Oct ‘22, followed by a series of higher highs and higher lows. The Aug ‘22 peak is an important pivot where it’s struggled to stay above but fighting that level now. This occurring with a positive MACD cross which is now above the zero line. We’ll have to see how this resolves but this seemingly is gearing to break up, not down.

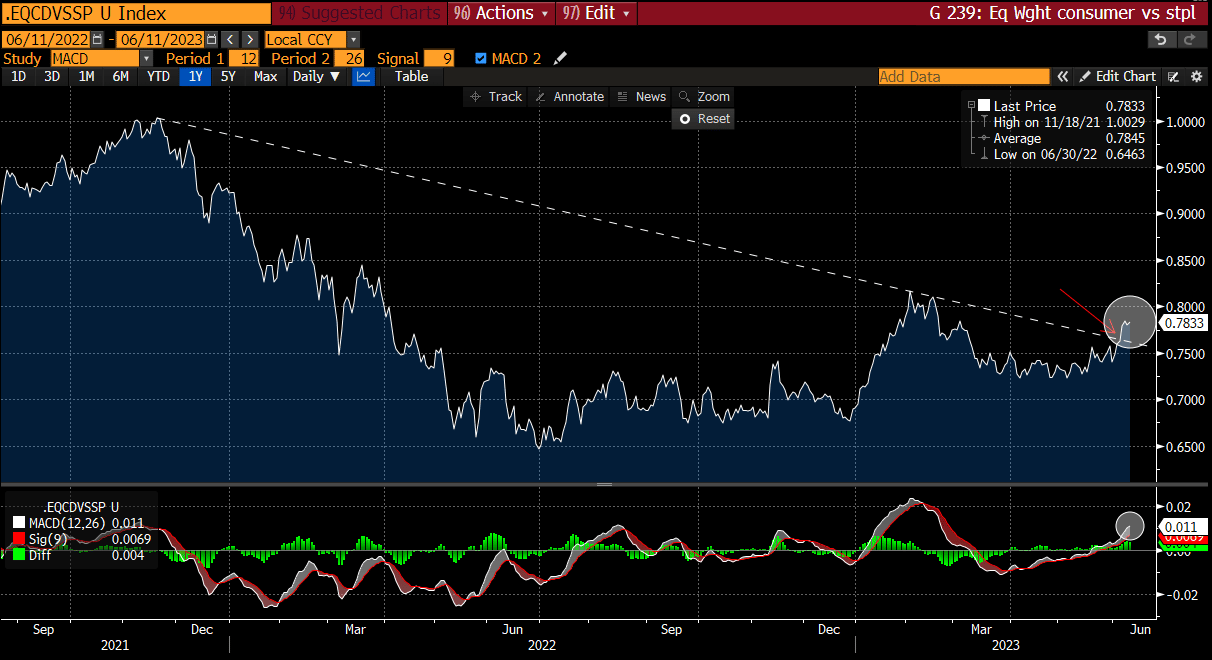

Let’s take it a step further and examine the ratio for Equal weight Consumer Discretionary vs Equal Weight Staples. This is a classic measure of risk appetite in the market. Last week this broke its DTL from the peak on increased MACD momentum. Not sure how this can be conceived as bearish.

Then there is the mention of rotation. Rotation is bullish, so when someone tells you that the market has only been going up because of 3 sectors, this is rear view thinking. The way to read a relative rotation chart is not what’s leading but what’s moving from quadrant to quadrant. If a sector is lagging but moving to improving, or from improving to leading, that’s forward thinking. In fact, you want to be long sectors that are moving from lagging to improving. Which sectors are doing that? Energy, Financials, Real Estate, Industrials. Tech is actually moving closer to weakening. Sorry bears, but this is bullish.

Here is a snapshot of the performance of all the SPX GICS sectors that exhibits this rotation.

YTD, it’s obvious who is leading the charge: Tech with a +35% gain.

For QTD (2Q ends at the end of Jun), tech is still leading the charge with a +11% gain and financials snuck into the top 5 with a +2.7% gain.

And now MTD: quite the different picture with Energy leading with a +6% gain, Industrials not far behind with a +5.7% gain and financials building on last month’s gain and posting an additional +4.4%. Guess what’s lagging? Tech with a paltry +1% gain and staples pulling up the rear w/ a less than 1% gain. Staples is a defensive sector, so when they are lagging that usually implies a bullish risk/on environment.

Here is another way to look at it (side by side):

We agree with Bloomberg, this looks like clear rotation to us, and heading into 2Q, maybe that’s exactly what we get. Because the weightings in the indexes are so top heavy, it’s possible the indexes don’t do much this summer if this rotation out of tech (large cap especially) plays out.

Does this mean we can’t have corrections in the stock market? No, not at all. But corrections can be healthy as they reset the bar and create better entry points.

We are not here to tell you the market is going to ATH’s, in fact we are in print since the beginning of the year talking about the markets being stuck in a large trading range. Instead of being married to a particular view of where the stock market is headed, why not be more open minded to alternative possibilities? Undoubtedly, freeing yourself from these provincial shackles, will help you focus more on what we are all here to do…make money.

You can listen to one dimensional perma-viewpoints, or you can open the curtains, let the sunlight in and take a deep crisp breath of fresh thinking and change the course of your future. The choice is yours.