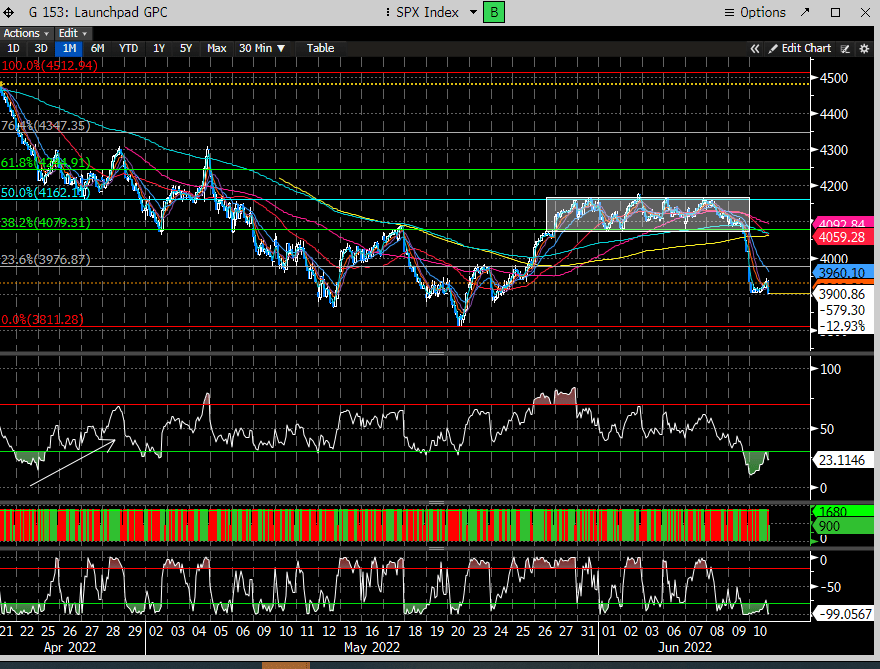

For the last 2 weeks we've been advocating to expect chop until new data presented itself. There was some belief being priced into the market that inflation may have peaked and the Fed wouldn't need to be as aggressive with their rate hike path. As evidenced in the chart, the last week saw a fairly tight range - trapped between these 2 Fib levels on shorter TF's. We said when the range finally resolves itself, a new direction will be forged. We got that clue on Thursday as the market range gave up, signaling that inflation had indeed not backed off at all and the Fed might need to be more aggressive.

The market doesn't like what it doesn't know. In other words it hates uncertainty. And Friday's CPI print injected more uncertainty about how far the Fed rate hikes will go. This is not a good set up for the bulls as resolution to this topic will now extend into the summer.

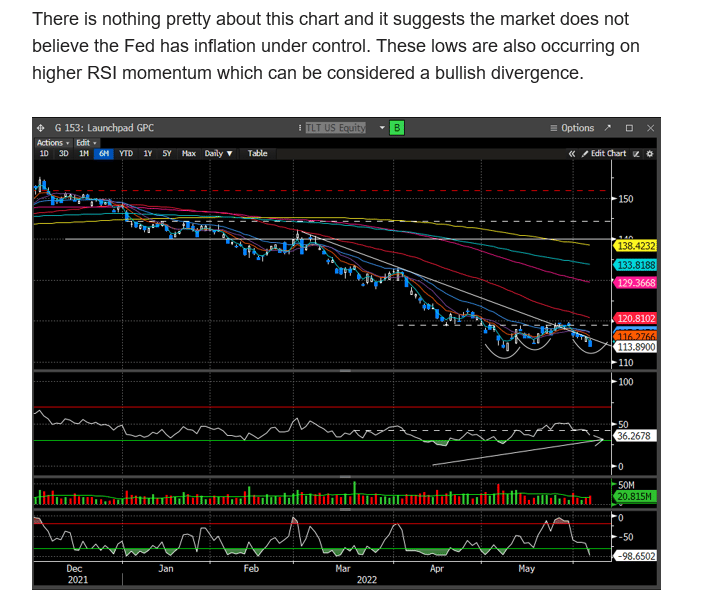

The 10 year had been signaling this would occur as it broke back above 3% before the CPI print, something we've been saying would not be good for equity investors. Is it possible this was the last push before rolling over? More on that below.

We also discussed last week that the TLT chart was also signaling that the market did not believe the Fed has inflation under control. From last week's report:

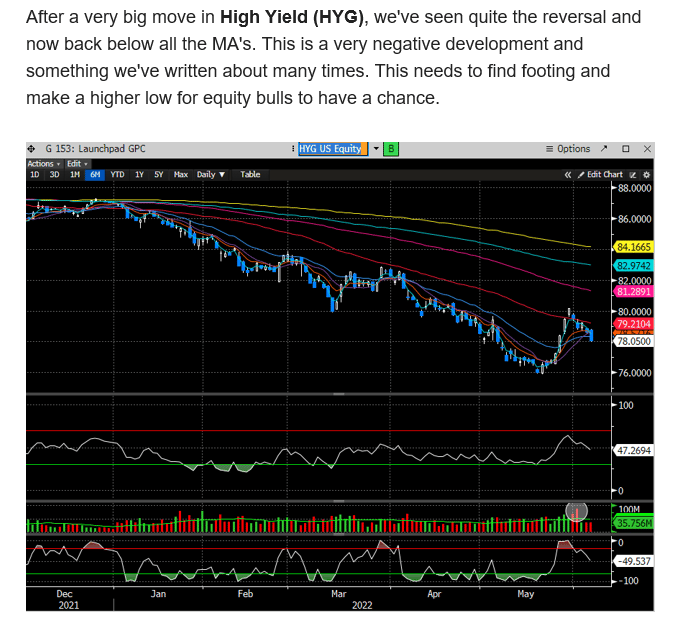

One of our biggest issues with the market is what high yield has been signaling as well. We pointed out the big reversal in HYG as something to be concerned about.

Last weekend we mentioned to buy volatility protection as all the volatility instruments were printing buy signals and to possibly think about a down move in the market as the McClellan Summation Index was close to printing a sell signal. We have been talking about Chinese stocks for a month now and $BABA (our favorite stock and something we highlighted multiple times), exploded higher. Here is the performance of said instruments this past week:

We also wrote a mid-week piece highlighting the vulnerability of the Russell Small cap index as it was into a difficult level, had shorter TF DeMark sell signals, and can lead the market lower. That note was published on Tuesday night.

The Russel was down almost down -6.5%, Weds through Friday, and the puts we highlighted, above, were up +91%.

Pretty good week it seems....

How should we think about this week?